Bidenomics At Work

-

Another strong, very strong, job report for March 2024:

https://www.cnn.com/2024/04/05/economy/us-jobs-report-march-final/index.html

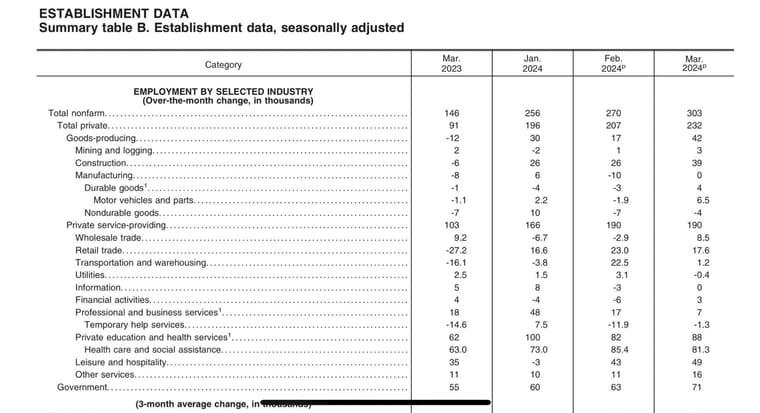

Employers added 303,000 jobs in March, the Bureau of Labor Statistics reported. The unemployment rate fell to 3.8% from 3.9% the month before.

...

Annual wage gains slowed to 4.1% from 4.3%, a trajectory likely welcomed by the Federal Reserve in its efforts to tame inflation but yet a still-strong rate to help Americans recapture earnings that were decimated by the pandemic and high inflation.

...

Last month’s job growth was driven by industries such as health care (+72,300 jobs); government (+71,000 jobs); leisure and hospitality (+49,000 jobs); and construction (+39,000 jobs).

.

