Trumpenomics

-

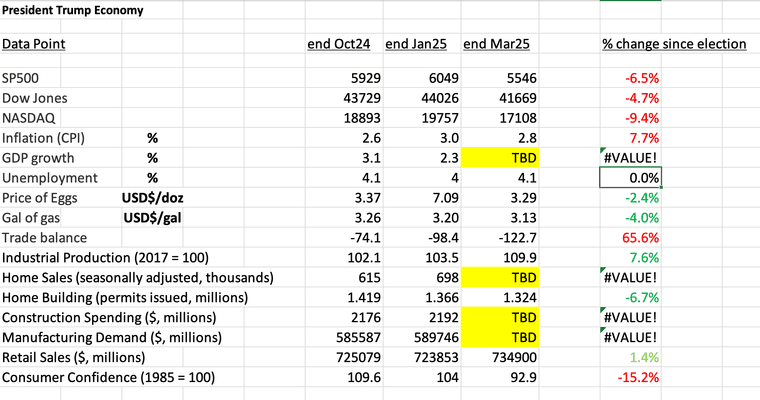

End of Q1 numbers. I will update as the missing ones come in, and plan on updating this every quarter. If anybody feels something else should be on here (economically), let me know.

-

Cost of gas is down, even to $1.98! Umm the national average was $3.22 on 1/20 and $3.29 as of yesterday.

Cost of eggs have gone down 92%! They were $6.55 on 1/20 and $3.11 as of yesterday. Thats like 47%?

What idiots does he have feeding him data, I’m guessing only sycophants have access to him.

Link to video -

Link to video

TL;DR version:

- Delta: doesn’t want to pay tariffs on incoming Airbus aircraft; willing to delay taking delivery

- Airbus: OK, we accelerate delivery to other customers eager to take delivery earlier

-

Thing is as China and America face off, it seems clear one has a massive advantage...

A country led by a brutal autocrat unmindful of his peoples suffering and perfectly willing to give up their living standards to win whatever the cost.

But Xi is a tough old bastard too so let's not write off China just yet. -

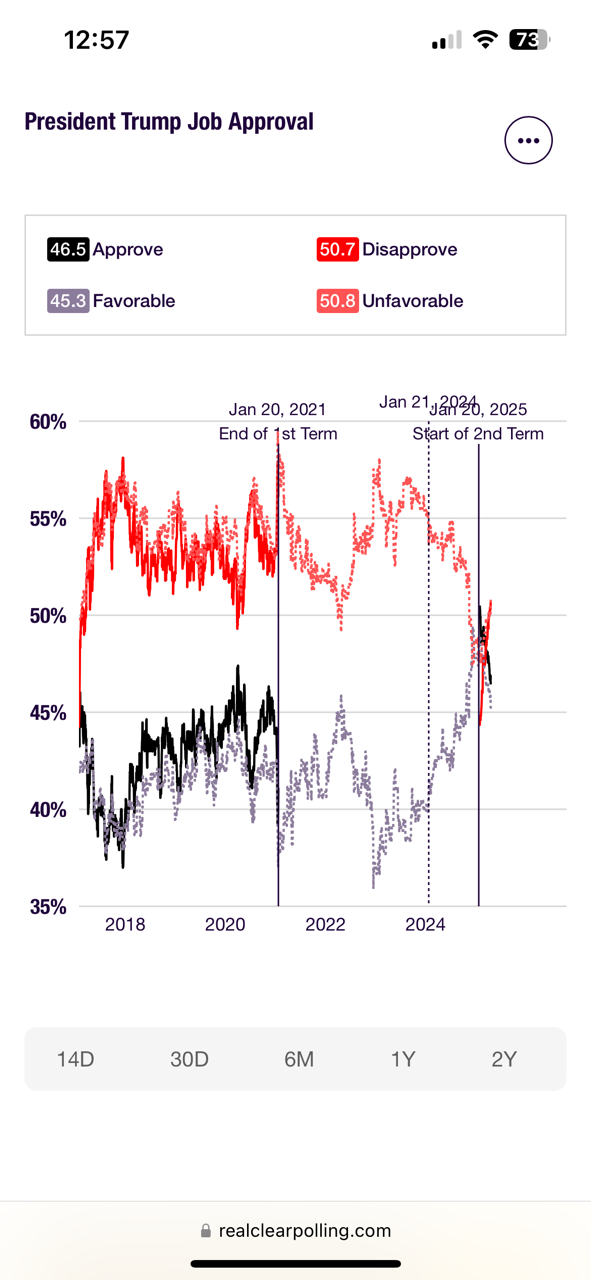

It's ironic since they'll be massacred in 2026 anyway, as if Trump's support will be helpful then. It'll be a repeat of 2018, but on Solfeggio steroids.

@89th said in Trumpenomics:

It's ironic since they'll be massacred in 2026 anyway, as if Trump's support will be helpful then. It'll be a repeat of 2018, but on Solfeggio steroids.

