Mortgage Questions

-

Excellent advice from Jon. This is a major purchase, and it's hundreds of thousands of dollars. Don't be "nice," be pragmatic. Look out for yourself, you can be assured that realtors and lenders are doing that for themselves.

Also, in the big scheme a difference of 0.5% on a $300K loan is about $50 a month, or $600 a year. If that $600 is going to make a difference in how you live, perhaps you should consider not buying right now (that was snark, but I'm being practical here).

That's what I told D3 when she was looking at a condo. Don't let a $20K difference in price end up costing you a place that you really like - the difference is negligible in the short term, and you can always refinance when it's better.

-

Excellent advice from Jon. This is a major purchase, and it's hundreds of thousands of dollars. Don't be "nice," be pragmatic. Look out for yourself, you can be assured that realtors and lenders are doing that for themselves.

Also, in the big scheme a difference of 0.5% on a $300K loan is about $50 a month, or $600 a year. If that $600 is going to make a difference in how you live, perhaps you should consider not buying right now (that was snark, but I'm being practical here).

That's what I told D3 when she was looking at a condo. Don't let a $20K difference in price end up costing you a place that you really like - the difference is negligible in the short term, and you can always refinance when it's better.

-

Echo Jon. If your lender is smiling at closing, you screwed up. Hopefully they flip you the bird.

-

By the way, you are looking for a home, not a house. You mentioned living there 30-40 years. Choose accordingly. Check local planning... How much of a pain will it be to get permits for renovation, etc..,

-

By the way, you are looking for a home, not a house. You mentioned living there 30-40 years. Choose accordingly. Check local planning... How much of a pain will it be to get permits for renovation, etc..,

@lufins-dad said in Mortgage Questions:

By the way, you are looking for a home, not a house. You mentioned living there 30-40 years. Choose accordingly. Check local planning...

Excellent point. I posted about a "historical home" in my town that wouldn't sell because of all the restrictions on renovation.

-

Shop the best rate.

I do think some recent political moves point to a rise in interest rates and with the kind of money we're talking about, 1% would make a deal breaker for some people.

But...Beware. If rates do rise, prices may drop. If you are buying a long-term home, it might be awhile before you could make a profit.

Choose wisely.

-

Not rude to choose a different lender than the own who pre-approved you.

Choose the best rate, yes, but also pay attention to a couple of details:

-

Is it a non-recourse loan? If the SHTF and the lender frock over to sell the house for less than the balance on the mortgage, would you still be on the hook to repay the difference? Not saying it’s good or bad, but it’s something you want to know for sure before you sign on the dotted line.

-

Will there be any penalty to prepayment? If your finances improve and you want to make additional principal payments or just pay off the loan ahead of schedule, will there be any penalty?

There should be no surprises if you go for a conventional loan, and hopefully that will be the case for you. Surprises should also be rare for jumbo loans. But if you ever go subprime or do one of those super low down payment FHA loans, the rules will be more complicated and you want to spend some quality time with your mortgage broker to understand the catches. Ditto if you have to do PMI (private mortgage insurance; typically any loan with less than 20% down payment requires PMI).

Good luck!

-

-

Wow, great advice here. No joke, and also not surprised.

A few replies, in

no orderreverse order:@jon-nyc @Axtremus - Minnesota is a non-recourse state. Never knew of that concept, but there you go. That favors the buyer. Federal law does prohibit prepayment penalties after 3 years, so that is good. Thanks for the ideas.

@Jolly - We are indeed buying for 30 years, and I have embraced that we are likely near or on the bubble, so if prices drop in the next couple years, it will be a non-factor for us. Thanks for the reply.

@LuFins-Dad @George-K - I downloaded the various HOA (etc) docs to read on the plane tomorrow. It might be short-sighted, but based on the house and yard, I do not foresee any changes that would warrant the local planning committee (or whatever) getting involved. The "biggest thing" is there is a 3-season porch we might want to get converted (insulated) into a 4-season porch.

@George-K - Good advice. Regarding the difference, I won't go into details other than our mortgage will be above $500k, but at this point it's not a matter of affordability but rather...do I go with a 3.2% or 2.7% if I can get the latter, which brings me to...