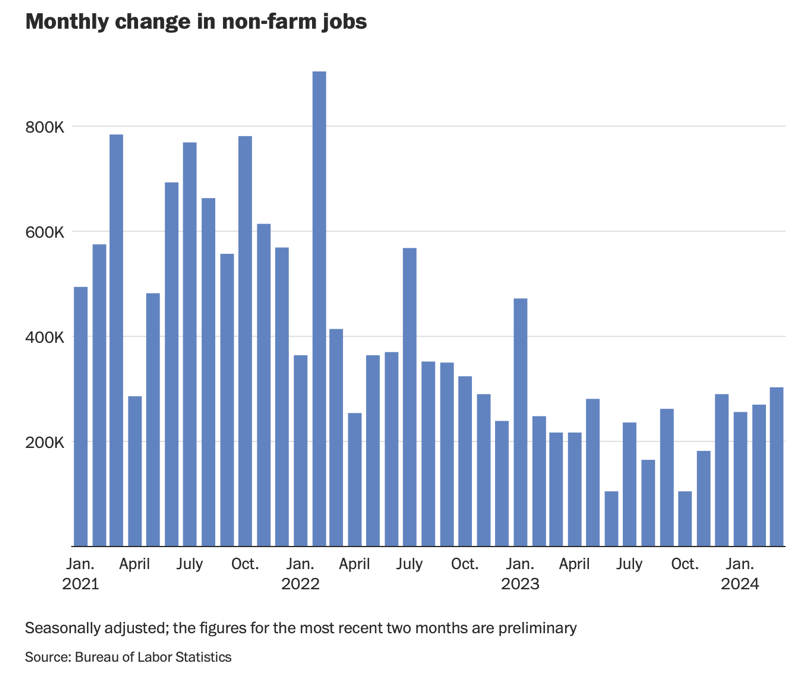

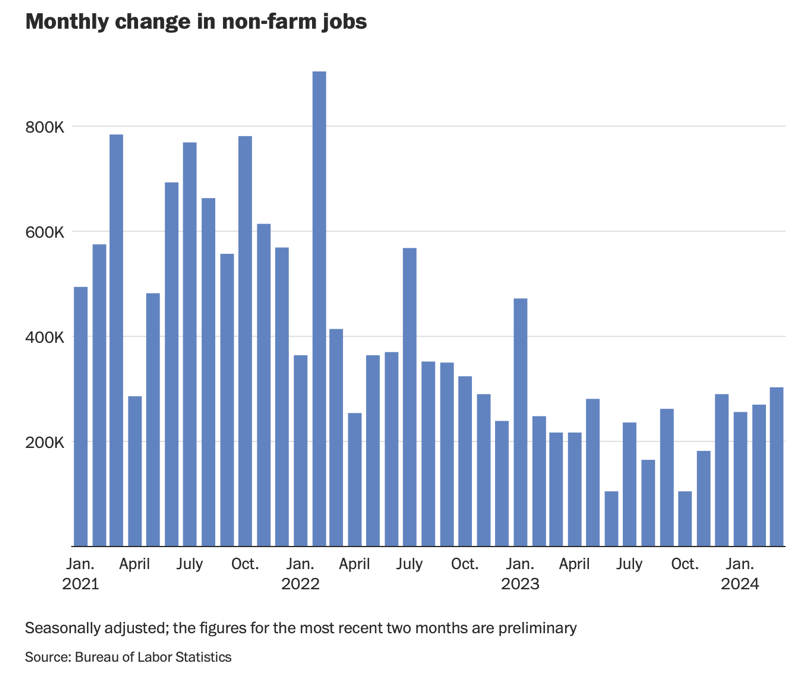

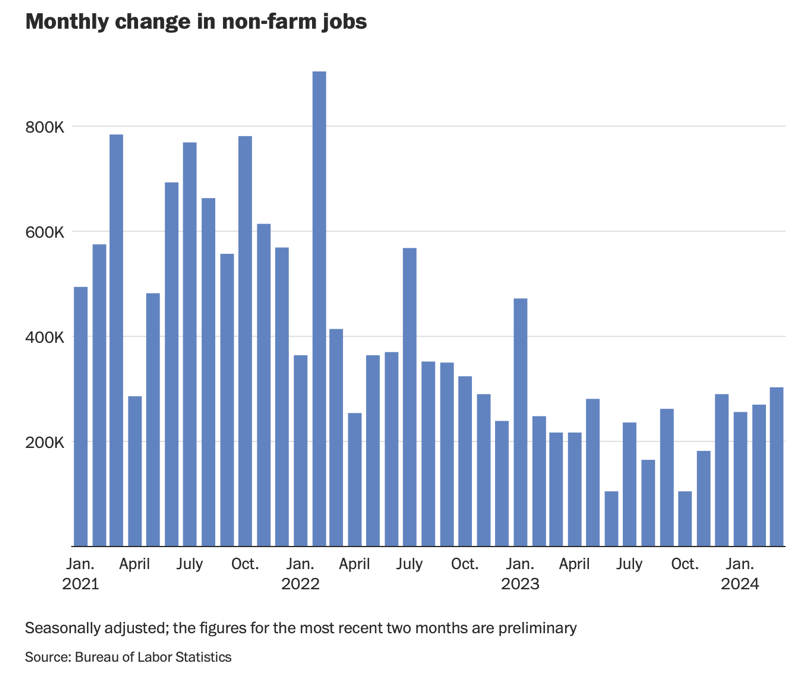

The current US job market is also one of the strongest, historically: The economy has added jobs for 39 consecutive months, marking the fifth-longest period of job expansion on record, BLS data shows. The unemployment rate has been below 4% for 26 months in a row, the longest streak since the late 1960s.Chart from the Washington Post:

Source: https://www.washingtonpost.com/business/2024/04/05/jobs-march-unemployment-rate/ -

