"If you're innocent, why do you need a lawyer?"

-

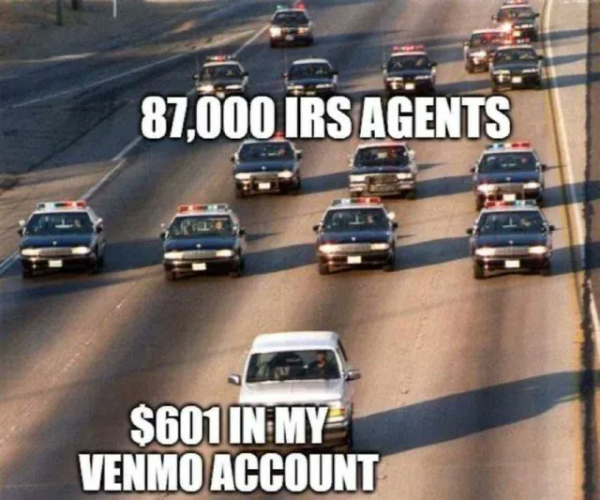

This makes the IRS bigger than the Pentagon, State Department, FBI, and Border Patrol combined.

You have nothing to fear, citizen.

That would make the IRS one of the largest federal agencies. The Pentagon houses roughly 27,000 employees, according to the Defense Department, while a human resources fact sheet says the State Department employs just over 77,243 staff. The FBI employs approximately 35,000 people, according to the agency's website, and Customs and Border Protection says it employs 19,536 Border Patrol agents.

The money allocated to the IRS would increase the agency's budget by more than 600 percent. In 2021, the IRS received $12.6 billion.

Although Democrats say the hiring of additional IRS agents will help root out tax cheats and other criminals, federal tax revenues have steadily risen over the past several decades. Federal tax receipts are projected to hit $5.7 trillion in 2027, up from just over $4 trillion last year without additional IRS agents.

But the roughly $450 billion in new spending proposed by Democrats requires new funding mechanisms. Some of the new spending includes $161 billion for clean electricity tax credits and $64 billion in new Affordable Care Act subsidies.

The majority of new revenue from IRS audits and scrutiny will come from those making less than $200,000 a year, according to a study from the nonpartisan Joint Committee on Taxation. The committee found that just 4 to 9 percent of money raised will come from those making more than $500,000, contrary to Democrats' claims that new IRS agents are necessary to target millionaires and billionaires who hide income.

ETA: Oh, with all that ammo the IRS bought, that comes to about 57 rounds per new hire.

-

Jonah Goldberg talks about the joys of an audit (thread).

Oh, Comey...

In the case of the Comeys, it cost $5,000 in accountant fees. The IRS agent conducting the audit spent at least 50 working hours on it, including meeting face to face with the family's accountant, who drove several hours to meet the agent, according to internal IRS documents produced in response to a Freedom of Information Act request filed by The Times.

Along with having to produce all of his personal financial information, such as brokerage and bank statements, Comey gave the IRS a copy of his family's Christmas card that had a photograph to prove that he had the children he had claimed as dependents.

Comey's audit, which lasted more than a year, revealed that he and his wife, Patrice Comey, had overpaid their 2017 federal income taxes. They received a $347 refund.

But it's to tax the rich! Right?

Nope:

