The Big Beautiful Bill needs its own thread.

-

US gets its debt downgraded.

https://www.reuters.com/markets/us/moodys-downgrades-us-aa1-rating-2025-05-16/

@jon-nyc said in The Big Beautiful Bill needs its own thread.:

US gets its debt downgraded.

https://www.reuters.com/markets/us/moodys-downgrades-us-aa1-rating-2025-05-16/

House GOP whistled past the downgrade and passed the Big Beautiful Bill anyway.

-

-

LOL

I look at a couple of forums about thailand and there are starting to complaints from expat retirees about how their money has lost XX% vs the Thai baht.

-

It’s so great of them to make other countries great again, too!

-

-

You know, Republican budget hawks might have an opportunity to finally push through legitimate entitlement reform.

-

Good for Elon.

-

Grok, how did the TCJA perform vs. CBO projections?

CBO Projections vs. Actual Outcomes

Revenue Projections:

CBO Estimate: The CBO initially projected that the TCJA would reduce federal revenues by $1.8 trillion over 2018–2028, excluding dynamic effects, or $1.3 trillion after accounting for economic growth (macroeconomic feedback). They anticipated a significant revenue shortfall due to lower tax rates, particularly for corporate and individual income taxes.Reality: Actual revenue collections outperformed CBO’s projections:

In 2022, federal tax revenues reached $4.9 trillion, $884 billion above CBO’s post-TCJA projections for that year, and $642 billion higher than projected for individual tax revenues alone.Over the five years following the TCJA (FY 2019–2023), tax revenues averaged $170–$205 billion per year above CBO’s post-2017 projections.

Corporate tax revenues in FY 2022 and 2023 exceeded CBO projections by $103 billion, with FY 2024 corporate receipts at $529 billion, surpassing the CBO’s $421 billion estimate.

However, when adjusted for inflation, total real revenue in 2023 was $3.6 trillion, below the CBO’s pre-TCJA projection of $3.9 trillion, suggesting that nominal revenue gains were partly driven by inflation and other factors like capital gains realizations.

Economic Growth:

CBO Estimate: The CBO projected that the TCJA would boost GDP by an average of 0.7% over 2018–2028, with stronger effects in the early years (e.g., 2.1% GDP growth in 2018). They expected growth to taper off after 2025 when individual tax cuts expired.Reality: Economic growth exceeded CBO forecasts in the initial years:

GDP growth in 2018 reached 3.0%, a full percentage point above the CBO’s pre-TCJA forecast of 2.1%.Total U.S. investment increased by over 20%, including an 18% rise in R&D investment, and wages grew by 4.9% in 2018–2019, the fastest two-year growth in 20 years.

Real median household income rose by $5,000 in the first two years post-TCJA, outpacing the prior eight years combined. Unemployment hit 50-year lows, with record lows for African American, Hispanic, and non-high-school-educated workers.

I’m not a big believer in CBO projections.

Deficit Impact:

CBO Estimate: The CBO projected the TCJA would increase the primary deficit by $1.8 trillion over 2018–2028, or $1.3 trillion after macroeconomic feedback, with total deficits (including debt-service costs) rising by $2.3 trillion.Reality: Deficits grew, but the extent is debated:

The deficit increased by 17% in 2018 and was projected to grow another 15% in 2019, even with stronger economic growth.Some sources argue the TCJA’s revenue shortfalls were less severe than predicted due to higher-than-expected revenues, but the Committee for a Responsible Federal Budget notes that inflation-adjusted revenues in 2023 were close to post-TCJA projections, not pre-TCJA levels, implying no significant deficit reduction.

Extending the TCJA’s provisions is estimated to add $3.5–$4.7 trillion to deficits over the next decade, depending on the scope of extensions.

That’s a spending problem, not a revenue problem. Especially due to the COVID stimulus packages. Take those out and the deficits would not have grown anywhere close to the projections.

