Bidenomics

-

Why parents with young children are reporting a dramatic drop-off in their financial well-being

The Survey of Household Economics and Decisionmaking found a decline in the percentage of parents living with children under age 18 who felt financially secure, dropping from 69% in 2022 to 64% in 2023. That was also down from a record high of 75% in 2021.

So … @89th , @Aqua-Letifer , how are you feeling?

@Axtremus said in Bidenomics:

Why parents with young children are reporting a dramatic drop-off in their financial well-being

The Survey of Household Economics and Decisionmaking found a decline in the percentage of parents living with children under age 18 who felt financially secure, dropping from 69% in 2022 to 64% in 2023. That was also down from a record high of 75% in 2021.

So … @89th , @Aqua-Letifer , how are you feeling?

We are part of the majority (64%). We worked hard, and saved hard, and tried to make smart decisions (having 3 kids is a financially risky decision these days!). but still... we are fortunate to not feel the financial pressures that 36% of the country feels.

Also, I'm not surprised. Child care costs is a massive burden these days, plus housing, plus college... all 3 of those cost buckets have vastly outpaced the average income. And don't even get me started about McDonald's!

-

@Axtremus said in Bidenomics:

Why parents with young children are reporting a dramatic drop-off in their financial well-being

The Survey of Household Economics and Decisionmaking found a decline in the percentage of parents living with children under age 18 who felt financially secure, dropping from 69% in 2022 to 64% in 2023. That was also down from a record high of 75% in 2021.

So … @89th , @Aqua-Letifer , how are you feeling?

We are part of the majority (64%). We worked hard, and saved hard, and tried to make smart decisions (having 3 kids is a financially risky decision these days!). but still... we are fortunate to not feel the financial pressures that 36% of the country feels.

Also, I'm not surprised. Child care costs is a massive burden these days, plus housing, plus college... all 3 of those cost buckets have vastly outpaced the average income. And don't even get me started about McDonald's!

@89th said in Bidenomics:

@Axtremus said in Bidenomics:

Why parents with young children are reporting a dramatic drop-off in their financial well-being

The Survey of Household Economics and Decisionmaking found a decline in the percentage of parents living with children under age 18 who felt financially secure, dropping from 69% in 2022 to 64% in 2023. That was also down from a record high of 75% in 2021.

So … @89th , @Aqua-Letifer , how are you feeling?

We are part of the majority (64%). We worked hard, and saved hard, and tried to make smart decisions (having 3 kids is a financially risky decision these days!). but still... we are fortunate to not feel the financial pressures that 36% of the country feels.

Also, I'm not surprised. Child care costs is a massive burden these days, plus housing, plus college... all 3 of those cost buckets have vastly outpaced the average income. And don't even get me started about McDonald's!

Vote Biden and enjoy!

-

@89th said in Bidenomics:

@Axtremus said in Bidenomics:

Why parents with young children are reporting a dramatic drop-off in their financial well-being

The Survey of Household Economics and Decisionmaking found a decline in the percentage of parents living with children under age 18 who felt financially secure, dropping from 69% in 2022 to 64% in 2023. That was also down from a record high of 75% in 2021.

So … @89th , @Aqua-Letifer , how are you feeling?

We are part of the majority (64%). We worked hard, and saved hard, and tried to make smart decisions (having 3 kids is a financially risky decision these days!). but still... we are fortunate to not feel the financial pressures that 36% of the country feels.

Also, I'm not surprised. Child care costs is a massive burden these days, plus housing, plus college... all 3 of those cost buckets have vastly outpaced the average income. And don't even get me started about McDonald's!

Vote Biden and enjoy!

@Jolly said in Bidenomics:

@89th said in Bidenomics:

@Axtremus said in Bidenomics:

Why parents with young children are reporting a dramatic drop-off in their financial well-being

The Survey of Household Economics and Decisionmaking found a decline in the percentage of parents living with children under age 18 who felt financially secure, dropping from 69% in 2022 to 64% in 2023. That was also down from a record high of 75% in 2021.

