Bidenomics At Work

-

@Axtremus said in Bidenomics At Work:

Goldman Sachs seems to be more optimistic than the concensus most of the time.

What is GS seeing that the rest are not?

Or is GS trying to mislead everyone else?You don't make much money preaching doom and gloom in the financial sector. At least for most investments.

-

@George-K said in Bidenomics At Work:

Yeah, the economy sucks because MAGA extremists.

Yeah, they’ll finish the job…

-

Why Americans Dislike the Economy

“Why are the vibes so bad?” ask legions of commentators, noting the disconnect between polling on the economy and top-level economic indicators. The unemployment rate is within spitting distance of 60-year lows, and measured inflation has dropped from a punishingly high 9 percent rate to a lower, though still too high, 3.2 percent.

And yet, citizens are unhappy with the economy. According to a New York Times–Siena poll, 81 percent of registered voters described the condition of the economy as fair or poor, and only 19 percent called it good or excellent. Another poll, conducted by the Financial Times and the University of Michigan, found that a majority of voters said that they are worse off under President Biden then they were before, and only 14 percent said that they are better off. By a 59 percent to 37 percent margin, the Times–Siena poll found voters trusting Donald Trump more than President Biden on the economy.

To reconcile voters’ discontent with the economic data, we shouldn’t consider the top-level employment and inflation indicators separately. Instead, we should combine them—and when we do, we observe workers’ real (that is, after inflation) wages have declined significantly in recent years.

Some commentators argue that real wages are rising, but these claims are based on the popular average hourly earnings measure from the Bureau of Labor Statistics’ Current Employment Statistics. Average hourly earnings is a less useful indicator now because of large workforce-composition changes. During the pandemic, the economy shed large numbers of low-paying service jobs (for instance, in leisure and hospitality), which pushed the average wage in the economy higher. The average moved up because low-paying jobs dropped from BLS’s sample, not because individuals experienced strong wage growth. The effect reversed as the economy began adding those low-paying service jobs back, which pushed average hourly earnings down. Those composition effects linger today, as the economy is still short 560,000 leisure and hospitality jobs (adjusting for labor-force growth), relative to pre-pandemic levels, due largely to firms’ difficulty finding workers.

-

I think it is because the price changes were somewhat "drastic" compared to previously, when the inflation rate was low for an extended period of time. The "old" prices are still fresh in peoples minds.

-

People remember 2018 and 2019. They understand how things changed with COVID and the inflation Biden has not been able to tamp down.

And they understand that the rosy scenario the Biden Administration is painting is not entirely true. Hospitality jobs have not recovered. Many people can no longer afford a car. Many people cannot afford food. As temporary Medicaid rolls are scaled back, many can no longer afford health insurance.

The people know.

-

People remember 2018 and 2019. They understand how things changed with COVID and the inflation Biden has not been able to tamp down.

And they understand that the rosy scenario the Biden Administration is painting is not entirely true. Hospitality jobs have not recovered. Many people can no longer afford a car. Many people cannot afford food. As temporary Medicaid rolls are scaled back, many can no longer afford health insurance.

The people know.

@Jolly said in Bidenomics At Work:

the inflation Biden has not been able to tamp down.

That's simply not true. Inflation is way lower than it was. I don't think it's got much to do with Biden, but it is significantly lower.

-

@Jolly said in Bidenomics At Work:

the inflation Biden has not been able to tamp down.

That's simply not true. Inflation is way lower than it was. I don't think it's got much to do with Biden, but it is significantly lower.

@Doctor-Phibes said in Bidenomics At Work:

@Jolly said in Bidenomics At Work:

the inflation Biden has not been able to tamp down.

That's simply not true. Inflation is way lower than it was. I don't think it's got much to do with Biden, but it is significantly lower.

That's Ax reasoning. Look at a 90 day chart and then extrapolate to reach whatever conclusion is desired.

People look back at pre-COVID and then they look at prices now. Most - rightly or wrongly (I think rightly) - place a lot of blame on The Resident.

-

@Doctor-Phibes said in Bidenomics At Work:

@Jolly said in Bidenomics At Work:

the inflation Biden has not been able to tamp down.

That's simply not true. Inflation is way lower than it was. I don't think it's got much to do with Biden, but it is significantly lower.