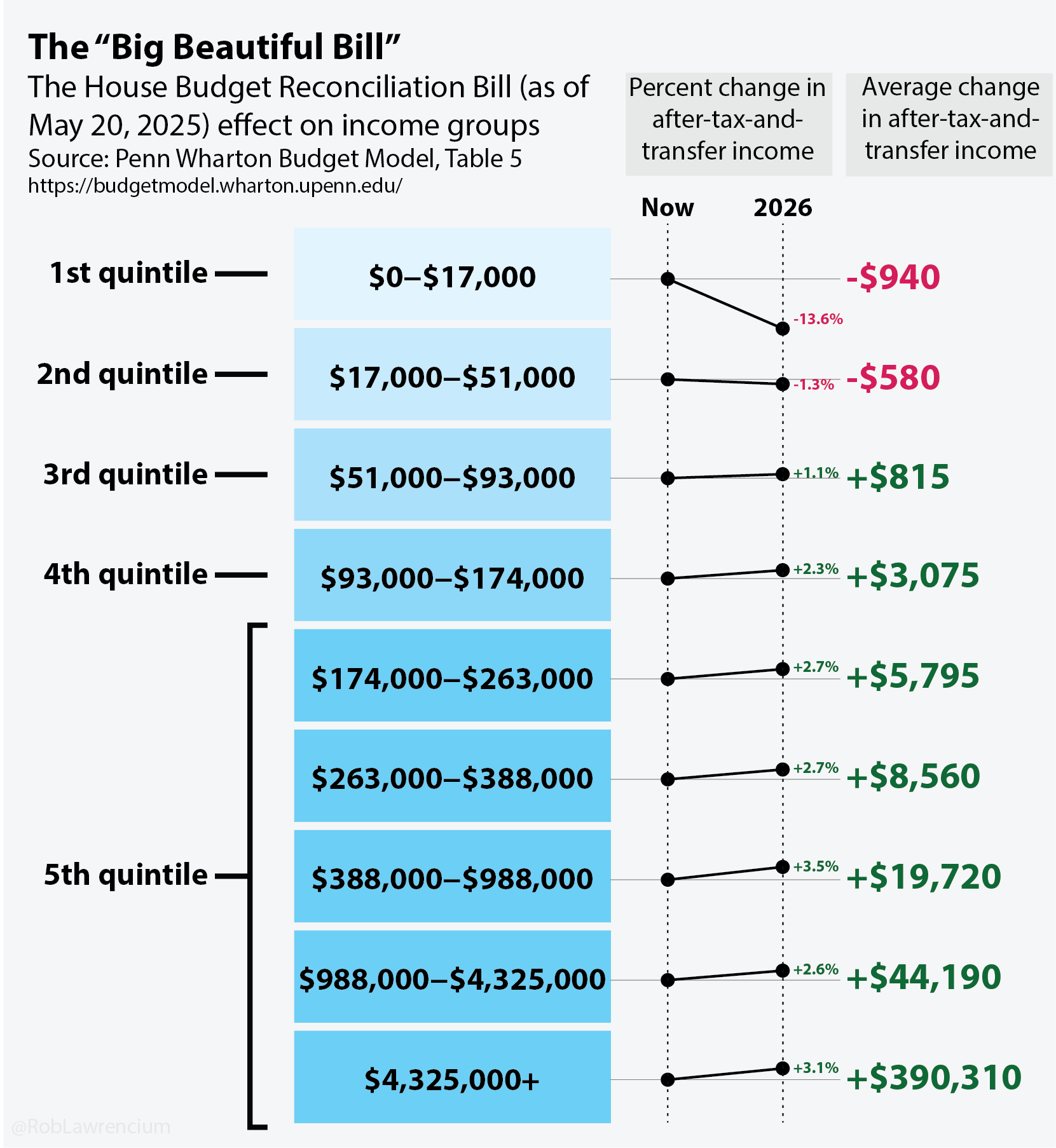

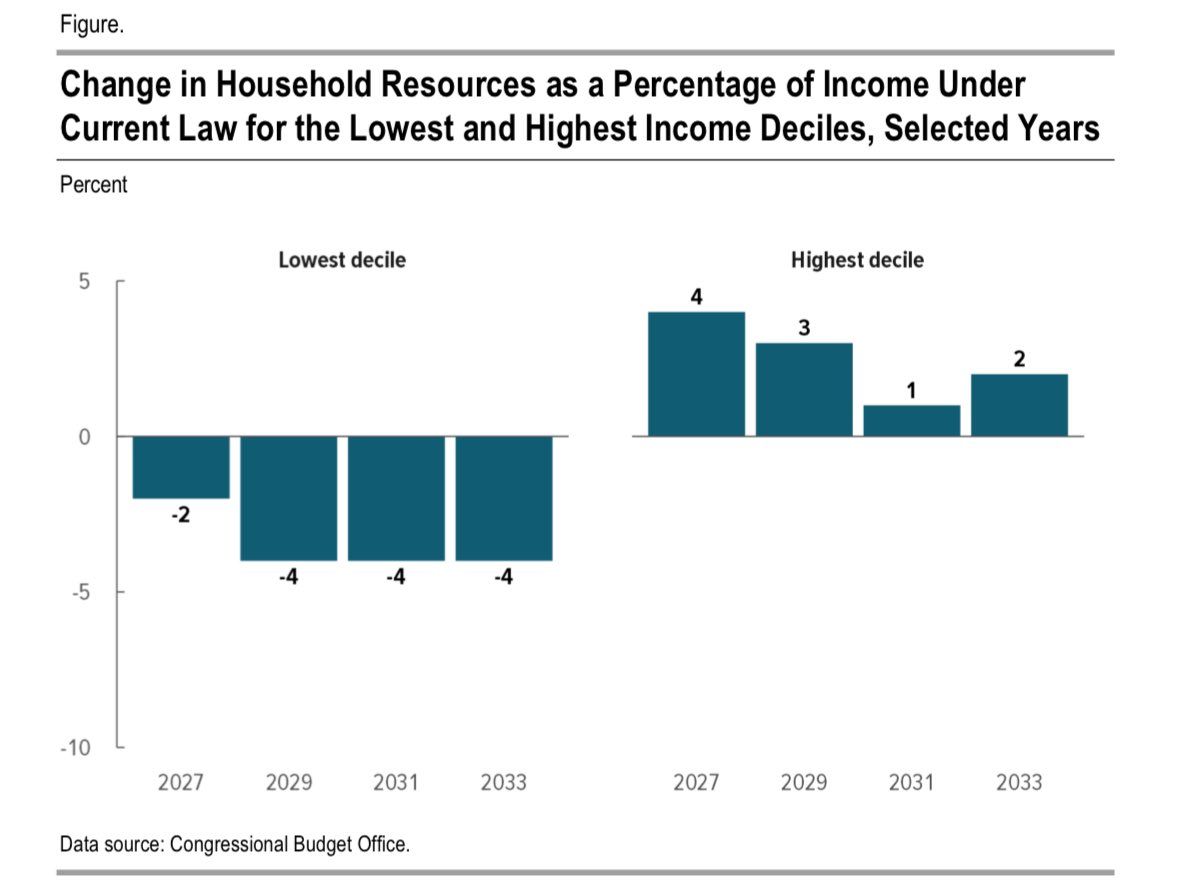

Distributional Effects:

CBO Estimate: The CBO and Joint Committee on Taxation (JCT) projected the TCJA would disproportionately benefit higher earners, with the top 1% seeing significant tax cuts due to estate tax and pass-through business provisions.Reality: The TCJA provided broad tax relief but skewed benefits upward:

Americans earning under $100,000 saw an average tax cut of 16%, while the top 1% paid a higher share of federal taxes post-TCJA.However, the Senate Budget Committee reported that the richest 5% reaped 40% of the benefits in the first year, with the top 1% saving nearly $26,000 on average in 2026 if extended.

Low-income households ($25,000 or less) saved an average of $60 in 2018, per the Tax Policy Center, compared to over $51,000 for the top 1%.

Again, the percentage of the tax revenues from the top 5% INCREASED. The percentage from the poorest decreased…