Trumpenomics

-

North Dakota went big for Trump. Now many farmers say they face an uncertain future

As they get bit by tariffs, the North Dakota farmers who voted for Trump may be experiencing "buyer's remorse."

-

North Dakota went big for Trump. Now many farmers say they face an uncertain future

As they get bit by tariffs, the North Dakota farmers who voted for Trump may be experiencing "buyer's remorse."

-

@89th said in Trumpenomics:

"Tariffs are a tax a tax hike on foreign countries. Tariffs are a tax cut for the American people."

Press secretary has to be one of the worst jobs I would not want.

@taiwan_girl said in Trumpenomics:

@89th said in Trumpenomics:

"Tariffs are a tax a tax hike on foreign countries. Tariffs are a tax cut for the American people."

Press secretary has to be one of the worst jobs I would not want.

If you lie good enough, you can become governor of a red state the very next election.

-

@jon-nyc said in Trumpenomics:

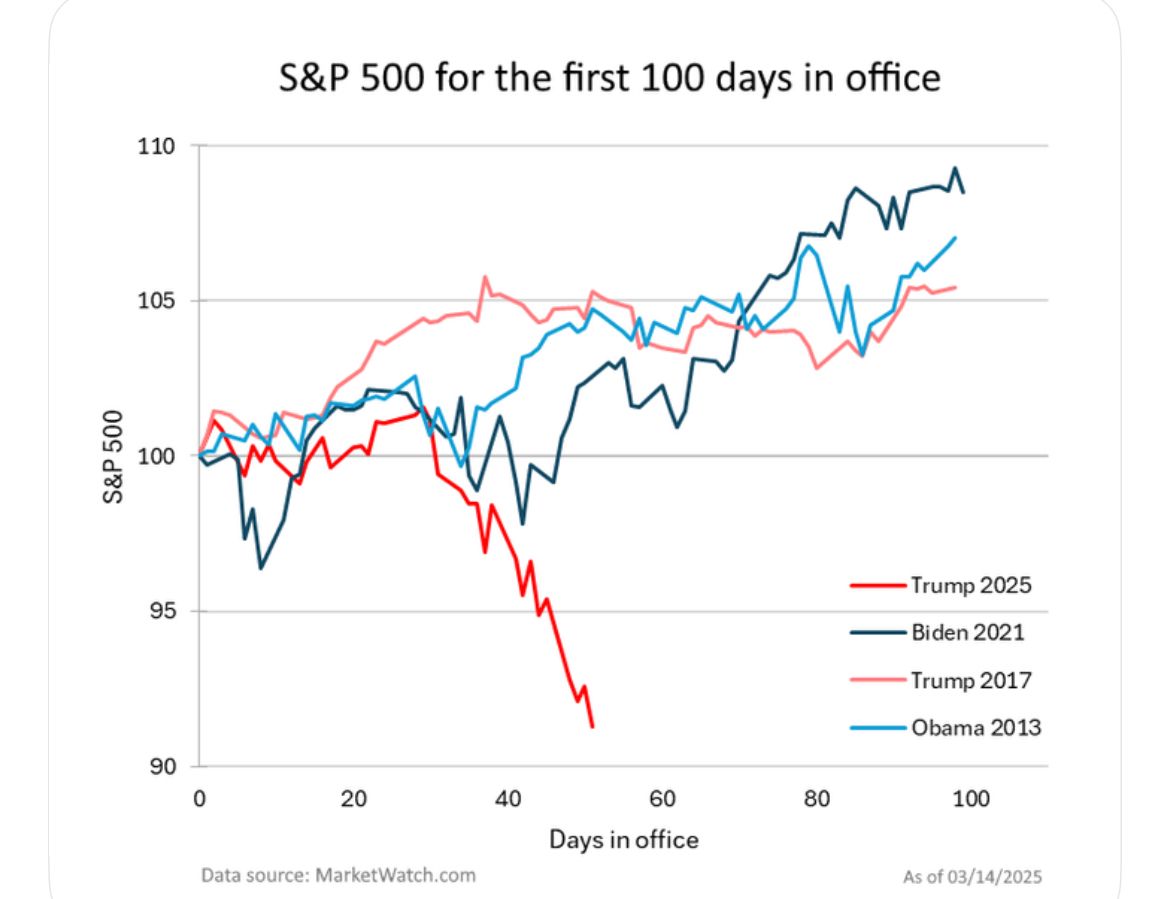

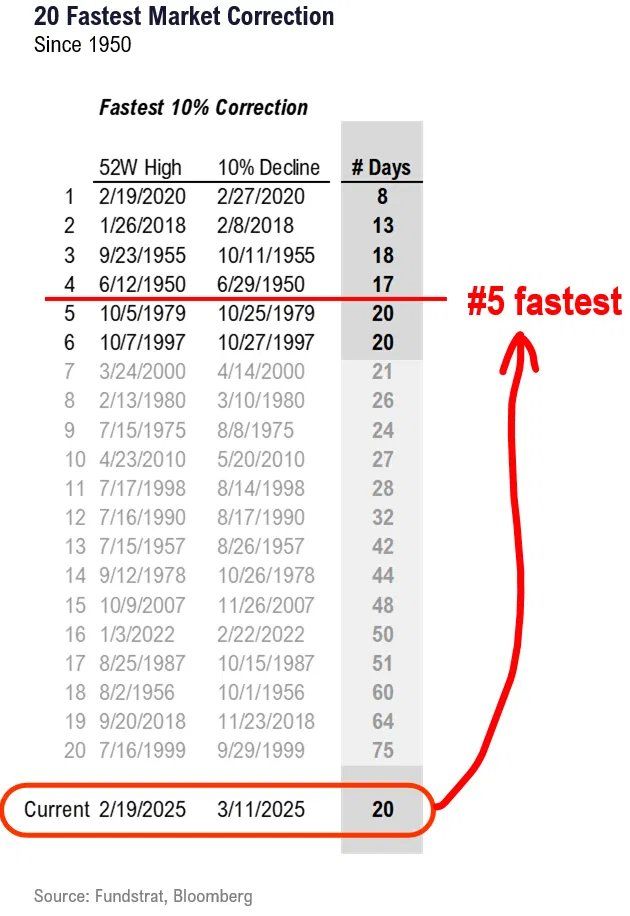

Fifth fasted correction since 1950.

That’s great news! It means everyone is investing in bonds, which is huge since we’re raising our debt and pretty soon no other countries will want to buy it! Winning at 5D Chess!

-

Good take from Larry Summers, starting at 9:30.

