Bidenomics At Work

-

Sen. Joe Manchin on the American energy policy:

Joe Manchin: Our energy policy is a success. President Biden should be proud.

I want to congratulate President Biden for the record-breaking energy production we are seeing in America today. The United States is producing more oil, gas and renewable energy than ever before. We are exporting more fossil fuel energy than we import. Our country has never been more energy-independent than we are today.

.

This is something to celebrate. And it would not have been possible without the Inflation Reduction Act and the Bipartisan Infrastructure Law that Biden signed. Thanks to these two historic laws, we are unlocking major opportunities throughout the country, implementing an “all-of-the-above” energy strategy that we need today while continuing to innovate the technologies we want for tomorrow.

... -

@Doctor-Phibes said in Bidenomics At Work:

@George-K said in Bidenomics At Work:

https://www.cbsnews.com/news/joann-bankruptcy-filing-stores/?ftag=CNM-00-10aab7e&linkId=363930095

Fabric and crafts retailer Joann declared bankruptcy on Monday amid spending cutbacks from consumers and higher operating costs. The retail chain said it plans to keep its 800-plus stores open while it works through the restructuring process.

Hudson, Ohio-based Joann, which filed for Chapter 11 bankruptcy, reported between $1 billion and $10 billion in debt. In court documents filed Monday, the retailer blamed higher costs from shipping overseas products, as well as waning consumer demand.

As part of its bankruptcy, Joann said it has received about $132 million in new financing and expects to reduce its balance sheet's funded debt by about $505 million. The financing is "a significant step forward" to help Joann continue operating its stores, Scott Sekella, Joann's chief financial officer said in a statement.

The filing marks the latest in a series of major retailers that have filed for bankruptcy in recent years, including GNC, J.C. Penney and Party City. Brick-and-mortar retailers have struggled as Americans have increasingly shifted their spending to online rivals such as Amazon.com.

In Joann's case, the company was buoyed in the early days of the pandemic as the shutdown spurred some consumers to take up crafts and other projects. But during the past two years, Joann's sales have tumbled, with the company blaming consumer cutbacks due to inflation and other economic challenges.

Oh my God, my daughter will be devastated. That place is her idea of heaven.

It’s a restructuring… She’ll be fine. But really? What does she do? Apparel?

@LuFins-Dad said in Bidenomics At Work:

Oh my God, my daughter will be devastated. That place is her idea of heaven.

It’s a restructuring… She’ll be fine. But really? What does she do? Apparel?

She makes cosplay outfits for herself and her friends, dresses for herself, random projects like hats. Some of them are really good. She made a couple of hundred bucks selling cuddly toy things she'd made at college on Valentine's Day. It's also a good mental-health activity. The problem, as with everything she does, is she's a perfectionist, and when things don't go quite right things can get quite fraught.

-

@LuFins-Dad said in Bidenomics At Work:

Oh my God, my daughter will be devastated. That place is her idea of heaven.

It’s a restructuring… She’ll be fine. But really? What does she do? Apparel?

She makes cosplay outfits for herself and her friends, dresses for herself, random projects like hats. Some of them are really good. She made a couple of hundred bucks selling cuddly toy things she'd made at college on Valentine's Day. It's also a good mental-health activity. The problem, as with everything she does, is she's a perfectionist, and when things don't go quite right things can get quite fraught.

@Doctor-Phibes said in Bidenomics At Work:

@LuFins-Dad said in Bidenomics At Work:

Oh my God, my daughter will be devastated. That place is her idea of heaven.

It’s a restructuring… She’ll be fine. But really? What does she do? Apparel?

She makes cosplay outfits for herself and her friends, dresses for herself, random projects like hats. Some of them are really good. She made a couple of hundred bucks selling cuddly toy things she'd made at college on Valentine's Day. It's also a good mental-health activity. The problem, as with everything she does, is she's a perfectionist, and when things don't go quite right things can get quite fraught.

That’s great!

-

I get new brakes every 40k-50K (pads and rotors). Last set was November of 2022. $640. Getting a new set right now. $965.

