The Bitcoin/Crypto Thread

-

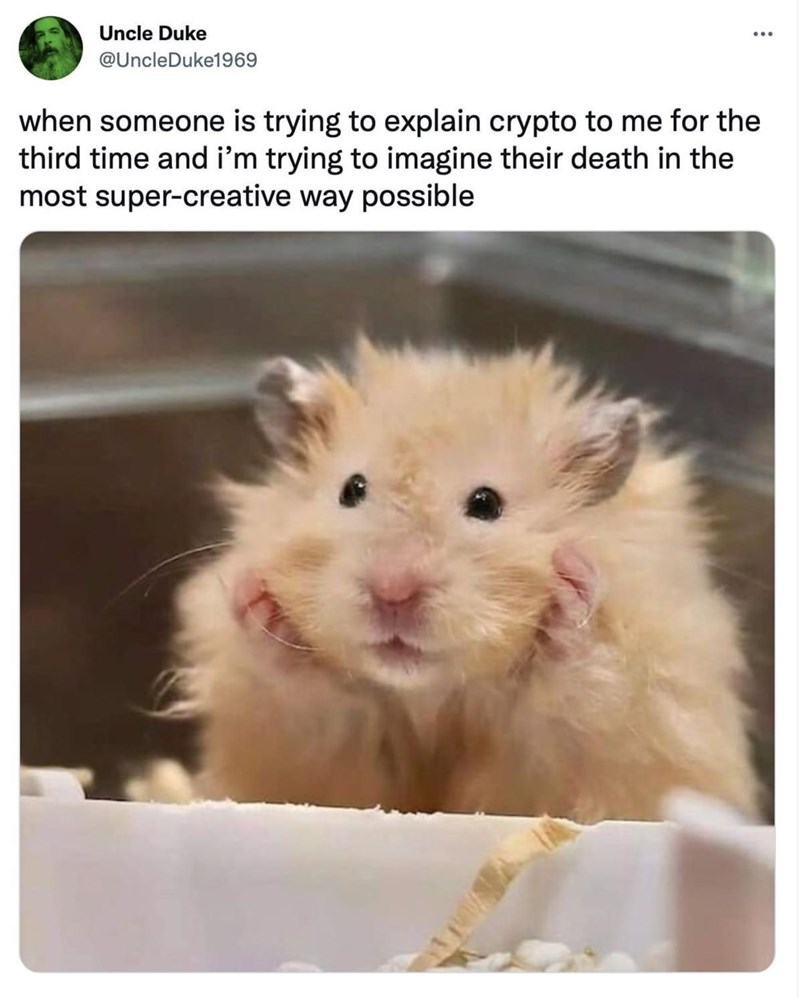

I'm in Jolly's camp. I've read up on crypto and still don't really understand it so I steer clear.

Cats, I think you are referring to Buffett's lack of investment in the original dot com bubble back in the 90's.

@Mik said in The Bitcoin/Crypto Thread:

I'm in Jolly's camp. I've read up on crypto and still don't really understand it so I steer clear.

Me three. NFTs, for example, are absolutely a greater fool scheme and any sane appraisal of them would show them to be the grift that they are.

And all NFTs are, are digital baubles intended for you to buy crypto. So no thanks to all of it. It's hypercapitalist usury.

-

@Catseye3 said in The Bitcoin/Crypto Thread:

@Axtremus

Well, shet mah mouf.Ax is not being entirely transparent. There is a reason B-H owns Apple stock. Buffet looks for companies that have a moat around their product...IOW, competitors will have a hard time duplicating what they do. It's all about the successful niche that cannot be assailed. And it's about the total worth of a company being more than the worth of its outstanding stock.

In Apple's case, it's a line of unique products and operating systems, which feature ease of use, a loyal user base and a ton of global market share

-

@Axtremus said in The Bitcoin/Crypto Thread:

@Jolly said in The Bitcoin/Crypto Thread:

- Buffet said he started investing at 11, but wishes he had started investing at 7. I wish I had, too.

US law requires that you be at least 18 years old before you can open a brokerage account.