Link to video -

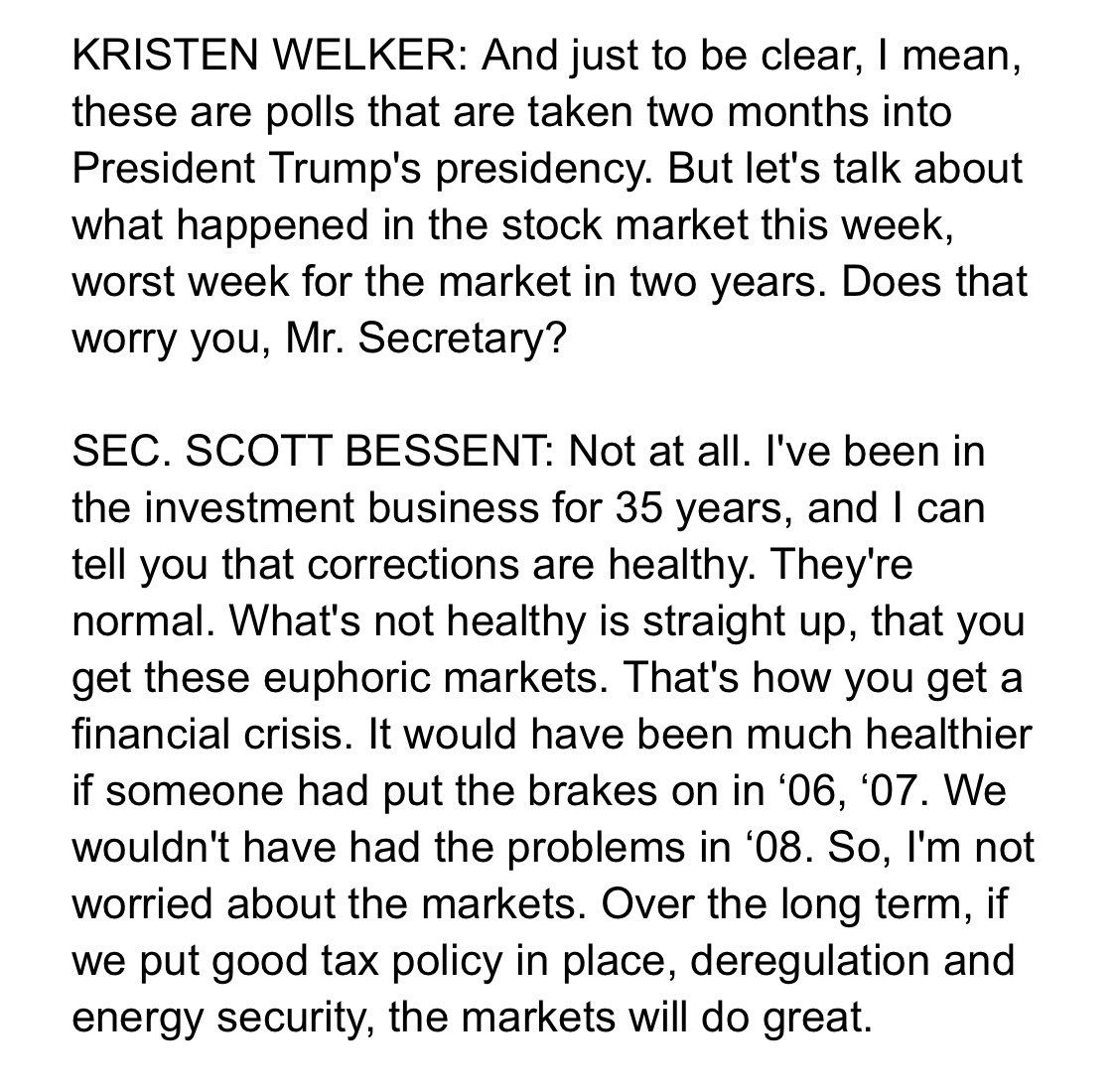

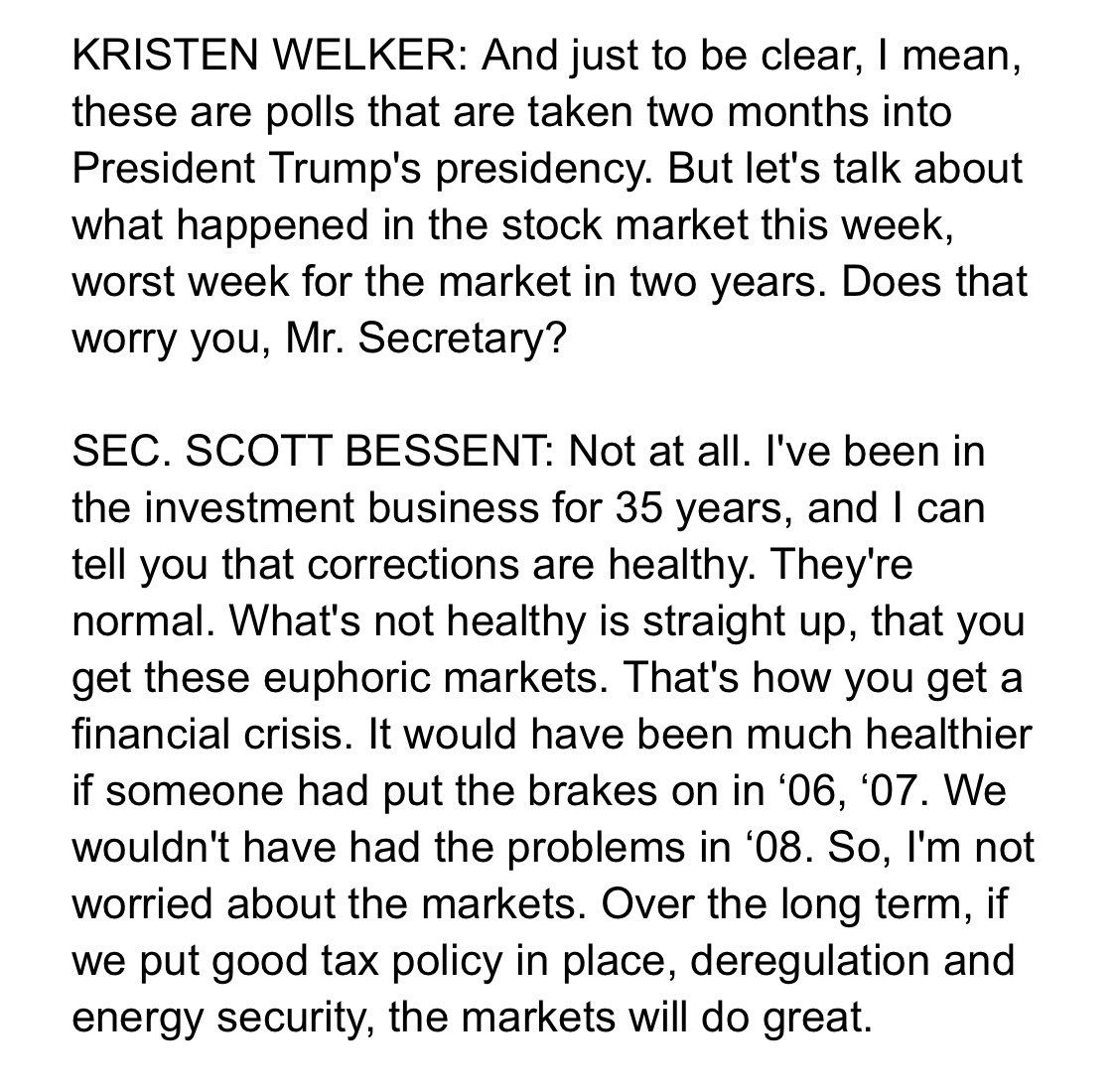

Funny how they never claimed the stock market was "overvalued" during the late Biden administration, the fall campaign, the transition, or even Trump's first month when he promised immediate prosperity.

But his tariffs cause a 10% freefall and suddenly "corrections are healthy."

-

Funny how they never claimed the stock market was "overvalued" during the late Biden administration, the fall campaign, the transition, or even Trump's first month when he promised immediate prosperity.

But his tariffs cause a 10% freefall and suddenly "corrections are healthy."

@jon-nyc said in Trumpenomics:

Funny how they never claimed the stock market was "overvalued" during the late Biden administration, the fall campaign, the transition, or even Trump's first month when he promised immediate prosperity.

But his tariffs cause a 10% freefall and suddenly "corrections are healthy."

That’s willfully ignoring many posts and links from @Jolly over that time discussing the real estate bubble and way out of proportion PE Ratios. There were discussions about why Buffett was holding so much cash, and several times there were links provided where Trump himself was stating there was a likely recession coming and he almost didn’t want the job because of the predicted downturn.

All that being said, as @Horace pointed out, we are all still blaming the current fall on the Trump Tariff Tangent, and it’s likely not a true correction. We will have to wait and see.

-