@LuFins-Dad said in Bidenomics At Work:

I get new brakes every 40k-50K (pads and rotors). Last set was November of 2022. $640. Getting a new set right now. $965.

Just saw this one. Car are getting more finicky, but pads&rotors for something like a 2018 Camry are less than 300 bucks (ceramic pads). It's the labor that has gotten ridiculous.

Last week I had to have the fuel pump and sending unit put in my GMC. Like most stuff, they either dropped the tank or pulled the bed to replace the part. I also had a couple of wires with mouse damage, so they fixed that. Cost? $1000 with the tax.

-

R Renauda referenced this topic on

R Renauda referenced this topic on

-

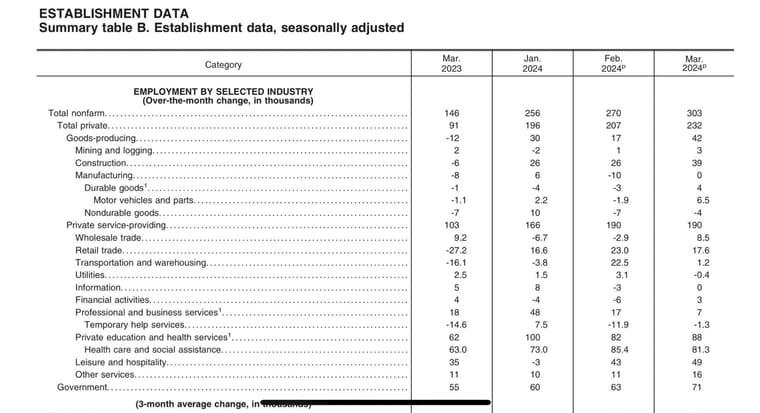

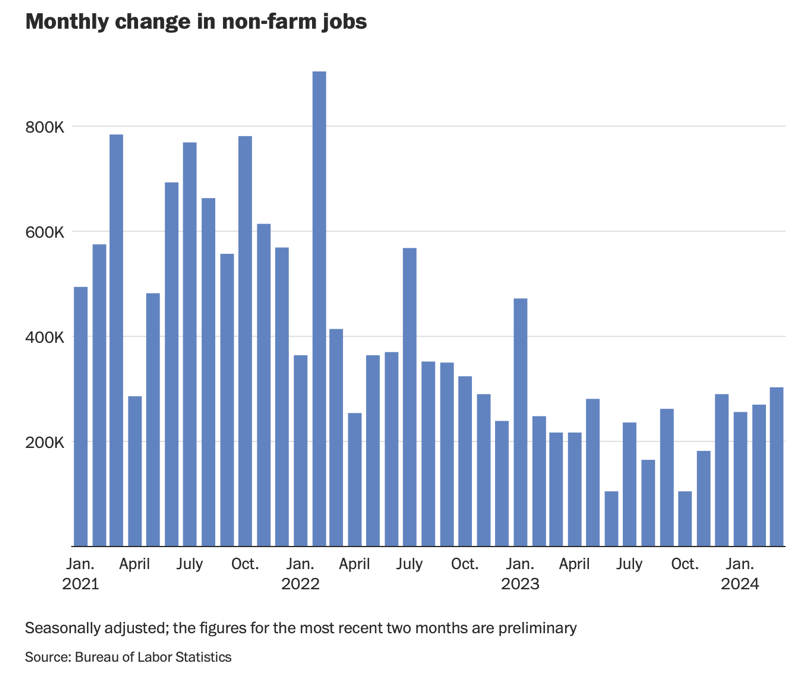

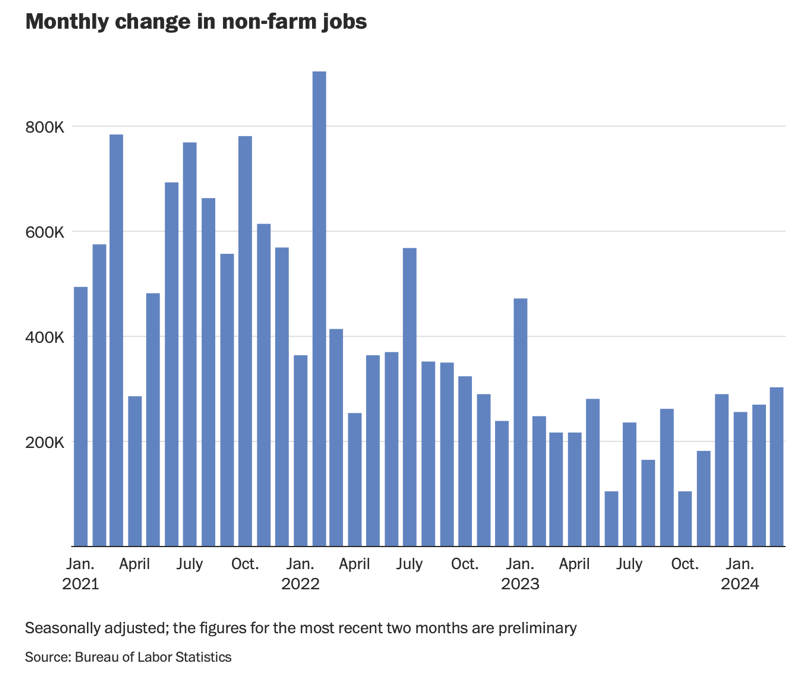

Another strong, very strong, job report for March 2024:

https://www.cnn.com/2024/04/05/economy/us-jobs-report-march-final/index.html

Employers added 303,000 jobs in March, the Bureau of Labor Statistics reported. The unemployment rate fell to 3.8% from 3.9% the month before.

...

Annual wage gains slowed to 4.1% from 4.3%, a trajectory likely welcomed by the Federal Reserve in its efforts to tame inflation but yet a still-strong rate to help Americans recapture earnings that were decimated by the pandemic and high inflation.

...

Last month’s job growth was driven by industries such as health care (+72,300 jobs); government (+71,000 jobs); leisure and hospitality (+49,000 jobs); and construction (+39,000 jobs).

.

The current US job market is also one of the strongest, historically: The economy has added jobs for 39 consecutive months, marking the fifth-longest period of job expansion on record, BLS data shows. The unemployment rate has been below 4% for 26 months in a row, the longest streak since the late 1960s.Chart from the Washington Post:

Source: https://www.washingtonpost.com/business/2024/04/05/jobs-march-unemployment-rate/ -