You seem to have a too narrow view of what an investment can be.

@Klaus said in The Bitcoin/Crypto Thread:

@Axtremus said in The Bitcoin/Crypto Thread:

@Jolly said in The Bitcoin/Crypto Thread:

- Buffet said he started investing at 11, but wishes he had started investing at 7. I wish I had, too.

US law requires that you be at least 18 years old before you can open a brokerage account.

You seem to have a too narrow view of what an investment can be.

Maybe. What investment options might you suggest for young people who have not reach the legal age to open a brokerage account? I am hoping for options that allow the young investors to “self direct” rather than having other adults do it for them.

@Jolly, it looks you have done some retail investment promotion work, your thoughts?

Anyway, this can be a useful and interesting topic by itself, so please feel free to start a new thread for “how can young people invest” discussion.

-

@Jolly "I don't invest in things I don't understand."

You and Warren Buffett. That's why he's invested his whole life in Coca-Cola and none at all in computers.

Is that where you got this investing strategy?

@Catseye3 said in The Bitcoin/Crypto Thread:

@Jolly "I don't invest in things I don't understand."

You and Warren Buffett. That's why he's invested his whole life in Coca-Cola and none at all in computers.

Is that where you got this investing strategy?

Well Buffet did start to invest in Apple. Only later did someone tell him it wasn't a fruit company.

-

@Jolly said in The Bitcoin/Crypto Thread:

If I could live my life over, there are some money things I would do different...or the same...

- Buffet said he started investing at 11, but wishes he had started investing at 7. I wish I had, too. Dollar average, dollar average, dollar average.

- Debt is a money killer. Some debt types are preferred over others. Mortgage debt is not entirely bad. Student loan debt - within reason - is not entirely bad. That comes with the caveat that you acquire DIY skills and start with a fixer-upper you can later sell at a profit. The caveat on student loan debt is you borrow no more than what you must and for most common degrees, there exists less expensive schools.

- Buy and hold. If you picked a good stock or a good fund, ride it.

- Diversify. Either by investing in the whole market by index funds or select sector funds in businesses that you know well. Own some real estate. Have a bit in bonds or bond funds.

- Always beware of fees. Some companies (example: M-L) will kill you with fees.

- Cash ain't bad. And the best way to acquire cash for the average person is to live below your means. You don't want too much of your wealth tied up in cash, but you want enough to be flexible in regards to opportunities or enough to cover any emergencies.

Sounds good. I'd sharpen 2. to "No debt ever, except for a house (and in the US potentially student loan)". Don't have the cash for a new car? Buy a used one you can afford.

I'd add: If you have money to spend, spend it on big "dream-fulfilling" things, rather than on general lifestyle things.

And: Don't buy insurance for something that won't kill you financially in the damage event. The ROI is bad, so it's only worth it if the damage case is life-threatening.

And: Separate friends and money. Don't lend money to your friends, or ask them for money.

@Klaus said in The Bitcoin/Crypto Thread:

@Jolly said in The Bitcoin/Crypto Thread:

If I could live my life over, there are some money things I would do different...or the same...

- Buffet said he started investing at 11, but wishes he had started investing at 7. I wish I had, too. Dollar average, dollar average, dollar average.

- Debt is a money killer. Some debt types are preferred over others. Mortgage debt is not entirely bad. Student loan debt - within reason - is not entirely bad. That comes with the caveat that you acquire DIY skills and start with a fixer-upper you can later sell at a profit. The caveat on student loan debt is you borrow no more than what you must and for most common degrees, there exists less expensive schools.

- Buy and hold. If you picked a good stock or a good fund, ride it.

- Diversify. Either by investing in the whole market by index funds or select sector funds in businesses that you know well. Own some real estate. Have a bit in bonds or bond funds.

- Always beware of fees. Some companies (example: M-L) will kill you with fees.

- Cash ain't bad. And the best way to acquire cash for the average person is to live below your means. You don't want too much of your wealth tied up in cash, but you want enough to be flexible in regards to opportunities or enough to cover any emergencies.

