HELOC vs Cash out vs 401K loan?

-

Anyway back to your question... is the HELOC variable? At first that seems like a good deal since you probably have decent equity in your home, but borrowing anything that potentially puts your home at risk would make me nervous.

I wouldn't touch the 401K either... there are some great charts out there that show if you miss the top 10 "best days" of a stock market return over the life of the retirement account, it has profound effects on the long term gains. Who knows what'll happen in the market... back when Biden took office and the markets became t3h sux0rs, I figured the market will continue to be t3h sux0rs until summer of 2024 or so when (hopefully) a GOP candidate makes it back in and/or interest rates start to march down.

So I agree on cashing out some investments now if you can afford it. They say to have 3 buckets of accounts. 1) Short term... cash you would need for the next 6 months for bills, keep that in savings. 2) Long term, retirement accounts like 401K, 529, IRA, etc... contribute to them and don't touch. 3) Intermediate... try to get 5+ percent returns via investments, taxable accounts, etc... but also cash you can use for "big" projects such as a home or improvements.

That being said..... I agree with Jolly on considering the kitchen table or other modest means for the schooling. Depends on your house dynamic, but with juggling 1 kid at home, that might be sufficient? What other projects are you looking at?

-

Renovating the house for homeschooling is a bit like buying a grand piano for the kid to take piano lessons. On the one hand you can argue that a better environment/instrument increases the kid's interest, on the other hand there is a chance that it won't "stick" anyway so what would that leave you with the renovation/big piano?

In any case, good luck.

-

Of your three options I would consider cashing out non-retirement investments if you wouldn’t pay a big capital gains tax.

Your logic about 9.5% being less than what the 401k has earned doesn’t resonate with me since you’ll be the one providing the ‘return’.

@jon-nyc said in HELOC vs Cash out vs 401K loan?:

Of your three options I would consider cashing out non-retirement investments if you wouldn’t pay a big capital gains tax.

Your logic about 9.5% being less than what the 401k has earned doesn’t resonate with me since you’ll be the one providing the ‘return’.

With post tax dollars, plus you sacrifice the appreciation that money might be making.

I’m with Jolly. Do you really HAVE to make those improvements?

-

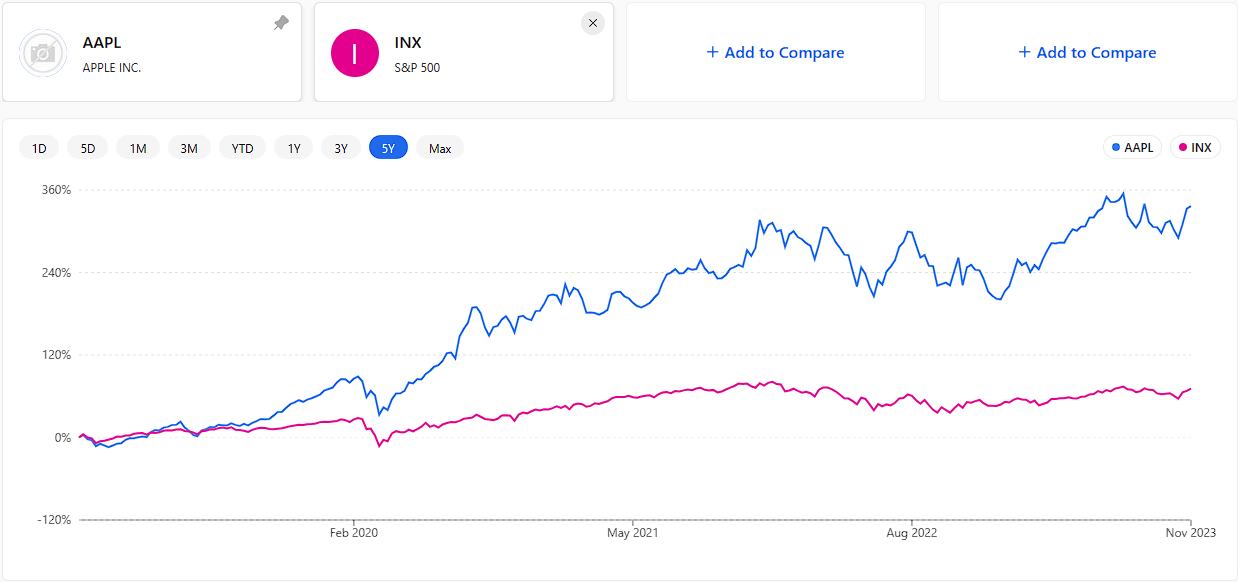

Three months from now will mark the end of my 5 year loan from my 401k. I put it into apple as a financial maneuver to get AAPL returns rather than well balanced 401k returns. I should see how well it worked out.