That's Ax reasoning. Look at a 90 day chart and then extrapolate to reach whatever conclusion is desired.

People look back at pre-COVID and then they look at prices now. Most - rightly or wrongly (I think rightly) - place a lot of blame on The Resident.

-

Why Americans Dislike the Economy

“Why are the vibes so bad?” ask legions of commentators, noting the disconnect between polling on the economy and top-level economic indicators. The unemployment rate is within spitting distance of 60-year lows, and measured inflation has dropped from a punishingly high 9 percent rate to a lower, though still too high, 3.2 percent.

And yet, citizens are unhappy with the economy. According to a New York Times–Siena poll, 81 percent of registered voters described the condition of the economy as fair or poor, and only 19 percent called it good or excellent. Another poll, conducted by the Financial Times and the University of Michigan, found that a majority of voters said that they are worse off under President Biden then they were before, and only 14 percent said that they are better off. By a 59 percent to 37 percent margin, the Times–Siena poll found voters trusting Donald Trump more than President Biden on the economy.

To reconcile voters’ discontent with the economic data, we shouldn’t consider the top-level employment and inflation indicators separately. Instead, we should combine them—and when we do, we observe workers’ real (that is, after inflation) wages have declined significantly in recent years.

Some commentators argue that real wages are rising, but these claims are based on the popular average hourly earnings measure from the Bureau of Labor Statistics’ Current Employment Statistics. Average hourly earnings is a less useful indicator now because of large workforce-composition changes. During the pandemic, the economy shed large numbers of low-paying service jobs (for instance, in leisure and hospitality), which pushed the average wage in the economy higher. The average moved up because low-paying jobs dropped from BLS’s sample, not because individuals experienced strong wage growth. The effect reversed as the economy began adding those low-paying service jobs back, which pushed average hourly earnings down. Those composition effects linger today, as the economy is still short 560,000 leisure and hospitality jobs (adjusting for labor-force growth), relative to pre-pandemic levels, due largely to firms’ difficulty finding workers.

@George-K said in Bidenomics At Work:

Why Americans Dislike the Economy

“Why are the vibes so bad?” ask legions of commentators, noting the disconnect between polling on the economy and top-level economic indicators. The unemployment rate is within spitting distance of 60-year lows, and measured inflation has dropped from a punishingly high 9 percent rate to a lower, though still too high, 3.2 percent.

And yet, citizens are unhappy with the economy. According to a New York Times–Siena poll, 81 percent of registered voters described the condition of the economy as fair or poor, and only 19 percent called it good or excellent. Another poll, conducted by the Financial Times and the University of Michigan, found that a majority of voters said that they are worse off under President Biden then they were before, and only 14 percent said that they are better off. By a 59 percent to 37 percent margin, the Times–Siena poll found voters trusting Donald Trump more than President Biden on the economy.

To reconcile voters’ discontent with the economic data, we shouldn’t consider the top-level employment and inflation indicators separately. Instead, we should combine them—and when we do, we observe workers’ real (that is, after inflation) wages have declined significantly in recent years.

Some commentators argue that real wages are rising, but these claims are based on the popular average hourly earnings measure from the Bureau of Labor Statistics’ Current Employment Statistics. Average hourly earnings is a less useful indicator now because of large workforce-composition changes. During the pandemic, the economy shed large numbers of low-paying service jobs (for instance, in leisure and hospitality), which pushed the average wage in the economy higher. The average moved up because low-paying jobs dropped from BLS’s sample, not because individuals experienced strong wage growth. The effect reversed as the economy began adding those low-paying service jobs back, which pushed average hourly earnings down. Those composition effects linger today, as the economy is still short 560,000 leisure and hospitality jobs (adjusting for labor-force growth), relative to pre-pandemic levels, due largely to firms’ difficulty finding workers.

I think they are still missing the most obvious reasons, housing first and foremost.

