Inflation

-

@George-K , you are correct, there is currently no deflation. Not sure if deflation is good, but 0% inflation maybe would be. LOL

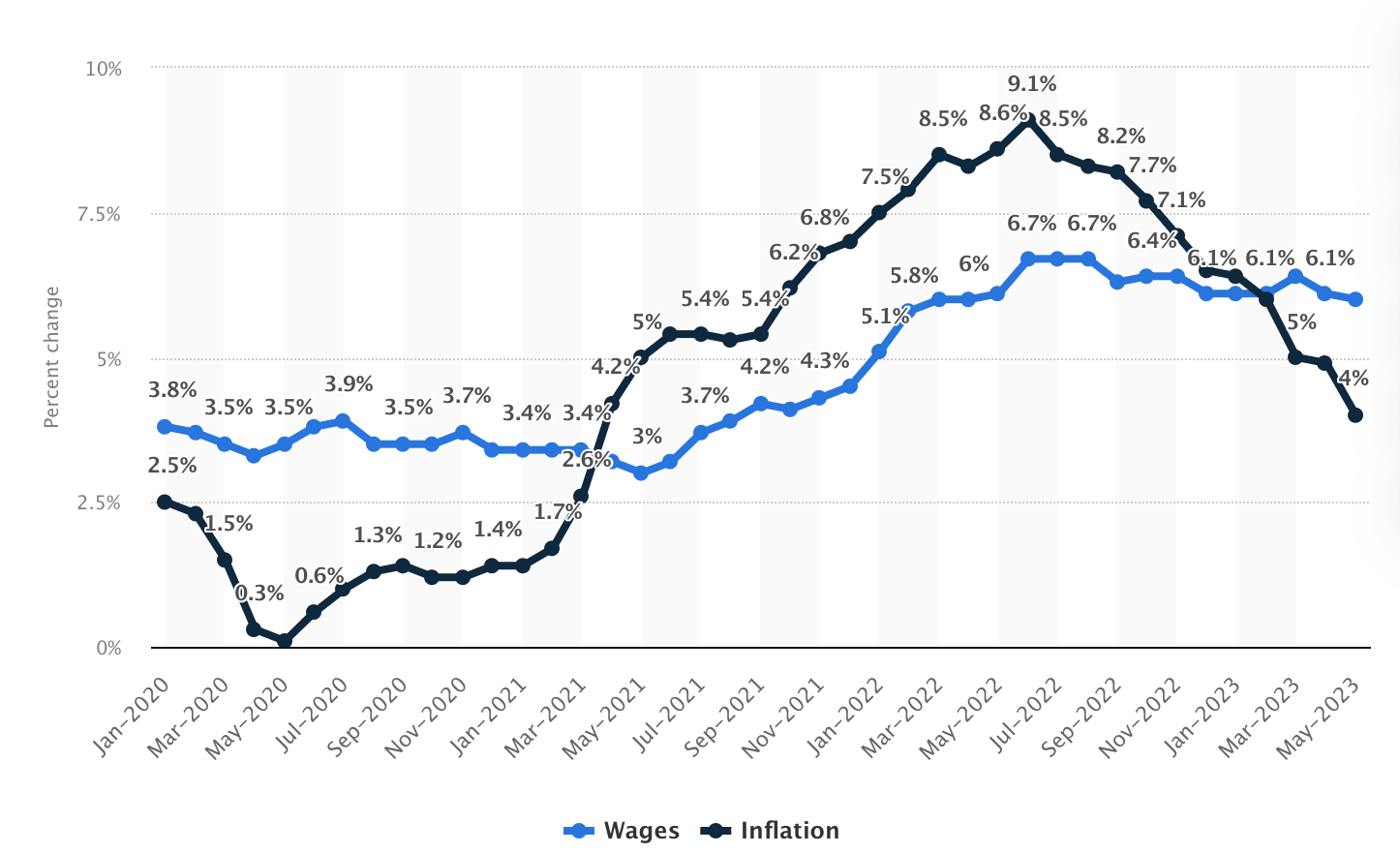

But definitely, inflation is trending downward and I expect it to flatten in the coming months at 2% or less.

image url)https://graphics.axios.com/hermesv2/batches/2023-07-12-1211-annual-change-in/2023-07-12-1211-annual-change-in-chicago/fallbacks/2023-07-12-1211-annual-change-in-chicago-fallback.png

image url)https://graphics.axios.com/hermesv2/batches/2023-07-12-1211-annual-change-in/2023-07-12-1211-annual-change-in-chicago/fallbacks/2023-07-12-1211-annual-change-in-chicago-fallback.png(Fun fact, i read somewhere that up until about 150-200 years ago, there was (almost) no inflation. For example, things in 1600 cost the same amount as in 1200. This is based on UK where they have some records of the cost of things over time.)

