Bidenomics At Work

-

About doing "multiple gig jobs" vs. "one full time job," while "one full time job" is easier and more more predictable day-to-day, the "multiple gig jobs" model is arguably lower risk long term because you won't be completely out of work and out of income because an employer goes bust or terminate you all of a sudden.

Yeah, the Industrial Revolution somehow led to an abundance of jobs that are steady year round, it lifted the standard of living for the masses. It's good to have "one steady full time job", it's good to not have to worry about what to do with your next eight hours (because your employer planned it out for you). But why would one expect that model to last forever?

-

@Jolly said in Bidenomics At Work:

Gig jobs do not normally come with benefits.

That we need to fix with single payer universal healthcare. Single payer universal healthcare is the right solution regardless of whether the labor pool is mostly “full time” or mostly “gig” workers.

-

@Jolly said in Bidenomics At Work:

Gig jobs do not normally come with benefits.

That we need to fix with single payer universal healthcare. Single payer universal healthcare is the right solution regardless of whether the labor pool is mostly “full time” or mostly “gig” workers.

@Axtremus said in Bidenomics At Work:

@Jolly said in Bidenomics At Work:

Gig jobs do not normally come with benefits.

That we need to fix with single payer universal healthcare. Single payer universal healthcare is the right solution regardless of whether the labor pool is mostly “full time” or mostly “gig” workers.

Great, I nominate you to be the single payer.

-

@Jolly said in Bidenomics At Work:

Gig jobs do not normally come with benefits.

That we need to fix with single payer universal healthcare. Single payer universal healthcare is the right solution regardless of whether the labor pool is mostly “full time” or mostly “gig” workers.

-

@Axtremus said in Bidenomics At Work:

@Jolly said in Bidenomics At Work:

Gig jobs do not normally come with benefits.

That we need to fix with single payer universal healthcare. Single payer universal healthcare is the right solution regardless of whether the labor pool is mostly “full time” or mostly “gig” workers.

Great, I nominate you to be the single payer.

@LuFins-Dad said in Bidenomics At Work:

@Axtremus said in Bidenomics At Work:

@Jolly said in Bidenomics At Work:

Gig jobs do not normally come with benefits.

That we need to fix with single payer universal healthcare. Single payer universal healthcare is the right solution regardless of whether the labor pool is mostly “full time” or mostly “gig” workers.

Great, I nominate you to be the single payer.