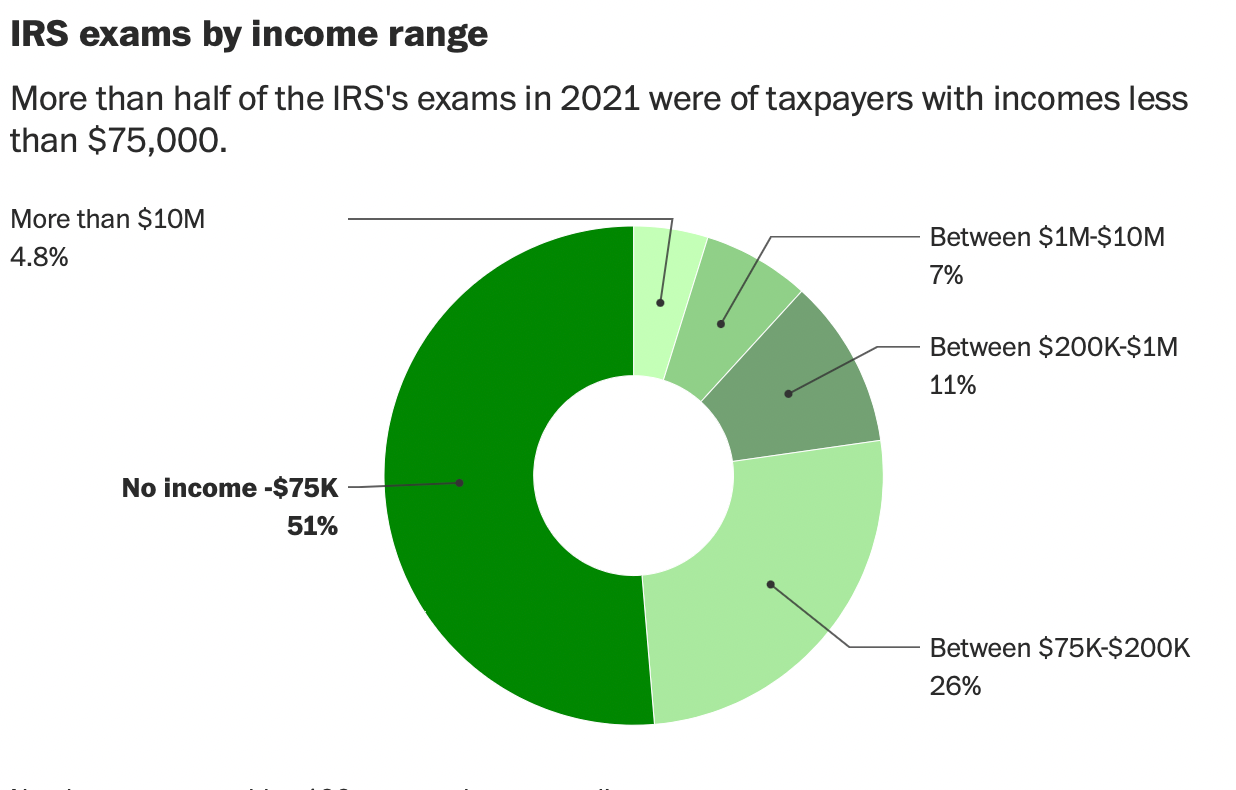

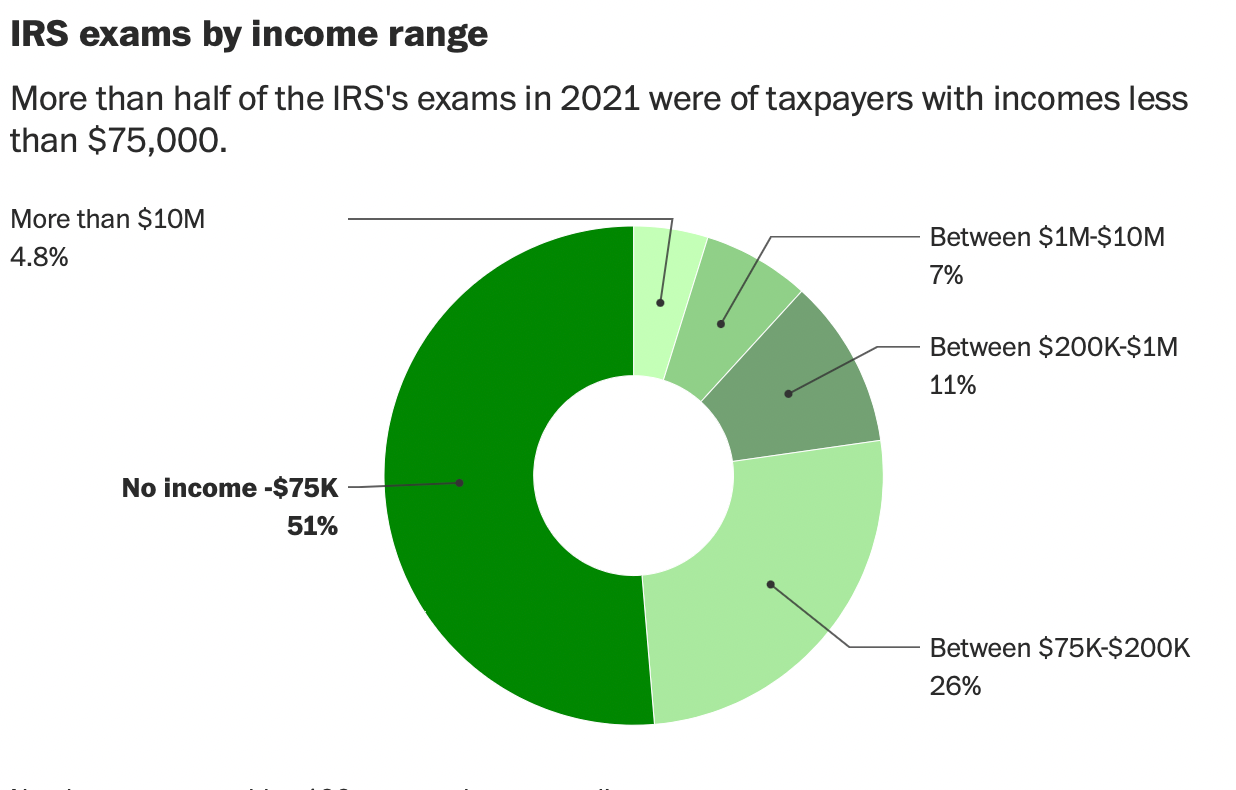

More than half of the agency’s audits in 2021 were directed at taxpayers with incomes less than $75,000, according to IRS data. More than 4 in 10 of its audits targeted recipients of the earned income tax credit, one of the country’s main anti-poverty measures.

-

Jonah Goldberg talks about the joys of an audit (thread).

Oh, Comey...

In the case of the Comeys, it cost $5,000 in accountant fees. The IRS agent conducting the audit spent at least 50 working hours on it, including meeting face to face with the family's accountant, who drove several hours to meet the agent, according to internal IRS documents produced in response to a Freedom of Information Act request filed by The Times.

Along with having to produce all of his personal financial information, such as brokerage and bank statements, Comey gave the IRS a copy of his family's Christmas card that had a photograph to prove that he had the children he had claimed as dependents.

Comey's audit, which lasted more than a year, revealed that he and his wife, Patrice Comey, had overpaid their 2017 federal income taxes. They received a $347 refund.

But it's to tax the rich! Right?

Nope:

More than half of the agency’s audits in 2021 were directed at taxpayers with incomes less than $75,000, according to IRS data. More than 4 in 10 of its audits targeted recipients of the earned income tax credit, one of the country’s main anti-poverty measures.

@George-K said in "If you're innocent, why do you need a lawyer?":

Just for fun I looked up the income distribution % in the US

0 - 75K = 54%

75K - 200K = 35%

'>200K = 10%Audit chance

0-75 = 51%

75-200 = 26%

'> 200 = 23%Seems like best to make between 75 and 200. LOL

-

The thread title echos Trump in 2016: “If you’re innocent why are you taking the Fifth Amendment?”

Link to video -

The thread title echos Trump in 2016: “If you’re innocent why are you taking the Fifth Amendment?”

Link to video@Axtremus Shhhhh

-

@Axtremus Shhhhh

@taiwan_girl said in "If you're innocent, why do you need a lawyer?":

@Axtremus Shhhhh

I fail to see the correlation. I see the correlation Ax went for and missed, but I know that you are smarter than that.

-

To play devil advocate, here is why the IRS does need additional money

The cafeteria at the Texas IRS office.

Article about walking through the office and how outdated it is

There is a picture in the article above of the computer screens used and they have the old "green" lettering from the 1990's or so. For you computer people here, they said that the programs used are written in COBOL.

Now, making taxes easier would solve alot of the problems. I often thought they should eliminate all deductions etc. You make this much, you pay this much.