-

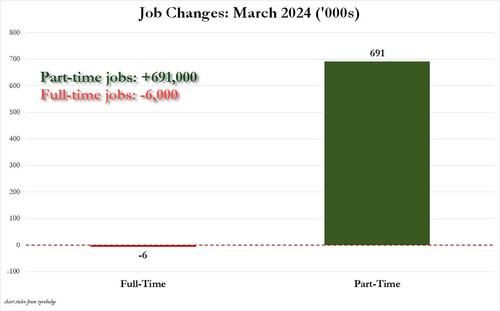

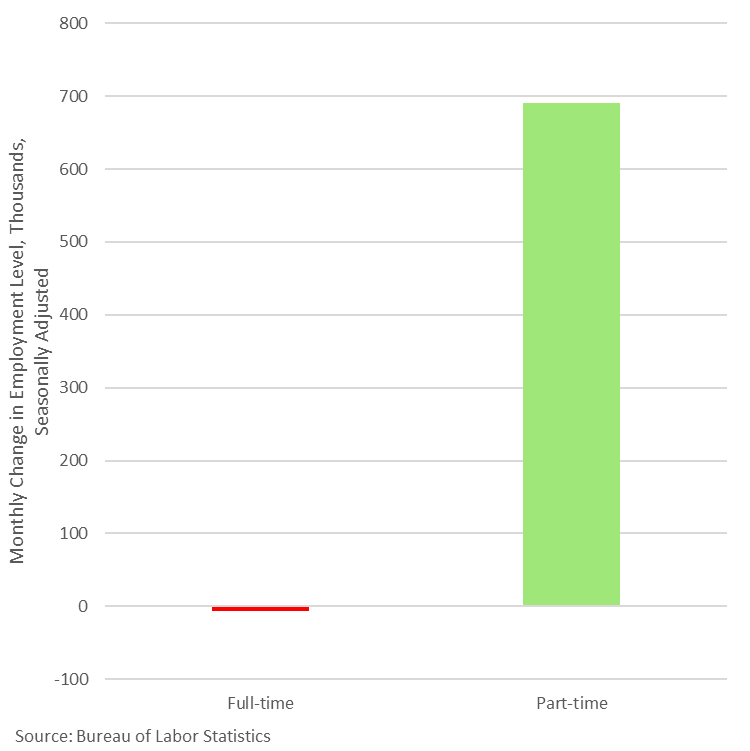

There is a serious catch within the job creation numbers, though, which is not really being discussed this morning across the financial media.** Part-time jobs showed a massive increase of 525K for March, up from an increase of 107K in February. That means that full-time jobs were lost on a net basis in March.** Even using the Household print, full-time jobs decreased by 27K in March. Using Non-Farm Payrolls... the U.S. economy lost 222K full-time jobs in March..

As to the racial demographics of March labor, Whites or Caucasians saw no change in their unemployment rate, while both Asians and Hispanics or Latinos made significant gains. However, Black or African American unemployment soared from 5.6% in February to 6.4% in March..

-

As to the racial demographics of March labor, Whites or Caucasians saw no change in their unemployment rate, while both Asians and Hispanics or Latinos made significant gains.

I get what they're trying to say there, but how frustrating is it that someone would write "significant gains in unemployment rate", and mean the rate went down?

-

https://committeetounleashprosperity.com/hotlines/part-time-nation/

he new job numbers for March were strong with 300,000 jobs added in the establishment survey and 500,000 in the household survey. But those positive headline numbers camouflage a very disturbing trend in the labor market. Almost all of the new jobs on the net are part-timers. That means a part-time paycheck.

Stock market advisor Stephanie Pomboy of MacroMavens has analyzed the number and reports that in the last four months, the labor market has LOST 1.8 million full-time jobs.

Here is a handy summary for the past year:

Overall payrolls up 1.9%

Part-time jobs up 7.5%

Full-time jobs down -1.35%

How many of the 300,000 jobs are double counting people holding TWO jobs?

-

Another strong, very strong, job report for March 2024:

https://www.cnn.com/2024/04/05/economy/us-jobs-report-march-final/index.html

Employers added 303,000 jobs in March, the Bureau of Labor Statistics reported. The unemployment rate fell to 3.8% from 3.9% the month before.

...

Annual wage gains slowed to 4.1% from 4.3%, a trajectory likely welcomed by the Federal Reserve in its efforts to tame inflation but yet a still-strong rate to help Americans recapture earnings that were decimated by the pandemic and high inflation.

...