-

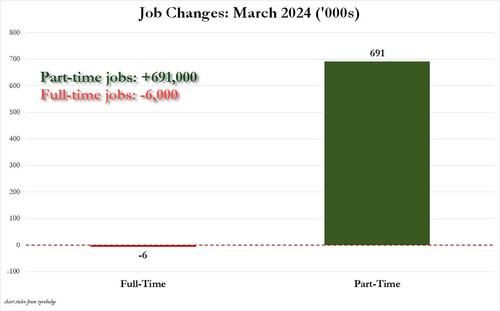

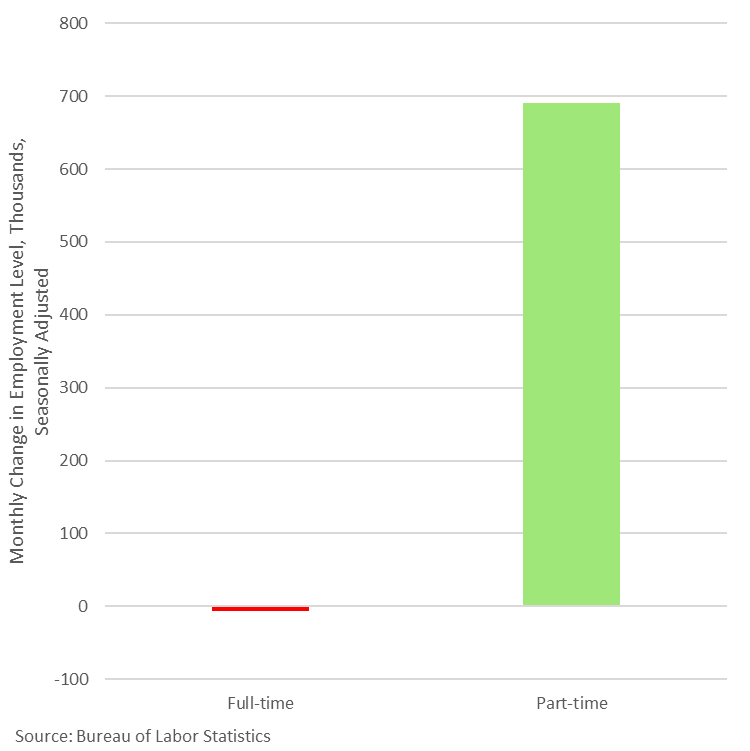

There is a serious catch within the job creation numbers, though, which is not really being discussed this morning across the financial media.** Part-time jobs showed a massive increase of 525K for March, up from an increase of 107K in February. That means that full-time jobs were lost on a net basis in March.** Even using the Household print, full-time jobs decreased by 27K in March. Using Non-Farm Payrolls... the U.S. economy lost 222K full-time jobs in March..

As to the racial demographics of March labor, Whites or Caucasians saw no change in their unemployment rate, while both Asians and Hispanics or Latinos made significant gains. However, Black or African American unemployment soared from 5.6% in February to 6.4% in March..

-

As to the racial demographics of March labor, Whites or Caucasians saw no change in their unemployment rate, while both Asians and Hispanics or Latinos made significant gains.

I get what they're trying to say there, but how frustrating is it that someone would write "significant gains in unemployment rate", and mean the rate went down?

-

https://committeetounleashprosperity.com/hotlines/part-time-nation/

he new job numbers for March were strong with 300,000 jobs added in the establishment survey and 500,000 in the household survey. But those positive headline numbers camouflage a very disturbing trend in the labor market. Almost all of the new jobs on the net are part-timers. That means a part-time paycheck.

Stock market advisor Stephanie Pomboy of MacroMavens has analyzed the number and reports that in the last four months, the labor market has LOST 1.8 million full-time jobs.

Here is a handy summary for the past year:

Overall payrolls up 1.9%

Part-time jobs up 7.5%

Full-time jobs down -1.35%

How many of the 300,000 jobs are double counting people holding TWO jobs?

-

Another strong, very strong, job report for March 2024:

https://www.cnn.com/2024/04/05/economy/us-jobs-report-march-final/index.html

Employers added 303,000 jobs in March, the Bureau of Labor Statistics reported. The unemployment rate fell to 3.8% from 3.9% the month before.

...

Annual wage gains slowed to 4.1% from 4.3%, a trajectory likely welcomed by the Federal Reserve in its efforts to tame inflation but yet a still-strong rate to help Americans recapture earnings that were decimated by the pandemic and high inflation.

...

Last month’s job growth was driven by industries such as health care (+72,300 jobs); government (+71,000 jobs); leisure and hospitality (+49,000 jobs); and construction (+39,000 jobs).

.

The current US job market is also one of the strongest, historically: The economy has added jobs for 39 consecutive months, marking the fifth-longest period of job expansion on record, BLS data shows. The unemployment rate has been below 4% for 26 months in a row, the longest streak since the late 1960s.Chart from the Washington Post:

Source: https://www.washingtonpost.com/business/2024/04/05/jobs-march-unemployment-rate/@Axtremus said in Bidenomics At Work:

Another strong, very strong, job report for March 2024:

https://www.cnn.com/2024/04/05/economy/us-jobs-report-march-final/index.html

Employers added 303,000 jobs in March, the Bureau of Labor Statistics reported. The unemployment rate fell to 3.8% from 3.9% the month before.

...

Annual wage gains slowed to 4.1% from 4.3%, a trajectory likely welcomed by the Federal Reserve in its efforts to tame inflation but yet a still-strong rate to help Americans recapture earnings that were decimated by the pandemic and high inflation.