-

-

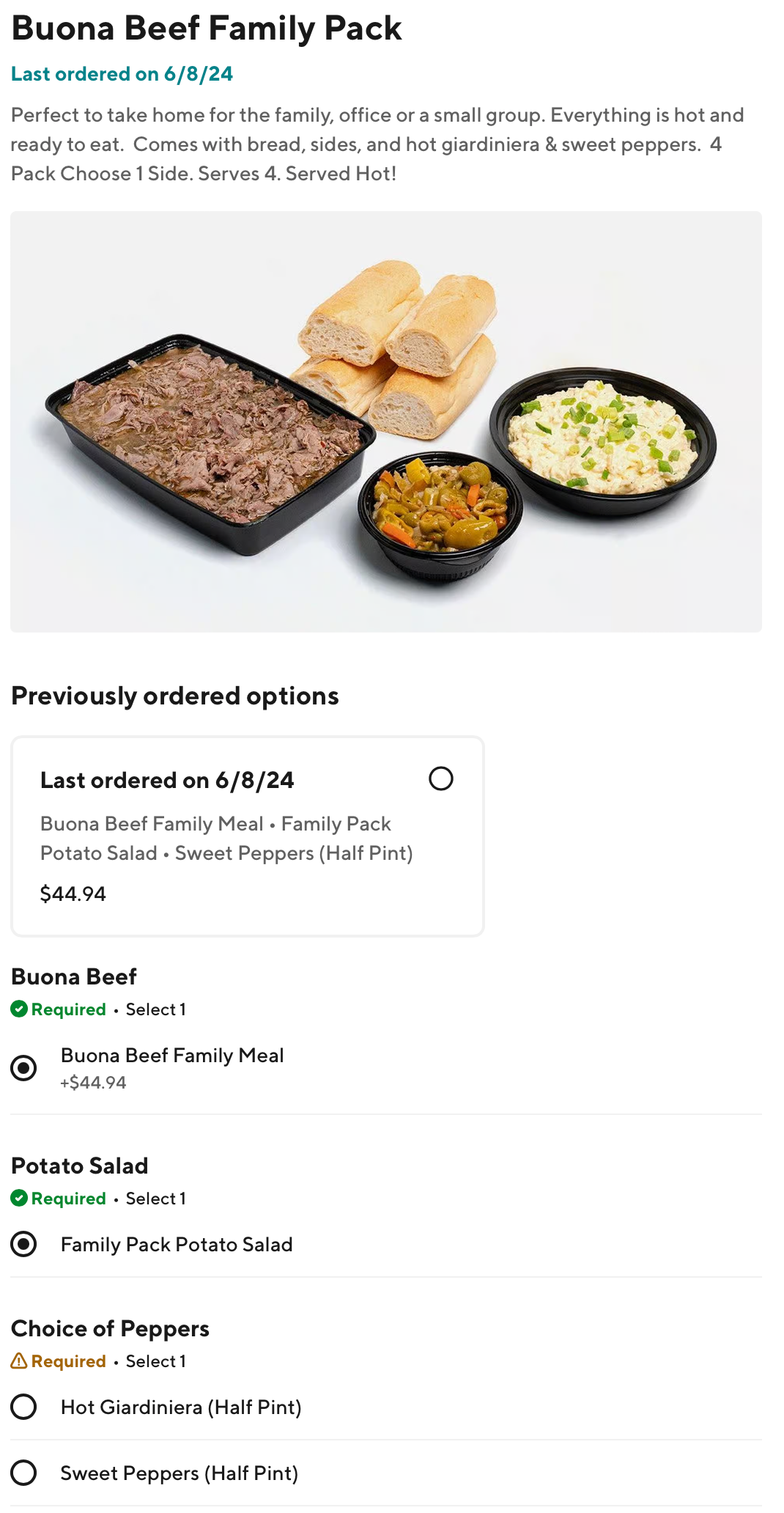

So it was 1¢ less?

-

So it was 1¢ less?

@LuFins-Dad said in Bidenomics At Work:

So it was 1¢ less?

Same price, one less bowl of peppers (I used to get sweet AND hot) one less piece of bread (I used to get five), and probably less italian beef.

Shrinkflation.

-

@LuFins-Dad said in Bidenomics At Work:

So it was 1¢ less?

Same price, one less bowl of peppers (I used to get sweet AND hot) one less piece of bread (I used to get five), and probably less italian beef.

Shrinkflation.

@George-K said in Bidenomics At Work:

@LuFins-Dad said in Bidenomics At Work:

So it was 1¢ less?

Same price, one less bowl of peppers (I used to get sweet AND hot) one less piece of bread (I used to get five), and probably less italian beef.

Shrinkflation.

Ahhh, I didn’t look closely enough at the packages.

-

BLS Jobs Report

https://www.bls.gov/news.release/pdf/empsit.pdf

The revisions:

The change in total nonfarm payroll employment for April was revised down by 57,000, from +165,000 to +108,000, and the change for May was revised down by 54,000, from +272,000 to +218,000. With these revisions, employment in April and May combined is 111,000 lower than previously reported. (Monthly revisions result from additional reports received from businesses and government agencies since the last published estimates and from the recalculation of seasonal factors.)

-

BLS Jobs Report

https://www.bls.gov/news.release/pdf/empsit.pdf

The revisions:

The change in total nonfarm payroll employment for April was revised down by 57,000, from +165,000 to +108,000, and the change for May was revised down by 54,000, from +272,000 to +218,000. With these revisions, employment in April and May combined is 111,000 lower than previously reported. (Monthly revisions result from additional reports received from businesses and government agencies since the last published estimates and from the recalculation of seasonal factors.)

@George-K Thats a good thing, right? "Cooler" economy means less pressure on keeping interest rates high?

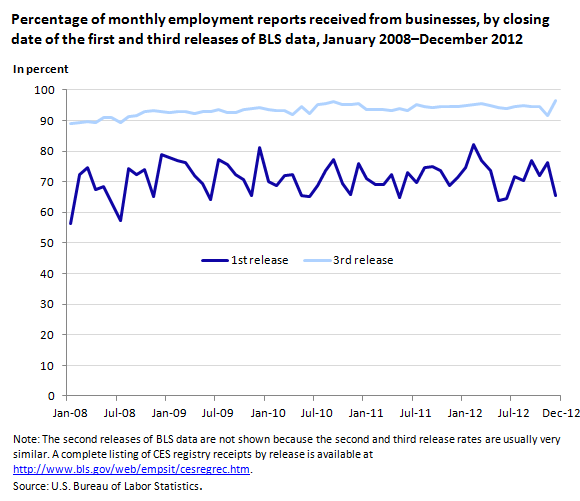

This isn't actually something very new. Been happening for years, not just under President Biden.

