Bidenomics

-

https://www.washingtonpost.com/business/2024/07/25/gdp-q2-economy/

The U.S. economy grew at a surprisingly robust 2.8 percent annualized rate in the second quarter, capping two years of solid expansion, despite some signs of softening.

Gross domestic product for the quarter ending in June was double the 1.4 percent reading in the previous quarter, but reflects a general cool-down from last year’s brisk pace, according to Commerce Department data released Thursday morning.

“Economic growth is solid, not too hot and not too cold,” said Chris Rupkey, chief economist at Fwdbonds, a financial research firm. “The soft patch we had at the beginning of the year has gone away and with it, the risks of a recession are dying on the vine.”

-

Bunch of tweets from yesterday commenting on how things are.

https://www.cnbc.com/2024/07/31/stock-market-today-live-updates.html

Some fresh data stoked fears over a possible recession and the notion that the Federal Reserve could be too late to start cutting interest rates. Initial jobless claims rose the most since August 2023. The ISM manufacturing index, a barometer of factory activity in the U.S., came in at 46.8%, worse than expected and a signal of economic contraction. After these releases, the 10-year Treasury yield dropped below 4% for the first time since February.

These weak data releases come a day after central bank policymakers chose to keep rates at the highest levels in two decades, when Fed Chair Jerome Powell gave investors some hope by signaling a September rate cut is on the table.

“The data we have got since the Fed meeting signals all of a sudden that people are now worrying that maybe it isn’t a soft landing and the Fed has vacillated too long,” said Tom Fitzpatrick, managing director for global market insights at R.J. O’Brien and Associates. “The bond market is already telling you that we’re behind the curve … the Fed is more prepared to make a different mistake for fear of making a similar mistake.”

-

-

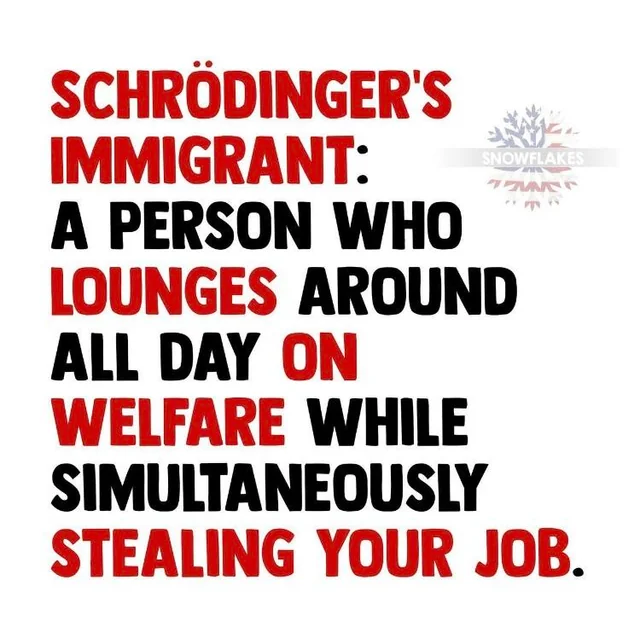

I had commented to Karla yesterday that the Republicans need to get back on message about the economy and immigration.

Later in the afternoon, I heard a great ad with Kamala doing her

“Bidenomics is working, hahaha!”Then a news reporter “The BLS” has revised the jobs estimate downward for the 8th month in a row”

K- “You know what’s working? Bidenomics! Haha”

News - “the data shows groceries are 27% higher than they were in 2020”

K- “Bidenomics is doing exactly what we want it to!”

News - “Energy Harbor is announcing the closure of a coal processing center. The center employed 3300 full time employees”

K - “Bidenomics! Hahahaha!”

It was really well done until they got to the weird music and slowing her voice down and dropping it several octaves. That was bad.

-

Harris: "Orange Man Bad!"

Vice President Kamala Harris’ campaign is blaming former President Trump for the latest negative jobs report — nearly a full term after he left office.

"Donald Trump failed Americans as president, costing our economy millions of jobs, and bringing us to the brink of recession," Harris for President spokesperson James Singer said in a statement.

Wow.

-

https://qz.com/us-recession-bank-of-america-bofa-moynihan-rates-1851619281

Bank of America (BAC) chief Brian Moynihan said the bank’s research team “does not have any recession predicted anymore,” even as fears about the health of the U.S. economy continue to rise.