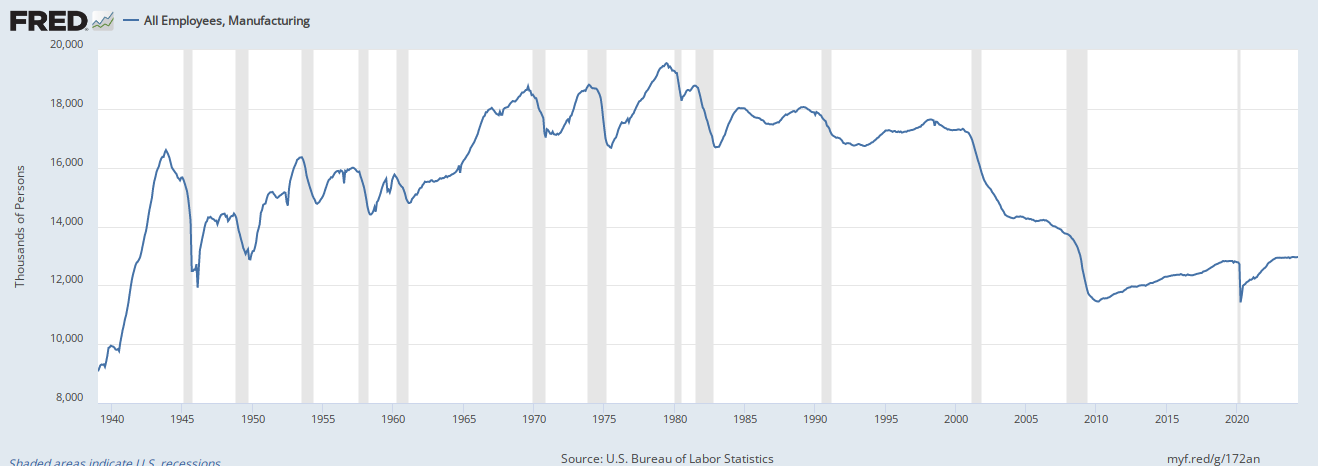

Below is the manufacturing jobs graph. Looks like it is return to where it was pre pandemic. But, at least it is going in the correct direction.

-

The government has, traditionally been "OK" with an inflation rate of 2-3%, iirc. However, that "OK" is predicated upon a concurrent rise in income.

That has not happened. I recall seeing a statistic that, in actual income, the average family is bringing home about $6K a year less.

Now, take that $500 a month decrease in real income, and combine it with a mortgage rate that has climbed from 3% to 7%, and a lot of folks are going to be very unhappy.

-

The government has, traditionally been "OK" with an inflation rate of 2-3%, iirc. However, that "OK" is predicated upon a concurrent rise in income.

That has not happened. I recall seeing a statistic that, in actual income, the average family is bringing home about $6K a year less.

Now, take that $500 a month decrease in real income, and combine it with a mortgage rate that has climbed from 3% to 7%, and a lot of folks are going to be very unhappy.

@George-K you always make me think!!!!

Unfortunately I was unable to find data that includes today.

Here is one graph that shows average income over the past 50 years

Could not get the picture to work, so a link to average hour salary

-

The government has, traditionally been "OK" with an inflation rate of 2-3%, iirc. However, that "OK" is predicated upon a concurrent rise in income.

That has not happened. I recall seeing a statistic that, in actual income, the average family is bringing home about $6K a year less.

Now, take that $500 a month decrease in real income, and combine it with a mortgage rate that has climbed from 3% to 7%, and a lot of folks are going to be very unhappy.

The government has, traditionally been "OK" with an inflation rate of 2-3%, iirc. However, that "OK" is predicated upon a concurrent rise in income.

That has not happened. I recall seeing a statistic that, in actual income, the average family is bringing home about $6K a year less.

Now, take that $500 a month decrease in real income, and combine it with a mortgage rate that has climbed from 3% to 7%, and a lot of folks are going to be very unhappy.

Bidenomics.

-

The government has, traditionally been "OK" with an inflation rate of 2-3%, iirc. However, that "OK" is predicated upon a concurrent rise in income.

That has not happened. I recall seeing a statistic that, in actual income, the average family is bringing home about $6K a year less.

Now, take that $500 a month decrease in real income, and combine it with a mortgage rate that has climbed from 3% to 7%, and a lot of folks are going to be very unhappy.

Bidenomics.

-

@George-K he got nailed yesterday, too.

-

-

@George-K he got nailed yesterday, too.

-

-

-

New season soon!

-

Goldman Sachs report says that the chance of recession is down to 15%.