Why do you say that? Trump actually has a more people liking him than ever before and has fewer people disliking him than ever before…

I mean, it’s nuts, but it’s where we are at…

-

The world trade war has yet to make its effects felt, beyond a dip in the stock market which is still pricing in some optimism that sanity will prevail.

@Horace said in Trumpenomics:

The world trade war has yet to make its effects felt, beyond a dip in the stock market which is still pricing in some optimism that sanity will prevail.

Okay. But, let’s lean into that optimism for a minute… What happens if over the next 60-80 days DJT does come to some new and more favorable trade deals? What happens if you see say another $1T in commitments to build new US factories? What happens to the market at that point? Especially if the tax cuts gets extended and the deregulation efforts take hold? What do you think the market looks like in September if we see these results?

I

-

@Horace said in Trumpenomics:

The world trade war has yet to make its effects felt, beyond a dip in the stock market which is still pricing in some optimism that sanity will prevail.

Okay. But, let’s lean into that optimism for a minute… What happens if over the next 60-80 days DJT does come to some new and more favorable trade deals? What happens if you see say another $1T in commitments to build new US factories? What happens to the market at that point? Especially if the tax cuts gets extended and the deregulation efforts take hold? What do you think the market looks like in September if we see these results?

I

@LuFins-Dad said in Trumpenomics:

@Horace said in Trumpenomics:

The world trade war has yet to make its effects felt, beyond a dip in the stock market which is still pricing in some optimism that sanity will prevail.

Okay. But, let’s lean into that optimism for a minute… What happens if over the next 60-80 days DJT does come to some new and more favorable trade deals? What happens if you see say another $1T in commitments to build new US factories? What happens to the market at that point? Especially if the tax cuts gets extended and the deregulation efforts take hold? What do you think the market looks like in September if we see these results?

