Bidenomics

-

@George-K said in Bidenomics:

Remember the article by Summers et al?

Which is it, RNC, median? Or average?

When Bill Gates walks into a soup kitchen the average net worth rises to $900MM. However the median net worth stays at a few bucks.

@jon-nyc said in Bidenomics:

Which is it, RNC, median? Or average?

https://www.realtor.com/news/trends/how-much-you-need-to-earn-in-every-state-to-buy-a-home/

Homebuyers in nearly half of the country need to earn at least six figures to be able to purchase a home.

Nationally, the typical household would need to earn $99,000 to buy a median-priced home of $415,500 in February, according to the most recent Realtor.com

data. This also accounts for property taxes and insurance costs, and assumes a 10% down payment.

data. This also accounts for property taxes and insurance costs, and assumes a 10% down payment. -

@George-K said in Bidenomics:

Another "revision."

That is probably a good thing. Means that the economy is not growing so fast, which is what the Central Bank is looking for.

-

-

https://www.washingtonpost.com/business/2024/07/25/gdp-q2-economy/

The U.S. economy grew at a surprisingly robust 2.8 percent annualized rate in the second quarter, capping two years of solid expansion, despite some signs of softening.

Gross domestic product for the quarter ending in June was double the 1.4 percent reading in the previous quarter, but reflects a general cool-down from last year’s brisk pace, according to Commerce Department data released Thursday morning.

“Economic growth is solid, not too hot and not too cold,” said Chris Rupkey, chief economist at Fwdbonds, a financial research firm. “The soft patch we had at the beginning of the year has gone away and with it, the risks of a recession are dying on the vine.”

-

Bunch of tweets from yesterday commenting on how things are.

https://www.cnbc.com/2024/07/31/stock-market-today-live-updates.html

Some fresh data stoked fears over a possible recession and the notion that the Federal Reserve could be too late to start cutting interest rates. Initial jobless claims rose the most since August 2023. The ISM manufacturing index, a barometer of factory activity in the U.S., came in at 46.8%, worse than expected and a signal of economic contraction. After these releases, the 10-year Treasury yield dropped below 4% for the first time since February.

These weak data releases come a day after central bank policymakers chose to keep rates at the highest levels in two decades, when Fed Chair Jerome Powell gave investors some hope by signaling a September rate cut is on the table.

“The data we have got since the Fed meeting signals all of a sudden that people are now worrying that maybe it isn’t a soft landing and the Fed has vacillated too long,” said Tom Fitzpatrick, managing director for global market insights at R.J. O’Brien and Associates. “The bond market is already telling you that we’re behind the curve … the Fed is more prepared to make a different mistake for fear of making a similar mistake.”

-

-

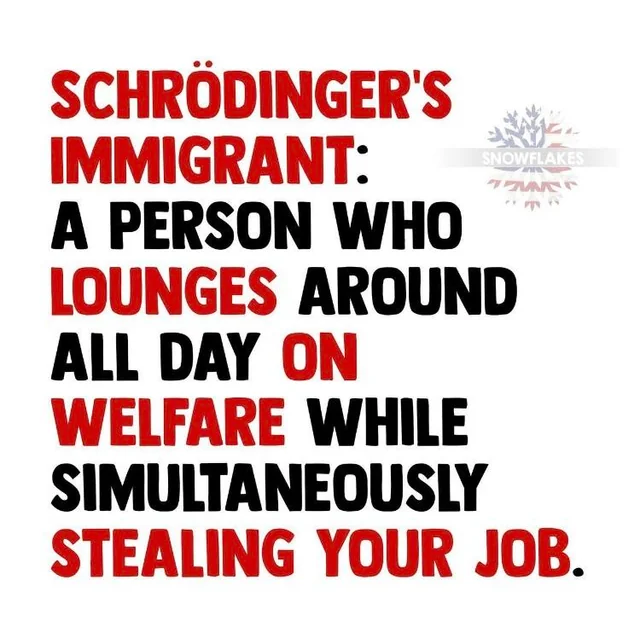

I had commented to Karla yesterday that the Republicans need to get back on message about the economy and immigration.

Later in the afternoon, I heard a great ad with Kamala doing her

“Bidenomics is working, hahaha!”Then a news reporter “The BLS” has revised the jobs estimate downward for the 8th month in a row”

K- “You know what’s working? Bidenomics! Haha”

News - “the data shows groceries are 27% higher than they were in 2020”

K- “Bidenomics is doing exactly what we want it to!”

News - “Energy Harbor is announcing the closure of a coal processing center. The center employed 3300 full time employees”

K - “Bidenomics! Hahahaha!”

It was really well done until they got to the weird music and slowing her voice down and dropping it several octaves. That was bad.