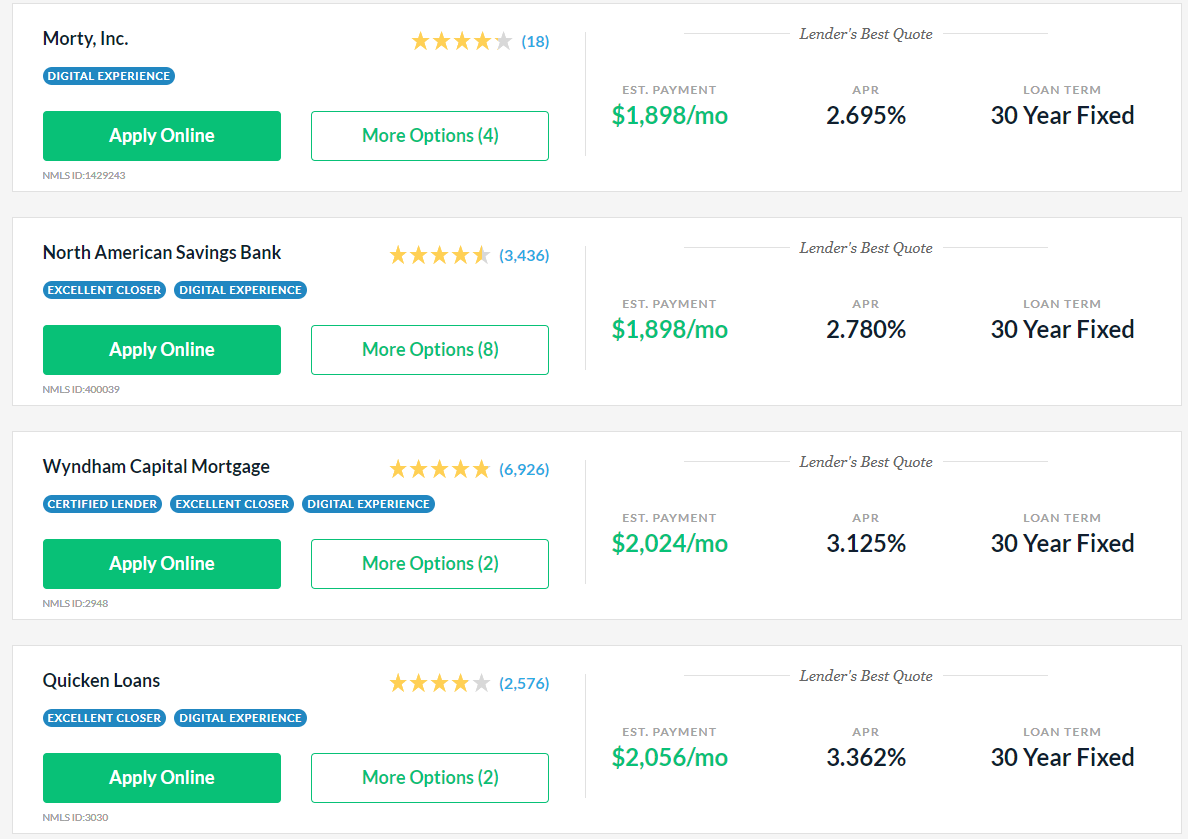

@jon-nyc - Good info. One of the better rates was via Morty(.com) which I guess is a newer player that gives good rates and uses tech to keep costs lower. Actually, I guess this isn't TMI so here's what I received:

-

Finance for thirty if you wish, but pay it off before then. There are several schemes to do so and I highly recommend it.

@jolly said in Mortgage Questions:

Finance for thirty if you wish, but pay it off before then. There are several schemes to do so and I highly recommend it.

Agreed, I still hesitate with giving too many personal details but yeah... our plan is to pay it off in 10-15 years. I know financial planners would say "Pay the 3% interest and make 5-10% in the stock market!" but I'm a simpleton and would enjoy not having debt.

-

@jolly said in Mortgage Questions:

Finance for thirty if you wish, but pay it off before then. There are several schemes to do so and I highly recommend it.

