Mortgage Questions

-

Wow, great advice here. No joke, and also not surprised.

A few replies, in

no orderreverse order:@jon-nyc @Axtremus - Minnesota is a non-recourse state. Never knew of that concept, but there you go. That favors the buyer. Federal law does prohibit prepayment penalties after 3 years, so that is good. Thanks for the ideas.

@Jolly - We are indeed buying for 30 years, and I have embraced that we are likely near or on the bubble, so if prices drop in the next couple years, it will be a non-factor for us. Thanks for the reply.

@LuFins-Dad @George-K - I downloaded the various HOA (etc) docs to read on the plane tomorrow. It might be short-sighted, but based on the house and yard, I do not foresee any changes that would warrant the local planning committee (or whatever) getting involved. The "biggest thing" is there is a 3-season porch we might want to get converted (insulated) into a 4-season porch.

@George-K - Good advice. Regarding the difference, I won't go into details other than our mortgage will be above $500k, but at this point it's not a matter of affordability but rather...do I go with a 3.2% or 2.7% if I can get the latter, which brings me to...

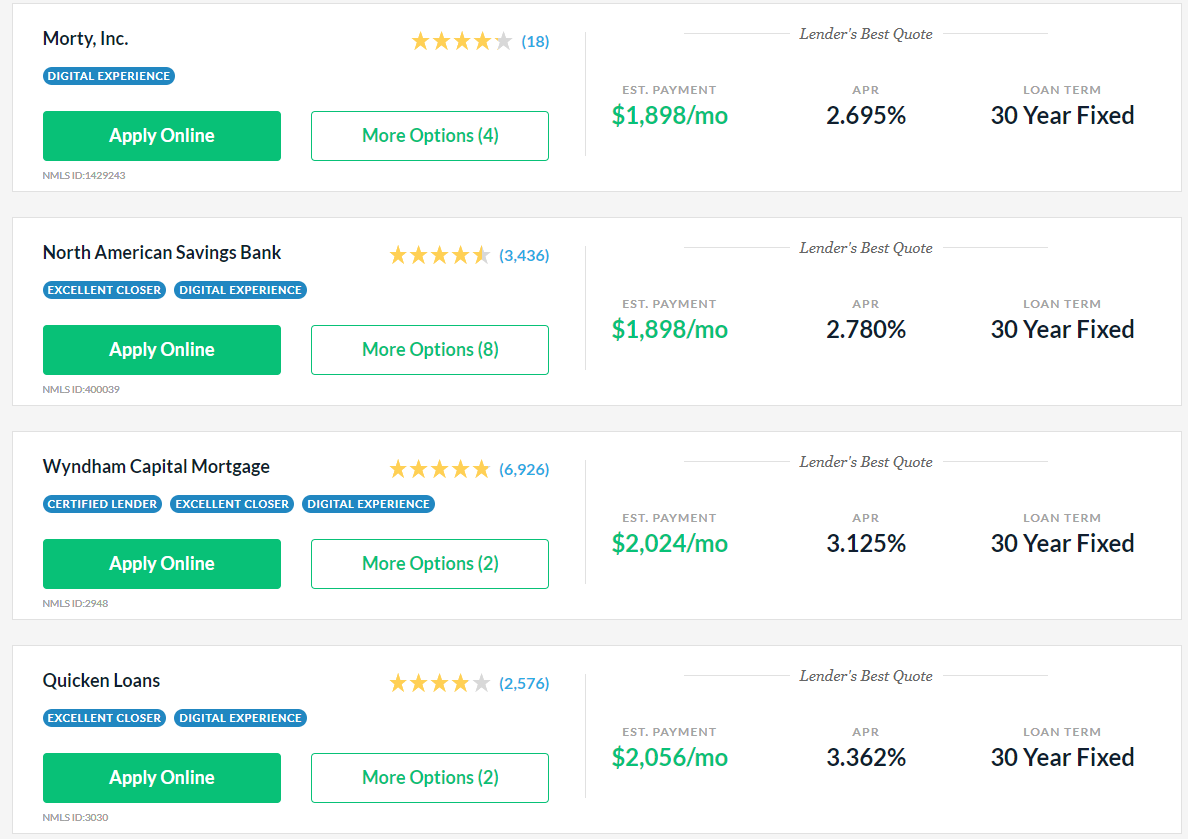

@jon-nyc - Good info. One of the better rates was via Morty(.com) which I guess is a newer player that gives good rates and uses tech to keep costs lower. Actually, I guess this isn't TMI so here's what I received:

-

Finance for thirty if you wish, but pay it off before then. There are several schemes to do so and I highly recommend it.

@jolly said in Mortgage Questions:

Finance for thirty if you wish, but pay it off before then. There are several schemes to do so and I highly recommend it.