...

Last month’s job growth was driven by industries such as health care (+72,300 jobs); government (+71,000 jobs); leisure and hospitality (+49,000 jobs); and construction (+39,000 jobs).

.

The current US job market is also one of the strongest, historically: The economy has added jobs for 39 consecutive months, marking the fifth-longest period of job expansion on record, BLS data shows. The unemployment rate has been below 4% for 26 months in a row, the longest streak since the late 1960s.Chart from the Washington Post:

Source: https://www.washingtonpost.com/business/2024/04/05/jobs-march-unemployment-rate/Kinda looks a lot worse once the numbers get explained, doesn't it? And again, these are not the final numbers...

-

But I thought that there was a wanting to decrease the jobs for a little bit to help "cool" inflation?

-

But I thought that there was a wanting to decrease the jobs for a little bit to help "cool" inflation?

@taiwan_girl said in Bidenomics At Work:

But I thought that there was a wanting to decrease the jobs for a little bit to help "cool" inflation?

I think the inflation monster is going to be hard to tame, with all the dollars dumped into the money supply.

-

https://www.cnn.com/2024/04/14/economy/working-past-retirement-age/index.html

Americans over 75 are the fastest-growing age group in the workforce, more than quadrupling in size since 1964, according to the Pew Research Center. Forecasters expect that cohort of older, working Americans to double over the next decade.

Pew Research: https://www.pewresearch.org/social-trends/2023/12/14/the-growth-of-the-older-workforce/

Numbering roughly 11 million today, the older workforce has nearly quadrupled in size since the mid-1980s. The increase is driven in part by the growth of the 65-and-older population. The bulk of the Baby Boom generation has now reached that threshold.

...

The share of older adults holding a job today is much greater than in the mid-1980s. Some 19% of adults ages 65 and older are employed today. In 1987, only 11% of older adults were working. Today’s share is similar to that of the early 1960s, when 18% of older Americans worked. -

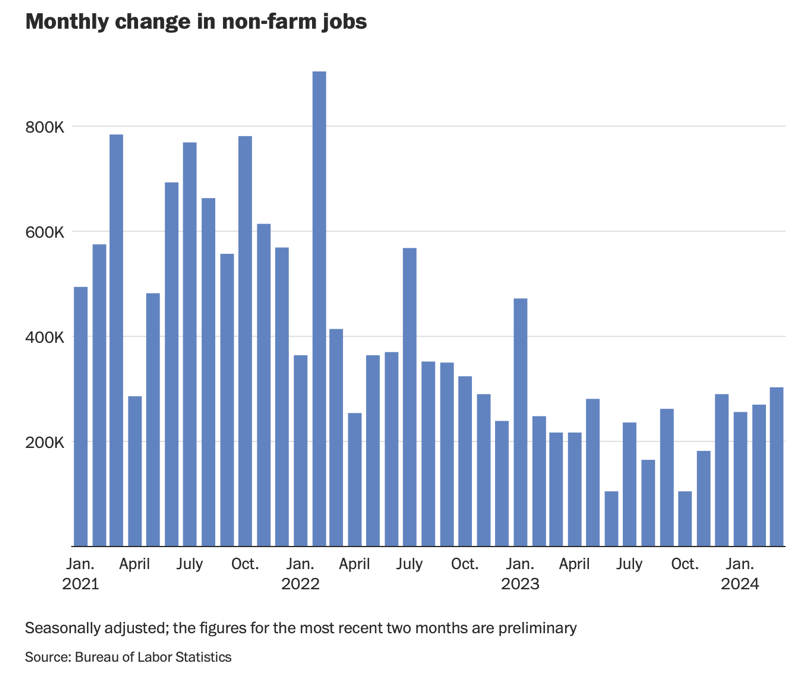

The US labor market cooled notably last month as both hiring and wage growth slowed more than economists had expected in April.

.