Should President Biden get credit for this? 555

(I think you all know my answer)

-

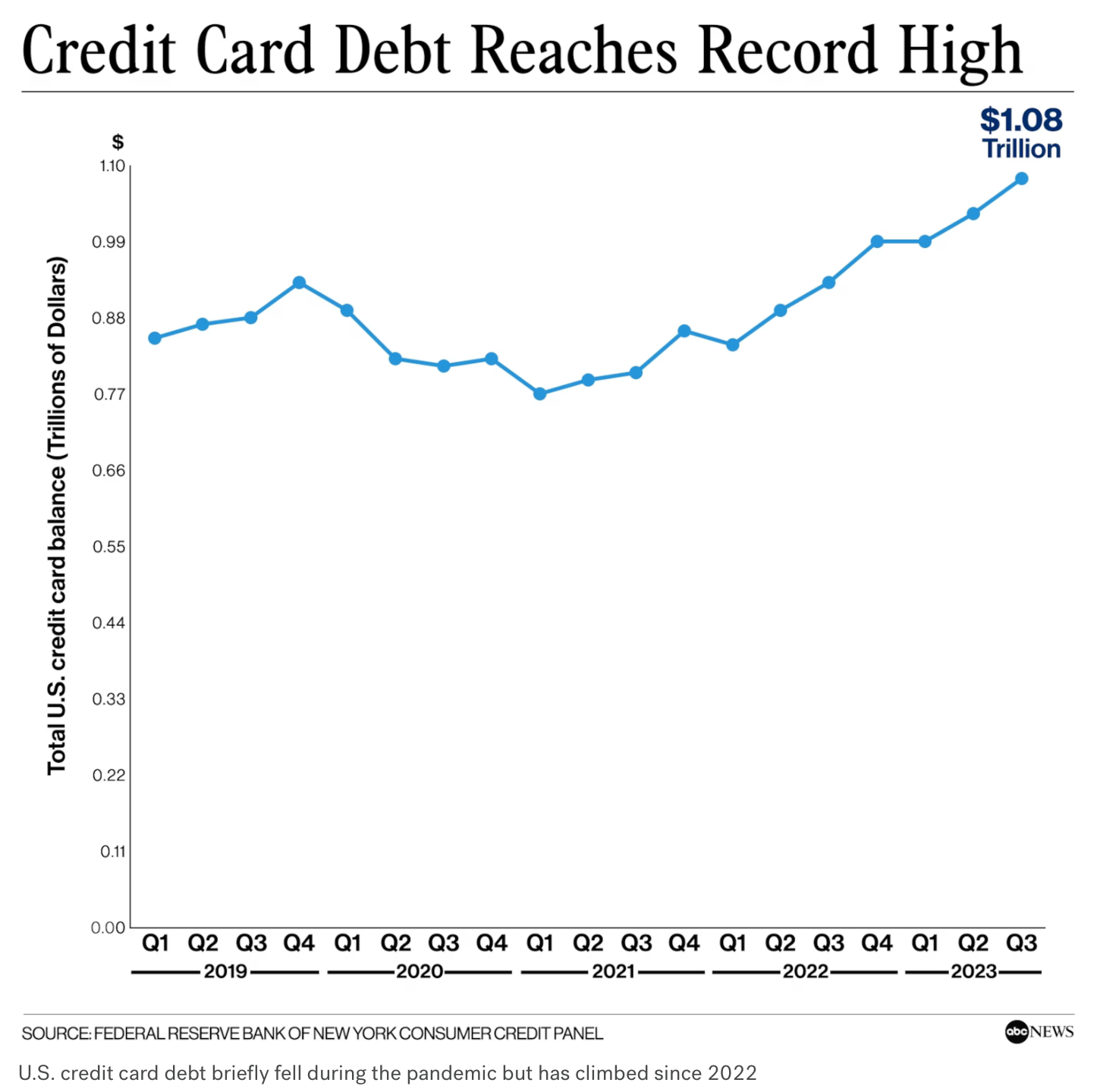

https://www.theatlantic.com/ideas/archive/2023/12/inflation-prices-buying-habits/676191/

If people are so mad about high prices, why do they keep buying so many expensive things?

...

People hate inflation, just not enough to spend less: This is one of the central tensions of today’s economy, in which things are going great yet everyone is miserable. ...

.

... And in surveys, people say that they are trading down because of cost pressures. But in fact they are spending more than they ever have, even after accounting for higher prices. ... -

Sorry, paywall, and I can’t afford their higher rates.

-

https://www.theatlantic.com/ideas/archive/2023/12/inflation-prices-buying-habits/676191/

If people are so mad about high prices, why do they keep buying so many expensive things?

...

People hate inflation, just not enough to spend less: This is one of the central tensions of today’s economy, in which things are going great yet everyone is miserable. ...

.

... And in surveys, people say that they are trading down because of cost pressures. But in fact they are spending more than they ever have, even after accounting for higher prices. ...https://www.theatlantic.com/ideas/archive/2023/12/inflation-prices-buying-habits/676191/

... And in surveys, people say that they are trading down because of cost pressures. But in fact they are spending more than they ever have, even after accounting for higher prices. ...

Everything is going along swimmingly.