TurboTax question

-

What’s the definition of a qualified employee?

This is going to suck, because fully 1/3 of her business deductions are no longer allowed. Her home office expenses, computer, business phone, etc…

And do you have any idea how difficult tracking her mileage becomes now? This is a nightmare.

@LuFins-Dad said in TurboTax question:

What’s the definition of a qualified employee?

This is going to suck, because fully 1/3 of her business deductions are no longer allowed. Her home office expenses, computer, business phone, etc…

And do you have any idea how difficult tracking her mileage becomes now? This is a nightmare.

Could always just divide it by 2/3 and clarify if an auditor ever asks that 1/3 of her work is as a W-2 employee. The company should be reimbursing her, btw. Not legally, but morally/policy/etc.

-

@George-K said in TurboTax question:

@jon-nyc said in TurboTax question:

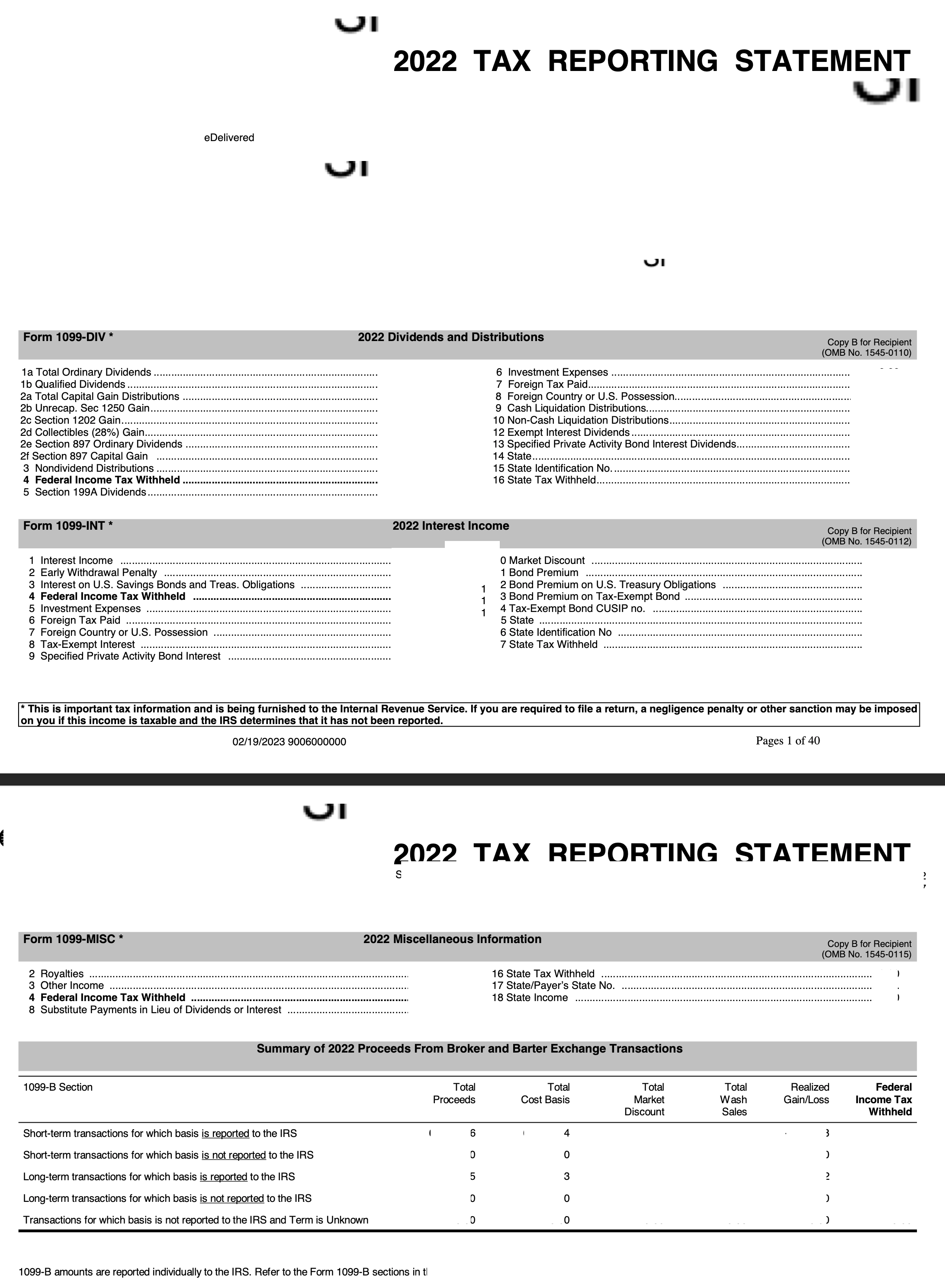

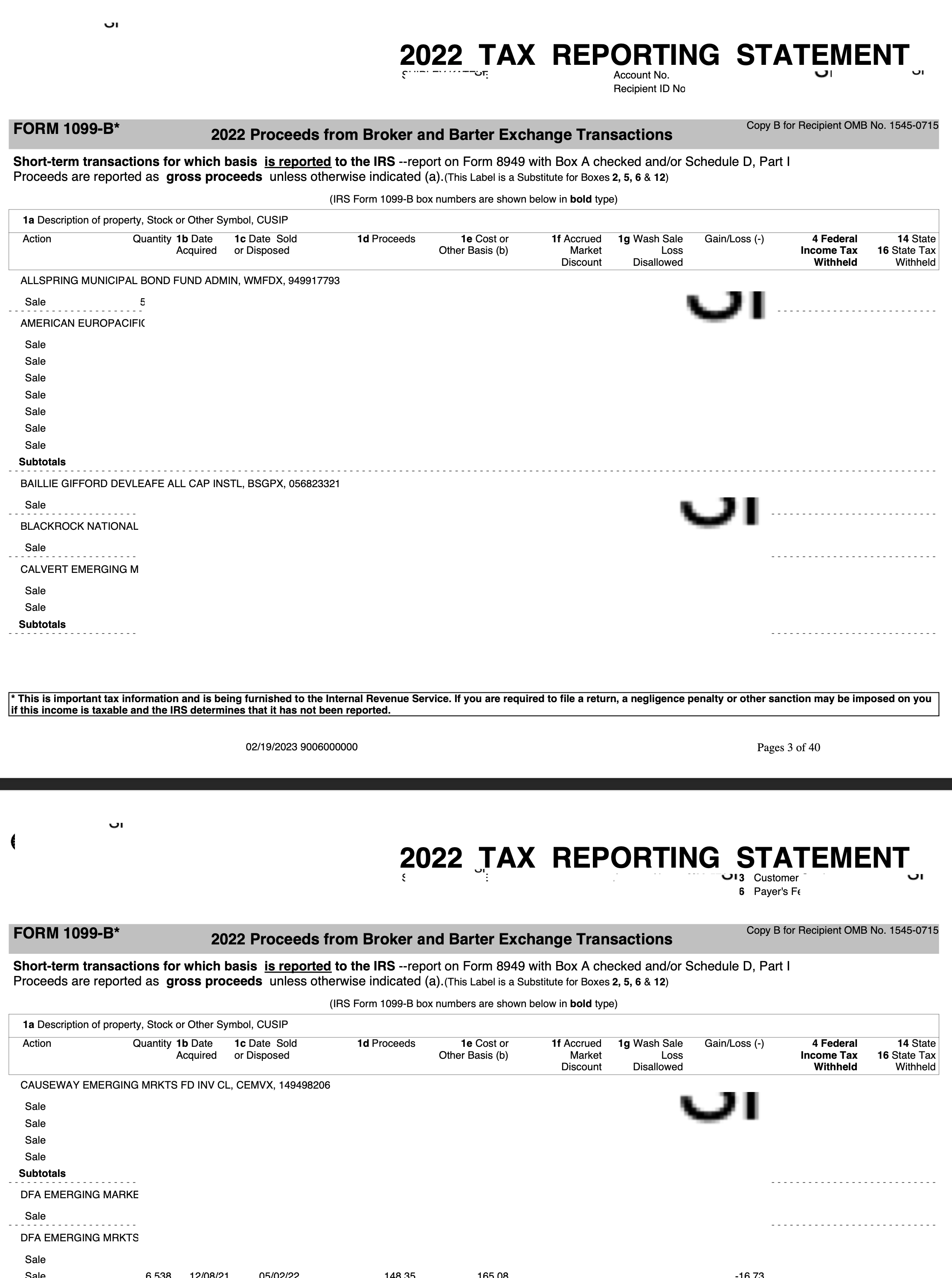

I get a consolidated 1099 and put it in TurboTax just fine.

Just drop the 40 page PDF into their window?

I think they also offer the option of entering the brokerage's (you wife's) log-in credentials into the system and they'll automatically pull it for you.

@89th said in TurboTax question:

@George-K said in TurboTax question:

@jon-nyc said in TurboTax question:

I get a consolidated 1099 and put it in TurboTax just fine.

Just drop the 40 page PDF into their window?

I think they also offer the option of entering the brokerage's (you wife's) log-in credentials into the system and they'll automatically pull it for you.

This