The Big Beautiful Bill needs its own thread.

-

wrote 15 days ago last edited by

-

wrote 15 days ago last edited by

Main Street will get tariffs at least.

-

wrote 15 days ago last edited by

-

wrote 15 days ago last edited by

-

wrote 14 days ago last edited by jon-nyc

There are jokes going around bond markets about Big Beautiful Bill.

BBB is the lowest credit rating you can have before junk status.

-

wrote 14 days ago last edited by jon-nyc

Just so we’re clear.

BESSENT: OTHER COUNTRIES' CURRENCIES RISING, NOT DOLLAR FALLING

-

wrote 14 days ago last edited by

LOL

I look at a couple of forums about thailand and there are starting to complaints from expat retirees about how their money has lost XX% vs the Thai baht.

-

wrote 13 days ago last edited by

@jon-nyc said in The Big Beautiful Bill needs its own thread.:

Just so we’re clear.

BESSENT: OTHER COUNTRIES' CURRENCIES RISING, NOT DOLLAR FALLING

The cheek of those “other countries”, eh?

-

wrote 13 days ago last edited by

It’s so great of them to make other countries great again, too!

-

wrote 12 days ago last edited by

-

wrote 12 days ago last edited by

You know, Republican budget hawks might have an opportunity to finally push through legitimate entitlement reform.

-

wrote 11 days ago last edited by

-

wrote 9 days ago last edited by

-

wrote 5 days ago last edited by

-

wrote 5 days ago last edited by

Good for Elon.

-

wrote 5 days ago last edited by

Grok, how did the TCJA perform vs. CBO projections?

CBO Projections vs. Actual Outcomes

Revenue Projections:

CBO Estimate: The CBO initially projected that the TCJA would reduce federal revenues by $1.8 trillion over 2018–2028, excluding dynamic effects, or $1.3 trillion after accounting for economic growth (macroeconomic feedback). They anticipated a significant revenue shortfall due to lower tax rates, particularly for corporate and individual income taxes.Reality: Actual revenue collections outperformed CBO’s projections:

In 2022, federal tax revenues reached $4.9 trillion, $884 billion above CBO’s post-TCJA projections for that year, and $642 billion higher than projected for individual tax revenues alone.Over the five years following the TCJA (FY 2019–2023), tax revenues averaged $170–$205 billion per year above CBO’s post-2017 projections.

Corporate tax revenues in FY 2022 and 2023 exceeded CBO projections by $103 billion, with FY 2024 corporate receipts at $529 billion, surpassing the CBO’s $421 billion estimate.

However, when adjusted for inflation, total real revenue in 2023 was $3.6 trillion, below the CBO’s pre-TCJA projection of $3.9 trillion, suggesting that nominal revenue gains were partly driven by inflation and other factors like capital gains realizations.

Economic Growth:

CBO Estimate: The CBO projected that the TCJA would boost GDP by an average of 0.7% over 2018–2028, with stronger effects in the early years (e.g., 2.1% GDP growth in 2018). They expected growth to taper off after 2025 when individual tax cuts expired.Reality: Economic growth exceeded CBO forecasts in the initial years:

GDP growth in 2018 reached 3.0%, a full percentage point above the CBO’s pre-TCJA forecast of 2.1%.Total U.S. investment increased by over 20%, including an 18% rise in R&D investment, and wages grew by 4.9% in 2018–2019, the fastest two-year growth in 20 years.

Real median household income rose by $5,000 in the first two years post-TCJA, outpacing the prior eight years combined. Unemployment hit 50-year lows, with record lows for African American, Hispanic, and non-high-school-educated workers.

I’m not a big believer in CBO projections.

Deficit Impact:

CBO Estimate: The CBO projected the TCJA would increase the primary deficit by $1.8 trillion over 2018–2028, or $1.3 trillion after macroeconomic feedback, with total deficits (including debt-service costs) rising by $2.3 trillion.Reality: Deficits grew, but the extent is debated:

The deficit increased by 17% in 2018 and was projected to grow another 15% in 2019, even with stronger economic growth.Some sources argue the TCJA’s revenue shortfalls were less severe than predicted due to higher-than-expected revenues, but the Committee for a Responsible Federal Budget notes that inflation-adjusted revenues in 2023 were close to post-TCJA projections, not pre-TCJA levels, implying no significant deficit reduction.

Extending the TCJA’s provisions is estimated to add $3.5–$4.7 trillion to deficits over the next decade, depending on the scope of extensions.

