SBF/FTX

-

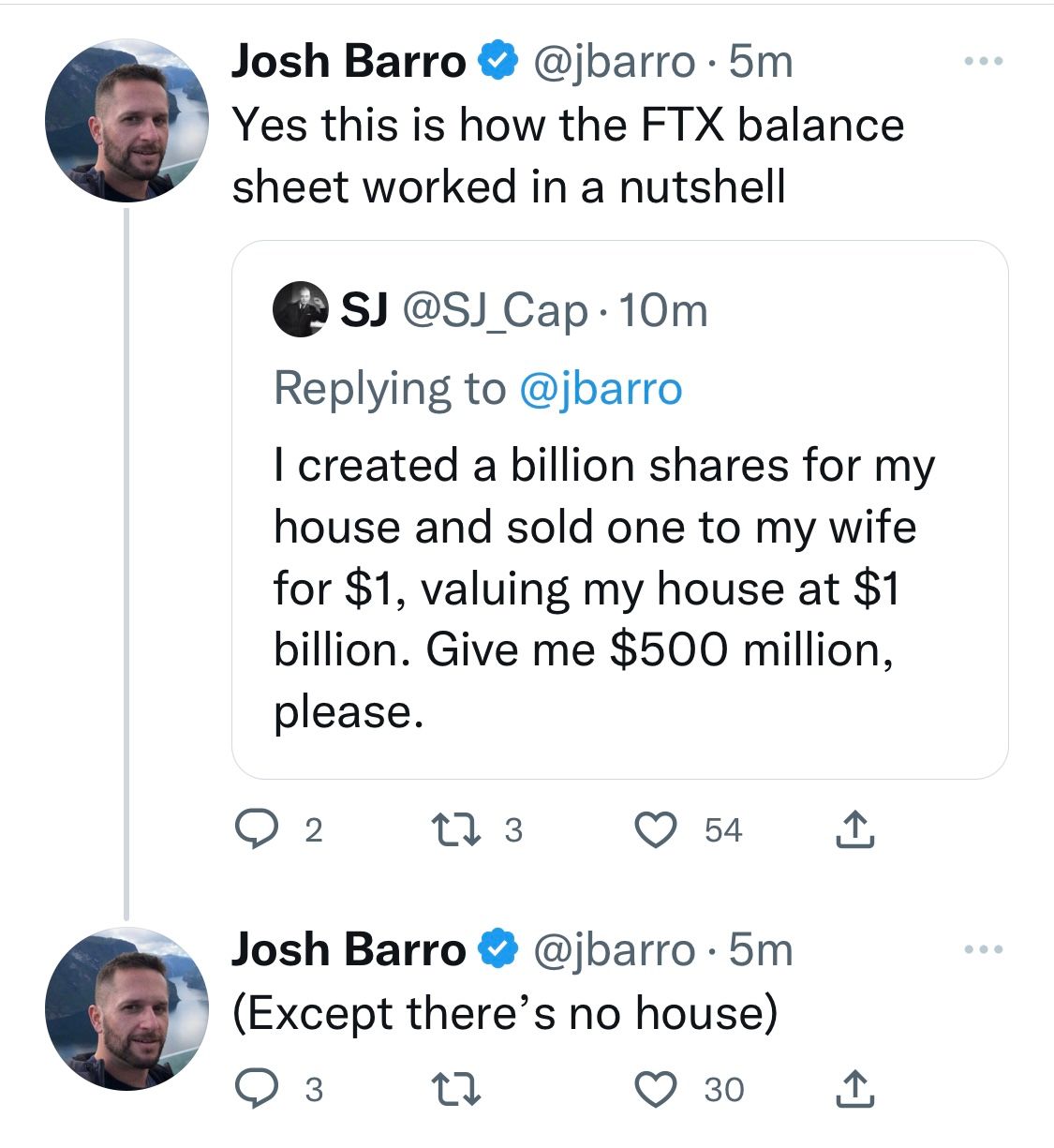

Sam Bankman-Fried and other FTX executives spent $8 billion worth of customer funds on real estate, venture capital investments, campaign donations, endorsement deals and even a sports stadium, according to testimony from former senior FTX executive Nishad Singh.

https://techcrunch.com/2023/10/16/ftx-execs-blew-through-8b-testimony-reveals-how/

-

"FTX cryptocurrency exchange founder Sam Bankman-Fried is "subsisting on bread and water" because the federal jail where he is being held ahead of his fraud trial has not provided him with a vegan diet as he requested, his lawyer said on Tuesday."

LOL

https://www.reuters.com/legal/jailed-ftx-founder-bankman-fried-return-court-new-plea-2023-08-22/

@taiwan_girl said in SBF/FTX:

"FTX cryptocurrency exchange founder Sam Bankman-Fried is "subsisting on bread and water" because the federal jail where he is being held ahead of his fraud trial has not provided him with a vegan diet as he requested, his lawyer said on Tuesday."

LOL

https://www.reuters.com/legal/jailed-ftx-founder-bankman-fried-return-court-new-plea-2023-08-22/

He won't subsist on it long. Do you know what happens to a prisoner fed a diet of nothing but bread and water?

-

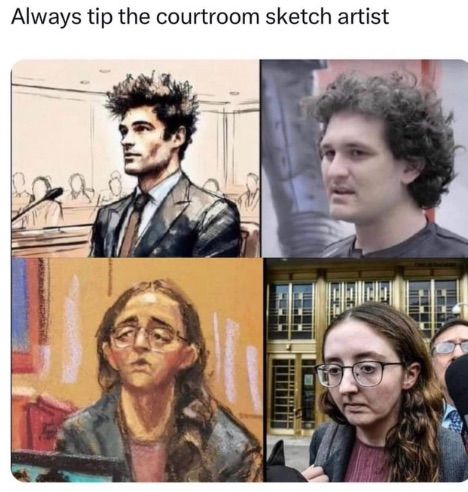

Sam Bankman-Fried was sentenced Thursday to 25 years in prison for his role in defrauding users of the collapsed cryptocurrency exchange FTX.

In a federal courtroom in lower Manhattan, U.S. District Judge Lewis Kaplan called the defense argument misleading, logically flawed and speculative.

He said Bankman-Fried had obstructed justice and tampered with witnesses in mounting his defense — something Kaplan said he weighed in his sentencing decision.

Bankman-Fried, wearing a beige jailhouse jumpsuit, struck an apologetic tone, saying he had made a series of "selfish" decisions while leading FTX and "threw it all away."

"It haunts me every day," he said in his statement.

Prosecutors had sought as much as 50 years, while Bankman-Fried's legal team argued for no more than 6½ years. He was convicted on seven criminal counts in November and had been held at the Metropolitan Detention Center in Brooklyn since.

In a statement following Thursday's sentencing, Damian Williams, United States Attorney for the Southern District of New York, said Bankman-Fried had orchestrated one of the largest frauds in financial history.

-

It doesn’t change the fact that he invested much of it illegally. The ultimate success or failures of the investment are irrelevant to a fair extent.

-

Not at all. And for a time it was insolvent. But even if that had never happened, advertising segregated customer funds and then using them for investing is fraud. Even if it were to end up being ‘victimless’.

(Ask the non-resident if you want confirmation)