@Horace said in HELOC vs Cash out vs 401K loan?:

Three months from now will mark the end of my 5 year loan from my 401k. I put it into apple as a financial maneuver to get AAPL returns rather than well balanced 401k returns. I should see how well it worked out.

Follow me for more life hacks.

-

@jon-nyc said in HELOC vs Cash out vs 401K loan?:

No, a 401k is an IRA with limited options. That’s why you couldn’t just buy it there.

I am aware of what a 401k is. I thought your question was, why did I take the money out, rather than keep it in and buy the stock there.

-

Ah, ok. Still, did you not have a self-directed IRA? Would have been a good option for buying AAPl

@jon-nyc said in HELOC vs Cash out vs 401K loan?:

Ah, ok. Still, did you not have a self-directed IRA? Would have been a good option for buying AAPl

If one starts from the assumption that all accounts are allocated responsibly, and one wanted to concentrate just a little, then it would be a fair point that one could concentrate in the IRA rather than pulling a loan out of the 401k to concentrate taxable dollars from that.

-

I don’t know, there’s no law that says IRAs have to be little. Many people roll 401ks into them when they change jobs.

@jon-nyc said in HELOC vs Cash out vs 401K loan?:

I don’t know, there’s no law that says IRAs have to be little. Many people roll 401ks into them when they change jobs.

I did just that with a small 401k from my first job. It's managed to keep pace with my now 20 year old current 401k, even though it's gotten a small fraction of the deposits.

-

LD, I missed the reason for the homeschooling? Of course immediately I'd imagine it's related to the LOCO (Loudon County) public school policies.

I was homeschooled for 1st, 2nd, and 5th grade (staggered because of siblings and other factors). It depends how it is done, but I caution the cost/benefit specifically as it relates to the social education a kid gets during elementary school years, and more specifically when it really starts to matter in middle school years. I know for many years I felt "out of the loop" with my fellow classmates, probably until near the end of high school and I witnessed the same with other kids were homeschooled.

I'd imagine the social and local associations, as well as online content, makes for a different homeschooling approach in 2020s vs the 1980s, so take the above with a grain of salt.

@89th said in HELOC vs Cash out vs 401K loan?:

LD, I missed the reason for the homeschooling? Of course immediately I'd imagine it's related to the LOCO (Loudon County) public school policies.

I was homeschooled for 1st, 2nd, and 5th grade (staggered because of siblings and other factors). It depends how it is done, but I caution the cost/benefit specifically as it relates to the social education a kid gets during elementary school years, and more specifically when it really starts to matter in middle school years. I know for many years I felt "out of the loop" with my fellow classmates, probably until near the end of high school and I witnessed the same with other kids were homeschooled.

I'd imagine the social and local associations, as well as online content, makes for a different homeschooling approach in 2020s vs the 1980s, so take the above with a grain of salt.

Thread drift, cuz that's how we roll...I mentioned associations earlier. They make a huge difference, at least the biggest one down here. The association meets at one of the larger SBC churches in the area, which gives them access to the family life center building. Therefore, they can offer some athletics (volunteer coaches) such as soccer, volleyball and basketball. And by Louisiana law, if a homeschooled kid lives in the district, he can try out for a team at the local high school.

The association also has a list of music teachers with negotiated rates, teaching violin, piano, guitar along with some brass and woodwind instruments. The kids do a couple of recitals each year. There is also a choir that usually does a Christmas program and a smaller concert in the late spring.

Socially, the association does an early fall mixer for parents and students, a midwinter dance and a junior-senior prom.

So while these homeschooled kids don't have as much social interaction as public school kids, they do have some.

-

@89th said in HELOC vs Cash out vs 401K loan?:

Interesting, and a good example of how a community can work together.

It's not all sunshine and roses. Where I think they really fall short is in STEM classes. To teach some of those classes effectively, you need labs and/or teachers with appropriate backgrounds. Chemistry, physics and advanced math are particularly weak areas.