This time last year the bank had priced in a recession, but that’s no longer the case,

Bank of America, the second-largest U.S. bank by assets, sees about 60 million customers spending each week, giving it key insights into consumer health. Moynihan said that the consumer spending rate has halved from this time last year, sitting at about 3%.

“The consumer has slowed down. They have money in their accounts, but they’re depleting a little bit,” he said. “They’re employed, they’re earning money, but ... they’ve really slowed down.”

-

https://qz.com/us-recession-bank-of-america-bofa-moynihan-rates-1851619281

Bank of America (BAC) chief Brian Moynihan said the bank’s research team “does not have any recession predicted anymore,” even as fears about the health of the U.S. economy continue to rise.

This time last year the bank had priced in a recession, but that’s no longer the case,

Bank of America, the second-largest U.S. bank by assets, sees about 60 million customers spending each week, giving it key insights into consumer health. Moynihan said that the consumer spending rate has halved from this time last year, sitting at about 3%.

“The consumer has slowed down. They have money in their accounts, but they’re depleting a little bit,” he said. “They’re employed, they’re earning money, but ... they’ve really slowed down.”

@taiwan_girl said in Bidenomics:

https://qz.com/us-recession-bank-of-america-bofa-moynihan-rates-1851619281

Bank of America (BAC) chief Brian Moynihan said the bank’s research team “does not have any recession predicted anymore,” even as fears about the health of the U.S. economy continue to rise.

This time last year the bank had priced in a recession, but that’s no longer the case,

Bank of America, the second-largest U.S. bank by assets, sees about 60 million customers spending each week, giving it key insights into consumer health. Moynihan said that the consumer spending rate has halved from this time last year, sitting at about 3%.

“The consumer has slowed down. They have money in their accounts, but they’re depleting a little bit,” he said. “They’re employed, they’re earning money, but ... they’ve really slowed down.”

Anecdotally speaking, I am seeing a lot fewer customers through the door, but the customers we are seeing are higher ticket sales. The U1 and the $10K-25K grand customers are a lot rarer, but the Seiler, Used Steinway, and Bosie business is going well…

-

-

@Doctor-Phibes LOL

-

https://www.nytimes.com/2024/08/14/business/cpi-inflation-july.html

The Consumer Price Index cooled in July compared with a year earlier, providing further evidence that inflation is moderating and likely keeping the Federal Reserve firmly on track to cut interest rates at its meeting next month.

Overall inflation was 2.9 percent in July on a yearly basis, the Bureau of Labor Statistics reported, easing slightly from 3 percent in June. The figure was milder than economists had expected, and it marked the first time inflation has slipped below 3 percent since 2021.

(Not sure this actually belongs in the "Bidenomics" forum thread as I don't think he did a lot to bring it down. (But I also think he was not the main reason that it went so high in the beginning of his term.))

-

https://www.nytimes.com/2024/08/14/business/cpi-inflation-july.html

The Consumer Price Index cooled in July compared with a year earlier, providing further evidence that inflation is moderating and likely keeping the Federal Reserve firmly on track to cut interest rates at its meeting next month.

Overall inflation was 2.9 percent in July on a yearly basis, the Bureau of Labor Statistics reported, easing slightly from 3 percent in June. The figure was milder than economists had expected, and it marked the first time inflation has slipped below 3 percent since 2021.

(Not sure this actually belongs in the "Bidenomics" forum thread as I don't think he did a lot to bring it down. (But I also think he was not the main reason that it went so high in the beginning of his term.))

@taiwan_girl said in Bidenomics:

(Not sure this actually belongs in the "Bidenomics" forum thread as I don't think he did a lot to bring it down. (But I also think he was not the main reason that it went so high in the beginning of his term.))

-

It belongs in this thread for the simple reason that I basically throw most public policy related economic news here. Employment statistics and news I generally throw into the "Bidenomics at Work" thread.

-

The American economy is pretty resilient. The government just have to not do crazy stupid stuff and it will recover most of the time just by itself. Say what you will about the Biden administration, I think they have so far managed to not do any crazy stupid stuff.

-

-

@taiwan_girl said in Bidenomics:

(Not sure this actually belongs in the "Bidenomics" forum thread as I don't think he did a lot to bring it down. (But I also think he was not the main reason that it went so high in the beginning of his term.))

