SBF/FTX

-

Sam Bankman-Fried was sentenced Thursday to 25 years in prison for his role in defrauding users of the collapsed cryptocurrency exchange FTX.

In a federal courtroom in lower Manhattan, U.S. District Judge Lewis Kaplan called the defense argument misleading, logically flawed and speculative.

He said Bankman-Fried had obstructed justice and tampered with witnesses in mounting his defense — something Kaplan said he weighed in his sentencing decision.

Bankman-Fried, wearing a beige jailhouse jumpsuit, struck an apologetic tone, saying he had made a series of "selfish" decisions while leading FTX and "threw it all away."

"It haunts me every day," he said in his statement.

Prosecutors had sought as much as 50 years, while Bankman-Fried's legal team argued for no more than 6½ years. He was convicted on seven criminal counts in November and had been held at the Metropolitan Detention Center in Brooklyn since.

In a statement following Thursday's sentencing, Damian Williams, United States Attorney for the Southern District of New York, said Bankman-Fried had orchestrated one of the largest frauds in financial history.

-

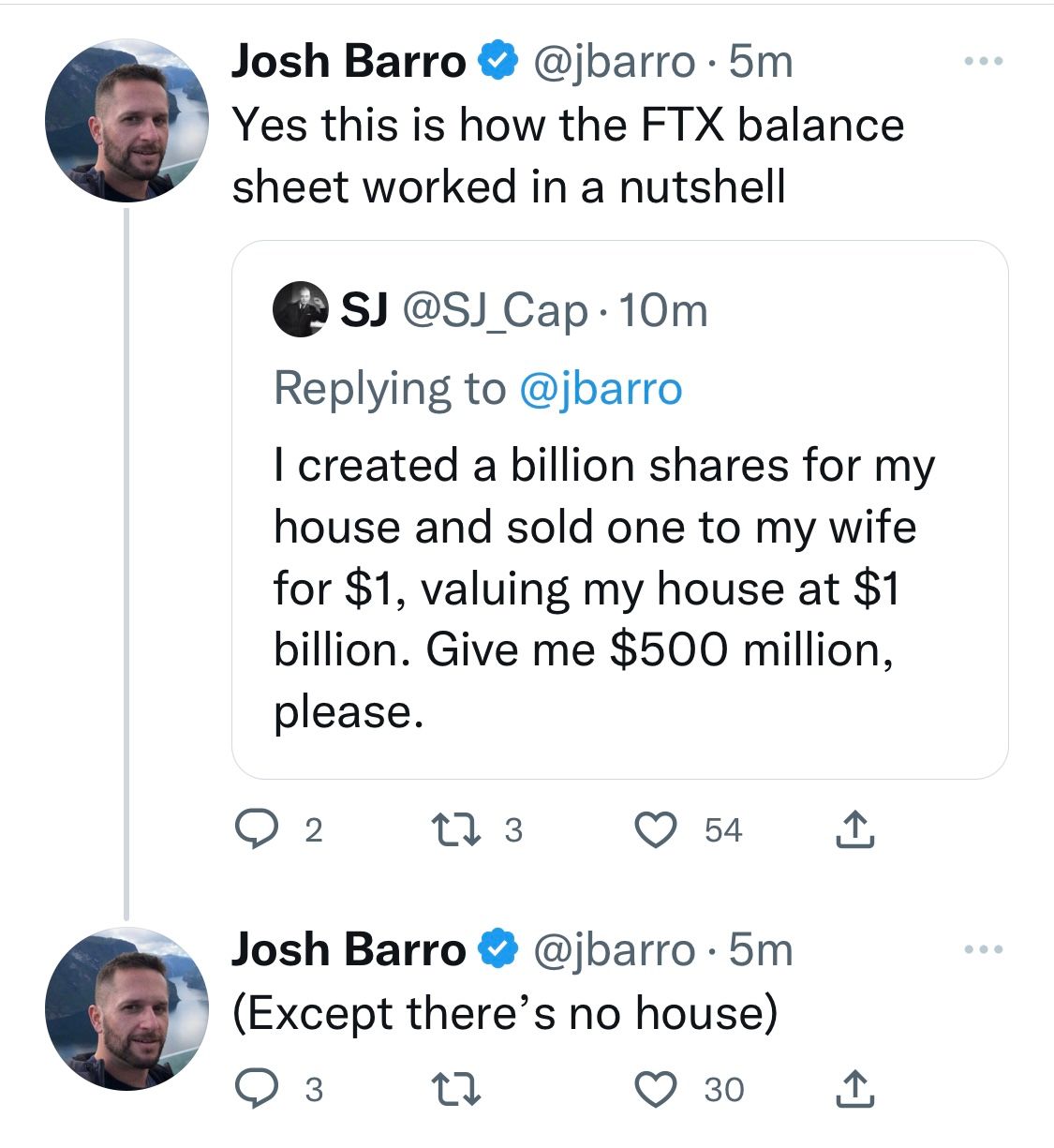

It doesn’t change the fact that he invested much of it illegally. The ultimate success or failures of the investment are irrelevant to a fair extent.