-

Harris: "Orange Man Bad!"

Vice President Kamala Harris’ campaign is blaming former President Trump for the latest negative jobs report — nearly a full term after he left office.

"Donald Trump failed Americans as president, costing our economy millions of jobs, and bringing us to the brink of recession," Harris for President spokesperson James Singer said in a statement.

Wow.

-

https://qz.com/us-recession-bank-of-america-bofa-moynihan-rates-1851619281

Bank of America (BAC) chief Brian Moynihan said the bank’s research team “does not have any recession predicted anymore,” even as fears about the health of the U.S. economy continue to rise.

This time last year the bank had priced in a recession, but that’s no longer the case,

Bank of America, the second-largest U.S. bank by assets, sees about 60 million customers spending each week, giving it key insights into consumer health. Moynihan said that the consumer spending rate has halved from this time last year, sitting at about 3%.

“The consumer has slowed down. They have money in their accounts, but they’re depleting a little bit,” he said. “They’re employed, they’re earning money, but ... they’ve really slowed down.”

-

https://qz.com/us-recession-bank-of-america-bofa-moynihan-rates-1851619281

Bank of America (BAC) chief Brian Moynihan said the bank’s research team “does not have any recession predicted anymore,” even as fears about the health of the U.S. economy continue to rise.

This time last year the bank had priced in a recession, but that’s no longer the case,

Bank of America, the second-largest U.S. bank by assets, sees about 60 million customers spending each week, giving it key insights into consumer health. Moynihan said that the consumer spending rate has halved from this time last year, sitting at about 3%.

“The consumer has slowed down. They have money in their accounts, but they’re depleting a little bit,” he said. “They’re employed, they’re earning money, but ... they’ve really slowed down.”

@taiwan_girl said in Bidenomics:

https://qz.com/us-recession-bank-of-america-bofa-moynihan-rates-1851619281

Bank of America (BAC) chief Brian Moynihan said the bank’s research team “does not have any recession predicted anymore,” even as fears about the health of the U.S. economy continue to rise.

This time last year the bank had priced in a recession, but that’s no longer the case,

Bank of America, the second-largest U.S. bank by assets, sees about 60 million customers spending each week, giving it key insights into consumer health. Moynihan said that the consumer spending rate has halved from this time last year, sitting at about 3%.

“The consumer has slowed down. They have money in their accounts, but they’re depleting a little bit,” he said. “They’re employed, they’re earning money, but ... they’ve really slowed down.”

Anecdotally speaking, I am seeing a lot fewer customers through the door, but the customers we are seeing are higher ticket sales. The U1 and the $10K-25K grand customers are a lot rarer, but the Seiler, Used Steinway, and Bosie business is going well…

-

-

@Doctor-Phibes LOL

-

https://www.nytimes.com/2024/08/14/business/cpi-inflation-july.html

The Consumer Price Index cooled in July compared with a year earlier, providing further evidence that inflation is moderating and likely keeping the Federal Reserve firmly on track to cut interest rates at its meeting next month.

Overall inflation was 2.9 percent in July on a yearly basis, the Bureau of Labor Statistics reported, easing slightly from 3 percent in June. The figure was milder than economists had expected, and it marked the first time inflation has slipped below 3 percent since 2021.

(Not sure this actually belongs in the "Bidenomics" forum thread as I don't think he did a lot to bring it down. (But I also think he was not the main reason that it went so high in the beginning of his term.))

-

https://www.nytimes.com/2024/08/14/business/cpi-inflation-july.html

The Consumer Price Index cooled in July compared with a year earlier, providing further evidence that inflation is moderating and likely keeping the Federal Reserve firmly on track to cut interest rates at its meeting next month.

Overall inflation was 2.9 percent in July on a yearly basis, the Bureau of Labor Statistics reported, easing slightly from 3 percent in June. The figure was milder than economists had expected, and it marked the first time inflation has slipped below 3 percent since 2021.

(Not sure this actually belongs in the "Bidenomics" forum thread as I don't think he did a lot to bring it down. (But I also think he was not the main reason that it went so high in the beginning of his term.))

@taiwan_girl said in Bidenomics:

(Not sure this actually belongs in the "Bidenomics" forum thread as I don't think he did a lot to bring it down. (But I also think he was not the main reason that it went so high in the beginning of his term.))

-

It belongs in this thread for the simple reason that I basically throw most public policy related economic news here. Employment statistics and news I generally throw into the "Bidenomics at Work" thread.

-

The American economy is pretty resilient. The government just have to not do crazy stupid stuff and it will recover most of the time just by itself. Say what you will about the Biden administration, I think they have so far managed to not do any crazy stupid stuff.

-