Inflation

-

Silly Psaki.

Yes, meat conglomerates are a problem. I've spoken before about what guys are getting for their beef. That's why a rancher -owned meat processing plant is being built in the Midwest.

But they're not the main problem. Ask any grain farmer about the price and scarcity of seed. The cost of fertilizer. The cost of fuel. The cost of equipment (if you can get it) and the cost of labor.

That's why feed has gotten so high in price. Trucks and fuel to ship cattle are more expensive. And even cowboys ain't cheap.

-

Silly Psaki.

Yes, meat conglomerates are a problem. I've spoken before about what guys are getting for their beef. That's why a rancher -owned meat processing plant is being built in the Midwest.

But they're not the main problem. Ask any grain farmer about the price and scarcity of seed. The cost of fertilizer. The cost of fuel. The cost of equipment (if you can get it) and the cost of labor.

That's why feed has gotten so high in price. Trucks and fuel to ship cattle are more expensive. And even cowboys ain't cheap.

-

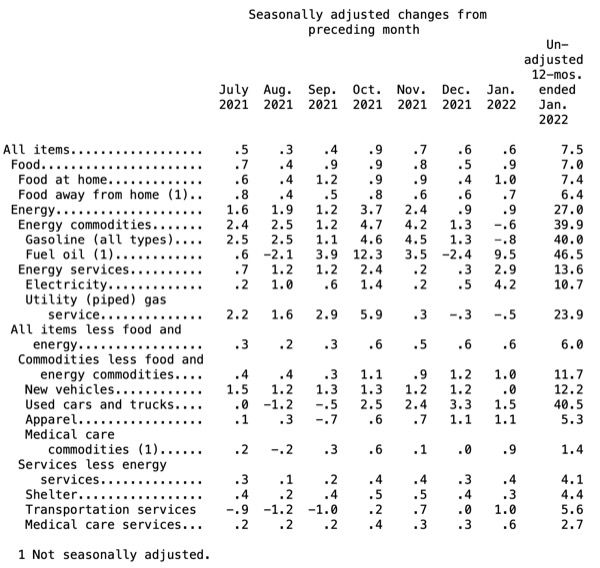

7.5%.

https://www.bls.gov/news.release/cpi.nr0.htm

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.6 percent in January on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 7.5 percent before seasonal adjustment.

Increases in the indexes for food, electricity, and shelter were the largest contributors to the seasonally adjusted all items increase. The food index rose 0.9 percent in January following a 0.5-percent increase in December. The energy

index also increased 0.9 percent over the month, with an increase in theelectricity index being partially offset by declines in the gasoline index and the natural gas index.The index for all items less food and energy rose 0.6percent in January, the same increase as in December. This was the seventh time in the last 10 months it has increased at least 0.5 percent. Along with the index for shelter, the indexes for household furnishings and operations, used cars and trucks, medical care, and apparel were among many indexes that increased over the month.

The all items index rose 7.5 percent for the 12 months ending January, the largest 12-month increase since the period ending February 1982. The all items less food and energy index rose 6.0 percent, the largest 12-month change since the period ending August 1982. The energy index rose 27.0 percent over the last year, and the food index increased 7.0 percent.

-

CPI Inflation Rate Hits Scorching 7.5%; Dow Jones Slides On Fed Rate-Hike Views

The consumer price index came in hotter than expected in January, as both the CPI inflation rate and the core rate, excluding food and energy, hit new 39-year highs. Dow Jones industrial average and Nasdaq losses deepened in Thursday afternoon stock market action as Wall Street priced in additional Fed rate hikes. Meanwhile, the 10-year Treasury yield crested 2% for the first time since August 2019 and kept on rising.

-

Just a SWAG, but I suspect even those numbers a smidgen. I would guess closer to 10%, rather than 7.5%.

-

Snowballing. In order to pay sales staff, technicians, and movers enough to maintain their equivalent income while also accounting for higher overhead for store supplies and higher energy costs, I have to raise my margins which will raise the prices further, and that’s before I get my price increases from the manufacturers…

-

Snowballing. In order to pay sales staff, technicians, and movers enough to maintain their equivalent income while also accounting for higher overhead for store supplies and higher energy costs, I have to raise my margins which will raise the prices further, and that’s before I get my price increases from the manufacturers…

@lufins-dad and the fact that energy (fuel) prices are rising will only increase prices for everything that's dependent upon transportation.

Which is...everything.

-

-

-

A more cynical solution would be to go to war…

-

A more cynical solution would be to go to war…