https://www.bls.gov/opub/btn/volume-2/revisions-to-jobs-numbers.htm

The initial estimate of job change for a month is based on the growth or loss of jobs at the businesses that have reported their data. Generally, BLS assumes that the employment situation at businesses that had reported is representative of the situation at those that had not yet reported. BLS continues to collect outstanding reports from the businesses in the sample as it prepares a second and then a third estimate for the month. With each subsequent estimate, more businesses have provided their information. In 2012, the average collection rate at the time of the third estimate for a month was 94.6 percent. (See chart 1.)

So why doesn’t BLS wait until it has all the reports to make the estimate and avoid revisions? Users of the data are intensely interested in the earliest possible read on labor market developments, and experience suggests that the initial estimate is generally very good. For example, in 2012, the average monthly employment change using the first estimate would have been +142,000, compared with a monthly average change of +165,000 using the third estimate. (See table 1.) Nevertheless, it is true that in some months, revisions are large enough that they change the users’ perspectives on the current state of the economy. In November 2012, for example, the initial estimate of over-the-month change was +146,000, while the third estimate was +247,000.

-

https://www.washingtonpost.com/business/2024/07/28/homeless-lack-of-affordable-housing-economy/

Article on people who have jobs (even full time jobs) and are still homeless anyway (often due to rent being too high/unaffordable).

-

About doing "multiple gig jobs" vs. "one full time job," while "one full time job" is easier and more more predictable day-to-day, the "multiple gig jobs" model is arguably lower risk long term because you won't be completely out of work and out of income because an employer goes bust or terminate you all of a sudden.

Yeah, the Industrial Revolution somehow led to an abundance of jobs that are steady year round, it lifted the standard of living for the masses. It's good to have "one steady full time job", it's good to not have to worry about what to do with your next eight hours (because your employer planned it out for you). But why would one expect that model to last forever?

@Axtremus said in Bidenomics At Work:

About doing "multiple gig jobs" vs. "one full time job," while "one full time job" is easier and more more predictable day-to-day, the "multiple gig jobs" model is arguably lower risk long term because you won't be completely out of work and out of income because an employer goes bust or terminate you all of a sudden.

Ax, have you ever supported yourself through multiple gig jobs? I'd be very interested in hearing about your experiences.

-

Because Biden jacked the interest rates and slowed the housing industry, coupled with a decrease in real wages during his administration?

@Jolly said in Bidenomics At Work:

Biden jacked the interest rates

I am pretty sure the US Central Bank is independent. One of the great things about it is that it has been able to maintain its independence, and (mostly) avoids politics,

-

@Jolly said in Bidenomics At Work:

Biden jacked the interest rates

I am pretty sure the US Central Bank is independent. One of the great things about it is that it has been able to maintain its independence, and (mostly) avoids politics,

@taiwan_girl said in Bidenomics At Work:

@Jolly said in Bidenomics At Work:

Biden jacked the interest rates

I am pretty sure the US Central Bank is independent. One of the great things about it is that it has been able to maintain its independence, and (mostly) avoids politics,

You dump trillions of

into the economy, while racking up two trillion

into the economy, while racking up two trillion  deficits and a rise in interest rates is a certainty.

deficits and a rise in interest rates is a certainty.From Heritage...

