TurboTax question

-

@LuFins-Dad said in TurboTax question:

While we’re on the subject… One of the companies Karla subs too made them actual employees this year, but didn’t reimburse for things like mileage and other strictly job related expenses that comes with the job. How do you claim the mileage when you aren’t self employed for that portion?

Don't think you can. For W-2 work, you can't deduct mileage expenses, etc.

@89th said in TurboTax question:

@LuFins-Dad said in TurboTax question:

While we’re on the subject… One of the companies Karla subs too made them actual employees this year, but didn’t reimburse for things like mileage and other strictly job related expenses that comes with the job. How do you claim the mileage when you aren’t self employed for that portion?

Don't think you can. For W-2 work, you can't deduct mileage expenses, etc.

I'm not sure about that...

Correction...The law changed in 2020.

-

When I was working, our business manager's office did our income taxes for us. It was one of the perks of working there.

When I retired, I used them for about 3 years, but the fees they charged for a simple tax return simply weren't worth it for my situation, so I went with a local CPA.

She's done a reasonable job, I guess (can you ever really know?), but my taxes are really simple.

I have income from four sources (two retirement accounts for me, one for Mrs. George, and our Social Security.

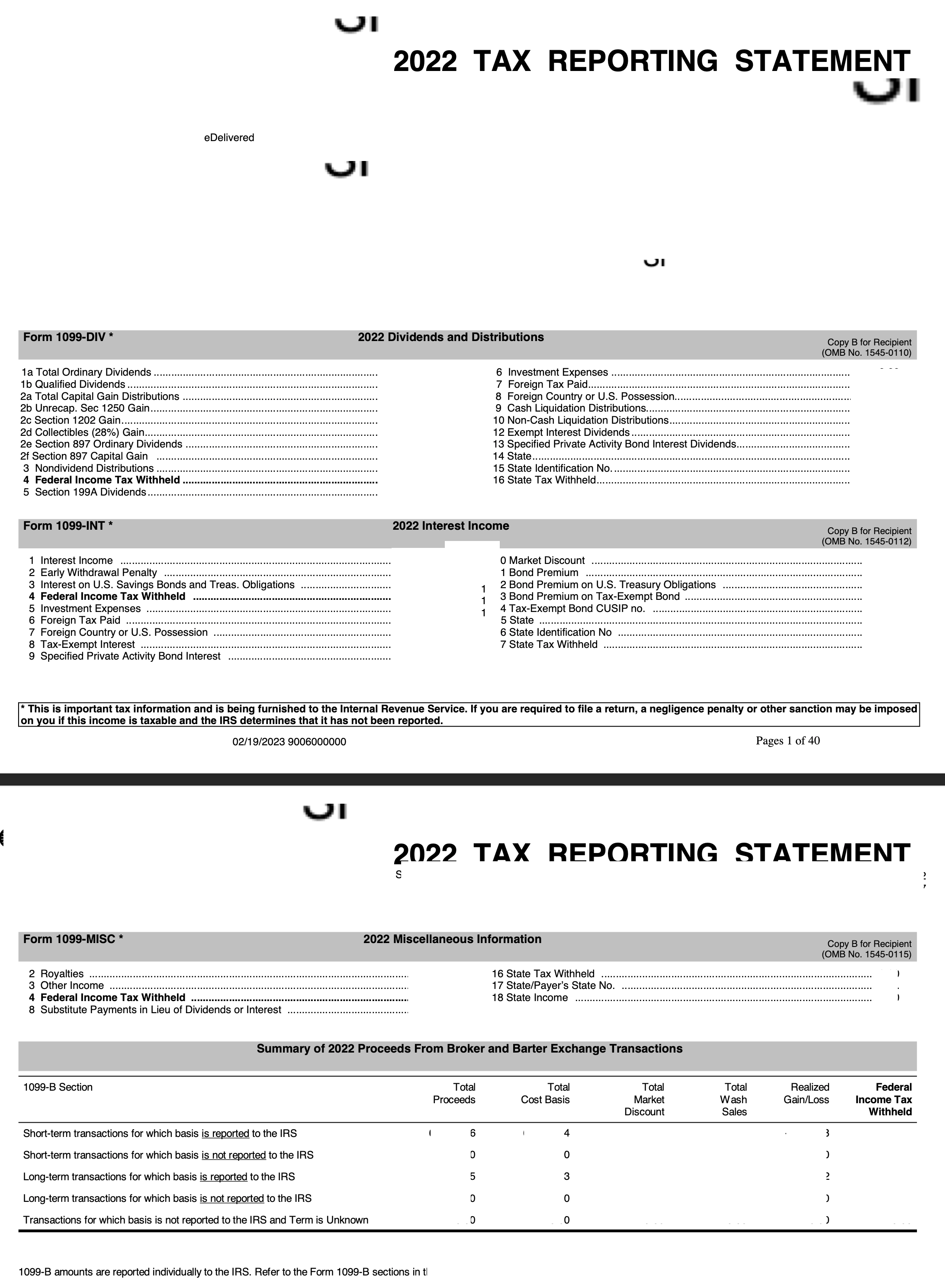

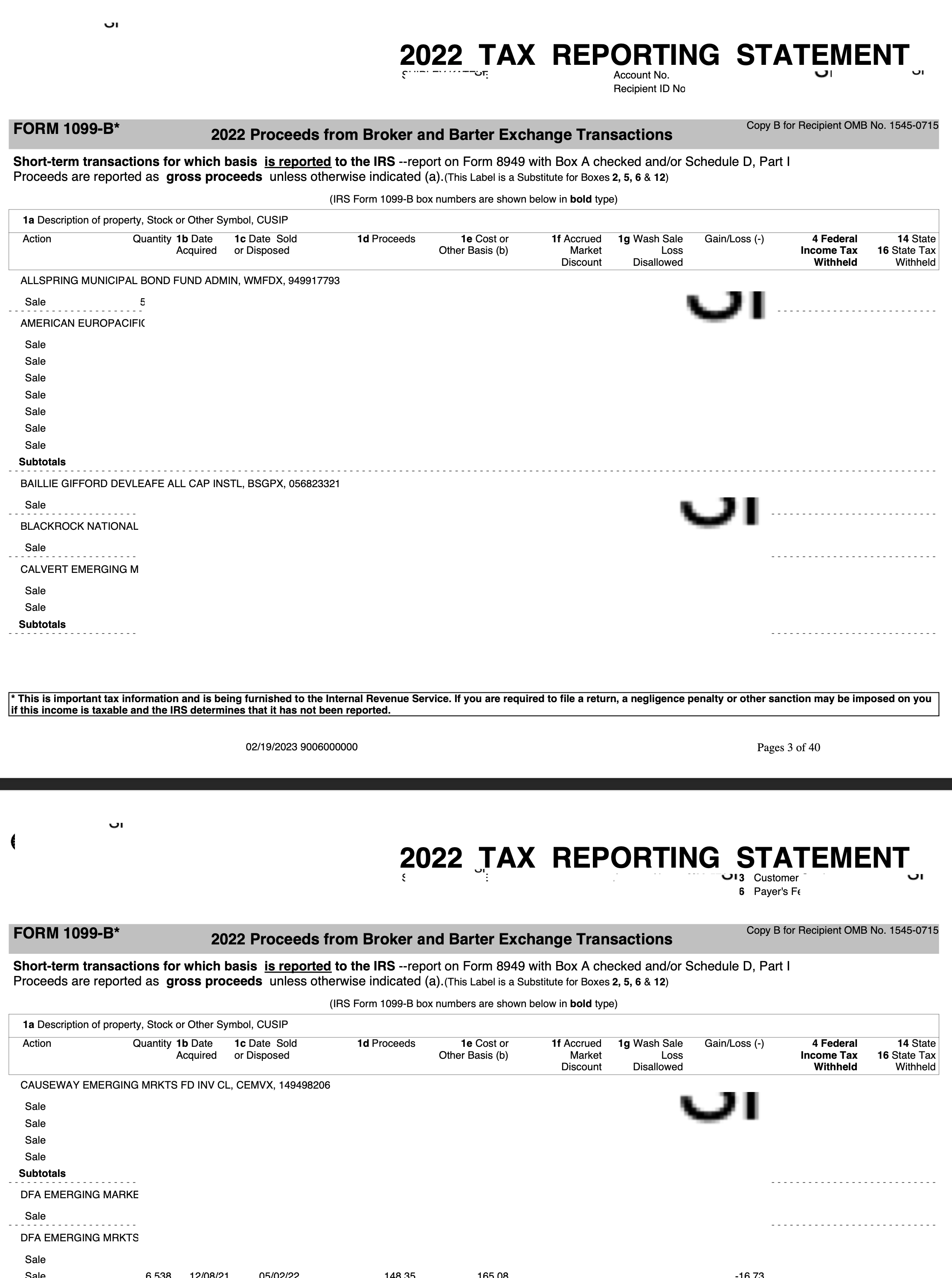

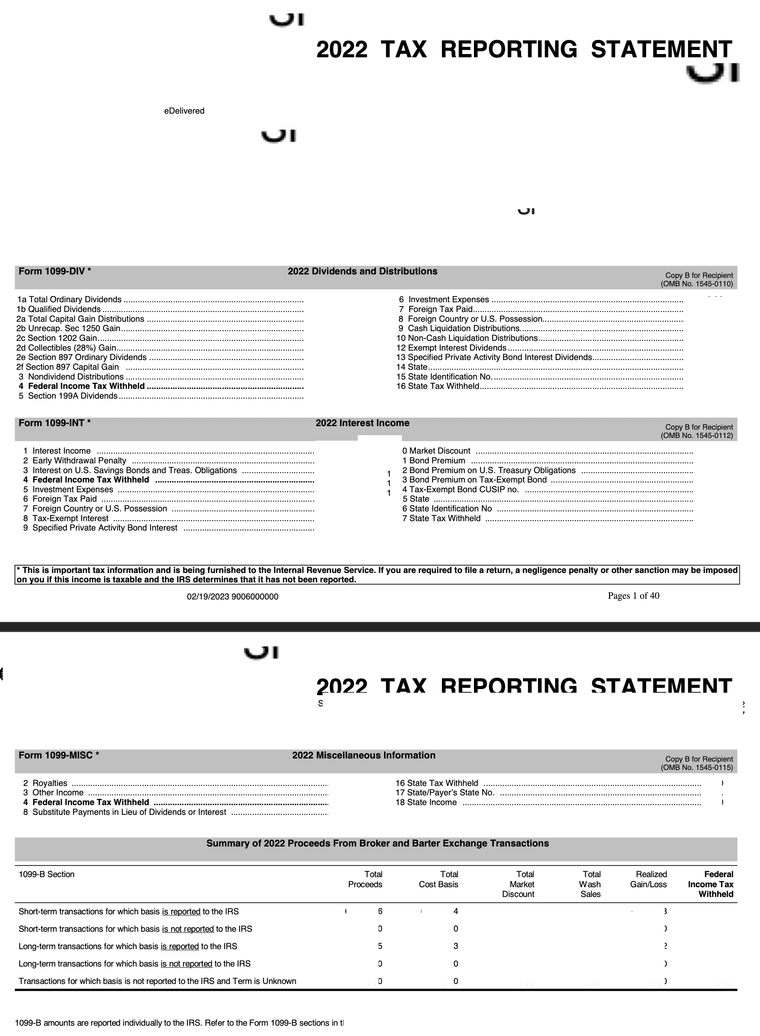

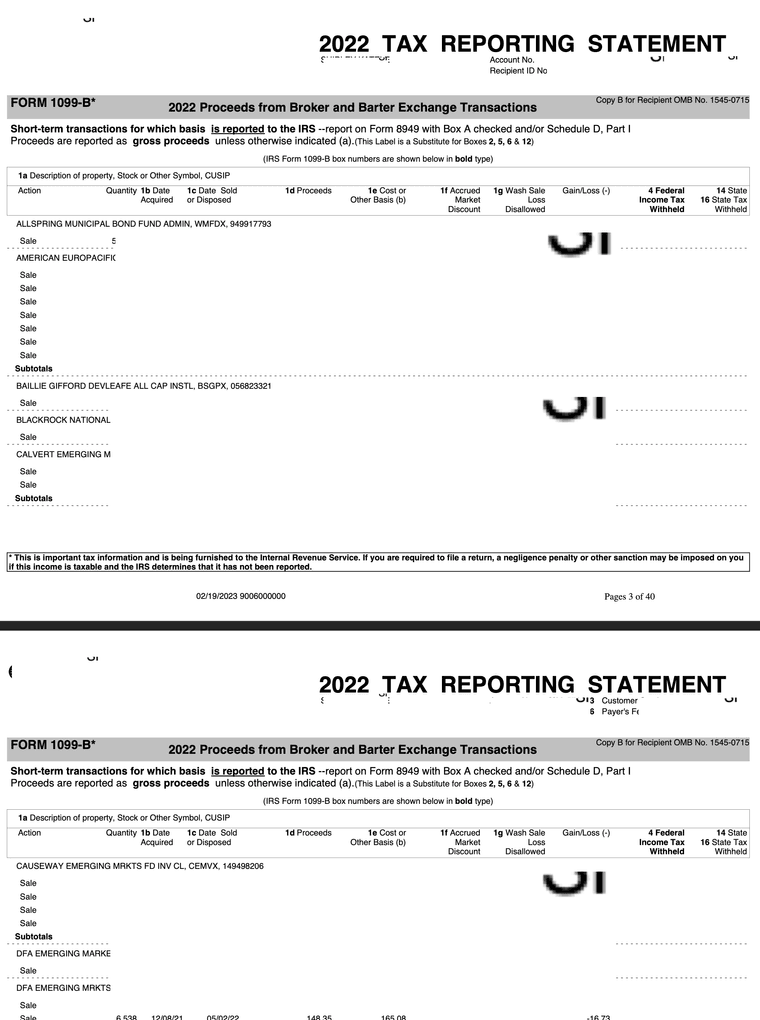

So, I thought using Turbotax would be an easy way for me to file - but, there's one thing I'm not sure TT can handle. Mrs. George has an individual brokerage account, and in mid-February, they send out a "consolidated" 1099 form - 1099-INT, and 1099-DIV.

Turbotax was great at parsing my other 1099s but I wonder if it'll be able to do a 40-page form like this.

Sample of the info - with personal stuff redacted.

@George-K said in TurboTax question:

Turbotax was great at parsing my other 1099s but I wonder if it'll be able to do a 40-page form like this.

I put my 1099s from Charles Schwab directly into Turbo Tax, no paper involved. I have been using it for a number of years, I don't remember exactly what I did to set it up. Now it remembers what I did last year and asks if I want to do it again. Then TT has me log-in to Schwab and it downloads everything.

-

@89th said in TurboTax question:

@LuFins-Dad said in TurboTax question:

While we’re on the subject… One of the companies Karla subs too made them actual employees this year, but didn’t reimburse for things like mileage and other strictly job related expenses that comes with the job. How do you claim the mileage when you aren’t self employed for that portion?