There was always a fair case to be made that the market was overvalued (and continues to be). But that doesn't mean that this correction has anything to do with anything other than the chaos tariffs.

@Horace said in Trumpenomics:

There was always a fair case to be made that the market was overvalued (and continues to be). But that doesn't mean that this correction has anything to do with anything other than the chaos tariffs.

My point was they (Trump and his financial team) never even hinted that they believed that before the Trump sell off.

-

@Horace said in Trumpenomics:

There was always a fair case to be made that the market was overvalued (and continues to be). But that doesn't mean that this correction has anything to do with anything other than the chaos tariffs.

My point was they (Trump and his financial team) never even hinted that they believed that before the Trump sell off.

@jon-nyc said in Trumpenomics:

@Horace said in Trumpenomics:

There was always a fair case to be made that the market was overvalued (and continues to be). But that doesn't mean that this correction has anything to do with anything other than the chaos tariffs.

My point was they (Trump and his financial team) never even hinted that they believed that before the Trump sell off.

I took your point, that they are using situational rhetoric. That would be ubiquitous in all of politics.

-

I wonder how much money will go to the coffers through these tariffs. It seems like that's never talked about. I'm not sure it's even budgeted in the deficit forecasts. Of course, nobody knows what the tariffs will be, so there's good reason not to budget them.