-

It belongs in this thread for the simple reason that I basically throw most public policy related economic news here. Employment statistics and news I generally throw into the "Bidenomics at Work" thread.

-

The American economy is pretty resilient. The government just have to not do crazy stupid stuff and it will recover most of the time just by itself. Say what you will about the Biden administration, I think they have so far managed to not do any crazy stupid stuff.

@Axtremus said in Bidenomics:

The American economy is pretty resilient. The government just have to not do crazy stupid stuff and it will recover most of the time just by itself. Say what you will about the Biden administration, I think they have so far managed to not do any crazy stupid stuff.

Agree.

And that is why I do not agree that it is 'doomsday" if Candidate (insert the one you don't like) is elected.

-

-

Well, if we follow the economist that @jon-nyc referenced, there is about an 18 month lag.

Looking at the chart above, 18 months from President Biden inauguration takes us to Mar 22, which is the peak inflation. From that point, it begins to fall.

-

The Editorial Board at WSJ

President Biden claims that he inherited the worst economy since the Great Depression, but this isn’t close to true. The economy in January 2021 was fast recovering from the pandemic as vaccines rolled out and state lockdowns eased. GDP grew 34.8% in the third quarter of 2020, 4.2% in the fourth, and 5.2% in the first quarter of 2021. By the end of that first quarter, real GDP had returned to its pre-pandemic high. All Mr. Biden had to do was let the recovery unfold.

Instead, Democrats in March 2021 used Covid relief as a pretext to pass $1.9 trillion in new spending. This was more than double Barack Obama’s 2009 spending bonanza. State and local governments were the biggest beneficiaries, receiving $350 billion in direct aid, $122 billion for K-12 schools and $30 billion for mass transit. Insolvent union pension funds received a $86 billion rescue.

The rest was mostly transfer payments to individuals, including a five-month extension of enhanced unemployment benefits, a $3,600 fully refundable child tax credit, $1,400 stimulus payments per person, sweetened Affordable Care Act subsidies, an increased earned income tax credit including for folks who didn’t work, housing subsidies and so much more.

In November 2021, Congress passed a $1 trillion bill full of green pork and more money for states. Then came the $280 billion Chips Act and Mr. Biden’s Green New Deal—aka the Inflation Reduction Act—which Goldman Sachs estimates will cost $1.2 trillion over a decade. Such heaps of government spending have distorted private investment.

While investment in new factories has grown, spending on research and development and new equipment has slowed. Overall private fixed investment has grown at roughly half the rate under Mr. Biden as it did under Mr. Trump. Manufacturing output remains lower than before the pandemic.

Magnifying market misallocations, the Administration conditioned subsidies on businesses advancing its priorities such as paying union-level wages and providing child care to workers. It also boosted food stamps, expanded eligibility for ObamaCare subsidies and waved away hundreds of billions of dollars in student debt. The result: $5.8 trillion in deficits during Mr. Biden’s first three years—about twice as much as during Donald Trump’s—and the highest inflation in four decades.

Ms. Harris boasts that the economy has added nearly 16 million jobs during the Biden Presidency—compared to about 6.4 million during Mr. Trump’s first three years. But most of these “new” jobs are backfilling losses from the pandemic lockdowns. The U.S. has fewer jobs than it was on track to add before the pandemic.

What’s more, all the Biden-Harris spending has yielded little economic bang for the taxpayer buck. Washington has borrowed more than $400,000 for every additional job added under Mr. Biden compared to Mr. Trump’s first three years. Most new jobs are concentrated in government, healthcare and social assistance—60% of new jobs in the last year.

The economy is still expanding, but business investment has slowed. And although the affluent are doing relatively well because of buoyant asset prices, surveys show that most Americans feel financially insecure. Thus another political paradox of the Biden-Harris years: Socioeconomic disparities have increased.

Ms. Harris is promising the same economic policies with a shinier countenance. Don’t expect better results.

-

The U.S. economy grew faster than initially thought in the second quarter amid strong consumer spending, while corporate profits rebounded, which should help to sustain the expansion.

Gross domestic product increased at a 3.0% annualized rate last quarter, the Commerce Department's Bureau of Economic Analysis said in its second estimate of second-quarter GDP on Thursday. That was an upward revision from the 2.8% rate reported last month.