Oil Futures

-

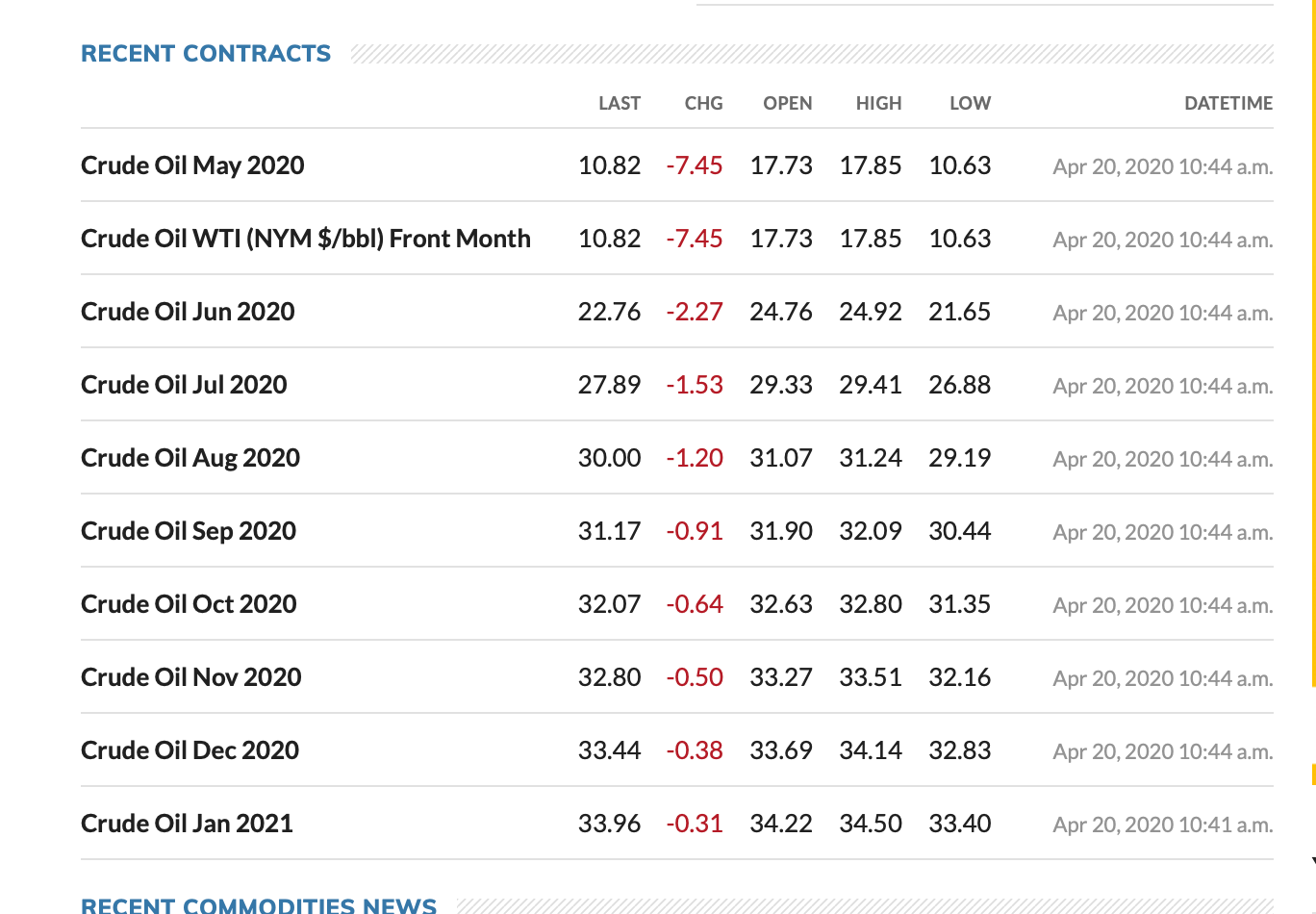

May futures expire tomorrow. If you're long you gotta accept delivery. There's no where to store it. In theory it could go negative.

@jon-nyc said in Oil Futures:

May futures expire tomorrow. If you're long you gotta accept delivery. There's no where to store it. In theory it could go negative.

And it did!

https://www.barrons.com/articles/oil-futures-fall-below-1-for-first-time-ever-51587406408

-

@89th said in Oil Futures:

I don't really understand oil futures. Maybe I'm the only one.

There's a lot of implications and math that falls out from the basic structure. But the basic structure is quite simple:

The spot price is the price of a commodity today.

The futures price is the price of a commodity at a specific point in the future.

The futures price includes the cost of carrying and storing the commodity until the "delivery date".

Those two prices converge as the future date gets closer to today (spot price)

In this case, storage in May is expected to be full - which significantly increases storage and carrying costs. This makes the commodity itself quite unattractive and is the reason why we're seeing next to zero or even negative prices.

At this point full storage isn't priced into later months (July, August, etc.) - so those prices are still positive.