Inflation

-

The Fed Is the Main Inflation Culprit

If price stability is squandered, financial stability is put at risk. If financial stability is lost, the economy is imperiled and the social contract is threatened.

During the past several quarters, U.S. inflation has surged—now running about triple the Federal Reserve’s 2% target. The surge in prices is unlikely to reverse on its own. The longer that prices are unstable, the greater the challenge to the conduct of macroeconomic policy. The last thing the country needs is its third major economic upheaval in a decade and a half.

Inflation is a choice. It’s a choice for which the Fed is chiefly responsible. The risk of an inflationary spiral arises when policy makers first dismiss the problem and then cast blame elsewhere. Inflation becomes embedded in the price-formation process when the central bank acts belatedly or with insufficient conviction. To date, the Fed has acted as an enabler.

In congressional testimony recently, Mr. Powell made clear he was surprised and troubled by the medium-term trajectory of inflation. At this week’s Federal Open Market Committee meeting, the Fed seems ready to abandon its policy priors.

Achieving a soft economic landing at this late stage is difficult. If the sole task were to drive inflation down, the Fed would immediately taper its asset purchases and start raising rates. But a significant tightening cycle would likely cause market volatility to surge and assets to reprice. The authorities have expressed little concern about financial excesses, bubbles or financial imbalances. Hope they’re right. I expect tension between the Fed’s goals of price stability and financial stability to be in sharper relief in the new year.

Stopping QE altogether—even a few quarters ago—would have kept a lid on inflation and allowed a more measured path of rate increases. The Fed now has fewer degrees of freedom to keep the economy out of harm’s way. If the Fed doesn’t act with due speed and skill, inflation—the most regressive tax of all—will do further harm, particularly to the least well-off. If the central bank lurches into a significant, unexpected rate-rising cycle, the same hardworking Americans will bear the brunt of an economic slowdown.

The economy—and the country—is at a critical juncture. The biggest mistake of all, however, is to underestimate America’s strengths. The U.S. economic and political system often shows less well than it performs. At present, the first obligation of policy makers is to ensure a return to price stability.

Mr. Warsh, a former member of the Federal Reserve Board, is a distinguished visiting fellow in economics at Stanford University’s Hoover Institution.

-

As a Smithfield resident I am well aware that Smithfield Foods controls roughly 25% of the pork market.

And Smithfield Foods is owned by Chinese.

And 40% of Chinese hogs were killed by a swine fever last year

Of course prices went up

I wasn't greed, it was dead hogs

-

Nobody’s getting their hands on big meat in Biden’s government

-

Nobody’s getting their hands on big meat in Biden’s government

@doctor-phibes said in Inflation:

Nobody’s getting their hands on big meat in Biden’s government

Mayor Pete…

-

@doctor-phibes said in Inflation:

Nobody’s getting their hands on big meat in Biden’s government

Mayor Pete…

@lufins-dad said in Inflation:

@doctor-phibes said in Inflation:

Nobody’s getting their hands on big meat in Biden’s governmentMayor Pete…

Post of the month.