Sounds good. I'd sharpen 2. to "No debt ever, except for a house (and in the US potentially student loan)". Don't have the cash for a new car? Buy a used one you can afford.

I'd add: If you have money to spend, spend it on big "dream-fulfilling" things, rather than on general lifestyle things.

And: Don't buy insurance for something that won't kill you financially in the damage event. The ROI is bad, so it's only worth it if the damage case is life-threatening.

And: Separate friends and money. Don't lend money to your friends, or ask them for money.

Good collection of advice. I'd also add avoid a credit card when you're young or get one only if you're able to pay it off every month. I know life is complicated and that's not possible for families who need purchasing power today, but I remember in my early 20s I almost got sucked into a "pay off one credit card with another credit card" black hole that could've been bad.

-

@89th said in The Bitcoin/Crypto Thread:

@xenon said in The Bitcoin/Crypto Thread:

The rest of the stuff? I don't know how it makes anyone's life better. (Maybe lower remittance fees... that's about it).

I think ETH is behind NFTs which I could see as a significant way of the future for digital ownership.

@mark nice! Let's get SHIB to the moon.

It could... but digital ownership of what though... I don't own anything that would benefit from having a "digital deed" or being subject to digital scarcity.... that might just be "me" bias though.

@xenon said in The Bitcoin/Crypto Thread:

@89th said in The Bitcoin/Crypto Thread:

@xenon said in The Bitcoin/Crypto Thread:

The rest of the stuff? I don't know how it makes anyone's life better. (Maybe lower remittance fees... that's about it).

I think ETH is behind NFTs which I could see as a significant way of the future for digital ownership.

@mark nice! Let's get SHIB to the moon.

It could... but digital ownership of what though... I don't own anything that would benefit from having a "digital deed" or being subject to digital scarcity.... that might just be "me" bias though.

Fair, I just have a gut feeling that in the future... provable ownership of digital assets will be a "thing" and that NFT seems to address that "thing" now.

As far as crypto, I have about 1% of my whole investment portfolio in it. And it's very much a "check the balance in 20 years" type of thing.

-

If you have a risk tolerance, and you believe your ability to pick stocks is of some value, then your expected long term return on your investments goes up as your diversification goes down. Diversification is a risk reducer rather than a returns improver.

-

I turned one of those offers around! A card sent me an offer like that -- pay off other debt with this great one-time offer! Pay the balance in a year and owe no finance charge!

I had something, I forget what, that I wanted. I divided the purchase price by 12, determined I could do it, and signed up. I paid off the balance in 12 months. no finance charge. The cherry on top was that the company actually LOST a little bit of money on postage!

Ha!

-

I turned one of those offers around! A card sent me an offer like that -- pay off other debt with this great one-time offer! Pay the balance in a year and owe no finance charge!

I had something, I forget what, that I wanted. I divided the purchase price by 12, determined I could do it, and signed up. I paid off the balance in 12 months. no finance charge. The cherry on top was that the company actually LOST a little bit of money on postage!

Ha!

-

@xenon said in The Bitcoin/Crypto Thread:

@89th said in The Bitcoin/Crypto Thread:

@xenon said in The Bitcoin/Crypto Thread:

The rest of the stuff? I don't know how it makes anyone's life better. (Maybe lower remittance fees... that's about it).

I think ETH is behind NFTs which I could see as a significant way of the future for digital ownership.

@mark nice! Let's get SHIB to the moon.

It could... but digital ownership of what though... I don't own anything that would benefit from having a "digital deed" or being subject to digital scarcity.... that might just be "me" bias though.

Fair, I just have a gut feeling that in the future... provable ownership of digital assets will be a "thing" and that NFT seems to address that "thing" now.

As far as crypto, I have about 1% of my whole investment portfolio in it. And it's very much a "check the balance in 20 years" type of thing.

@89th said in The Bitcoin/Crypto Thread:

@xenon said in The Bitcoin/Crypto Thread:

@89th said in The Bitcoin/Crypto Thread:

@xenon said in The Bitcoin/Crypto Thread:

The rest of the stuff? I don't know how it makes anyone's life better. (Maybe lower remittance fees... that's about it).