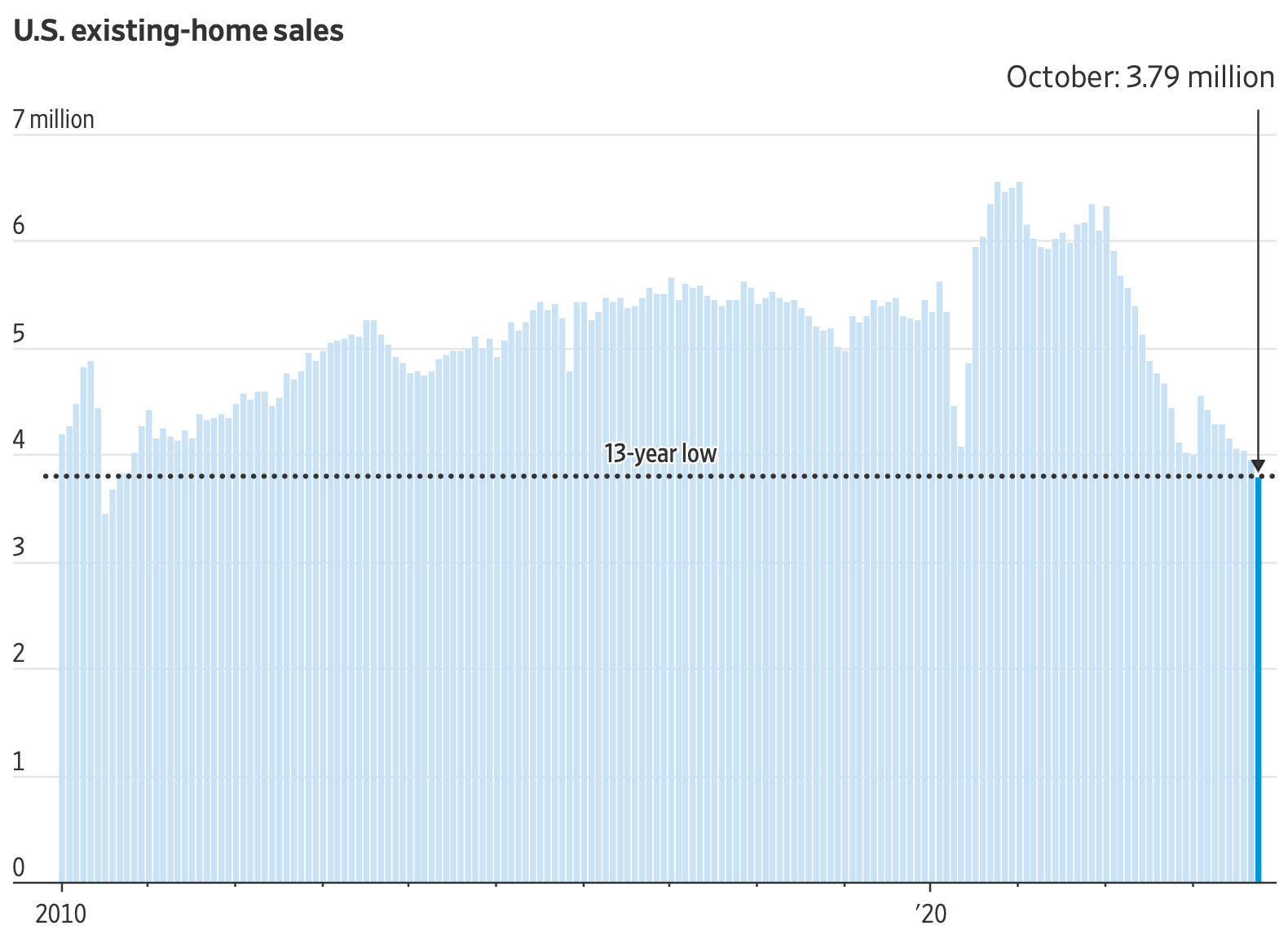

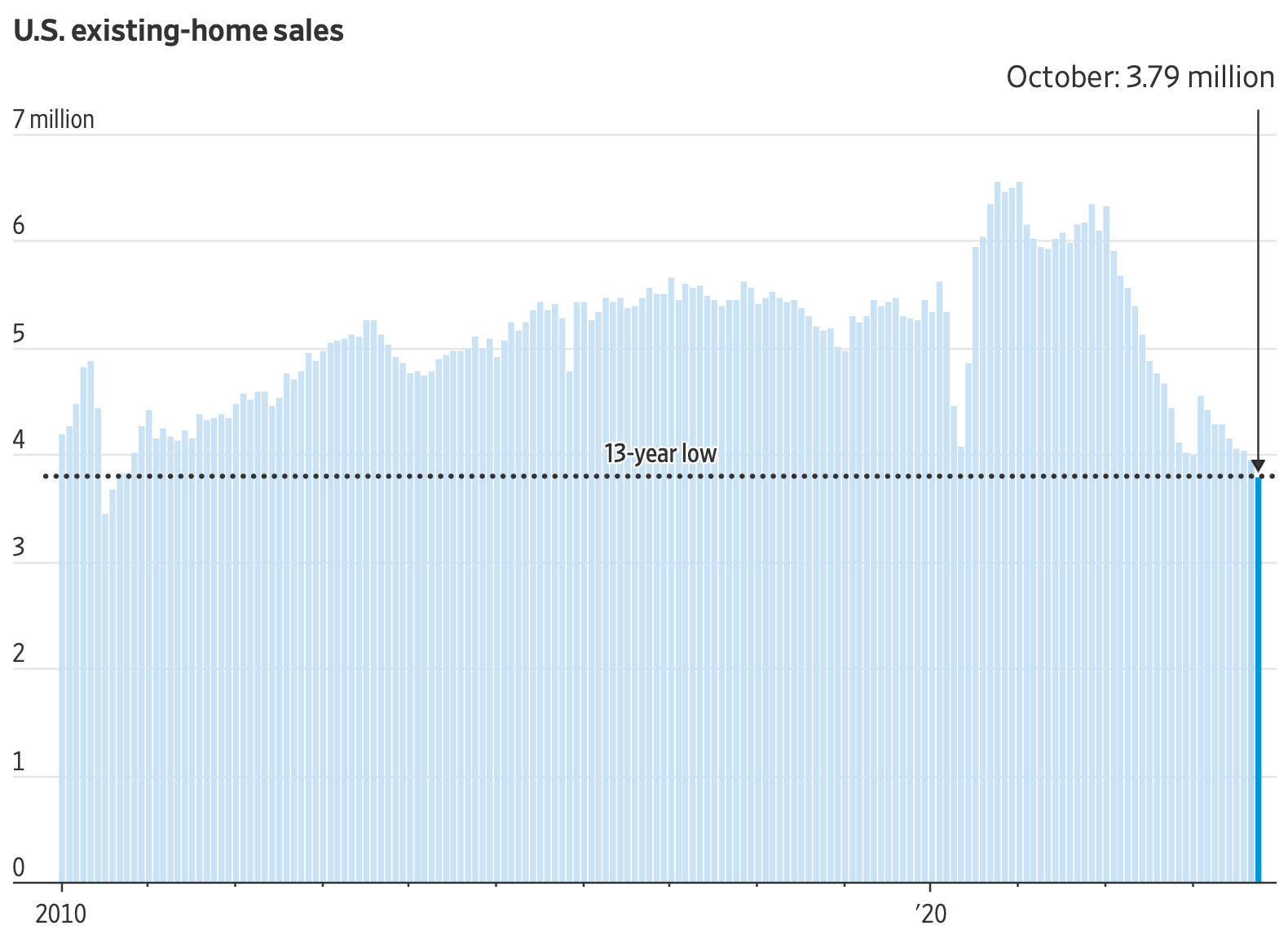

Home sales are down between 15% to 20%, and that’s from last year, which was down from 2021… It’s a snowball. And those numbers are worse than they appear as 15% of the current home sales are institutional buyers for investment, paying cash, and renting out the properties. But because of the extreme shortage of properties available, values are still going up. That’s screwing with rental prices drastically.

On top of the renters, you have roughly 20 percent of households that have either acquired new mortgages over the past 2 years with extremely higher interest rates and another 5% with existing ARMS whose rates and payments have nearly doubled. Even those with existing fixed rate mortgages are stuck… They can’t refinance or take out HELOC’s due to the rates. This has another effect on the construction industry as home remodeling, additions, etc… are stalled. This has another effect on job mobility as workers can’t afford to move to take another job…

Much of the growth shown over the last two quarters has been generated by Governmental growth and spending. That is simply not sustainable.

