The Never-ending Grift

-

Trump Hotels and Casino Resorts

Launched to much fanfare in 1995, Trump took Trump Hotels and Casino Resorts public, attracting $140 million in stock purchases from investors betting big on the well-known real estate tycoon.

However, with Trump at the helm, holdings went from a single Atlantic City Casino to quickly snatching up debt-burdened Taj Mahal and a third Atlantic City casino, both previously owned by the now-president himself.

A number of personal loans borrowed from the company followed suit, according to a Forbes report, and eventually, the company lost $647 million from 1995 through 2004, when it declared bankruptcy.

Trump Entertainment Resorts

Following the initial 2004 bankruptcy, Trump Hotels and Casino Resorts was renamed as Trump Entertainment Resorts.

And while Trump was paid $2 million per year despite stepping down as CEO (after receiving an approximately $50 million for services and rents rendered during his tenure as chief over Trump Hotels and Casino Resorts), that company lost $189 million in 2007 and a further $232 million in 2008.

On Feb. 13, 2009, Trump as well as his daughter, Ivanka Trump — installed on the board in 2007 — resigned their posts. On Feb. 17, Trump Entertainment Resorts declared bankruptcy.

Today, Trump Entertainment Resorts exists as a fractional penny stock with negligible value, meaning that investors who did not sell their shares earlier would be essentially left with no value.

Trump Media & Technology Group

Trump Media & Technology Group remains in play, however, with majority ownership resting in the hands of the president. The company is most notably involved with Trump’s Truth Social social media platform, although in recent days it has been dedicated to building a substantial Bitcoin treasury reserve.

According to Benzinga, the SEC recently gave the nod of approval for Trump Media to expand upon these plans with a slated $2.3 billion capital investment, coming from more than 50 institutional investors.

Following an initial blockbuster public opening on March 26, 2024 — the first time in nearly 30 years where a portion of the president’s business empire went public, per CNN — where shares reached ~$78 before falling to rest at around $70, Trump Media’s stock price has tumbled precipitously.

As of close of trading on June 20, share prices were at $17.83.

-

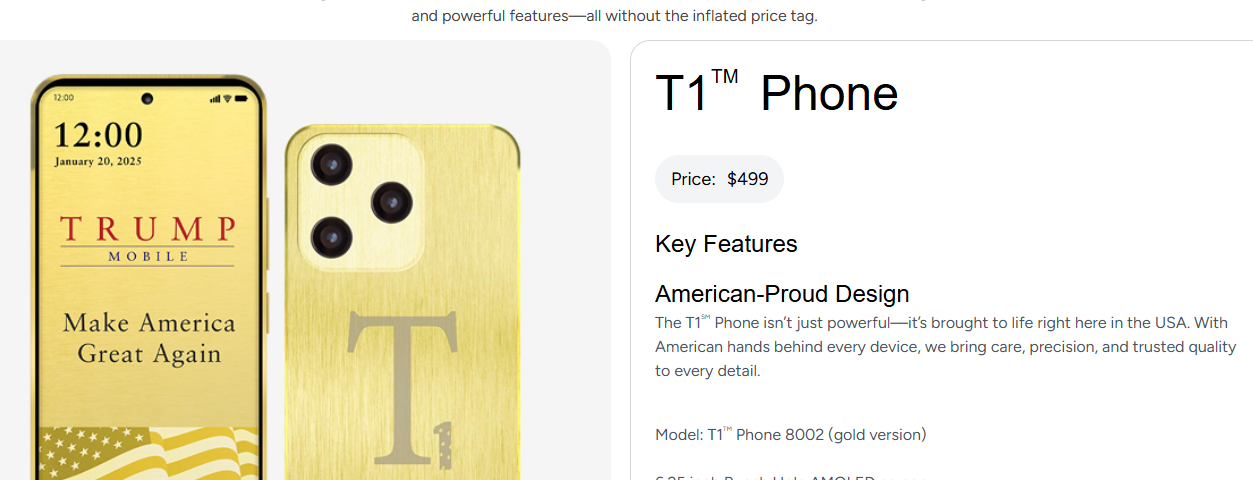

https://www.fastcompany.com/91352863/trump-mobile-is-here-experts-are-baffled

Trump Mobile would be an MVNO—a mobile virtual network operator—which, at present, doesn’t own any of its own infrastructure. That may be intentional, considering the risks involved. “The puzzle to me is why are they resurrecting this idea from, like, 10 years ago and trying to milk a little bit of extra money out of this,” Dediu says.

MVNOs have minimal presence in the U.S. smartphone market, holding less than a 5% share. The major providers—Verizon, AT&T, and T-Mobile—dominate, and they will supply the actual infrastructure for Trump phones.

and

Success is far from certain. “I’m struggling to figure out why even the phone would make sense,” Dediu says. While some profit could be made on hardware sales, he notes that branding might allow a $200 device to be sold for $500, though the costs of servicing customers could quickly erode that margin.

-

Well the website now says it's no longer "made in the USA", it just says "America-proud design", LOL. I do have a question, do you have to be white trash to buy it or is the phone sort of a ticket to the white trash club?

https://www.cnbc.com/2025/06/26/trump-phone-website-removes-made-in-the-usa-tag-for-the-device.html

-

https://www.fastcompany.com/91352863/trump-mobile-is-here-experts-are-baffled

Trump Mobile would be an MVNO—a mobile virtual network operator—which, at present, doesn’t own any of its own infrastructure. That may be intentional, considering the risks involved. “The puzzle to me is why are they resurrecting this idea from, like, 10 years ago and trying to milk a little bit of extra money out of this,” Dediu says.