I think ETH is behind NFTs which I could see as a significant way of the future for digital ownership.

@mark nice! Let's get SHIB to the moon.

It could... but digital ownership of what though... I don't own anything that would benefit from having a "digital deed" or being subject to digital scarcity.... that might just be "me" bias though.

Fair, I just have a gut feeling that in the future... provable ownership of digital assets will be a "thing" and that NFT seems to address that "thing" now.

As far as crypto, I have about 1% of my whole investment portfolio in it. And it's very much a "check the balance in 20 years" type of thing.

About the same here except I am looking at 10 years. I have very little money invested in it. Once ETH and BC rebound, I will fire up the GPU mining again. Right now the profitability is way down. I turned them off last night after my latest round hit the payout trigger.

-

@Jolly said in The Bitcoin/Crypto Thread:

- Buffet said he started investing at 11, but wishes he had started investing at 7. I wish I had, too.

US law requires that you be at least 18 years old before you can open a brokerage account.

@Axtremus said in The Bitcoin/Crypto Thread:

@Jolly said in The Bitcoin/Crypto Thread:

- Buffet said he started investing at 11, but wishes he had started investing at 7. I wish I had, too.

US law requires that you be at least 18 years old before you can open a brokerage account.

Easily solved with a UGMA account. My daughter’s been invested since birth.

-

@Axtremus said in The Bitcoin/Crypto Thread:

@Jolly said in The Bitcoin/Crypto Thread:

- Buffet said he started investing at 11, but wishes he had started investing at 7. I wish I had, too.

US law requires that you be at least 18 years old before you can open a brokerage account.

Easily solved with a UGMA account. My daughter’s been invested since birth.

@Mik said in The Bitcoin/Crypto Thread:

@Axtremus said in The Bitcoin/Crypto Thread:

@Jolly said in The Bitcoin/Crypto Thread:

- Buffet said he started investing at 11, but wishes he had started investing at 7. I wish I had, too.

US law requires that you be at least 18 years old before you can open a brokerage account.

Easily solved with a UGMA account. My daughter’s been invested since birth.

Much respect and kudos to all parents who start investments for their children early. I was thinking more along the line of actual ownership and self-direction by the young person. A parent doing stuff for you is not the same as you doing stuff yourself, a bit like the “trust fund vs. self-made” difference. Of course, at the end of the day, a dollar from mom and dad will still worth the same as a dollar from one’s own labor on the open market. Just that for this discussion, I am hoping for options that young people can execute on their own. :man-shrugging:

-

It's easy. Just set up an account and have the parent invest whatever monies the child comes up with. Jesus.

-

@Mik said in The Bitcoin/Crypto Thread:

It's easy. Just set up an account and have the parent invest whatever monies the child comes up with. Jesus.

I thought I wrote I was hoping for “options that the young people can execute on their own”.

@Axtremus said in The Bitcoin/Crypto Thread:

@Mik said in The Bitcoin/Crypto Thread:

It's easy. Just set up an account and have the parent invest whatever monies the child comes up with. Jesus.

I thought I wrote I was hoping for “options that the young people can execute on their own”.

They don’t actually check who presses the buy/sell buttons on the website, or the conversations that led up to those decisions.

-

-

The complexity of crypto is really beside the point. It’s not dissimilar in theory from a discovery of a shiny new metal that is hard to find and that enough people agree has value. Actually not even dissimilar from baseball cards and their value.

@Horace said in The Bitcoin/Crypto Thread:

The complexity of crypto is really beside the point. It’s not dissimilar in theory from a discovery of a shiny new metal that is hard to find and that enough people agree has value. Actually not even dissimilar from baseball cards and their value.

That's the best argument for bitcoin. And bitcoin is strictly better than everything else on this dimension - it's not trying to be a platform for defi, there's no group of founders trying to take it in a certain direction, there's too much interest voting power that don't want the fundamentals of the platform to change, etc.

Bitcoin has a chance of becoming digital gold. Everything else just sounds like bullshit.

Yeah, bitcoin sucks as a transactional currency - but I don't need my gold transactions to be fast.

