Bidenomics

-

@George-K said in Bidenomics:

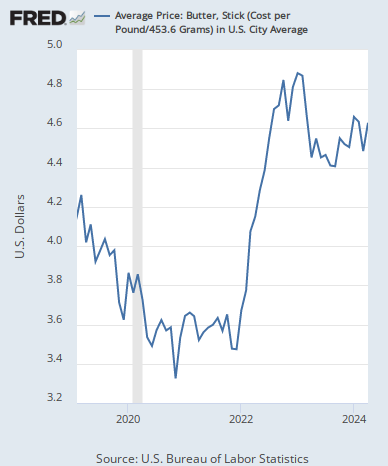

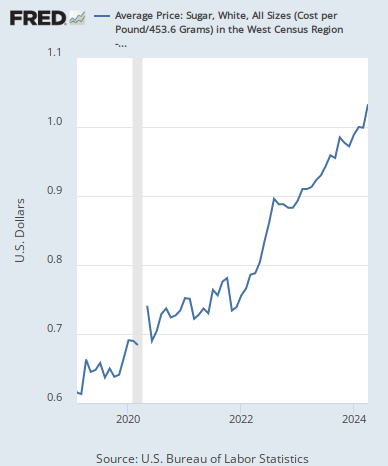

The cost of making popcorn:

I’d suggest that he hire somebody to handle both his sourcing of ingredients and his accounting.

Prices are up, but they aren’t up as high as he’s saying.

-

@Jolly said in Bidenomics:

These guys don't shop at Piggly Wiggly.

Right. But he’s manipulating the numbers. He’s showing his wholesale cost in 21, and retail in 24. That’s not just fudging the numbers, that’s outright fraud. Letitia James would like to have a conversation with him…

-

The bitch of it is, it’s an unforced error and unneeded lie to make his point. It’s a 27% increase in butter. For the sake of this argument, let’s say that’s a universal increase on all materials. That doesn’t translate into only a 27% increase in his product price. With inflation, he’s also having to raise his wages, and to match that inflation, he has needed to raise his wages by the 20% per hour. Now I have no idea his volume and the labor costs involved per unit for his product, but you could easily see that being another 5%-7%. In addition, and this gets missed by most, if the company’s output volume stays the same and the costs have all increased dramatically, then the company must increase their profit margin to simply maintain.

-

Krugman:

Bidenomics Is Making China Angry. That’s OK.

https://www.nytimes.com/2024/03/28/opinion/biden-trump-china.html

Trump made a big show of taking on China, but he was ineffective when in office and appears to have folded on TikTok when donor money was at stake. Biden talks more softly but is wielding a really big stick. Or to put it another way, Trump isn’t actually a tough guy on China; he just plays one on TV. Biden is the real deal.

-

Why people don't feel good about the economy, from the WSJ:

Link to video -

I watched most of it but didn't hear any mention about the job market.

-

Krugman:

Bidenomics Is Making China Angry. That’s OK.

https://www.nytimes.com/2024/03/28/opinion/biden-trump-china.html

Trump made a big show of taking on China, but he was ineffective when in office and appears to have folded on TikTok when donor money was at stake. Biden talks more softly but is wielding a really big stick. Or to put it another way, Trump isn’t actually a tough guy on China; he just plays one on TV. Biden is the real deal.

@Axtremus said in Bidenomics:

Krugman:

Bidenomics Is Making China Angry. That’s OK.

https://www.nytimes.com/2024/03/28/opinion/biden-trump-china.html

Trump made a big show of taking on China, but he was ineffective when in office and appears to have folded on TikTok when donor money was at stake. Biden talks more softly but is wielding a really big stick. Or to put it another way, Trump isn’t actually a tough guy on China; he just plays one on TV. Biden is the real deal.

Snort. He should get a job writing for SNL.

-

@George-K said in Bidenomics:

Remember the article by Summers et al?

I'm so old that I can remember when Millennials bitched about this very phenomenon 15 years ago, and boomers told them to stop whining because it didn't fit their narrative at the time.

This exact issue.

-

@George-K said in Bidenomics:

Remember the article by Summers et al?

I'm so old that I can remember when Millennials bitched about this very phenomenon 15 years ago, and boomers told them to stop whining because it didn't fit their narrative at the time.

This exact issue.

@Aqua-Letifer said in Bidenomics:

This exact issue.

We bought our first house in 1980. 13.25% mortgage on a $75K note. I wonder how the statistics of this tweet would compare to that.

(too lazy to look it up)

-

About home buying affordability referenced in reply #81, this is the underlying study:

https://www.bankrate.com/real-estate/home-affordability-in-current-housing-market-study/

Out of all 50 states and the District of Columbia, California requires the highest annual salary to afford a typical home at $197,057, followed by:

Hawaii: $185,829

District of Columbia: $167,871

Massachusetts: $162,471

Washington: $156,814Mississippi requires the lowest income to afford a home in the U.S. at $63,043, followed by:

Ohio: $64,071

Arkansas: $64,714

Indiana: $65,143

Kentucky: $65,1865 states where income required to afford a typical home grew the most

Skyrocketing home prices in these states mean higher salaries are needed to afford a typical home

Montana experienced the most significant increase of income needed to afford a typical home between January 2020 and January 2024, followed by Utah, Tennessee, South Carolina and Arizona.5 states where income required to afford a typical home grew the least

The annual salary needed to afford a typical home grew the least in North Dakota, the District of Columbia, Louisiana, Illinois and Kansas between January 2020 and January 2024.By “salary,” I think they mean household income, or “combined salary” of both spouses; in which case $110,871 means roughly $55.5k each for a two-income household.

-

@Axtremus said in Bidenomics:

Biden is owning it.

Surging gas prices and sky-high mortgages and rent sent inflation rising more than expected in March, adding to Americans’ prolonged and painful battle with high costs. That could force the Federal Reserve to keep its punishing rates higher for longer.

US consumer prices picked up again last month, vaulting to a 3.5% increase for the 12 months ended in March, according to the latest Consumer Price Index data released Wednesday by the Bureau of Labor Statistics.

That’s up considerably from February’s 3.2% rate and marks the highest annual gain in the past six months. Friday’s report further highlights that the path to lower inflation remains extremely bumpy — and continue to be a drag on Americans’ hard-earned finances — and that any loosening of monetary policy might not happen soon.

“You can kiss a June interest rate cut goodbye,” Greg McBride, chief financial analyst for Bankrate, wrote in commentary issued Wednesday.

US futures tanked Wednesday after the release of the hotter-than-expected inflation data, with Dow futures falling by more than 475 points. Futures on the S&P fell by 1.25% and Nasdaq futures slipped by 1.3%. Treasury yields topped 4.5%.