-

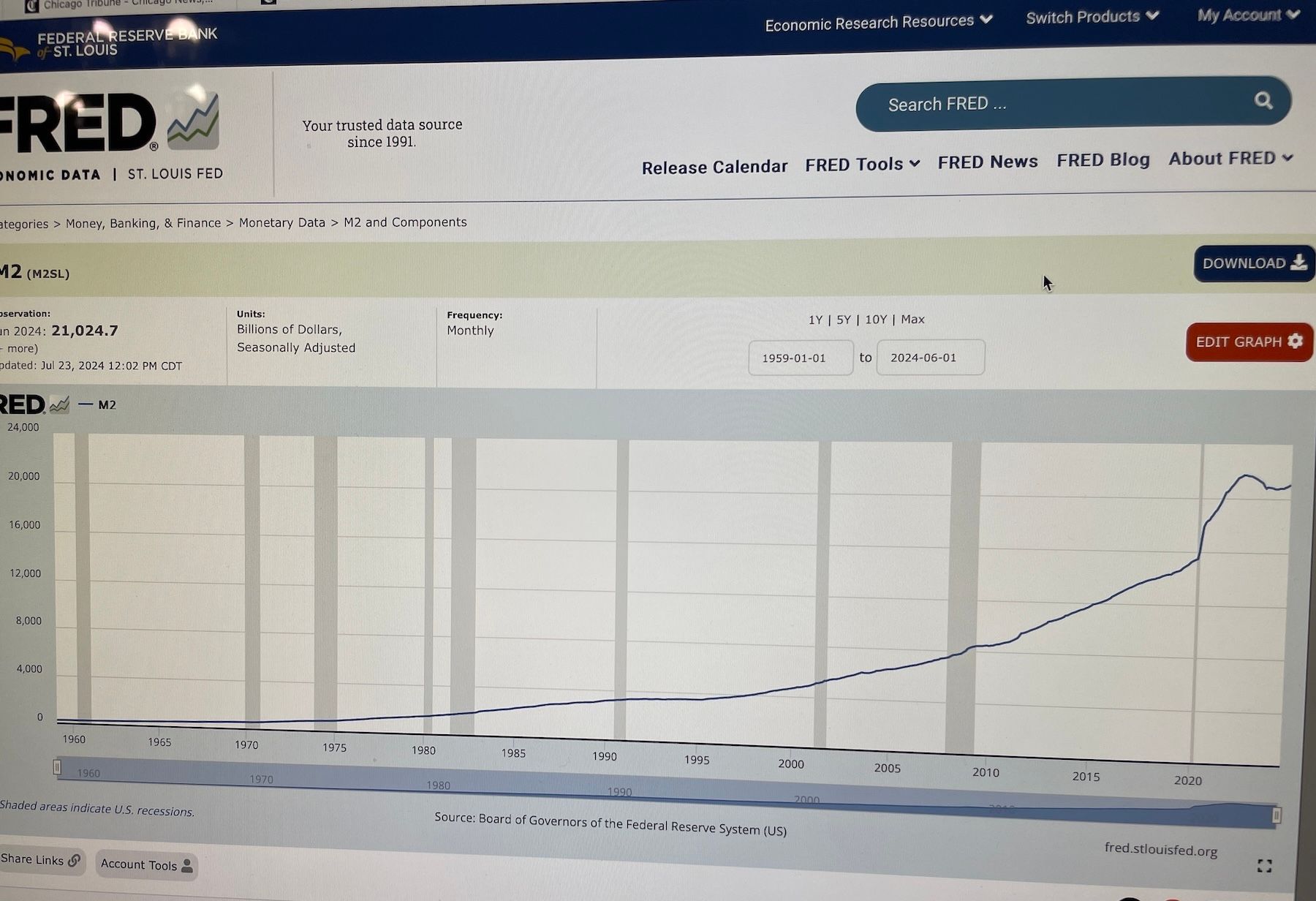

Money Supply

Jan 2017. $13.2

Jan 2021. $19.3

%change = 46.2%Jan 2021. $19.3

Jul 2024. $21.0

%change = 8.8%I am not an economist but I would hazard a guess that the period from Jan 2017-Jan 2021 had a larger impact on the economy (inflation, interest rates) than the period from Jan 2021 - Jul 2024.

The US economy is like a huge ship. You can start to turn the "ship" but it takes a long long time to make that turn.

That is why I have say many many times before. The president gets too much credit and too much blame because people only look at their term as if economic things that happen before and after their time have nothing to do with them.

-

Indeed. The traditional conservative view of inflation would peg this clearly on the increase of the money supply in the spring of 2020. Precisely as Milton Friedman’s theory predicted, inflation increased dramatically 18 months later.

In sober moments Jolly admits this and makes weak noises about the perception of the electorate.

-

Intel announces huge layoff:

https://www.washingtonpost.com/technology/2024/08/01/intel-layoffs-chips/

15,000 jobs; 15% of its workforce.

Biden has big plans to boost semiconductor manufacturing in the USA. The Chips and Science Act of 2022 allocates $52 billion in grants and $75 billion in loans to support the domestic chip industry. As the sole large scale semiconductor manufacturer left in the USA, Intel is expected to be the largest beneficiary of this. But none of the money has been released to Intel yet (still stuck in "due diligence").

But Intel has already missed the boat for smartphones and tablets (Arm wins this sector), NVIDIA is winning the AI chip race, and AMD is eating more and more of Intel's PC lunch. :man-shrugging: