Bidenomics At Work

-

https://www.washingtonpost.com/business/2023/10/06/september-jobs-report-unemployment/

Economy adds 336,000 jobs in September, in a stunning gain

The unemployment rate held at 3.8%

.

The average hourly wage rose in September by 4.2 percent over the previous 12 months to $33.88 an hour, a sharper annual increase than inflation, which climbed to 3.7 percent in August.You can see pitchers in the whole thread:

https://threadreaderapp.com/thread/1710301675234234566.html

Latest Jobs Report looks good w/ headline numbers blowing away expectations, but the devil is in the details - here's a plain-English thread on why this is a very troubling report🧵...

First the headlines:

Sep nonfarm payrolls jump 336k; Unemployment rate flat at 3.8%; Labor force participation rate remains depressed at 62.8%; Those not in the labor force rose to roughly 5 million more than pre-pandemic - this is artificially pushing down unemployment rate:There are various ways to account for the people missing from the labor force (4.5-5.4 million) and doing so yields an unemployment rate between 6.3 and 6.8%

Where were the jobs added in Sep? 22% came from government - an unsustainable increase; remember that private sector workers have to support those public sector jobs:

What kinds of jobs were added? Entirely part-time (+151k); in fact, we LOST full-time jobs (-22k); last 3 months have seen part-time jump 1.2 million while full-time fell 700k (most since lockdowns); double counting of multiple jobholders (123k) was 37% of job gains...

Who has the jobs? Let's break it down a few ways; first, foreign-born workers are already back to pre-pandemic trend while native-born workers have never recovered; since Mar '22, jobs disproportionately went to the foreign born, which brings up another important point...

Something broke in the labor market in Mar '22; the household and establishment surveys began to diverge and full-time job gains slowed dramatically; this continues today as nonfarm payrolls (establishment) jumped 336k in Sep, employment level (household) only rose 86k:

But back to who has the jobs, it's college grads, in spades: unemployment rate 2.1%, employment level 63 million (inline w/ pre-pandemic trend), emp-to-pop ratio 71.9%, and their earnings are outpacing inflation - why would you give this group a student loan bailout?

Lastly, the loss of full-time jobs and their replacement w/ part-time work is helping slow wage growth, which is then negative after adjusting for inflation - real weekly earnings fell dramatically until Jun '22 and have moved sideways since:

TLDR: people supplementing incomes w/ part-time jobs are goosing the headline numbers while underlying economic fundamentals remain weak; people absent from workforce pushing down unemployment rate; earnings not keeping up with inflation; don't expect the job gains to last...

-

You can see pitchers in the whole thread:

https://threadreaderapp.com/thread/1710301675234234566.html

Latest Jobs Report looks good w/ headline numbers blowing away expectations, but the devil is in the details - here's a plain-English thread on why this is a very troubling report🧵...

First the headlines:

Sep nonfarm payrolls jump 336k; Unemployment rate flat at 3.8%; Labor force participation rate remains depressed at 62.8%; Those not in the labor force rose to roughly 5 million more than pre-pandemic - this is artificially pushing down unemployment rate:There are various ways to account for the people missing from the labor force (4.5-5.4 million) and doing so yields an unemployment rate between 6.3 and 6.8%

Where were the jobs added in Sep? 22% came from government - an unsustainable increase; remember that private sector workers have to support those public sector jobs:

What kinds of jobs were added? Entirely part-time (+151k); in fact, we LOST full-time jobs (-22k); last 3 months have seen part-time jump 1.2 million while full-time fell 700k (most since lockdowns); double counting of multiple jobholders (123k) was 37% of job gains...

Who has the jobs? Let's break it down a few ways; first, foreign-born workers are already back to pre-pandemic trend while native-born workers have never recovered; since Mar '22, jobs disproportionately went to the foreign born, which brings up another important point...

Something broke in the labor market in Mar '22; the household and establishment surveys began to diverge and full-time job gains slowed dramatically; this continues today as nonfarm payrolls (establishment) jumped 336k in Sep, employment level (household) only rose 86k:

But back to who has the jobs, it's college grads, in spades: unemployment rate 2.1%, employment level 63 million (inline w/ pre-pandemic trend), emp-to-pop ratio 71.9%, and their earnings are outpacing inflation - why would you give this group a student loan bailout?

Lastly, the loss of full-time jobs and their replacement w/ part-time work is helping slow wage growth, which is then negative after adjusting for inflation - real weekly earnings fell dramatically until Jun '22 and have moved sideways since:

TLDR: people supplementing incomes w/ part-time jobs are goosing the headline numbers while underlying economic fundamentals remain weak; people absent from workforce pushing down unemployment rate; earnings not keeping up with inflation; don't expect the job gains to last...

@George-K said in Bidenomics At Work:

don't expect the job gains to last...

I thought there was some desire to not have very high job gains?

Too many jobs added, economy still going too strong, Central Bank increases interest rates to slow it down

So, wouldn't it be good to have the job creation slow down a bit?

-

@George-K said in Bidenomics At Work:

@Jolly said in Bidenomics At Work:

A lot of second jobs is not an indicator of a strong economy.

Im a glass half full person.

According to US government, 134.56 million people hold a full time job.

0.447 million hold 2 full time jobs.

That is only 0.3% of the working population.

It looks like the history average for two full time jobs is about 0.3 MM

So, the % of people holding 2 full-time jobs has increased from 0.2% of the population to 0.3% of the population.

The % of people having only one full-time job has decreased from 99.8% to 99.7%. Still doesn't seem too bad.

(Of course, easy for me to say, as I am not one of the 150K people who have had to get a second full time job)

-

@Rich said in Bidenomics At Work:

