Bidenomics

-

https://www.cnbc.com/2024/04/25/stock-markets-today-live-updates.html

Unexpectedly, of course.

U.S. gross domestic product expanded 1.6% in the first quarter, the Bureau of Economic Analysis said. Economists polled by Dow Jones forecast GDP growth would come in at 2.4%.

Along with the downbeat growth rate for the quarter, the report showed consumer prices increased at a 3.4% pace, well above the previous quarter’s 1.8% advance. This raised concern over persistent inflation and put into question whether the Federal Reserve will be able to cut rates anytime soon.

“In the short term, the numbers don’t appear to be a green light for either bulls or bears, but if the initial reaction of stock index futures is any indication, the uncertainty is unlikely to ease pressures in a market experiencing its deepest pullback since last year,” said Chris Larkin, managing director of trading and investing at E*Trade from Morgan Stanley.

Following the GDP print, traders moved down expectations for an easing of Federal Reserve monetary policy. Traders now forecast just one interest rate cut this year, according to the CME FedWatch Tool.

The lackluster GDP added further pressure to an already-tense market contending with concerns over a pullback in growth among technology earnings.

Meta plunged 15% in premarket trading after the social media giant issued light revenue guidance for the second quarter. That would be the stock’s biggest one-day decline since October 2022. International Business Machines also fell 8% after missing consensus estimates for first-quarter revenue.

-

Delayed rate cut? We might see another hike!

-

Delayed rate cut? We might see another hike!

@LuFins-Dad said in Bidenomics:

Delayed rate cut? We might see another hike!

Not until end of the year, after the election.

-

https://www.cnn.com/2024/05/05/business/retailers-cutting-prices/index.html

CNN reports that consumers, even the high-income ones, are becoming more budget conscious. Retailers are marking down prices for items deemed "discretionary spending."