So … @89th , @Aqua-Letifer , how are you feeling?

We are part of the majority (64%). We worked hard, and saved hard, and tried to make smart decisions (having 3 kids is a financially risky decision these days!). but still... we are fortunate to not feel the financial pressures that 36% of the country feels.

Also, I'm not surprised. Child care costs is a massive burden these days, plus housing, plus college... all 3 of those cost buckets have vastly outpaced the average income. And don't even get me started about McDonald's!

Vote Biden and enjoy!

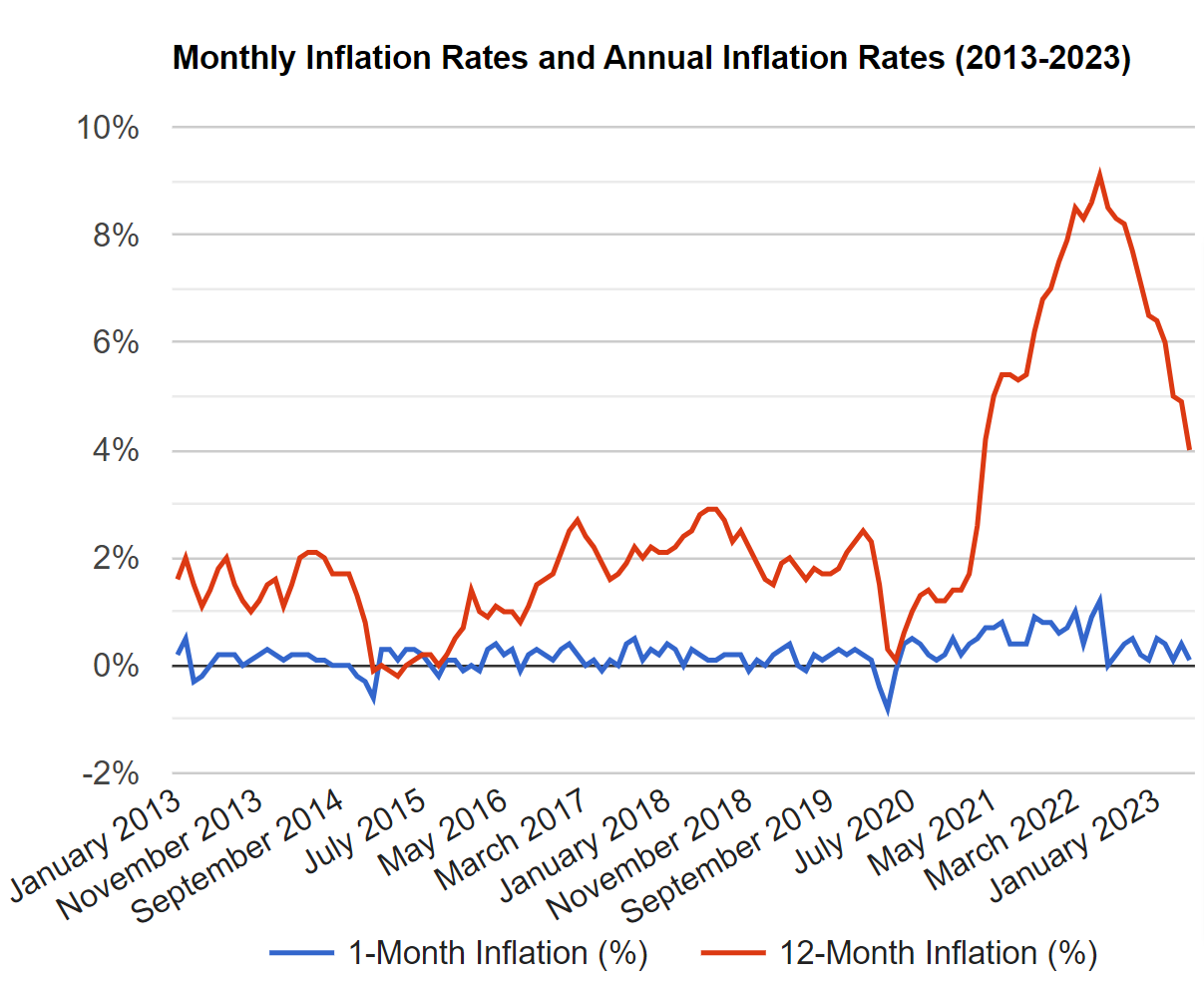

I mean…costs were already exploding during the bush and Obama years, and really took off at the end of Trump, so one could say Biden had stopped the bleeding?

