Subsidizing Homeborrowership

-

FFS

-

This is why you don’t elect democrats to office.

-

I ran the numbers real quick on the median mortgage (at origination) of 324k after 10 years (average time we own homes).

At selling time you’d have 17k of equity vs 50k. That house you got the 324k mortgage for is valued at ~410k.

17k wouldn’t cover closing costs. You built essentially no equity unless the value increased.

-

I ran the numbers real quick on the median mortgage (at origination) of 324k after 10 years (average time we own homes).

At selling time you’d have 17k of equity vs 50k. That house you got the 324k mortgage for is valued at ~410k.

17k wouldn’t cover closing costs. You built essentially no equity unless the value increased.

@jon-nyc said in Subsidizing Homeborrowership:

I ran the numbers real quick on the median mortgage (at origination) of 324k after 10 years (average time we own homes).

At selling time you’d have 17k of equity vs 50k. That house you got the 324k mortgage for is valued at ~410k.

17k wouldn’t cover closing costs. You built essentially no equity unless the value increased.

As a comparison the 30yr mortgage would provide 51k of equity.

In all fairness, you would also have to factor in the home’s current market value after 10 years. That would likely bump up the equity substantially;

-

Why not perpetual mortgages?

The UK has perpetual bonds. Some are left over from the War of Austrian Succession (~1750). They used to fuck with our modeling.

It formalizes the idea that you make payments as low as possible and just accept that your equity will only be from appreciation

-

It's easy to understand where the economic populism of the young generation is coming from. And it's not stupid, not at all. Individual policies might be, but not the perspective on unfairness and hopelessness.

@Horace said in Subsidizing Homeborrowership:

It's easy to understand where the economic populism of the young generation is coming from. And it's not stupid, not at all. Individual policies might be, but not the perspective on unfairness and hopelessness.

Just wait till the AI layoffs hit.

While I’m an optimist and think there will be potential massive economic opportunities, that will be after quite a bit of economic pain for many people….

-

-

@jon-nyc said in Subsidizing Homeborrowership:

It’s like they don’t expect Trump to be able to think for himself. How rude!

-

@jon-nyc said in Subsidizing Homeborrowership:

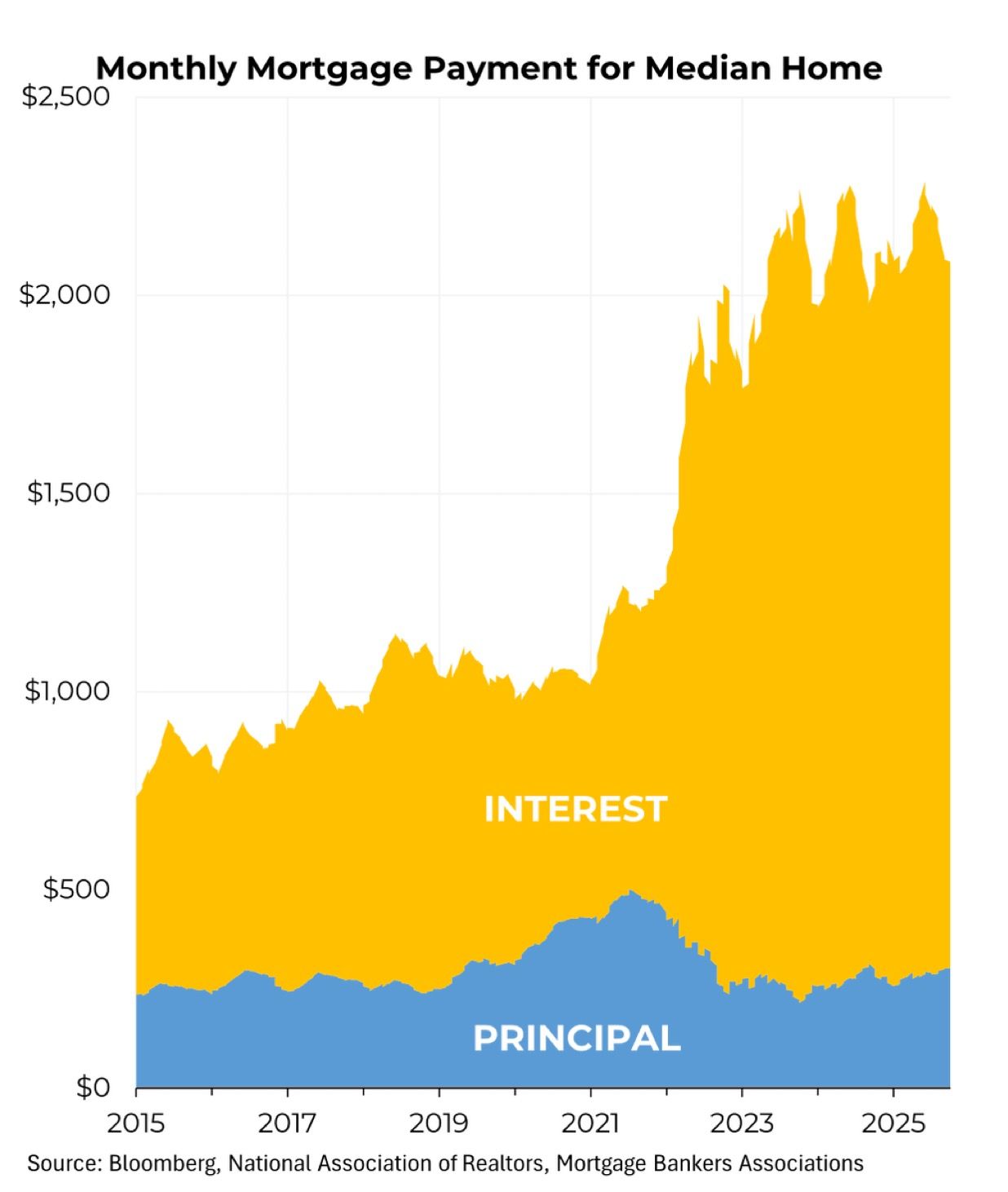

Very illuminating.

Kind of surprising that it went up that much. Yes, I get that interest rates nearly doubled, but I would still think that the vast majority of mortgages pre-date the rate increases and wouldn’t be affected. Plus, there’s been a substantial decrease in home purchases over the last three years with the higher rates, and to top it off, cash buyers represent over a third of those new home sales…The only way this chart makes sense to me is if more people had variable rate mortgages than I had supposed.

-

Yeah, the more I think about it, that must be based on new mortgages only.

Edit… Unless Interest only mortgages have made another comeback? I know a lot of investors use them when buying vacation rental properties….

-

Agreed, LuFin. I'm gently coaxing my daughter to get on top of this and be the one who pilots using it in project management at her firm. i say gently because she's up to her ass in alligators at the moment through poorly written contracts and scopes.

@Mik said in Subsidizing Homeborrowership:

Agreed, LuFin. I'm gently coaxing my daughter to get on top of this and be the one who pilots using it in project management at her firm. i say gently because she's up to her ass in alligators at the moment through poorly written contracts and scopes.

Smart, if you can get informed NOW (certs, training, youtube videos, etc) and help lead the adoption of AI tools, you will cover your butt for a few years at least. I'll start a new thread with a fun AI game called gandalf...