-

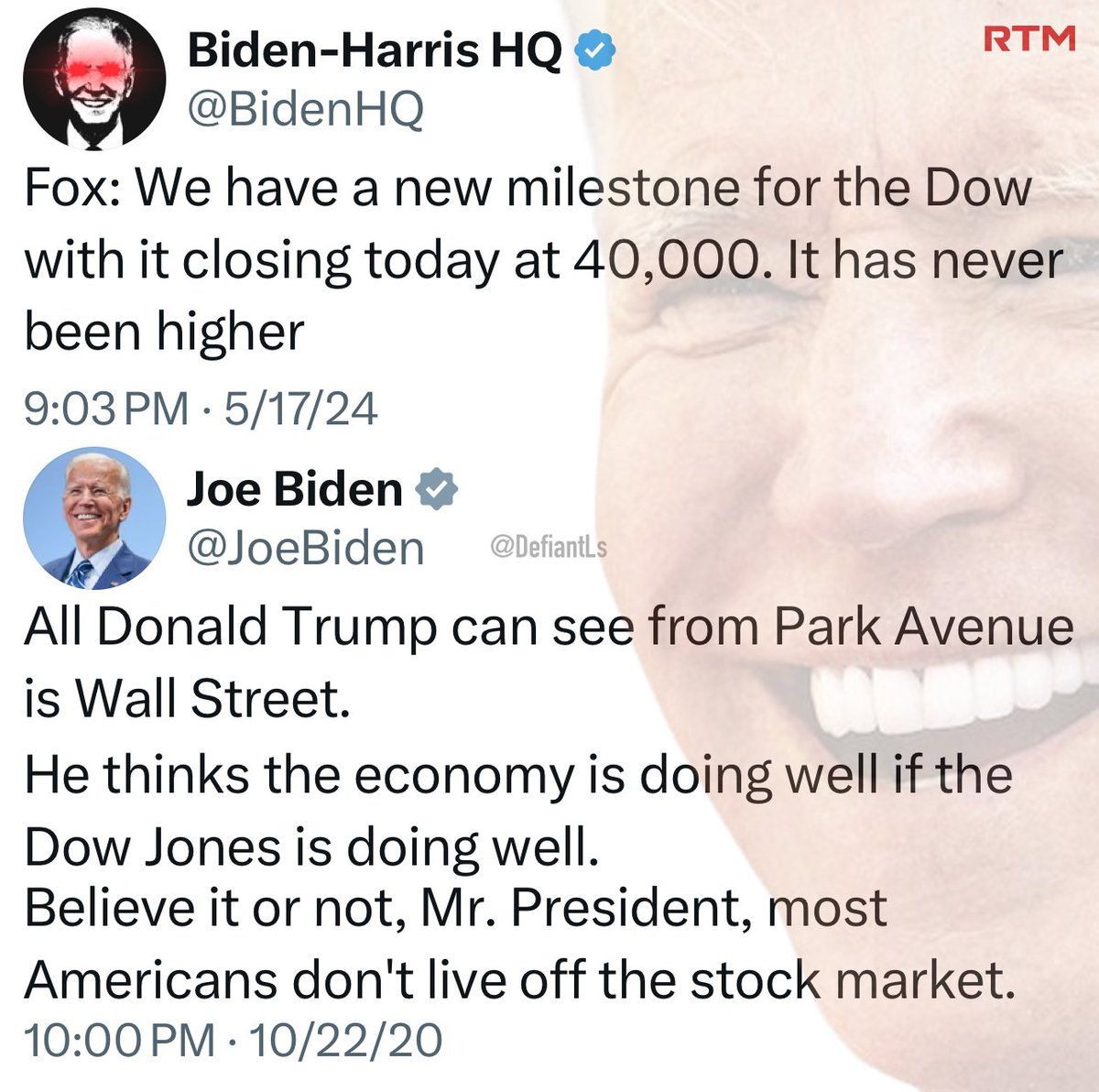

https://amp.cnn.com/cnn/2024/05/17/markets/dow-closes-above-40-000

The Dow Jones Industrial Average index closed above 40,000.

-

https://amp.cnn.com/cnn/2024/05/17/markets/dow-closes-above-40-000

The Dow Jones Industrial Average index closed above 40,000.

@Axtremus said in Bidenomics:

https://amp.cnn.com/cnn/2024/05/17/markets/dow-closes-above-40-000

The Dow Jones Industrial Average index closed above 40,000.

Joe still has 8 months to catch the red man's gains.

-

Congressional Budget Office's new report:

https://www.cbo.gov/publication/60166?mod=ANLink

A new report from the Congressional Budget Office released this week shows that inflation may have had less of an impact on households’ bottom lines than months of sticker shock on everything from Big Macs to daycare might suggest.

.

The agency’s analysis took a look at a typical household’s 2019 “consumption bundle”: the goods and services representing a year’s worth of purchases pre-pandemic.

.

Then, researchers analyzed how much households would pay for that same consumption bundle in 2023 prices, and how much their income rose or fell over the same period.

.

On average, purchasing power for households increased over that period, the agency found.

.

“By CBO’s estimate, aggregate income grew more than prices did between 2019 and 2023,” the report states.

...

The portion of household income required to purchase the same bundle of goods and services decreased by 2% for the lowest-earning quintile of households, and by 6.3% for those in the top group. -

Snort… this ought to be good…

-

Snort… this ought to be good…

-

Congressional Budget Office's new report:

https://www.cbo.gov/publication/60166?mod=ANLink

A new report from the Congressional Budget Office released this week shows that inflation may have had less of an impact on households’ bottom lines than months of sticker shock on everything from Big Macs to daycare might suggest.

.

The agency’s analysis took a look at a typical household’s 2019 “consumption bundle”: the goods and services representing a year’s worth of purchases pre-pandemic.

.

Then, researchers analyzed how much households would pay for that same consumption bundle in 2023 prices, and how much their income rose or fell over the same period.

.

On average, purchasing power for households increased over that period, the agency found.

.

“By CBO’s estimate, aggregate income grew more than prices did between 2019 and 2023,” the report states.

...

The portion of household income required to purchase the same bundle of goods and services decreased by 2% for the lowest-earning quintile of households, and by 6.3% for those in the top group.@Axtremus said in Bidenomics:

The portion of household income required to purchase the same bundle of goods and services decreased by 2% for the lowest-earning quintile of households, and by 6.3% for those in the top group.