-

@LuFins-Dad said in Bidenomics:

You also think Walmart ties are appropriate work attire, so,…

And that’s proven true in the real world judging by compliments received from clients, colleagues, and business associates on Walmart ties.

@Axtremus said in Bidenomics:

@LuFins-Dad said in Bidenomics:

You also think Walmart ties are appropriate work attire, so,…

And that’s proven true in the real world judging by compliments received from clients, colleagues, and business associates on Walmart ties.

It's cute you thought they were serious.

-

@Jolly said in Bidenomics:

@89th said in Bidenomics:

@Axtremus said in Bidenomics:

Why parents with young children are reporting a dramatic drop-off in their financial well-being

The Survey of Household Economics and Decisionmaking found a decline in the percentage of parents living with children under age 18 who felt financially secure, dropping from 69% in 2022 to 64% in 2023. That was also down from a record high of 75% in 2021.

So … @89th , @Aqua-Letifer , how are you feeling?

We are part of the majority (64%). We worked hard, and saved hard, and tried to make smart decisions (having 3 kids is a financially risky decision these days!). but still... we are fortunate to not feel the financial pressures that 36% of the country feels.

Also, I'm not surprised. Child care costs is a massive burden these days, plus housing, plus college... all 3 of those cost buckets have vastly outpaced the average income. And don't even get me started about McDonald's!

Vote Biden and enjoy!

I mean…costs were already exploding during the bush and Obama years, and really took off at the end of Trump, so one could say Biden had stopped the bleeding?

@89th said in Bidenomics:

@Jolly said in Bidenomics:

@89th said in Bidenomics:

@Axtremus said in Bidenomics:

Why parents with young children are reporting a dramatic drop-off in their financial well-being

The Survey of Household Economics and Decisionmaking found a decline in the percentage of parents living with children under age 18 who felt financially secure, dropping from 69% in 2022 to 64% in 2023. That was also down from a record high of 75% in 2021.

So … @89th , @Aqua-Letifer , how are you feeling?

We are part of the majority (64%). We worked hard, and saved hard, and tried to make smart decisions (having 3 kids is a financially risky decision these days!). but still... we are fortunate to not feel the financial pressures that 36% of the country feels.

Also, I'm not surprised. Child care costs is a massive burden these days, plus housing, plus college... all 3 of those cost buckets have vastly outpaced the average income. And don't even get me started about McDonald's!

Vote Biden and enjoy!

I mean…costs were already exploding during the bush and Obama years, and really took off at the end of Trump, so one could say Biden had stopped the bleeding?

Don't know what your smoking, but it's powerful stuff.

You forget, during those years I wasn't some craven, nerditic college student, jerking off in the bathroom after getting turned down on Saturday night. I was a working man, paying bills and putting my kids through college.

I don't have a plethora of horseshit graphs and junk data, but I knew what cars, groceries, clothes and utilities cost.

-

@Jolly said in Bidenomics:

@89th said in Bidenomics:

@Axtremus said in Bidenomics:

Why parents with young children are reporting a dramatic drop-off in their financial well-being

The Survey of Household Economics and Decisionmaking found a decline in the percentage of parents living with children under age 18 who felt financially secure, dropping from 69% in 2022 to 64% in 2023. That was also down from a record high of 75% in 2021.

So … @89th , @Aqua-Letifer , how are you feeling?

We are part of the majority (64%). We worked hard, and saved hard, and tried to make smart decisions (having 3 kids is a financially risky decision these days!). but still... we are fortunate to not feel the financial pressures that 36% of the country feels.