Agreed, I still hesitate with giving too many personal details but yeah... our plan is to pay it off in 10-15 years. I know financial planners would say "Pay the 3% interest and make 5-10% in the stock market!" but I'm a simpleton and would enjoy not having debt.

@89th said in Mortgage Questions:

@jolly said in Mortgage Questions:

Finance for thirty if you wish, but pay it off before then. There are several schemes to do so and I highly recommend it.

Agreed, I still hesitate with giving too many personal details but yeah... our plan is to pay it off in 10-15 years. I know financial planners would say "Pay the 3% interest and make 5-10% in the stock market!" but I'm a simpleton and would enjoy not having debt.

I get that philosophy, but that comes from a day when interest rates were 11-12% (and higher, my parents mortgage in the early 80s was at 16%). Recouping 11-12% in the stock market carries a fair amount of risk so paying off early makes a ton more sense... But 3%? You can get high yield bonds that pay off higher...

-

@jolly said in Mortgage Questions:

Finance for thirty if you wish, but pay it off before then. There are several schemes to do so and I highly recommend it.

Agreed, I still hesitate with giving too many personal details but yeah... our plan is to pay it off in 10-15 years. I know financial planners would say "Pay the 3% interest and make 5-10% in the stock market!" but I'm a simpleton and would enjoy not having debt.

@89th said in Mortgage Questions:

@jolly said in Mortgage Questions:

Finance for thirty if you wish, but pay it off before then. There are several schemes to do so and I highly recommend it.

Agreed, I still hesitate with giving too many personal details but yeah... our plan is to pay it off in 10-15 years. I know financial planners would say "Pay the 3% interest and make 5-10% in the stock market!" but I'm a simpleton and would enjoy not having debt.

You are in good company, 89th. No debt gives you a lot more choices as to how to live, what you have to do workwise, all that. Making that small extra payment against principal makes a huge difference.

-

@89th the big question is how close to Darwin will you be?

-

@jolly said in Mortgage Questions:

Finance for thirty if you wish, but pay it off before then. There are several schemes to do so and I highly recommend it.

Agreed, I still hesitate with giving too many personal details but yeah... our plan is to pay it off in 10-15 years. I know financial planners would say "Pay the 3% interest and make 5-10% in the stock market!" but I'm a simpleton and would enjoy not having debt.

@89th said in Mortgage Questions:

@jolly said in Mortgage Questions:

Finance for thirty if you wish, but pay it off before then. There are several schemes to do so and I highly recommend it.

Agreed, I still hesitate with giving too many personal details but yeah... our plan is to pay it off in 10-15 years. I know financial planners would say "Pay the 3% interest and make 5-10% in the stock market!" but I'm a simpleton and would enjoy not having debt.

I get you as well 89. Though if you’re locked at 3% and inflation goes up in the future - you should let inflation do work on your debt.

-

I dont know much to add, but is it possible to get a 20 or 15 year loan? It will be more expensive at first, but (hopefully) your income will increase while the house payment stays the same. I think there is a big savings with the short loan.

-

I dont know much to add, but is it possible to get a 20 or 15 year loan? It will be more expensive at first, but (hopefully) your income will increase while the house payment stays the same. I think there is a big savings with the short loan.

@taiwan_girl said in Mortgage Questions:

I dont know much to add, but is it possible to get a 20 or 15 year loan? It will be more expensive at first, but (hopefully) your income will increase while the house payment stays the same. I think there is a big savings with the short loan.

Yes there are 15-year loans, which we were considering. But we want to get a lake house (cabin) soon too, and with my wife not working at first, we wanted the flexibility of having a lower payment with the 30-year mortgage, and can always pay extra each month if we want.

-

An update for those who care:

Ended up going with Wyndham Capital, mainly because they were pretty responsive when I had questions and others were a little slow on the response. I also had 3 lenders competing as I used one Loan Estimate against the next, when they would ask how I got a rate so low.

My initial lender said 30-year fixed conventional are averaging around 3.15% right now, but I was able to lock in at 2.75% with very minimal fees, so I'm happy. He wasn't able to match it, so I had to part ways... #sorrynotsorry

Here's hoping there are no hiccups during underwriting or whatever happens between now and closing.