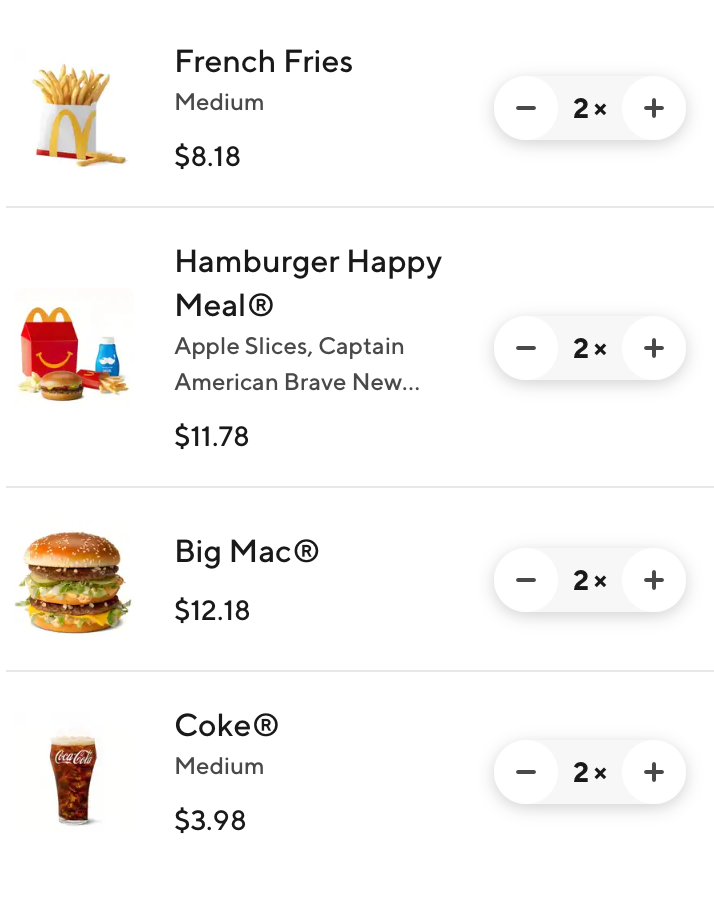

Family of four. Now, this is Doordash, so the prices might be higher than at the store, but...

Two Big Macs

Two Medium Fries

Two Happy Meals

Two Medium Cokes

$36.12

-

I’m going to have to dig through the CBO “package” of consumer goods.

-

Households in the top income quintile had the largest decline, on average, in the share of income required to pay for their 2019 consumption bundle over that four-year period.

So the rich got richer under Biden?

-

Nowhere in the report does it detail what goods and services were in the packages. An iPhone 11 sold for $750 in 19, and are sold new for $225. It wouldn’t be hard for government agency to game these kind of numbers…

-

Average Rent in 2019 was $1465. https://www.rentcafe.com/blog/rental-market/2019-mid-year-rent-report-national-average-rent-ends-first-half-year-1465/

Average rent today is $1716. That’s $3,000 per year. Weekly Real Earnings are up $7 to $365 over 2019’s $358. That’s $364 dollars per year increase.

-

@Axtremus said in Bidenomics:

https://amp.cnn.com/cnn/2024/05/17/markets/dow-closes-above-40-000

The Dow Jones Industrial Average index closed above 40,000.