Don't think you can. For W-2 work, you can't deduct mileage expenses, etc.

I'm not sure about that...

Correction...The law changed in 2020.

@Jolly said in TurboTax question:

@89th said in TurboTax question:

@LuFins-Dad said in TurboTax question:

While we’re on the subject… One of the companies Karla subs too made them actual employees this year, but didn’t reimburse for things like mileage and other strictly job related expenses that comes with the job. How do you claim the mileage when you aren’t self employed for that portion?

Don't think you can. For W-2 work, you can't deduct mileage expenses, etc.

I'm not sure about that...

Correction...The law changed in 2020.

Wouldn’t it be an unreimbursed business expense?

-

What’s the definition of a qualified employee?

This is going to suck, because fully 1/3 of her business deductions are no longer allowed. Her home office expenses, computer, business phone, etc…

And do you have any idea how difficult tracking her mileage becomes now? This is a nightmare.

-

Geez, this is confusing...some clarity?

-

I’m going to have to take this to the TurboTax help line.

-

Geez, this is confusing...some clarity?

@Jolly said in TurboTax question:

Geez, this is confusing...some clarity?

This is a bit clearer:

https://www.irs.gov/newsroom/heres-who-qualifies-for-the-employee-business-expense-deduction

-

What’s the definition of a qualified employee?

