Property Taxes?

-

Once again, those on fixed income suffer.

On the other hand, if the government needs the money to provide services, it has to come from somewhere.

@Copper said in Property Taxes?:

Once again, those on fixed income suffer.

On the other hand, if the government needs the money to provide services, it has to come from somewhere.

Yeah, well summarized as always.

Those on fixed income will probably pay less if they live in a paid-off home, and just pay taxes, vs paying rent. Either way, if the citizen is using roads, police departments, fire departments, and so forth... the funds need to come from somewhere.

It is an interesting though, albeit a rabbit hole I won't go down, to exactly why each tax exists and where the money goes. Local taxes, state taxes, sales taxes, gas taxes, property taxes, federal taxes, estate taxes....

-

No free lunch. I do support retirees not paying taxes on Social Security ever. I pay it now because of consulting on the side. I don't mind paying on earned income, but SS was already taxes to begin with.

Property tax? If I don't pay for the services I receive, someone else has to.

-

No free lunch. I do support retirees not paying taxes on Social Security ever. I pay it now because of consulting on the side. I don't mind paying on earned income, but SS was already taxes to begin with.

Property tax? If I don't pay for the services I receive, someone else has to.

@Mik said in Property Taxes?:

No free lunch. I do support retirees not paying taxes on Social Security ever. I pay it now because of consulting on the side. I don't mind paying on earned income, but SS was already taxes to begin with.

If you're above a certain threshold you'll pay taxes on up to 85% of your SS income - at whatever rate your bracket is.

Property tax? If I don't pay for the services I receive, someone else has to.

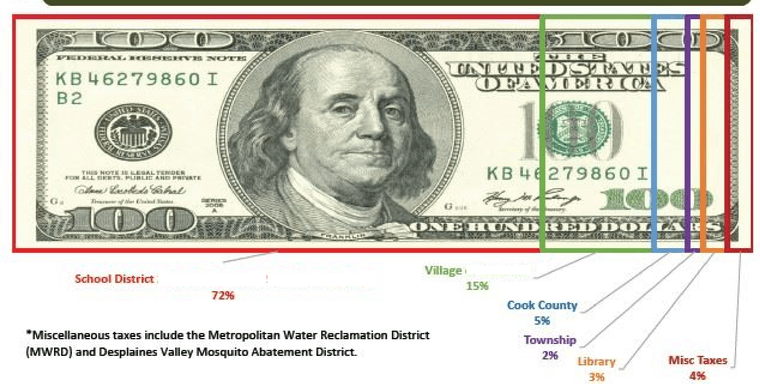

Have you looked at where your property taxes go? In my case only about 15% goes to my town. The rest goes to schools and other county stuff.

-

Here state law allows the township to charge 10 mils for operations. Anything over that must be approved by the voters in the form of a levy, as schools must be. I see your point, but I consider public schools to be a service that benefits me both in terms of an educated population and increased property value.

-

No free lunch. I do support retirees not paying taxes on Social Security ever. I pay it now because of consulting on the side. I don't mind paying on earned income, but SS was already taxes to begin with.

Property tax? If I don't pay for the services I receive, someone else has to.

@Mik said in Property Taxes?:

No free lunch. I do support retirees not paying taxes on Social Security ever. I pay it now because of consulting on the side. I don't mind paying on earned income, but SS was already taxes to begin with.

Compounding the issue is that it is essentially a forced loan to the Government with a payback that doesn’t begin for 30-40 years, and at a rate of 2%…

Social Security really is an abomination from a civics perspective.

-

@Mik said in Property Taxes?:

No free lunch. I do support retirees not paying taxes on Social Security ever. I pay it now because of consulting on the side. I don't mind paying on earned income, but SS was already taxes to begin with.

Compounding the issue is that it is essentially a forced loan to the Government with a payback that doesn’t begin for 30-40 years, and at a rate of 2%…

Social Security really is an abomination from a civics perspective.

@LuFins-Dad said in Property Taxes?:

@Mik said in Property Taxes?:

No free lunch. I do support retirees not paying taxes on Social Security ever. I pay it now because of consulting on the side. I don't mind paying on earned income, but SS was already taxes to begin with.

Compounding the issue is that it is essentially a forced loan to the Government with a payback that doesn’t begin for 30-40 years, and at a rate of 2%…

Social Security really is an abomination from a civics perspective.

They would be much better off enforcing a requirement for people to pay a percentage of their salary into a 401K, although I guess the practicality of enforcing such a law would essentially make it impossible.

-

@LuFins-Dad said in Property Taxes?:

@Mik said in Property Taxes?:

No free lunch. I do support retirees not paying taxes on Social Security ever. I pay it now because of consulting on the side. I don't mind paying on earned income, but SS was already taxes to begin with.

Compounding the issue is that it is essentially a forced loan to the Government with a payback that doesn’t begin for 30-40 years, and at a rate of 2%…

Social Security really is an abomination from a civics perspective.

They would be much better off enforcing a requirement for people to pay a percentage of their salary into a 401K, although I guess the practicality of enforcing such a law would essentially make it impossible.

@Doctor-Phibes said in Property Taxes?:

@LuFins-Dad said in Property Taxes?:

@Mik said in Property Taxes?:

No free lunch. I do support retirees not paying taxes on Social Security ever. I pay it now because of consulting on the side. I don't mind paying on earned income, but SS was already taxes to begin with.

Compounding the issue is that it is essentially a forced loan to the Government with a payback that doesn’t begin for 30-40 years, and at a rate of 2%…

Social Security really is an abomination from a civics perspective.

They would be much better off enforcing a requirement for people to pay a percentage of their salary into a 401K, although I guess the practicality of enforcing such a law would essentially make it impossible.

You still have the task and obligation of paying off the preexisting low interest loans.

-

@Axtremus said in Property Taxes?:

The correct answer is to tax the rich to pay for everything.

They already do.

Define "rich."

-

-

Right now I pay $521/month for our principal residence and $180/month in property taxes for the 1 acre vacant lot on Lake Okanagan that we may or may not build on and move to in five or so years. That vacant lot has gone through the roof in assessed value last four years. When we bought it 2016 it was around $65/month. As they say, location, location, location. Since then too many NHL players have bought into the subdivision and built their “summer cottages”.

-

@Axtremus said in Property Taxes?:

Anyone who has or makes more money than I.

That's a variant of "An alcoholic is someone (whom I don't like) who drinks more than I do."

-

@Axtremus said in Property Taxes?:

@George-K said in Property Taxes?:

Define "rich."

Anyone who has or makes more money than I.

Not sure how much you make but the top 10% (income over $150k) pay about 75% of all income taxes. On the other side, the bottom 50% pay about 3% of all income taxes. Of course that bottom 50% also consumes most of the tax-based benefits from the government.

But we’re talking property taxes, so that’s another story. Probably a similar thesis though.

-

Can US residents write off their property taxes on the annual income tax returns? We cannot. Nor can we write off the annual interest paid on principal residence mortgages.

@Renauda said in Property Taxes?:

Can US residents write off their property taxes on the annual income tax returns? We cannot. Nor can we write off the annual interest paid on principal residence mortgages.

Yes, but, in addition your other deductions have to exceed the standard deduction.

And...

You're limited to $10K of tax deductibility.