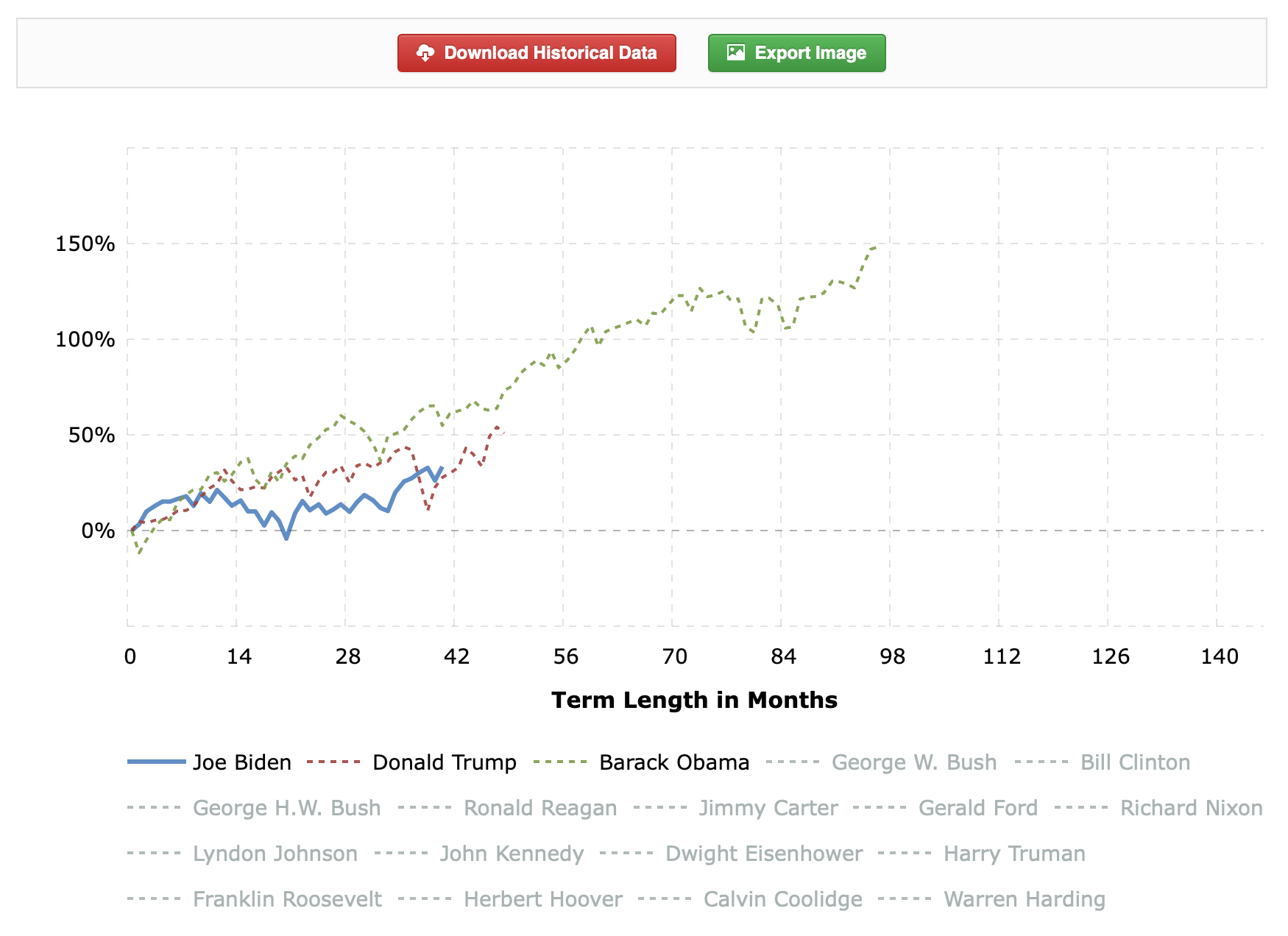

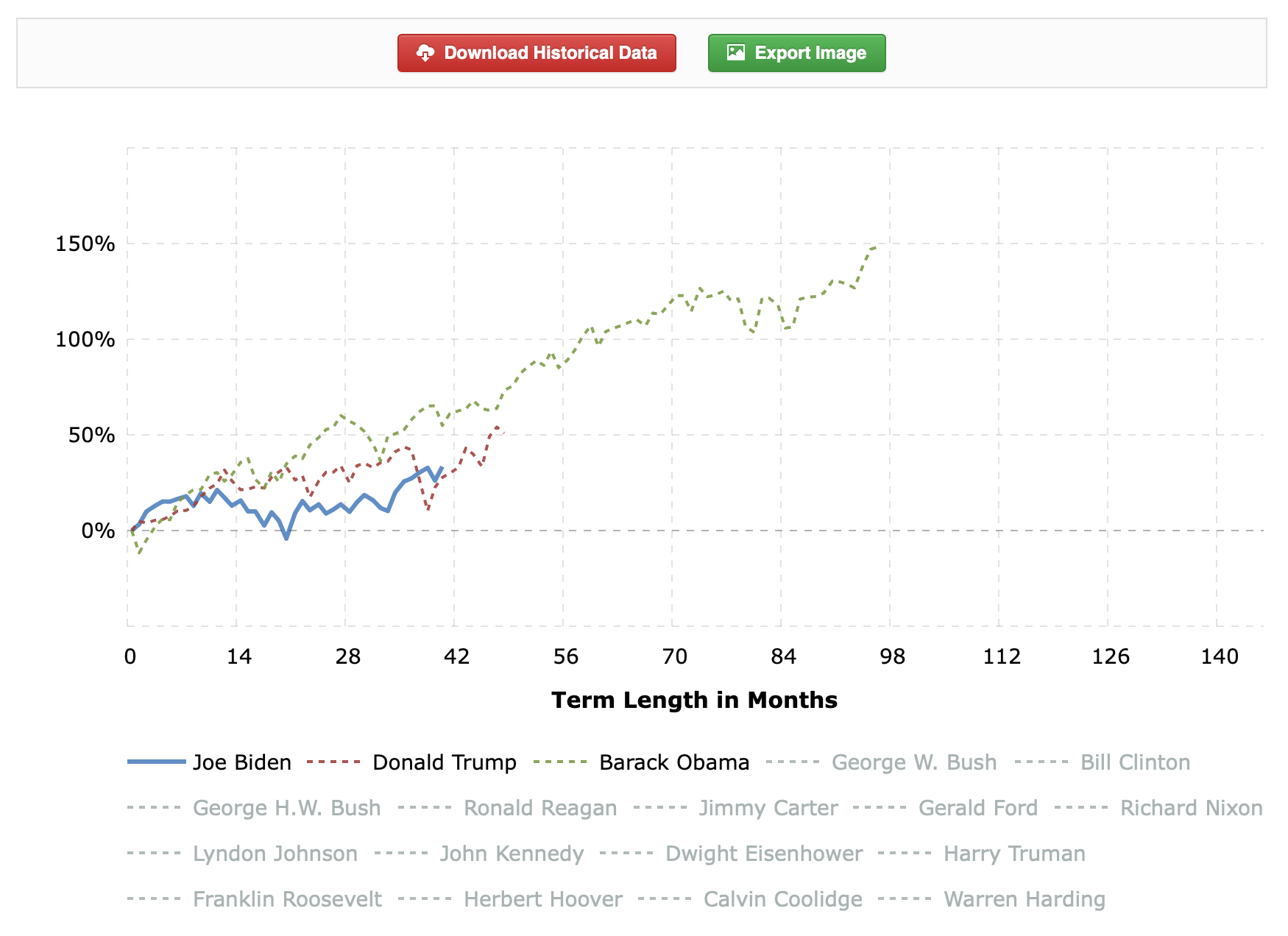

Joe still has 8 months to catch the red man's gains.

@George-K said in Bidenomics:

Joe still has 8 months to catch the red man's gains.

But at the same moment in their President, President Biden has higher returns than President Trump.

But it will be difficult to have increases like the last months of President Trump term.

-

@George-K said in Bidenomics:

Joe still has 8 months to catch the red man's gains.

But at the same moment in their President, President Biden has higher returns than President Trump.

But it will be difficult to have increases like the last months of President Trump term.

@taiwan_girl said in Bidenomics:

the last months of President Trump term

Which were mostly a recovery from the COVID dip.

-

@taiwan_girl said in Bidenomics:

the last months of President Trump term

Which were mostly a recovery from the COVID dip.

@George-K said in Bidenomics:

@taiwan_girl said in Bidenomics:

the last months of President Trump term

Which were mostly a recovery from the COVID dip.

Agree. But both of them are behind Obama, (who maybe is behind Clinton, etc.). To me, it just reinforce my thought that the president gets too much credit/too much blame for the economy.

-

@taiwan_girl said in Bidenomics:

the last months of President Trump term

Which were mostly a recovery from the COVID dip.

@George-K said in Bidenomics:

@taiwan_girl said in Bidenomics:

the last months of President Trump term

Which were mostly a recovery from the COVID dip.

Or optimism buoyed by the expectation of the coming Biden Presidency!

-

@George-K said in Bidenomics:

@taiwan_girl said in Bidenomics:

the last months of President Trump term

Which were mostly a recovery from the COVID dip.

Agree. But both of them are behind Obama, (who maybe is behind Clinton, etc.). To me, it just reinforce my thought that the president gets too much credit/too much blame for the economy.

@taiwan_girl said in Bidenomics:

to me, it just reinforce my thought that the president gets too much credit/too much blame for the economy.