This is going to suck, because fully 1/3 of her business deductions are no longer allowed. Her home office expenses, computer, business phone, etc…

And do you have any idea how difficult tracking her mileage becomes now? This is a nightmare.

@LuFins-Dad said in TurboTax question:

What’s the definition of a qualified employee?

This is going to suck, because fully 1/3 of her business deductions are no longer allowed. Her home office expenses, computer, business phone, etc…

And do you have any idea how difficult tracking her mileage becomes now? This is a nightmare.

Could always just divide it by 2/3 and clarify if an auditor ever asks that 1/3 of her work is as a W-2 employee. The company should be reimbursing her, btw. Not legally, but morally/policy/etc.

-

@George-K said in TurboTax question:

@jon-nyc said in TurboTax question:

I get a consolidated 1099 and put it in TurboTax just fine.

Just drop the 40 page PDF into their window?

I think they also offer the option of entering the brokerage's (you wife's) log-in credentials into the system and they'll automatically pull it for you.

@89th said in TurboTax question:

@George-K said in TurboTax question:

@jon-nyc said in TurboTax question:

I get a consolidated 1099 and put it in TurboTax just fine.

Just drop the 40 page PDF into their window?

I think they also offer the option of entering the brokerage's (you wife's) log-in credentials into the system and they'll automatically pull it for you.

This