Trumpenomics

-

Yes, but China’s a hit more people are willing to take…

-

I think the boat fees are actually as big as the tariffs…

-

Good lord. The comments…

-

From UBS:

Treasury Secretary Bessent said that they saw nothing unusual in yesterday’s market moves.

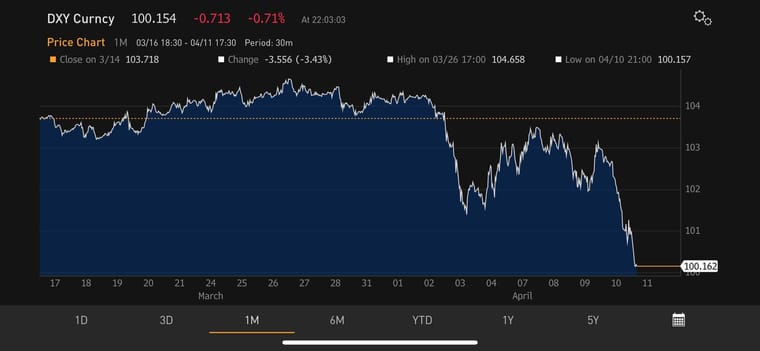

The 30yr treasury experienced the biggest increase since 1982, equities are falling, the dollar is falling, and gold hit an all time high.

Economists might consider this pattern not entirely usual.

-

Op-ed praising Trump's genius tariff moves, comparing Trump to Tuft, McKinley, Ford, Reagan:

-

An odd situation. The Chinese economy is under stress (real estate, demographics, etc), and they are highly reliant on exports. Then again, there are other customers to export to than the USA. On our side, the USA is highly reliant on Chinese exports both for end products but also supply chain for so many companies. Really it seems to be more about two power egos fighting it out than realistic long-term international trade objectives. Not sure how it plays out but it will be interesting to see in a year or so how it compares to December 2024 numbers.

-

This is starting to feel a lot like the 2008 panic and the 2020 COVID panic. I kinda think there is more than a bit of overreaction to this.

I think I’ve been blunt, I despise American Labor Unions. I think that they served a needed and valuable function 80 years ago, but are no longer needed, and have actually harmed American manufacturing extensively over the past 50 years. I also despise protectionist policies that go hand-in-hand with Union goals.

That being said, the response seems over the top. A little too much overreaction. Personally, I’ll tighten the belt a little (very glad the last tuition check has been cashed for Lucas) and will invest a little more aggressively over the next few weeks…

@LuFins-Dad said in Trumpenomics:

This is starting to feel a lot like the 2008 panic and the 2020 COVID panic. I kinda think there is more than a bit of overreaction to this.

What I don’t get is how this is consistent with your comment from 2 weeks ago or so about OMB and CBO underestimating the negative effects of tax increases. This is still the largest tax increase of your lifetime or mine.