Last month’s job growth was driven by industries such as health care (+72,300 jobs); government (+71,000 jobs); leisure and hospitality (+49,000 jobs); and construction (+39,000 jobs).

.

The current US job market is also one of the strongest, historically: The economy has added jobs for 39 consecutive months, marking the fifth-longest period of job expansion on record, BLS data shows. The unemployment rate has been below 4% for 26 months in a row, the longest streak since the late 1960s.Chart from the Washington Post:

Source: https://www.washingtonpost.com/business/2024/04/05/jobs-march-unemployment-rate/@Axtremus said in Bidenomics At Work:

Another strong, very strong, job report for March 2024:

https://www.cnn.com/2024/04/05/economy/us-jobs-report-march-final/index.html

Employers added 303,000 jobs in March, the Bureau of Labor Statistics reported. The unemployment rate fell to 3.8% from 3.9% the month before.

...

Annual wage gains slowed to 4.1% from 4.3%, a trajectory likely welcomed by the Federal Reserve in its efforts to tame inflation but yet a still-strong rate to help Americans recapture earnings that were decimated by the pandemic and high inflation.

...

Last month’s job growth was driven by industries such as health care (+72,300 jobs); government (+71,000 jobs); leisure and hospitality (+49,000 jobs); and construction (+39,000 jobs).

.

The current US job market is also one of the strongest, historically: The economy has added jobs for 39 consecutive months, marking the fifth-longest period of job expansion on record, BLS data shows. The unemployment rate has been below 4% for 26 months in a row, the longest streak since the late 1960s.Chart from the Washington Post:

Source: https://www.washingtonpost.com/business/2024/04/05/jobs-march-unemployment-rate/Kinda looks a lot worse once the numbers get explained, doesn't it? And again, these are not the final numbers...

-

But I thought that there was a wanting to decrease the jobs for a little bit to help "cool" inflation?

-

But I thought that there was a wanting to decrease the jobs for a little bit to help "cool" inflation?

@taiwan_girl said in Bidenomics At Work:

But I thought that there was a wanting to decrease the jobs for a little bit to help "cool" inflation?

I think the inflation monster is going to be hard to tame, with all the dollars dumped into the money supply.

-

https://www.cnn.com/2024/04/14/economy/working-past-retirement-age/index.html

Americans over 75 are the fastest-growing age group in the workforce, more than quadrupling in size since 1964, according to the Pew Research Center. Forecasters expect that cohort of older, working Americans to double over the next decade.

Pew Research: https://www.pewresearch.org/social-trends/2023/12/14/the-growth-of-the-older-workforce/

Numbering roughly 11 million today, the older workforce has nearly quadrupled in size since the mid-1980s. The increase is driven in part by the growth of the 65-and-older population. The bulk of the Baby Boom generation has now reached that threshold.

...

The share of older adults holding a job today is much greater than in the mid-1980s. Some 19% of adults ages 65 and older are employed today. In 1987, only 11% of older adults were working. Today’s share is similar to that of the early 1960s, when 18% of older Americans worked. -

The US labor market cooled notably last month as both hiring and wage growth slowed more than economists had expected in April.

.

The US economy added 175,000 new jobs and the unemployment rate rose to 3.9% last month, new data from the Bureau of Labor Statistics showed Friday. Wall Street economists had expected nonfarm payrolls to rise by 240,000 and the unemployment rate to remain at 3.8%, according to Bloomberg data.

.

Wages also rose less than forecast, with average hourly earnings rising 0.2% over last month and 3.9% over the last year. Economists had expected to see a monthly jump of 0.3% in April and a 4% rise over last year.

.

Friday's report also showed February's job growth was revised down — to a gain of 236,000 nonfarm payroll jobs from the 270,000 previously reported — while March's report was revised up to job gains of 315,000 from the 303,000 initially reported.

...In reaction to the weaker-than-expected jobs report, the stock market went UP in anticipation of the Federal Reserve Board cutting interest rates. It's as if Wall Street really doesn't like a strong economy.

-

The US labor market cooled notably last month as both hiring and wage growth slowed more than economists had expected in April.

.