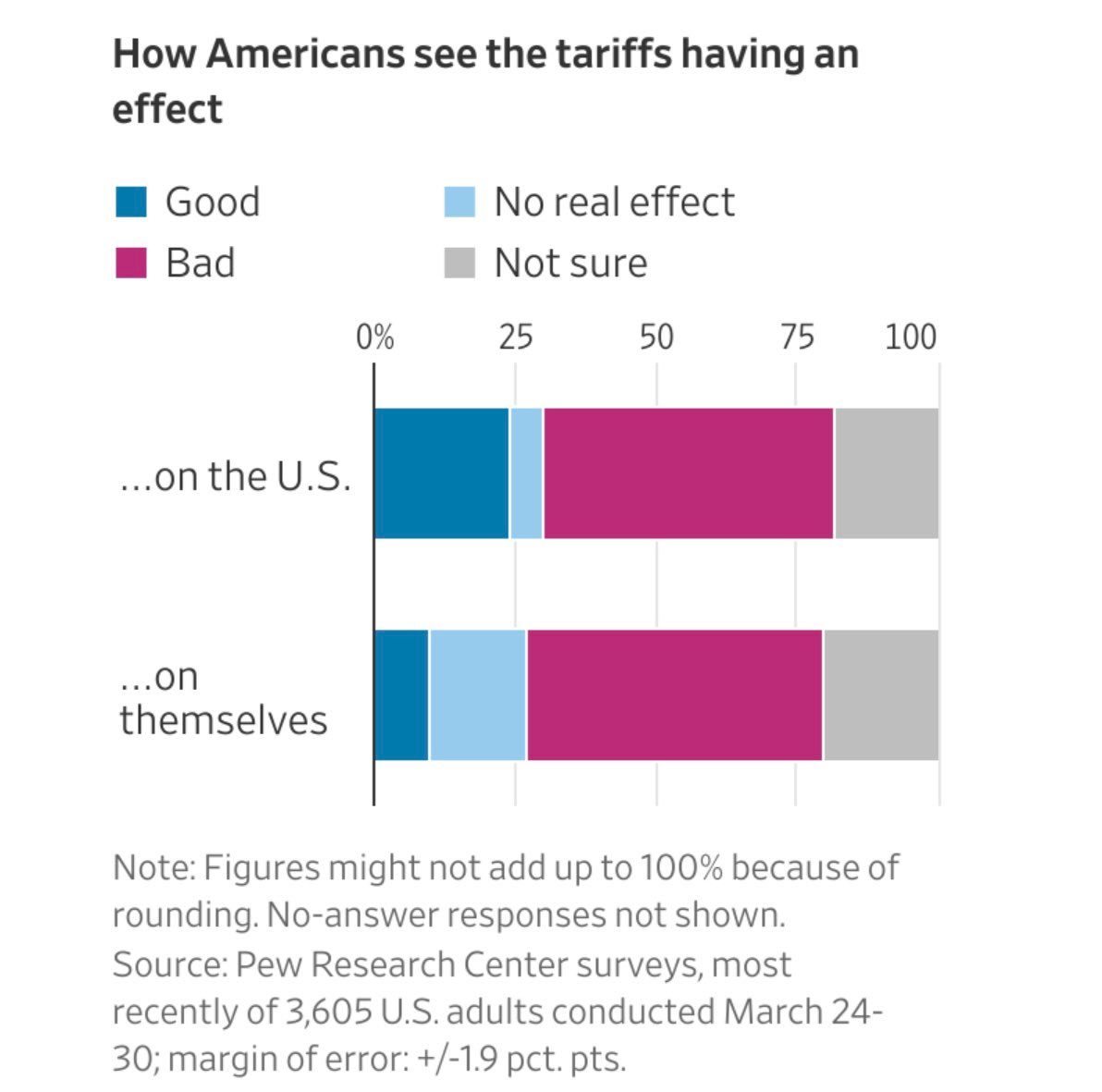

It's not clear to me how much actual room for improvement America had in these trade deals. The tariffs against us prior to Liberation Day do not seem to have amounted to much of importance. The hand waved non-tariff trade barriers are difficult to discuss, as they are not well defined, but they do not seem very important either.

As for factories, I think you have noted that they are a pipe dream.

Best case scenario where Trump rolls back all trade war stuff, an unlikely scenario, and China decides to forgive and forget? Sure, the market could regain its highs.

I expect a world trade war, if it's not called off by Trump, will affect a lot more than the stock market, though.

And I continue to believe that the reason for this trade war, is that Trump heard the word "deficit" in the phrase "trade deficit", some fateful day many decades ago, and got fixated on how bad that is. If only he'd been introduced to the concept with different words describing the same thing, a "capital surplus". History would have been different.

-

@LuFins-Dad said in Trumpenomics:

@Horace said in Trumpenomics:

The world trade war has yet to make its effects felt, beyond a dip in the stock market which is still pricing in some optimism that sanity will prevail.

Okay. But, let’s lean into that optimism for a minute… What happens if over the next 60-80 days DJT does come to some new and more favorable trade deals? What happens if you see say another $1T in commitments to build new US factories? What happens to the market at that point? Especially if the tax cuts gets extended and the deregulation efforts take hold? What do you think the market looks like in September if we see these results?

It's not clear to me how much actual room for improvement America had in these trade deals. The tariffs against us prior to Liberation Day do not seem to have amounted to much of importance. The hand waved non-tariff trade barriers are difficult to discuss, as they are not well defined, but they do not seem very important either.

As for factories, I think you have noted that they are a pipe dream.

Best case scenario where Trump rolls back all trade war stuff, an unlikely scenario, and China decides to forgive and forget? Sure, the market could regain its highs.

I expect a world trade war, if it's not called off by Trump, will affect a lot more than the stock market, though.

And I continue to believe that the reason for this trade war, is that Trump heard the word "deficit" in the phrase "trade deficit", some fateful day many decades ago, and got fixated on how bad that is. If only he'd been introduced to the concept with different words describing the same thing, a "capital surplus". History would have been different.

And I continue to believe that the reason for this trade war, is that Trump heard the word "deficit" in the phrase "trade deficit", some fateful day many decades ago, and got fixated on how bad that is. If only he'd been introduced to the concept with different words describing the same thing, a "capital surplus". History would have been different.

Agreed. He also wrongly believes the importation of goods and services into the US equates as a subsidy to a foreign country. At the same time however he appears to think that the right of export of goods and services should be exclusive to the US alone and that the rest of the world should be restricted to hewing wood and drawing water for the sole benefit of the US.

A rather blockheaded understanding of international trade and investment.

-

When the trade talks start to happen, I don't think tariffs will be the only thing discussed. I think trade barriers are also going to be thrown into the mix.

There's two countries I'm really interested in - China and Russia. I think Trump is going to try to corral trade with China. Not cut off, modify. And I think he's gong to try to drive the price of energy low enough that Russia will have trouble waging war at their current pace.

-

I think trade barriers are also going to be thrown into the mix.

Like what? Name some.

You start…

@Renauda I think that tariffs would qualify as trade barriers.

I disagree with the way President Trump is handling the trade issue, but it would be worthwhile to have trade with China more fair. China uses things like requirement of X% of domestic ownership, import quotas, subsidies, etc. I think that they do this a lot more than other countries.

-

Tariffs definitely but I gathered that the other poster was obliquely referring to non tariff barriers to trade such as those you listed.

-

Just more evidence that there was so little to gain with these antics. If one wants to put a coherent frame on it, you'd just have to take seriously the notion of protectionism, higher prices, and more manufacturing jobs. Which is not a better America, but at least it's a comprehensible goal.

In practice, what will probably happen is that these shenanigans will show up in inflation and jobs numbers, Trump will declare victory over a bunch of nothing-burger concessions by countries that never treated America unfairly to begin with, and the fate of the whole exercise will be left up to China, who may or may not decide to rub America's nose in it, at significant cost to both countries in the short term, and maybe a benefit to China in the long term.

-

US trade delegation asks the Japanese delegation what they were ready to offer. Japanese delegation says ‘well what do you guys want?’ They couldn’t answer.

Well the US g’ovt could hardly demand that tightening the border to address illegal immigrants or fentanyl trafficking from Japan. They blew both those lame excuses with Canada.

Maybe Japan as the 52nd state or demand reparations for the war in the Pacific?