The US economy added 175,000 new jobs and the unemployment rate rose to 3.9% last month, new data from the Bureau of Labor Statistics showed Friday. Wall Street economists had expected nonfarm payrolls to rise by 240,000 and the unemployment rate to remain at 3.8%, according to Bloomberg data.

.

Wages also rose less than forecast, with average hourly earnings rising 0.2% over last month and 3.9% over the last year. Economists had expected to see a monthly jump of 0.3% in April and a 4% rise over last year.

.

Friday's report also showed February's job growth was revised down — to a gain of 236,000 nonfarm payroll jobs from the 270,000 previously reported — while March's report was revised up to job gains of 315,000 from the 303,000 initially reported.

...In reaction to the weaker-than-expected jobs report, the stock market went UP in anticipation of the Federal Reserve Board cutting interest rates. It's as if Wall Street really doesn't like a strong economy.

-

The US labor market cooled notably last month as both hiring and wage growth slowed more than economists had expected in April.

.

The US economy added 175,000 new jobs and the unemployment rate rose to 3.9% last month, new data from the Bureau of Labor Statistics showed Friday. Wall Street economists had expected nonfarm payrolls to rise by 240,000 and the unemployment rate to remain at 3.8%, according to Bloomberg data.

.

Wages also rose less than forecast, with average hourly earnings rising 0.2% over last month and 3.9% over the last year. Economists had expected to see a monthly jump of 0.3% in April and a 4% rise over last year.

.

Friday's report also showed February's job growth was revised down — to a gain of 236,000 nonfarm payroll jobs from the 270,000 previously reported — while March's report was revised up to job gains of 315,000 from the 303,000 initially reported.

...In reaction to the weaker-than-expected jobs report, the stock market went UP in anticipation of the Federal Reserve Board cutting interest rates. It's as if Wall Street really doesn't like a strong economy.

-

The US labor market cooled notably last month as both hiring and wage growth slowed more than economists had expected in April.

.

The US economy added 175,000 new jobs and the unemployment rate rose to 3.9% last month, new data from the Bureau of Labor Statistics showed Friday. Wall Street economists had expected nonfarm payrolls to rise by 240,000 and the unemployment rate to remain at 3.8%, according to Bloomberg data.

.

Wages also rose less than forecast, with average hourly earnings rising 0.2% over last month and 3.9% over the last year. Economists had expected to see a monthly jump of 0.3% in April and a 4% rise over last year.

.

Friday's report also showed February's job growth was revised down — to a gain of 236,000 nonfarm payroll jobs from the 270,000 previously reported — while March's report was revised up to job gains of 315,000 from the 303,000 initially reported.

...In reaction to the weaker-than-expected jobs report, the stock market went UP in anticipation of the Federal Reserve Board cutting interest rates. It's as if Wall Street really doesn't like a strong economy.

@Axtremus said in Bidenomics At Work:

The US labor market cooled notably last month as both hiring and wage growth slowed more than economists had expected in April.

.

The US economy added 175,000 new jobs and the unemployment rate rose to 3.9% last month, new data from the Bureau of Labor Statistics showed Friday. Wall Street economists had expected nonfarm payrolls to rise by 240,000 and the unemployment rate to remain at 3.8%, according to Bloomberg data.

.

Wages also rose less than forecast, with average hourly earnings rising 0.2% over last month and 3.9% over the last year. Economists had expected to see a monthly jump of 0.3% in April and a 4% rise over last year.

.

Friday's report also showed February's job growth was revised down — to a gain of 236,000 nonfarm payroll jobs from the 270,000 previously reported — while March's report was revised up to job gains of 315,000 from the 303,000 initially reported.

...In reaction to the weaker-than-expected jobs report, the stock market went UP in anticipation of the Federal Reserve Board cutting interest rates. It's as if Wall Street really doesn't like a strong economy.

My understanding on economy (which I admit is minimum), is that the poor jobs reports indirectly says that inflation will be slowing (less salary pressure increase, etc.). Which, in the long term, is what is wanted. @jon-nyc is probably better to respond.