To @Doctor-Phibes and others pointing out that inflation has dropped… Think of a car driving at 65 MPH. Suddenly it accelerates to 80 over the course of 1 mile. Now it’s accelerates to 85 over the course of the next mile. The rate of acceleration is 1/3 what it was, but we’re still at 85 MPH and increasing…

-

@Doctor-Phibes said in Bidenomics At Work:

@Jolly said in Bidenomics At Work:

the inflation Biden has not been able to tamp down.

That's simply not true. Inflation is way lower than it was. I don't think it's got much to do with Biden, but it is significantly lower.

That's Ax reasoning. Look at a 90 day chart and then extrapolate to reach whatever conclusion is desired.

People look back at pre-COVID and then they look at prices now. Most - rightly or wrongly (I think rightly) - place a lot of blame on The Resident.

@Jolly said in Bidenomics At Work:

@Doctor-Phibes said in Bidenomics At Work:

@Jolly said in Bidenomics At Work:

the inflation Biden has not been able to tamp down.

That's simply not true. Inflation is way lower than it was. I don't think it's got much to do with Biden, but it is significantly lower.

That's Ax reasoning. Look at a 90 day chart and then extrapolate to reach whatever conclusion is desired.

People look back at pre-COVID and then they look at prices now. Most - rightly or wrongly (I think rightly) - place a lot of blame on The Resident.

Well, we went through a period of very high inflation, so obviously prices are higher now than they were. But inflation is much lower than it was. Anybody who thinks that means prices should go back to what they were before doesn't understand what inflation actually is. They're never going back to what they were before.

Some people seem to have a hard time distinguishing between 'inflation' and 'prices'.

-

@George-K said in Bidenomics At Work:

Why Americans Dislike the Economy

“Why are the vibes so bad?” ask legions of commentators, noting the disconnect between polling on the economy and top-level economic indicators. The unemployment rate is within spitting distance of 60-year lows, and measured inflation has dropped from a punishingly high 9 percent rate to a lower, though still too high, 3.2 percent.

And yet, citizens are unhappy with the economy. According to a New York Times–Siena poll, 81 percent of registered voters described the condition of the economy as fair or poor, and only 19 percent called it good or excellent. Another poll, conducted by the Financial Times and the University of Michigan, found that a majority of voters said that they are worse off under President Biden then they were before, and only 14 percent said that they are better off. By a 59 percent to 37 percent margin, the Times–Siena poll found voters trusting Donald Trump more than President Biden on the economy.

To reconcile voters’ discontent with the economic data, we shouldn’t consider the top-level employment and inflation indicators separately. Instead, we should combine them—and when we do, we observe workers’ real (that is, after inflation) wages have declined significantly in recent years.

Some commentators argue that real wages are rising, but these claims are based on the popular average hourly earnings measure from the Bureau of Labor Statistics’ Current Employment Statistics. Average hourly earnings is a less useful indicator now because of large workforce-composition changes. During the pandemic, the economy shed large numbers of low-paying service jobs (for instance, in leisure and hospitality), which pushed the average wage in the economy higher. The average moved up because low-paying jobs dropped from BLS’s sample, not because individuals experienced strong wage growth. The effect reversed as the economy began adding those low-paying service jobs back, which pushed average hourly earnings down. Those composition effects linger today, as the economy is still short 560,000 leisure and hospitality jobs (adjusting for labor-force growth), relative to pre-pandemic levels, due largely to firms’ difficulty finding workers.

I think they are still missing the most obvious reasons, housing first and foremost.

Home sales are down between 15% to 20%, and that’s from last year, which was down from 2021… It’s a snowball. And those numbers are worse than they appear as 15% of the current home sales are institutional buyers for investment, paying cash, and renting out the properties. But because of the extreme shortage of properties available, values are still going up. That’s screwing with rental prices drastically.

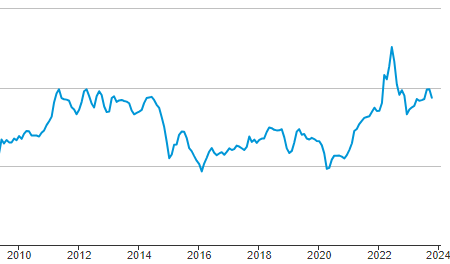

On top of the renters, you have roughly 20 percent of households that have either acquired new mortgages over the past 2 years with extremely higher interest rates and another 5% with existing ARMS whose rates and payments have nearly doubled. Even those with existing fixed rate mortgages are stuck… They can’t refinance or take out HELOC’s due to the rates. This has another effect on the construction industry as home remodeling, additions, etc… are stalled. This has another effect on job mobility as workers can’t afford to move to take another job…

Much of the growth shown over the last two quarters has been generated by Governmental growth and spending. That is simply not sustainable.