The US economy added 175,000 new jobs and the unemployment rate rose to 3.9% last month, new data from the Bureau of Labor Statistics showed Friday. Wall Street economists had expected nonfarm payrolls to rise by 240,000 and the unemployment rate to remain at 3.8%, according to Bloomberg data.

.

Wages also rose less than forecast, with average hourly earnings rising 0.2% over last month and 3.9% over the last year. Economists had expected to see a monthly jump of 0.3% in April and a 4% rise over last year.

.

Friday's report also showed February's job growth was revised down — to a gain of 236,000 nonfarm payroll jobs from the 270,000 previously reported — while March's report was revised up to job gains of 315,000 from the 303,000 initially reported.

...In reaction to the weaker-than-expected jobs report, the stock market went UP in anticipation of the Federal Reserve Board cutting interest rates. It's as if Wall Street really doesn't like a strong economy.

-

The US labor market cooled notably last month as both hiring and wage growth slowed more than economists had expected in April.

.

The US economy added 175,000 new jobs and the unemployment rate rose to 3.9% last month, new data from the Bureau of Labor Statistics showed Friday. Wall Street economists had expected nonfarm payrolls to rise by 240,000 and the unemployment rate to remain at 3.8%, according to Bloomberg data.

.

Wages also rose less than forecast, with average hourly earnings rising 0.2% over last month and 3.9% over the last year. Economists had expected to see a monthly jump of 0.3% in April and a 4% rise over last year.

.

Friday's report also showed February's job growth was revised down — to a gain of 236,000 nonfarm payroll jobs from the 270,000 previously reported — while March's report was revised up to job gains of 315,000 from the 303,000 initially reported.

...In reaction to the weaker-than-expected jobs report, the stock market went UP in anticipation of the Federal Reserve Board cutting interest rates. It's as if Wall Street really doesn't like a strong economy.

@Axtremus said in Bidenomics At Work:

The US labor market cooled notably last month as both hiring and wage growth slowed more than economists had expected in April.

.

The US economy added 175,000 new jobs and the unemployment rate rose to 3.9% last month, new data from the Bureau of Labor Statistics showed Friday. Wall Street economists had expected nonfarm payrolls to rise by 240,000 and the unemployment rate to remain at 3.8%, according to Bloomberg data.

.

Wages also rose less than forecast, with average hourly earnings rising 0.2% over last month and 3.9% over the last year. Economists had expected to see a monthly jump of 0.3% in April and a 4% rise over last year.

.

Friday's report also showed February's job growth was revised down — to a gain of 236,000 nonfarm payroll jobs from the 270,000 previously reported — while March's report was revised up to job gains of 315,000 from the 303,000 initially reported.

...In reaction to the weaker-than-expected jobs report, the stock market went UP in anticipation of the Federal Reserve Board cutting interest rates. It's as if Wall Street really doesn't like a strong economy.

My understanding on economy (which I admit is minimum), is that the poor jobs reports indirectly says that inflation will be slowing (less salary pressure increase, etc.). Which, in the long term, is what is wanted. @jon-nyc is probably better to respond.

-

https://www.bls.gov/news.release/empsit.nr0.htm

Total nonfarm payroll employment increased by 272,000 in May, and the unemployment rate changed

little at 4.0 percent ...In May, average hourly earnings for all employees on private nonfarm payrolls increased by 14 cents, or 0.4 percent, to $34.91. Over the past 12 months, average hourly earnings have increased by 4.1 percent. In May, average hourly earnings of private-sector production and nonsupervisory employees

increased by 14 cents, or 0.5 percent, to $29.99. ... -

LOL, @George-K , can you find that post about the adjustments that just happened?

-

LOL, @George-K , can you find that post about the adjustments that just happened?

@LuFins-Dad zerohedge usually comes out with that info in a timely basis. But not yet today.

-

@LuFins-Dad zerohedge usually comes out with that info in a timely basis. But not yet today.

@George-K said in Bidenomics At Work:

@LuFins-Dad zerohedge usually comes out with that info in a timely basis. But not yet today.

I thought I saw something that showed they just had a MASSIVE revision for December and March.