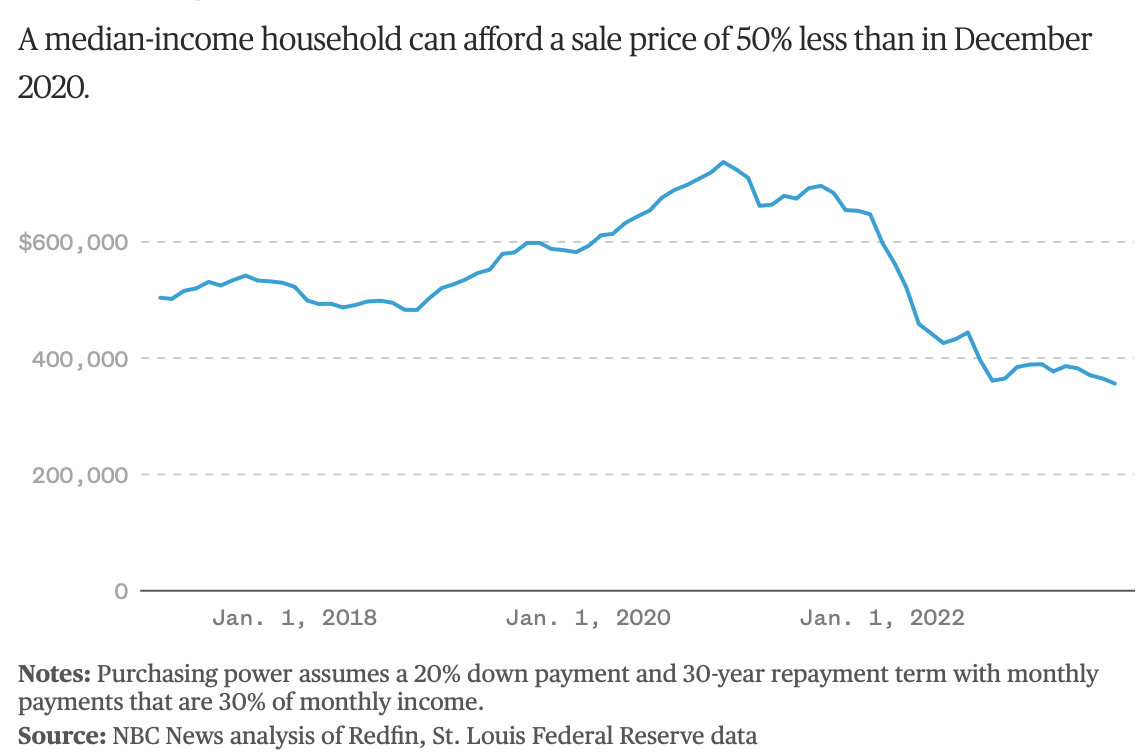

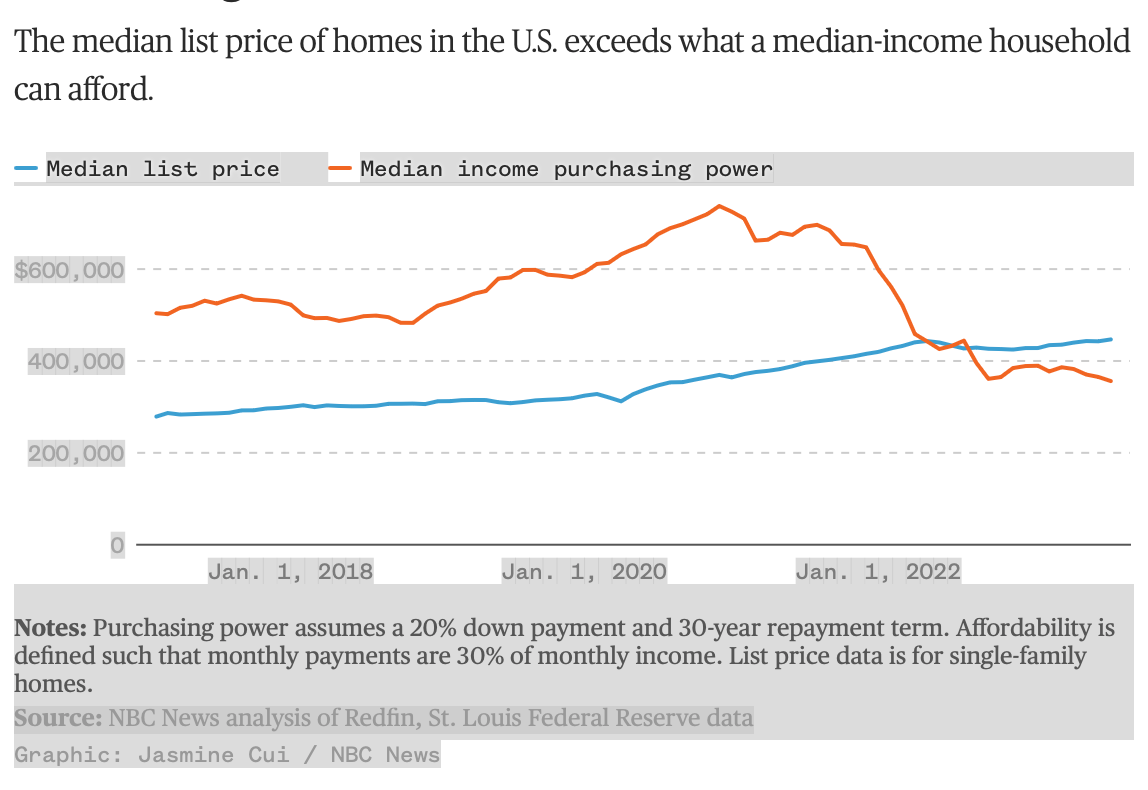

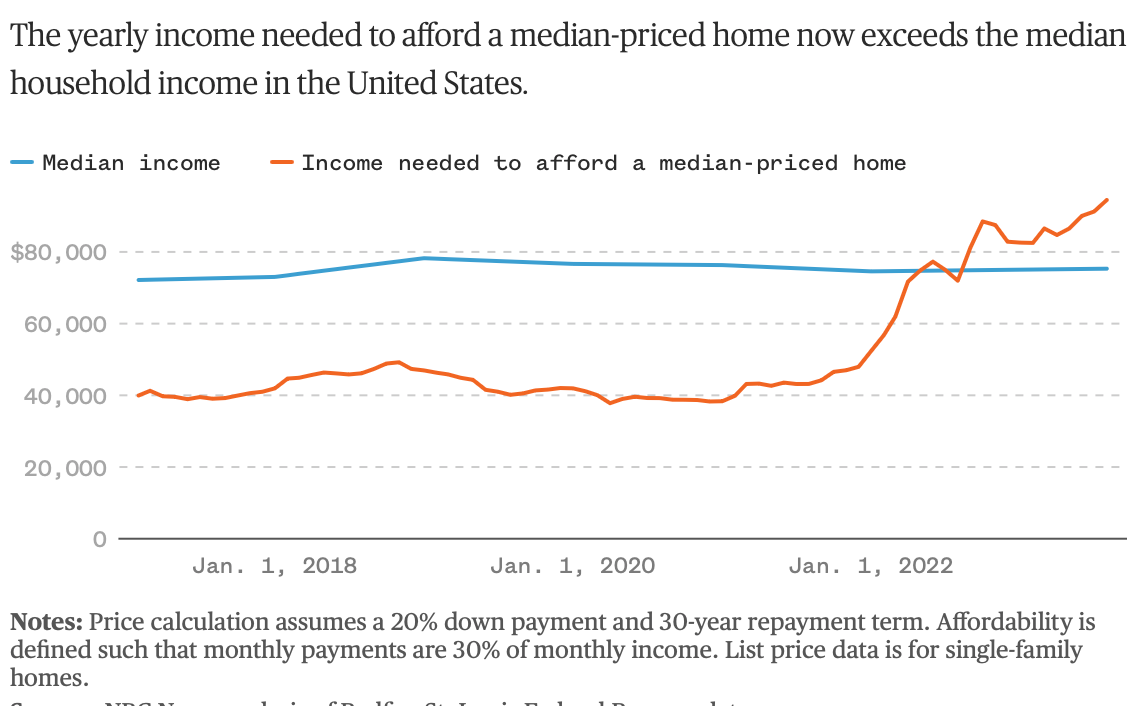

a decent little house in the $250-275k range

Three years ago, a conventional (30 year) 80% mortgage on that house would have cost you about $1137 a month.

Today, the same loan is $1746. More than $7,000 a year more.

@George-K said in Bidenomics At Work:

Three years ago, a conventional (30 year) 80% mortgage on that house would have cost you about $1137 a month.

Today, the same loan is $1746. More than $7,000 a year more.

-

The U.S. economy grew at a blistering pace over three months ending in September, more than doubling growth in the previous quarter ...

.

U.S. GDP grew at a 4.9% annualized rate over the three-month period ending in September, accelerating from a 2.1% annualized rate over the previous quarter. ... -

LOL, listening to a local news & traffic station (WTOP) not 5 minutes ago, and their financial guy came on and said “Enjoy it while it lasts! A surprising GDP of 4.9% was fueled primarily by Government and Consumer spending… Expect next quarter to be down around 1% and many analysts are predicting a coming recession…”

WTOP is not a right leaning news station and it s not in the doom business…

-

LOL, listening to a local news & traffic station (WTOP) not 5 minutes ago, and their financial guy came on and said “Enjoy it while it lasts! A surprising GDP of 4.9% was fueled primarily by Government and Consumer spending… Expect next quarter to be down around 1% and many analysts are predicting a coming recession…”

WTOP is not a right leaning news station and it s not in the doom business…

@LuFins-Dad said in Bidenomics At Work:

LOL, listening to a local news & traffic station (WTOP) not 5 minutes ago, and their financial guy came on and said “Enjoy it while it lasts! A surprising GDP of 4.9% was fueled primarily by Government and Consumer spending… Expect next quarter to be down around 1% and many analysts are predicting a coming recession…”

WTOP is not a right leaning news station and it s not in the doom business…

My son gets to talk with people at the larger telecom companies and he still has friends at the fruit company. Some of those businesses think we have already entered a recession and the numbers just haven't caught up, yet.

That would jibe with the above WTOP statement.