Stocks question

General Discussion

12

Posts

7

Posters

139

Views

-

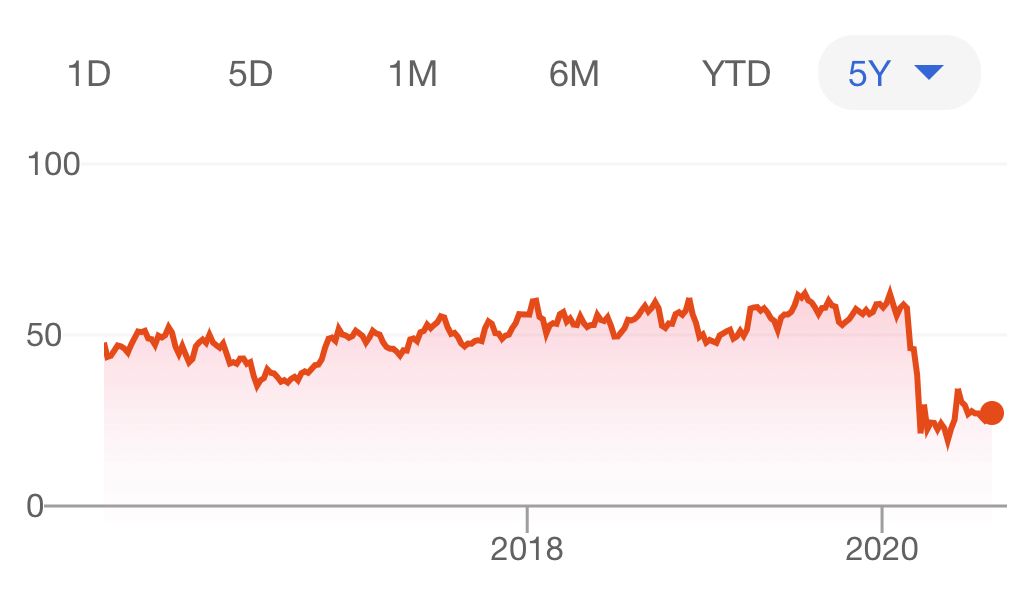

Well, I guess the point is that nobody knows for sure that they'll be back to normal in 5 years.

@Klaus said in Stocks question:

Well, I guess the point is that nobody knows for sure that they'll be back to normal in 5 years.

Exactly. If that were the case all the investors would have snapped up the bargains and these stocks would be right back to where they were.

-

The airline industry will recover but that doesn’t mean Delta will recover. Restaurants will recover but I’m not going to buy stock in TGI Friday’s...