To @Doctor-Phibes and others pointing out that inflation has dropped… Think of a car driving at 65 MPH. Suddenly it accelerates to 80 over the course of 1 mile. Now it’s accelerates to 85 over the course of the next mile. The rate of acceleration is 1/3 what it was, but we’re still at 85 MPH and increasing…

@LuFins-Dad said in Bidenomics At Work:

Home sales are down between 15% to 20%, and that’s from last year, which was down from 2021… It’s a snowball

https://www.wsj.com/economy/housing/october-2023-home-sales-fall-ec6b3164?mod=djemwhatsnews

Home sales fell in October to a fresh 13-year low as high interest rates and home prices continued to pummel the housing market.

Home-buying affordability sits near its lowest level in decades, pushing many buyers out of the market. Existing-home sales for the full year in 2023 are on track to be the lowest since at least 2011, according to economist forecasts.

Existing-home sales, which make up most of the housing market, decreased 4.1% in October from the prior month to a seasonally adjusted annual rate of 3.79 million, the lowest rate since August 2010, the National Association of Realtors said Tuesday. October sales fell 14.6% from a year earlier. Sales have been near 2010 levels in recent months.

Even as home-buying demand has slumped, the inventory of homes for sale has stayed low. High rates are making homeowners unwilling to sell and move, because they don’t want to give up their existing low interest rates. The limited supply is a major reason that home prices are rising in much of the U.S.

-

@LuFins-Dad said in Bidenomics At Work:

Home sales are down between 15% to 20%, and that’s from last year, which was down from 2021… It’s a snowball

https://www.wsj.com/economy/housing/october-2023-home-sales-fall-ec6b3164?mod=djemwhatsnews

Home sales fell in October to a fresh 13-year low as high interest rates and home prices continued to pummel the housing market.

Home-buying affordability sits near its lowest level in decades, pushing many buyers out of the market. Existing-home sales for the full year in 2023 are on track to be the lowest since at least 2011, according to economist forecasts.

Existing-home sales, which make up most of the housing market, decreased 4.1% in October from the prior month to a seasonally adjusted annual rate of 3.79 million, the lowest rate since August 2010, the National Association of Realtors said Tuesday. October sales fell 14.6% from a year earlier. Sales have been near 2010 levels in recent months.

Even as home-buying demand has slumped, the inventory of homes for sale has stayed low. High rates are making homeowners unwilling to sell and move, because they don’t want to give up their existing low interest rates. The limited supply is a major reason that home prices are rising in much of the U.S.

@George-K said in Bidenomics At Work:

Even as home-buying demand has slumped, the inventory of homes for sale has stayed low. High rates are making homeowners unwilling to sell and move, because they don’t want to give up their existing low interest rates. The limited supply is a major reason that home prices are rising in much of the U.S.

Yeah so the feds are doing the part where they are causing more people to not buy homes... but the price of homes (as noted above) aren't falling, and I'd imagine when rates do start to trickle back down to 5 or 4% you're just going to see further and further jumps in home prices making ownership even harder than it is now.

Side note. I have a friend who has been on the fence regarding purchasing a home for many years. They just pulled the trigger and their mortgage that would've been $2,500 in 2021 is now $4,500. That's hard to stomach.

-

Another side note, am I the only one that still expects this menu when I go to McDonalds? So many options are now gone (Snack wraps, salads, bagel steak and cheese breakfast sandwich), and what's worse... the dollar menu. Oh many the other day I bought a McDouble and it was like $3.89 instead of $1.00.

https://www.reddit.com/media?url=https%3A%2F%2Fi.redd.it%2Fr7bftxy58s2c1.jpg

-

Ah yes, gas is SO MUCH cheaper.

Also, pretty sure groceries, toys, and basically EVERYTHING has not gone down in price. Vendors are leaving prices as-is or increasing them, at least it seems to me. They need to keep up with the CPI, inflation, whatever... and they also know customers will pay higher prices if need be. Not much incentive to lower prices.