Agreed, I still hesitate with giving too many personal details but yeah... our plan is to pay it off in 10-15 years. I know financial planners would say "Pay the 3% interest and make 5-10% in the stock market!" but I'm a simpleton and would enjoy not having debt.

-

@jolly said in Mortgage Questions:

Finance for thirty if you wish, but pay it off before then. There are several schemes to do so and I highly recommend it.

Agreed, I still hesitate with giving too many personal details but yeah... our plan is to pay it off in 10-15 years. I know financial planners would say "Pay the 3% interest and make 5-10% in the stock market!" but I'm a simpleton and would enjoy not having debt.

@89th said in Mortgage Questions:

@jolly said in Mortgage Questions:

Finance for thirty if you wish, but pay it off before then. There are several schemes to do so and I highly recommend it.

Agreed, I still hesitate with giving too many personal details but yeah... our plan is to pay it off in 10-15 years. I know financial planners would say "Pay the 3% interest and make 5-10% in the stock market!" but I'm a simpleton and would enjoy not having debt.

I get that philosophy, but that comes from a day when interest rates were 11-12% (and higher, my parents mortgage in the early 80s was at 16%). Recouping 11-12% in the stock market carries a fair amount of risk so paying off early makes a ton more sense... But 3%? You can get high yield bonds that pay off higher...

-

@jolly said in Mortgage Questions:

Finance for thirty if you wish, but pay it off before then. There are several schemes to do so and I highly recommend it.

Agreed, I still hesitate with giving too many personal details but yeah... our plan is to pay it off in 10-15 years. I know financial planners would say "Pay the 3% interest and make 5-10% in the stock market!" but I'm a simpleton and would enjoy not having debt.

@89th said in Mortgage Questions:

@jolly said in Mortgage Questions:

Finance for thirty if you wish, but pay it off before then. There are several schemes to do so and I highly recommend it.

Agreed, I still hesitate with giving too many personal details but yeah... our plan is to pay it off in 10-15 years. I know financial planners would say "Pay the 3% interest and make 5-10% in the stock market!" but I'm a simpleton and would enjoy not having debt.

You are in good company, 89th. No debt gives you a lot more choices as to how to live, what you have to do workwise, all that. Making that small extra payment against principal makes a huge difference.

-

@89th the big question is how close to Darwin will you be?

-

@jolly said in Mortgage Questions:

Finance for thirty if you wish, but pay it off before then. There are several schemes to do so and I highly recommend it.

Agreed, I still hesitate with giving too many personal details but yeah... our plan is to pay it off in 10-15 years. I know financial planners would say "Pay the 3% interest and make 5-10% in the stock market!" but I'm a simpleton and would enjoy not having debt.

@89th said in Mortgage Questions:

@jolly said in Mortgage Questions:

Finance for thirty if you wish, but pay it off before then. There are several schemes to do so and I highly recommend it.

Agreed, I still hesitate with giving too many personal details but yeah... our plan is to pay it off in 10-15 years. I know financial planners would say "Pay the 3% interest and make 5-10% in the stock market!" but I'm a simpleton and would enjoy not having debt.

I get you as well 89. Though if you’re locked at 3% and inflation goes up in the future - you should let inflation do work on your debt.

-

I dont know much to add, but is it possible to get a 20 or 15 year loan? It will be more expensive at first, but (hopefully) your income will increase while the house payment stays the same. I think there is a big savings with the short loan.

-

I dont know much to add, but is it possible to get a 20 or 15 year loan? It will be more expensive at first, but (hopefully) your income will increase while the house payment stays the same. I think there is a big savings with the short loan.

@taiwan_girl said in Mortgage Questions:

I dont know much to add, but is it possible to get a 20 or 15 year loan? It will be more expensive at first, but (hopefully) your income will increase while the house payment stays the same. I think there is a big savings with the short loan.

Yes there are 15-year loans, which we were considering. But we want to get a lake house (cabin) soon too, and with my wife not working at first, we wanted the flexibility of having a lower payment with the 30-year mortgage, and can always pay extra each month if we want.

-

An update for those who care:

Ended up going with Wyndham Capital, mainly because they were pretty responsive when I had questions and others were a little slow on the response. I also had 3 lenders competing as I used one Loan Estimate against the next, when they would ask how I got a rate so low.

My initial lender said 30-year fixed conventional are averaging around 3.15% right now, but I was able to lock in at 2.75% with very minimal fees, so I'm happy. He wasn't able to match it, so I had to part ways... #sorrynotsorry

Here's hoping there are no hiccups during underwriting or whatever happens between now and closing.

-

Make sure you get a comfortable pen to write with. You will be signing/initialing a lot of papers.