Silicon Valley Bank / SVB Financial Group

-

@Jolly said in Silicon Valley Bank / SVB Financial Group:

Go woke, go broke?

So astoundingly stupid to blame SVB's failure on wokeness.

https://www.theatlantic.com/ideas/archive/2023/03/republicans-svb-collapse-wokeness-esg-dei/673378/

@Axtremus said in Silicon Valley Bank / SVB Financial Group:

@Jolly said in Silicon Valley Bank / SVB Financial Group:

Go woke, go broke?

So astoundingly stupid to blame SVB's failure on wokeness.

https://www.theatlantic.com/ideas/archive/2023/03/republicans-svb-collapse-wokeness-esg-dei/673378/

Ya think so? Do tell, banker boy...

-

@Jolly said in Silicon Valley Bank / SVB Financial Group:

Go woke, go broke?

So astoundingly stupid to blame SVB's failure on wokeness.

https://www.theatlantic.com/ideas/archive/2023/03/republicans-svb-collapse-wokeness-esg-dei/673378/

@Axtremus said in Silicon Valley Bank / SVB Financial Group:

@Jolly said in Silicon Valley Bank / SVB Financial Group:

Go woke, go broke?

So astoundingly stupid to blame SVB's failure on wokeness.

https://www.theatlantic.com/ideas/archive/2023/03/republicans-svb-collapse-wokeness-esg-dei/673378/

Trump Jr., for example, focused on a screenshot of an executive at SVB who touted her work on LGBTQ issues.

The problem is that the executive that TJ focused on was the head Risk Officer for SVB’s European Division and was really the only Risk Assessment Officer over the past year until SVB hired Kim Olson in January. So can the argument be made that Xe/Xer should have seen the potential problems earlier? Absolutely. Can the argument also be made that the officer was more interested in social causes than the actual job? Sure…

-

It really makes you think. If the best of us, our bankers, can fail at their jobs, it can happen to any of us. There but for grace of God.

@Horace said in Silicon Valley Bank / SVB Financial Group:

It really makes you think. If the best of us, our bankers, can fail at their jobs, it can happen to any of us. There but for grace of God.

Bean counters, technocrats and MBAs are not the best of us or of any known civilisation, past or present.

-

The author argues that “2018’s Regulatory Rollback Made the SVB Catastrophe More Likely” and “S.2155 Allowed Regulators to Miss SVB’s Warning Signs.” Prior to the 2018 regulatory rollback, Dodd-Frank required sharp regulatory monitoring ad “stress testing” of liquidities for banks with assets over $50 Billion — this would have included SVB. But the 2018 regulatory rollback raised that threshold to $250 Billion, that higher threshold allowed SVB (and many other regional banks) to operate under weakened regulatory oversight and a bunch of less stringent rules (examples cited in the article). The argument goes that SVB might not have gotten to where it was had all the original Dodd-Frank rules were left in place.

-

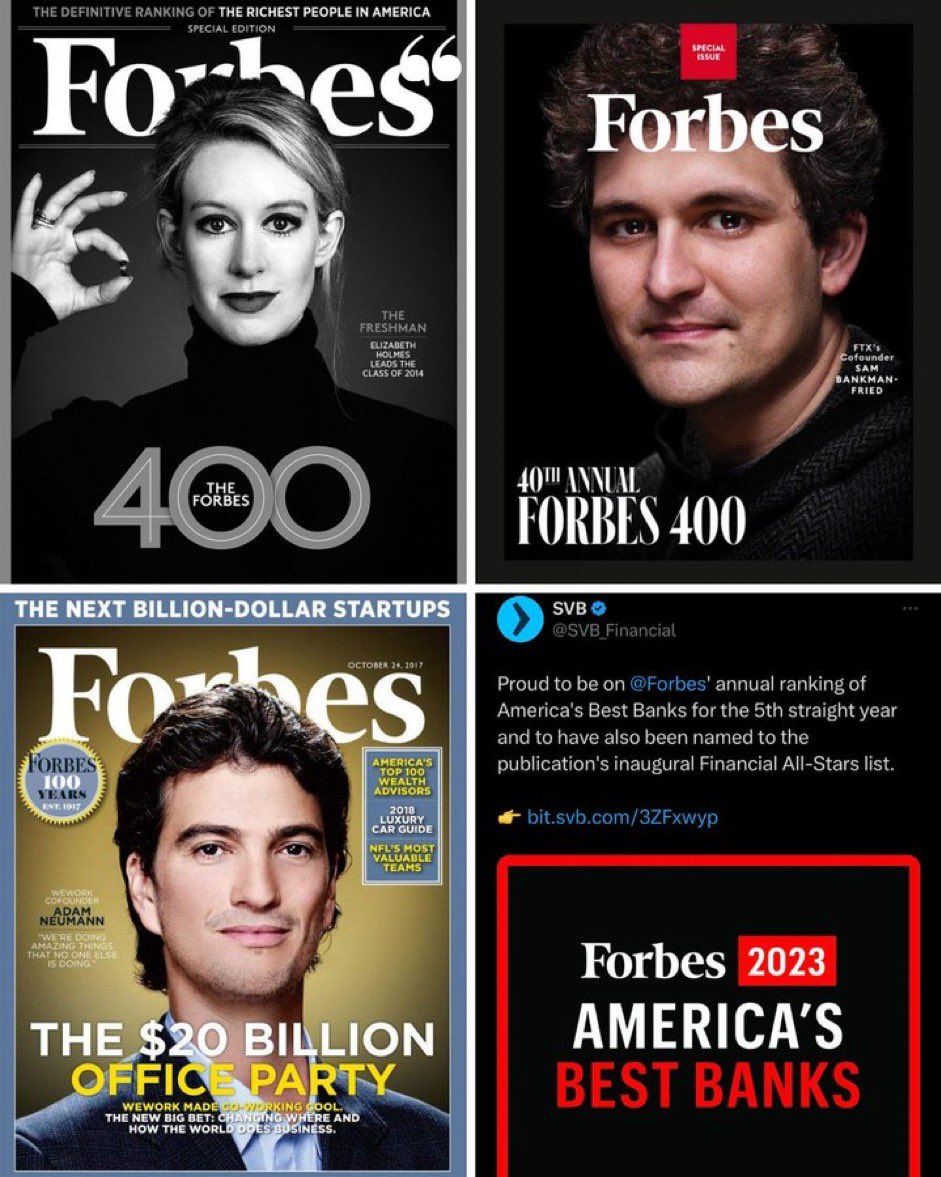

@jon-nyc said in Silicon Valley Bank / SVB Financial Group:

@George-K said in Silicon Valley Bank / SVB Financial Group:

Note the date.?

Two months before it went south.,

-

https://www.washingtonpost.com/us-policy/2023/04/02/rippling-svb-payroll-collapse/

Story on one company that does payroll processing that cuts checks using money deposited in SVB. Many of the payroll company’s clients are not even in Silicon Valley, the average income of the workers getting paychecks processed by this company is around $55k per year. 80% of the workers are outside of California.

Lots of rank of file middle class people would have gotten hurt had the government not step in. Bailing out the depositors, but letting SVB’s bond holders and stock holders suffer the consequences, and firing SVB’s senior management are the right things to do.