-

@Mik said in The Bitcoin/Crypto Thread:

@Axtremus said in The Bitcoin/Crypto Thread:

@Jolly said in The Bitcoin/Crypto Thread:

- Buffet said he started investing at 11, but wishes he had started investing at 7. I wish I had, too.

US law requires that you be at least 18 years old before you can open a brokerage account.

Easily solved with a UGMA account. My daughter’s been invested since birth.

Much respect and kudos to all parents who start investments for their children early. I was thinking more along the line of actual ownership and self-direction by the young person. A parent doing stuff for you is not the same as you doing stuff yourself, a bit like the “trust fund vs. self-made” difference. Of course, at the end of the day, a dollar from mom and dad will still worth the same as a dollar from one’s own labor on the open market. Just that for this discussion, I am hoping for options that young people can execute on their own. :man-shrugging:

@Axtremus said in The Bitcoin/Crypto Thread:

@Mik said in The Bitcoin/Crypto Thread:

@Axtremus said in The Bitcoin/Crypto Thread:

@Jolly said in The Bitcoin/Crypto Thread:

- Buffet said he started investing at 11, but wishes he had started investing at 7. I wish I had, too.

US law requires that you be at least 18 years old before you can open a brokerage account.

Easily solved with a UGMA account. My daughter’s been invested since birth.

Much respect and kudos to all parents who start investments for their children early. I was thinking more along the line of actual ownership and self-direction by the young person. A parent doing stuff for you is not the same as you doing stuff yourself, a bit like the “trust fund vs. self-made” difference. Of course, at the end of the day, a dollar from mom and dad will still worth the same as a dollar from one’s own labor on the open market. Just that for this discussion, I am hoping for options that young people can execute on their own. :man-shrugging:

Precious metals. If one is willing to forgo the benefits of Roth or traditional 401K's , a child can purchase gold, platinum or silver at any age. That's bullion, coins or jewelry.

Most everything else I know of revolves around an adult overseeing an account for a minor until they turn 18. I'm not sure if a minor becomes emancipated, if that rules still holds.

Other than that, since U.S. law has a problem with minors signing contracts, Mik is right about UGMA/UTMA accounts.

-

@Axtremus said in The Bitcoin/Crypto Thread:

@Mik said in The Bitcoin/Crypto Thread:

@Axtremus said in The Bitcoin/Crypto Thread:

@Jolly said in The Bitcoin/Crypto Thread:

- Buffet said he started investing at 11, but wishes he had started investing at 7. I wish I had, too.

US law requires that you be at least 18 years old before you can open a brokerage account.

Easily solved with a UGMA account. My daughter’s been invested since birth.

Much respect and kudos to all parents who start investments for their children early. I was thinking more along the line of actual ownership and self-direction by the young person. A parent doing stuff for you is not the same as you doing stuff yourself, a bit like the “trust fund vs. self-made” difference. Of course, at the end of the day, a dollar from mom and dad will still worth the same as a dollar from one’s own labor on the open market. Just that for this discussion, I am hoping for options that young people can execute on their own. :man-shrugging:

Precious metals. If one is willing to forgo the benefits of Roth or traditional 401K's , a child can purchase gold, platinum or silver at any age. That's bullion, coins or jewelry.

Most everything else I know of revolves around an adult overseeing an account for a minor until they turn 18. I'm not sure if a minor becomes emancipated, if that rules still holds.

Other than that, since U.S. law has a problem with minors signing contracts, Mik is right about UGMA/UTMA accounts.

@Jolly said in The Bitcoin/Crypto Thread:

Precious metals. If one is willing to forgo the benefits of Roth or traditional 401K's , a child can purchase gold, platinum or silver at any age. That's bullion, coins or jewelry.

OK, those are certainly options that can be executed by the young people themselves. I suppose possession of physical things is generally a practical option, older generations are known to have collected baseball cards, dolls/action figures, comic books, beanie babies, etc. People can argue whether collectibles make good financial investments but there are enough to precedents showing that collectibles have many times been treated as investments. Thanks.