Stocks question

-

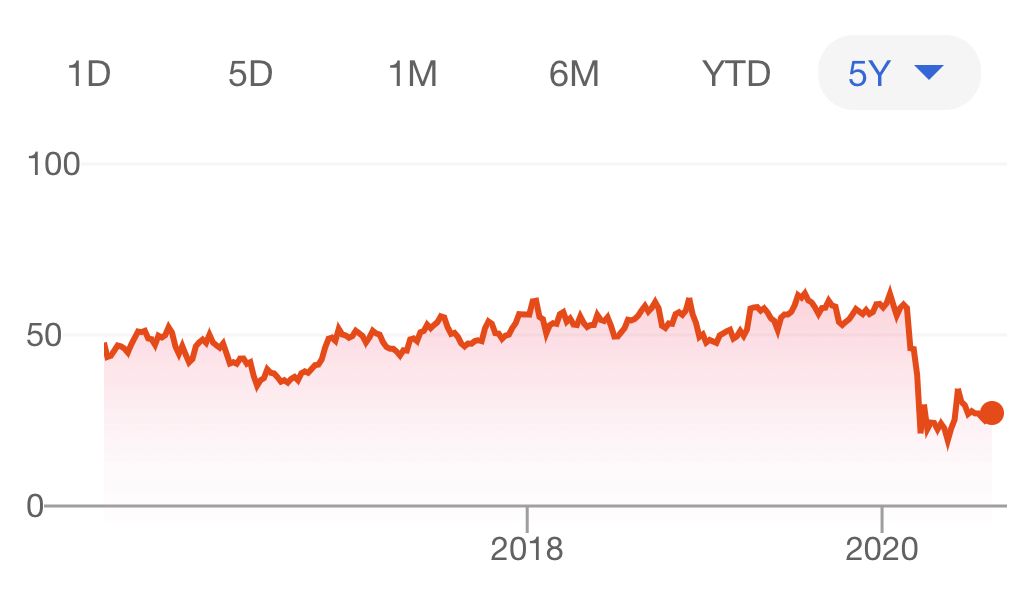

Let’s take Delta Airlines as an example. Above. But really we could talk Exxon, Marriott, etc.

For some of these large companies that were hit hard, but I’d imagine will fully rebound in the next 5 years. Why not invest heavily in them now knowing in, say 5 years, they should be somewhat back to normal and therefore investors would see 50% or more in stock growth?

-

Well, I guess the point is that nobody knows for sure that they'll be back to normal in 5 years.

@Klaus said in Stocks question:

Well, I guess the point is that nobody knows for sure that they'll be back to normal in 5 years.

Exactly. If that were the case all the investors would have snapped up the bargains and these stocks would be right back to where they were.

-

The airline industry will recover but that doesn’t mean Delta will recover. Restaurants will recover but I’m not going to buy stock in TGI Friday’s...