Also, I'm not surprised. Child care costs is a massive burden these days, plus housing, plus college... all 3 of those cost buckets have vastly outpaced the average income. And don't even get me started about McDonald's!

Vote Biden and enjoy!

I mean…costs were already exploding during the bush and Obama years, and really took off at the end of Trump, so one could say Biden had stopped the bleeding?

@89th said in Bidenomics:

costs were already exploding during the bush and Obama years, and really took off at the end of Trump

Not defending Trump's dumping money into the economy, but the inflation rate when Biden took office was 1.9%.

-

Why parents with young children are reporting a dramatic drop-off in their financial well-being

The Survey of Household Economics and Decisionmaking found a decline in the percentage of parents living with children under age 18 who felt financially secure, dropping from 69% in 2022 to 64% in 2023. That was also down from a record high of 75% in 2021.

So … @89th , @Aqua-Letifer , how are you feeling?

@Axtremus said in Bidenomics:

Why parents with young children are reporting a dramatic drop-off in their financial well-being

The Survey of Household Economics and Decisionmaking found a decline in the percentage of parents living with children under age 18 who felt financially secure, dropping from 69% in 2022 to 64% in 2023. That was also down from a record high of 75% in 2021.

So … @89th , @Aqua-Letifer , how are you feeling?

Oh, I wake up with my balls about an inch away from the bandsaw every morning, so inflation's just a nice extra.

-

@George-K said in Bidenomics:

Remember the article by Summers et al?

Which is it, RNC, median? Or average?

When Bill Gates walks into a soup kitchen the average net worth rises to $900MM. However the median net worth stays at a few bucks.

@jon-nyc said in Bidenomics:

Which is it, RNC, median? Or average?

https://www.realtor.com/news/trends/how-much-you-need-to-earn-in-every-state-to-buy-a-home/

Homebuyers in nearly half of the country need to earn at least six figures to be able to purchase a home.

Nationally, the typical household would need to earn $99,000 to buy a median-priced home of $415,500 in February, according to the most recent Realtor.com

data. This also accounts for property taxes and insurance costs, and assumes a 10% down payment.

data. This also accounts for property taxes and insurance costs, and assumes a 10% down payment. -

@George-K said in Bidenomics:

Another "revision."

That is probably a good thing. Means that the economy is not growing so fast, which is what the Central Bank is looking for.

-

-

https://www.washingtonpost.com/business/2024/07/25/gdp-q2-economy/

The U.S. economy grew at a surprisingly robust 2.8 percent annualized rate in the second quarter, capping two years of solid expansion, despite some signs of softening.

Gross domestic product for the quarter ending in June was double the 1.4 percent reading in the previous quarter, but reflects a general cool-down from last year’s brisk pace, according to Commerce Department data released Thursday morning.

“Economic growth is solid, not too hot and not too cold,” said Chris Rupkey, chief economist at Fwdbonds, a financial research firm. “The soft patch we had at the beginning of the year has gone away and with it, the risks of a recession are dying on the vine.”

-

Bunch of tweets from yesterday commenting on how things are.

https://www.cnbc.com/2024/07/31/stock-market-today-live-updates.html

Some fresh data stoked fears over a possible recession and the notion that the Federal Reserve could be too late to start cutting interest rates. Initial jobless claims rose the most since August 2023. The ISM manufacturing index, a barometer of factory activity in the U.S., came in at 46.8%, worse than expected and a signal of economic contraction. After these releases, the 10-year Treasury yield dropped below 4% for the first time since February.

These weak data releases come a day after central bank policymakers chose to keep rates at the highest levels in two decades, when Fed Chair Jerome Powell gave investors some hope by signaling a September rate cut is on the table.

“The data we have got since the Fed meeting signals all of a sudden that people are now worrying that maybe it isn’t a soft landing and the Fed has vacillated too long,” said Tom Fitzpatrick, managing director for global market insights at R.J. O’Brien and Associates. “The bond market is already telling you that we’re behind the curve … the Fed is more prepared to make a different mistake for fear of making a similar mistake.”

-