-

Current total tariffable trade is $4T. At 25% that’d be $1T.

But either the tariffs are about stopping imports to stimulate domestic producers or it’s about raising revenue. Can’t be both.

@xenon I think the practical effect of tariffs is necessarily a bit of both.

But the part where it's a supposedly good thing to bring back a bunch of mindless assembly line jobs at inflated wages in a dying industry that is destined to be overtaken by machines, makes me a little sick in my stomach. Then if it got to the point where we didn't allow those jobs to be overtaken by machines, because of union protectionism, while the rest of the world sprinted past us with automation, that becomes dystopic. Manufacturing jobs are nobody's American dream.

-

If it was possible to have factories up and running within a month or two, this still wouldn’t have merit.

-

Current total tariffable trade is $4T. At 25% that’d be $1T.

But either the tariffs are about stopping imports to stimulate domestic producers or it’s about raising revenue. Can’t be both.

@xenon said in Trumpenomics:

Current total tariffable trade is $4T. At 25% that’d be $1T.

About a quarter of that are services, many really difficult to put tariffs on. Example: travel. When you go to Portugal and get a hotel room in Lisbon, that counts as an ‘import’.

Imported goods are more like 3T. Of course the tariffs affect demand so you can’t just multiply that by 0.25. But it’s still a lot of money in taxes on the American people.