-

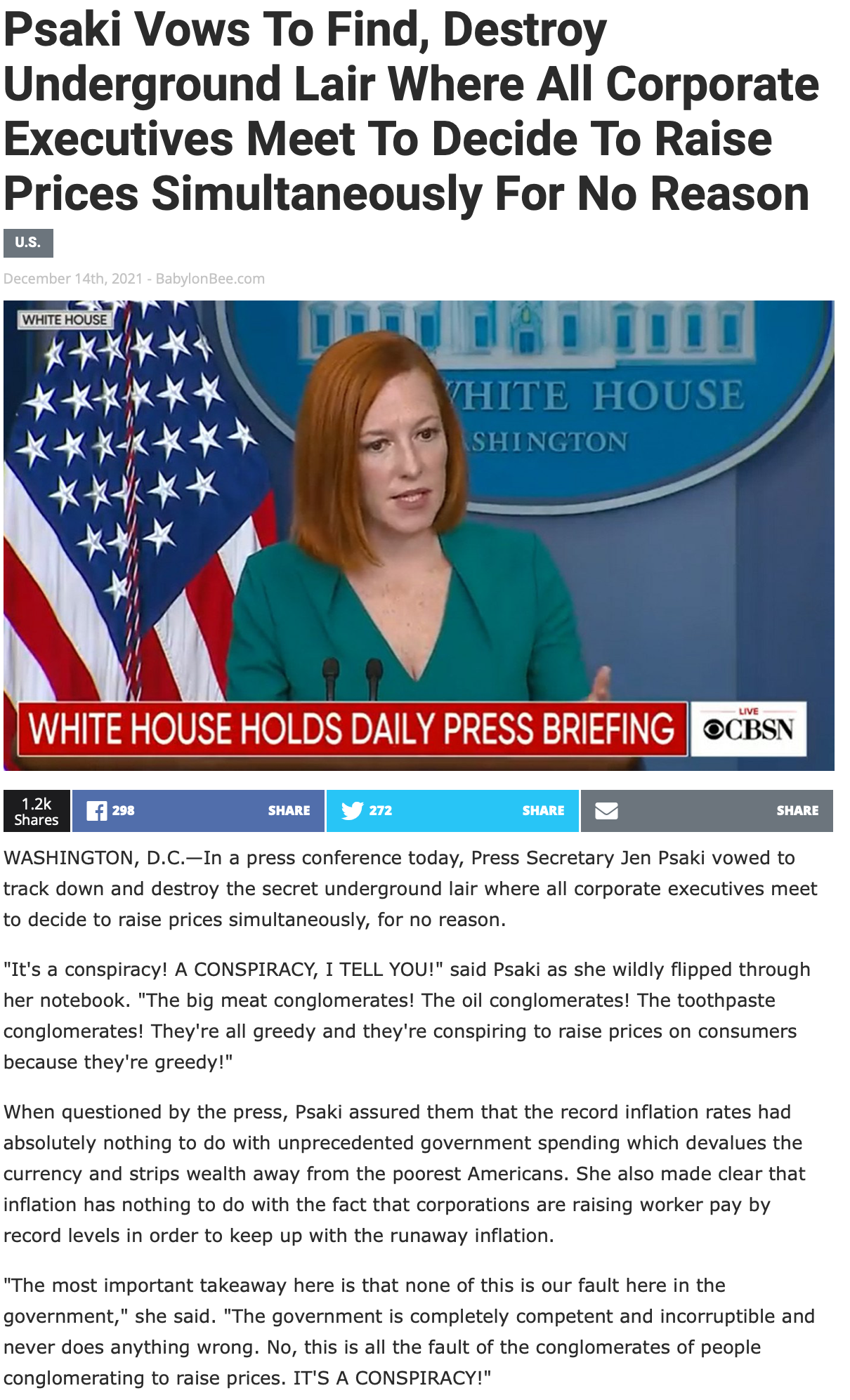

Silly Psaki.

Yes, meat conglomerates are a problem. I've spoken before about what guys are getting for their beef. That's why a rancher -owned meat processing plant is being built in the Midwest.

But they're not the main problem. Ask any grain farmer about the price and scarcity of seed. The cost of fertilizer. The cost of fuel. The cost of equipment (if you can get it) and the cost of labor.

That's why feed has gotten so high in price. Trucks and fuel to ship cattle are more expensive. And even cowboys ain't cheap.

-

Silly Psaki.

Yes, meat conglomerates are a problem. I've spoken before about what guys are getting for their beef. That's why a rancher -owned meat processing plant is being built in the Midwest.

But they're not the main problem. Ask any grain farmer about the price and scarcity of seed. The cost of fertilizer. The cost of fuel. The cost of equipment (if you can get it) and the cost of labor.

That's why feed has gotten so high in price. Trucks and fuel to ship cattle are more expensive. And even cowboys ain't cheap.

-

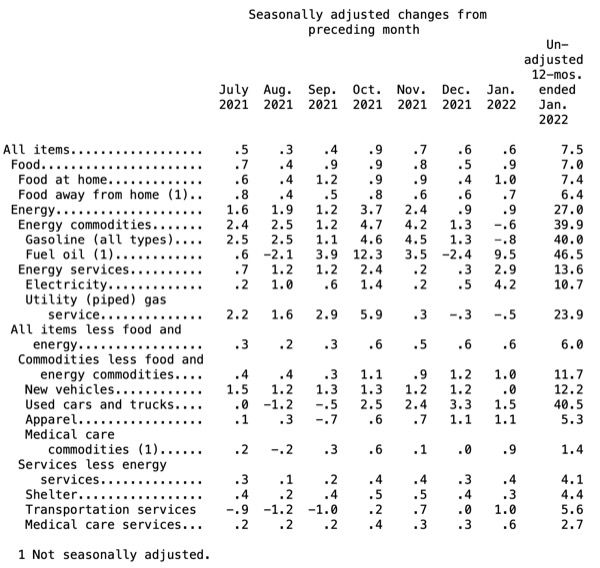

7.5%.

https://www.bls.gov/news.release/cpi.nr0.htm

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.6 percent in January on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 7.5 percent before seasonal adjustment.

Increases in the indexes for food, electricity, and shelter were the largest contributors to the seasonally adjusted all items increase. The food index rose 0.9 percent in January following a 0.5-percent increase in December. The energy

index also increased 0.9 percent over the month, with an increase in theelectricity index being partially offset by declines in the gasoline index and the natural gas index.The index for all items less food and energy rose 0.6percent in January, the same increase as in December. This was the seventh time in the last 10 months it has increased at least 0.5 percent. Along with the index for shelter, the indexes for household furnishings and operations, used cars and trucks, medical care, and apparel were among many indexes that increased over the month.

The all items index rose 7.5 percent for the 12 months ending January, the largest 12-month increase since the period ending February 1982. The all items less food and energy index rose 6.0 percent, the largest 12-month change since the period ending August 1982. The energy index rose 27.0 percent over the last year, and the food index increased 7.0 percent.

-

CPI Inflation Rate Hits Scorching 7.5%; Dow Jones Slides On Fed Rate-Hike Views

The consumer price index came in hotter than expected in January, as both the CPI inflation rate and the core rate, excluding food and energy, hit new 39-year highs. Dow Jones industrial average and Nasdaq losses deepened in Thursday afternoon stock market action as Wall Street priced in additional Fed rate hikes. Meanwhile, the 10-year Treasury yield crested 2% for the first time since August 2019 and kept on rising.

-

Just a SWAG, but I suspect even those numbers a smidgen. I would guess closer to 10%, rather than 7.5%.

-

Snowballing. In order to pay sales staff, technicians, and movers enough to maintain their equivalent income while also accounting for higher overhead for store supplies and higher energy costs, I have to raise my margins which will raise the prices further, and that’s before I get my price increases from the manufacturers…

-

Snowballing. In order to pay sales staff, technicians, and movers enough to maintain their equivalent income while also accounting for higher overhead for store supplies and higher energy costs, I have to raise my margins which will raise the prices further, and that’s before I get my price increases from the manufacturers…

@lufins-dad and the fact that energy (fuel) prices are rising will only increase prices for everything that's dependent upon transportation.

Which is...everything.

-