That’s a spending problem, not a revenue problem. Especially due to the COVID stimulus packages. Take those out and the deficits would not have grown anywhere close to the projections.

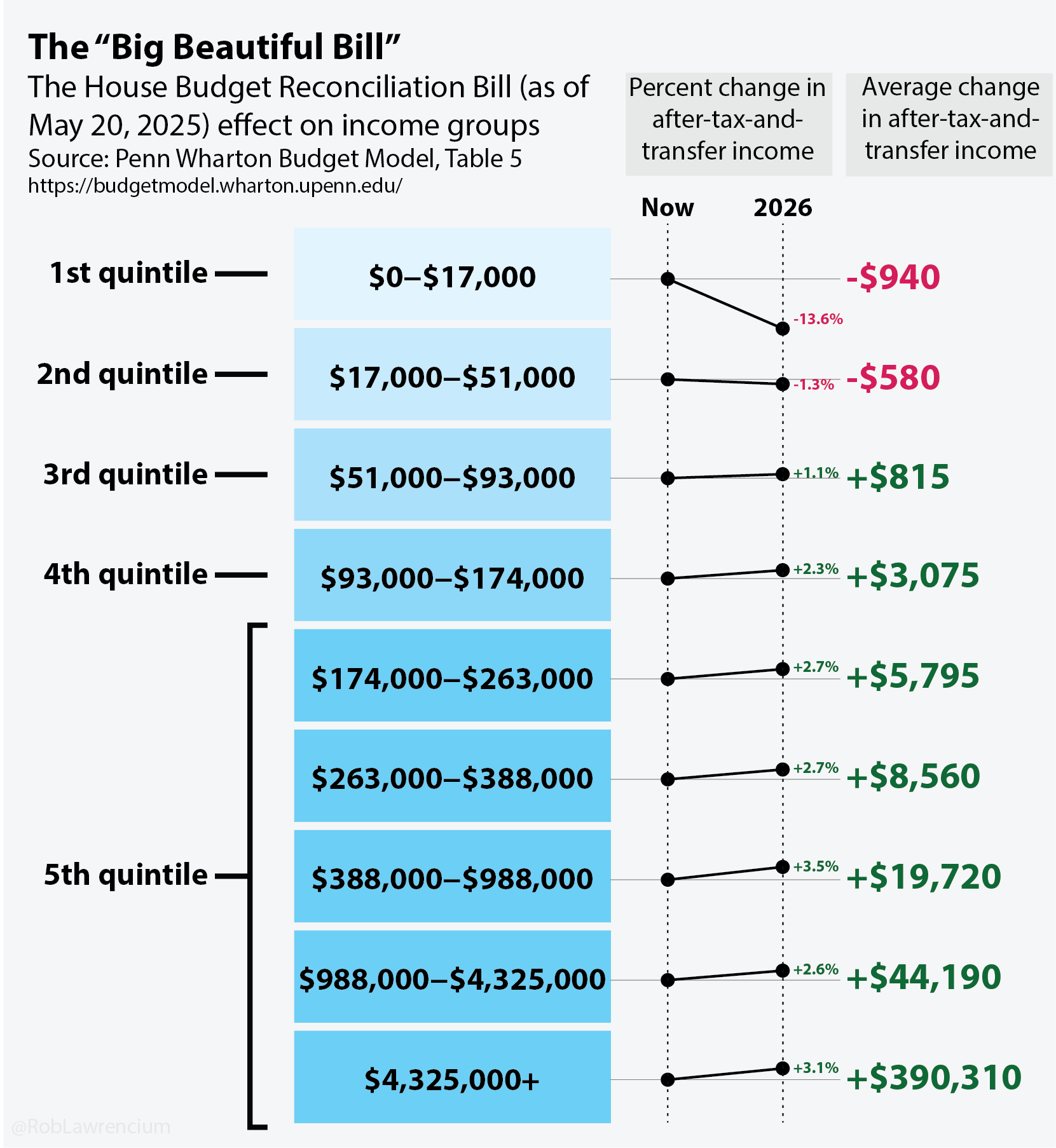

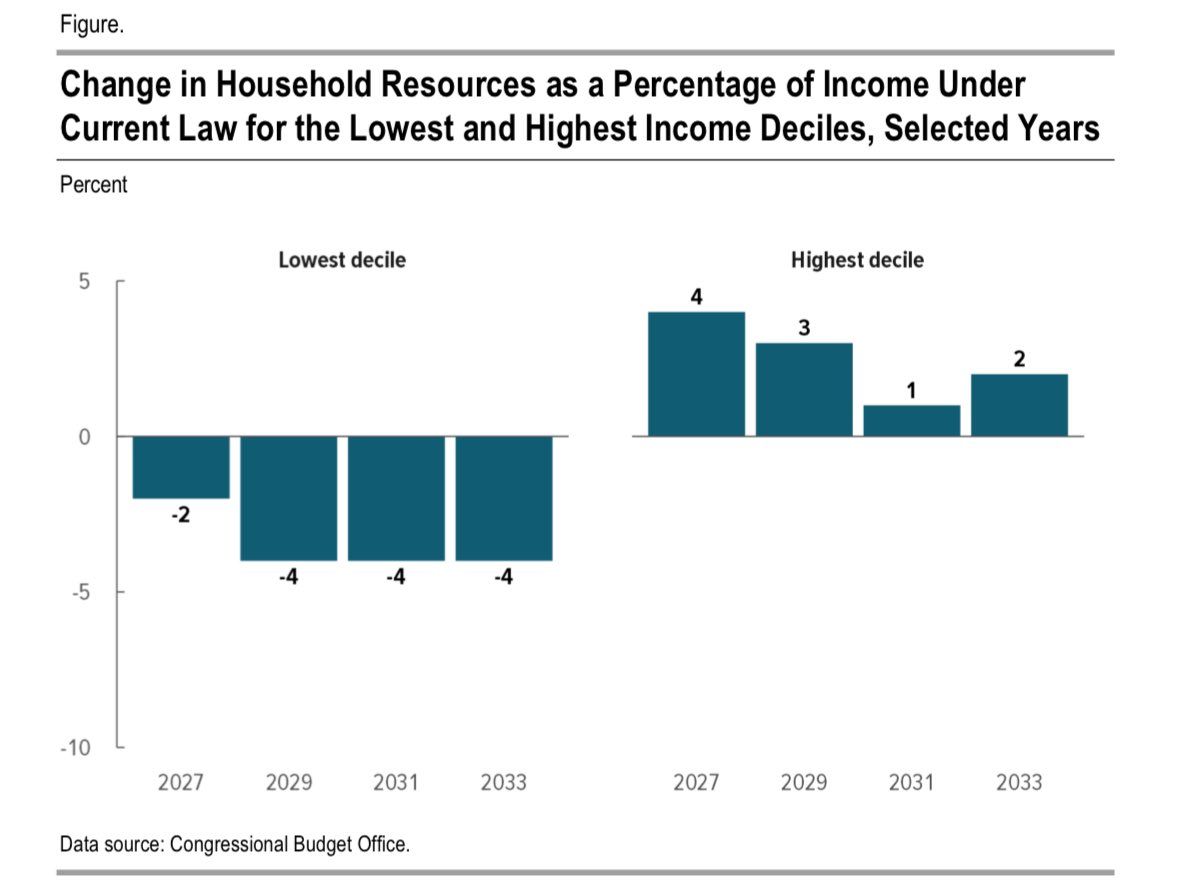

Distributional Effects:

CBO Estimate: The CBO and Joint Committee on Taxation (JCT) projected the TCJA would disproportionately benefit higher earners, with the top 1% seeing significant tax cuts due to estate tax and pass-through business provisions.Reality: The TCJA provided broad tax relief but skewed benefits upward:

Americans earning under $100,000 saw an average tax cut of 16%, while the top 1% paid a higher share of federal taxes post-TCJA.However, the Senate Budget Committee reported that the richest 5% reaped 40% of the benefits in the first year, with the top 1% saving nearly $26,000 on average in 2026 if extended.

Low-income households ($25,000 or less) saved an average of $60 in 2018, per the Tax Policy Center, compared to over $51,000 for the top 1%.

Again, the percentage of the tax revenues from the top 5% INCREASED. The percentage from the poorest decreased…

-

wrote 5 days ago last edited by

Simple math. Taxing the wealthy at 90% doesn’t get us out of this.

Cutting spending doesn’t get us out of this.

The only thing that does is reduced spending coupled with economic growth. Right now, Trump is failing on both tasks.

-

Good for Elon.

wrote 5 days ago last edited by@LuFins-Dad said in The Big Beautiful Bill needs its own thread.:

Good for Elon.

Sure doesn't comport with any purely cynical perspective on Elon. Which is to say, the mainstream Trump-hating perspective on Elon.

-

wrote 5 days ago last edited by

It’s not remotely surprising. Since it’s Congress not Trump he can criticize. Like how he indirectly called Trump’s tariff policy moronic by unleashing on Navarro.