MVNOs have minimal presence in the U.S. smartphone market, holding less than a 5% share. The major providers—Verizon, AT&T, and T-Mobile—dominate, and they will supply the actual infrastructure for Trump phones.

and

Success is far from certain. “I’m struggling to figure out why even the phone would make sense,” Dediu says. While some profit could be made on hardware sales, he notes that branding might allow a $200 device to be sold for $500, though the costs of servicing customers could quickly erode that margin.

@taiwan_girl said in The Never-ending Grift:

“The puzzle to me is why are they resurrecting this idea from, like, 10 years ago and trying to milk a little bit of extra money out of this,” Dediu says.

He answered his own puzzle. Grifters gonna grift. Magat grifters gonna grift magats.

-

Since January, President Trump bought over $100 million in bonds, including corporate, state, and municipal bonds.

The filings reveal more than 600 financial purchases since January 21, covering sectors potentially benefiting from US policy shifts.

Trump's annual disclosure showed over $600 million in income from various sources and assets worth at least $1.6 billion.

But

“President Trump’s net worth has increased substantially, with much of that concentrated in crypto holdings and Trump Media. Given that, there is no evidence currently that his bond purchases are anything other than a prudent diversification within his billions of dollars in assets,” said Mr John Canavan, lead US analyst at Oxford Economics.

“It seems like he was primarily purchasing corporate and municipal bonds and others that are high quality and highly rated, so it’s just a way to take a little bit of risk off the table,” he said.

-

The NYT tallied up the fortunes amassed by the Trumps since the start of his second term:

The number came up to $1,408,500,000.

-

Not saying anybody from the President Trump administration was involved, but.............

For one prediction market trader, the Trump administration's weekend capture of Venezuelan leader Nicolás Maduro was a nearly half-million-dollar payday.

On Polymarket, a popular site for making bets on the outcome of real world events, a user wagered $32,000 that Maduro would be toppled by the end of January hours before Trump ordered the operation. When it was clear the U.S. had captured Maduro, the trader made more than $400,000 in profit.

https://www.npr.org/2026/01/05/nx-s1-5667232/polymarket-maduro-bet-insider-trading

-

https://www.theguardian.com/film/2026/jan/28/melania-trump-documentary-amazon-release

Re: Melania documentary

But no one paid $40m to acquire Am I Racist? – or an additional $35m to market it. That’s how much Amazon has poured into Melania – remarkably, the most the deep-pocketed company has ever paid to secure distribution of a single film. This is seemingly the result of a post-election bidding war when corporate panic over matching a seeming rightward turn in the populace was at its peak.

Technically, paying the president-elect’s wife this much money – Melania reportedly pocketed nearly $30m of Amazon’s initial $40m outlay – was legal, because the first lady isn’t part of the government. She’s just a private citizen who happens to be married to the president and happened to receive a multimillion-dollar check from a company with many government contracts through its web services and other divisions.

-

https://www.theguardian.com/film/2026/jan/28/melania-trump-documentary-amazon-release

Re: Melania documentary

But no one paid $40m to acquire Am I Racist? – or an additional $35m to market it. That’s how much Amazon has poured into Melania – remarkably, the most the deep-pocketed company has ever paid to secure distribution of a single film. This is seemingly the result of a post-election bidding war when corporate panic over matching a seeming rightward turn in the populace was at its peak.

Technically, paying the president-elect’s wife this much money – Melania reportedly pocketed nearly $30m of Amazon’s initial $40m outlay – was legal, because the first lady isn’t part of the government. She’s just a private citizen who happens to be married to the president and happened to receive a multimillion-dollar check from a company with many government contracts through its web services and other divisions.

@taiwan_girl said in The Never-ending Grift:

https://www.theguardian.com/film/2026/jan/28/melania-trump-documentary-amazon-release

Re: Melania documentary

But no one paid $40m to acquire Am I Racist? – or an additional $35m to market it. That’s how much Amazon has poured into Melania – remarkably, the most the deep-pocketed company has ever paid to secure distribution of a single film. This is seemingly the result of a post-election bidding war when corporate panic over matching a seeming rightward turn in the populace was at its peak.

Technically, paying the president-elect’s wife this much money – Melania reportedly pocketed nearly $30m of Amazon’s initial $40m outlay – was legal, because the first lady isn’t part of the government. She’s just a private citizen who happens to be married to the president and happened to receive a multimillion-dollar check from a company with many government contracts through its web services and other divisions.

Apparently Melania has been nominated for a FIFA film award.

-

Re: Melania documentary

https://www.hollywoodreporter.com/movies/movie-news/amazon-pulls-melania-movie-theater-1236494861/

As first reported by The Oregonian, and then nationally spotted by The Daily Beast, an Oregon theater long known for finding creatively witty ways to advertise its movies was asked by Amazon to stop screening Melania.

The Lake Theater and Cafe in Lake Oswego had touted last week's release of Amazon MGM's controversial documentary with declarations such as "Does Melania wear Prada? Find out Friday" and -- quoting Sun Tzu's The Art of War -- "To defeat your enemy, you must know them. Melania starts Friday."

Then manager Jordan Perry says their booker received a call from somebody at Amazon asking the theater to pull the film.

"The studio was not happy and/or did not appreciate my take on marketing their film to our own public," Perry told The Oregonian. The theater marquee was then changed to: "Amazon called. Our marquee made them mad. All Melania showings cancelled. Show your support at Whole Foods instead." This was followed by "Join Amazon Prime for Free Two-Day Shipping." (Amazon had no immediate comment on the matter).