-

Not at all. And for a time it was insolvent. But even if that had never happened, advertising segregated customer funds and then using them for investing is fraud. Even if it were to end up being ‘victimless’.

(Ask the non-resident if you want confirmation)

-

Not at all. And for a time it was insolvent. But even if that had never happened, advertising segregated customer funds and then using them for investing is fraud. Even if it were to end up being ‘victimless’.

(Ask the non-resident if you want confirmation)

Not at all. And for a time it was insolvent. But even if that had never happened, advertising segregated customer funds and then using them for investing is fraud. Even if it were to end up being ‘victimless’.

(Ask the non-resident if you want confirmation)

But… Does it impact the penalties? He got 25 years, prosecutors wanted 50, and Friedman’s attorneys wanted 6… If the sentencing occurred 5 months ago, would Friedman have gotten closer to the 50 years? If the crypto rally had started a month earlier and Solana went up another 100% and now the investors are showing profit, would the sentence be closer to 10?

-

https://apnews.com/article/caroline-ellison-ftx-sentencing-64825081eae35afb0d14a278130c9526

Caroline Ellison, a former top executive in FTX founder Sam Bankman-Fried ’s collapsed cryptocurrency empire and his former girlfriend, is seeking no prison time at her sentencing later this month.

Lawyers for Ellison made the request shortly before midnight Tuesday in a filing in Manhattan federal court in advance of a sentencing scheduled for Sept. 24.

The lawyers cited her immediate and extensive cooperation with U.S. authorities when FTX and related companies collapsed in November 2022, and they noted that the court’s Probation Department recommended that she serve no prison time.

Ellison, 29, pleaded guilty nearly two years ago in the prosecution and testified against Bankman-Fried for nearly three days at his trial last November. After his conviction, Bankman-Fried was sentenced to 25 years in prison. Without her cooperation, Ellison could have faced decades in prison.

-

https://www.theverge.com/2024/9/24/24249490/caroline-ellison-sentence-ftx-alameda-fraud

Caroline Ellison, the former CEO of Alameda Research, was sentenced to 24 months in prison for her role in the FTX collapse. She must also forfeit $11 billion.

and

In sharp contrast to Bankman-Fried, Ellison appears to truly regret her role in the fraud. We know this not just because of her cooperation agreement — but because she confessed and apologized to her staff in a meeting she didn’t know was taped. That taped confession, in addition to sealing Bankman-Fried’s fate, also demonstrated her contrition.

There were some other mitigating factors, besides Ellison’s honesty. She was the only coconspirator who did not have equity in Alameda or FTX, and “the government found no evidence that Ellison enjoyed the wealth generated by the fraud,” prosecutors wrote.

Ellison has already experienced significant fallout. Her diaries have been splashed across the pages of The New York Times, her psychiatrist gave an interview about her to Michael Lewis for his book Going Infinite, and she was derided in shockingly misogynistic language by large chunks of the crypto community she’d once been a part of. She’s been unable to find paying work and is afraid to go out in public

-

https://www.theverge.com/2024/9/24/24249490/caroline-ellison-sentence-ftx-alameda-fraud

Caroline Ellison, the former CEO of Alameda Research, was sentenced to 24 months in prison for her role in the FTX collapse. She must also forfeit $11 billion.

and

In sharp contrast to Bankman-Fried, Ellison appears to truly regret her role in the fraud. We know this not just because of her cooperation agreement — but because she confessed and apologized to her staff in a meeting she didn’t know was taped. That taped confession, in addition to sealing Bankman-Fried’s fate, also demonstrated her contrition.

There were some other mitigating factors, besides Ellison’s honesty. She was the only coconspirator who did not have equity in Alameda or FTX, and “the government found no evidence that Ellison enjoyed the wealth generated by the fraud,” prosecutors wrote.

Ellison has already experienced significant fallout. Her diaries have been splashed across the pages of The New York Times, her psychiatrist gave an interview about her to Michael Lewis for his book Going Infinite, and she was derided in shockingly misogynistic language by large chunks of the crypto community she’d once been a part of. She’s been unable to find paying work and is afraid to go out in public

@taiwan_girl said in SBF/FTX:

She must also forfeit $11 billion.

How much does she have left after that, I wonder. Anything?

“the government found no evidence that Ellison enjoyed the wealth generated by the fraud,” prosecutors wrote.

Oh, how did she get that $11 billion?

Also, P-Diddy and Bankman-Fried are sharing a "common location" in the dormitory-style prison.

So, there's that. I guess.