Silicon Valley Bank / SVB Financial Group

-

Silicon Valley Bank paid out bonuses hours before seizure

Silicon Valley Bank on Friday paid out annual bonuses to eligible U.S. employees, just hours before the bank was seized by the U.S. government, Axios has learned from multiple sources.

What to know: The bonuses were for work done during 2022, and were previously scheduled to be disbursed on March 10. That date ultimately coincided with the bank's takeover by the Federal Deposit Insurance Corporation.

- Bonuses for employees in some other countries were scheduled for later in the month, so those haven't yet been paid.

State of play: An unknown number of SVB employees were emailed by the FDIC on Friday evening, offering them employment with the remnant organization for the next 45 days.

- The employees would be compensated 1.5x times their normal salaries, while hourly workers would receive 2x their normal wages for overtime.

- An FDIC spokesperson tells Axios: "Without commenting on salaries, it’s our standard practice to ask retain [sic] bank employees to assist with an orderly transition as part of our resolution process."

-

I know a lot of people are pointing to the 2018 rollback of Dodd Frank, but I don’t see where that would have made a difference in this particular case?

@LuFins-Dad said in Silicon Valley Bank / SVB Financial Group:

I know a lot of people are pointing to the 2018 rollback of Dodd Frank, but I don’t see where that would have made a difference in this particular case?

Doesn’t make much sense. This bank took an unusual amount of interest rate risk, depositors got nervous and started a run.

-

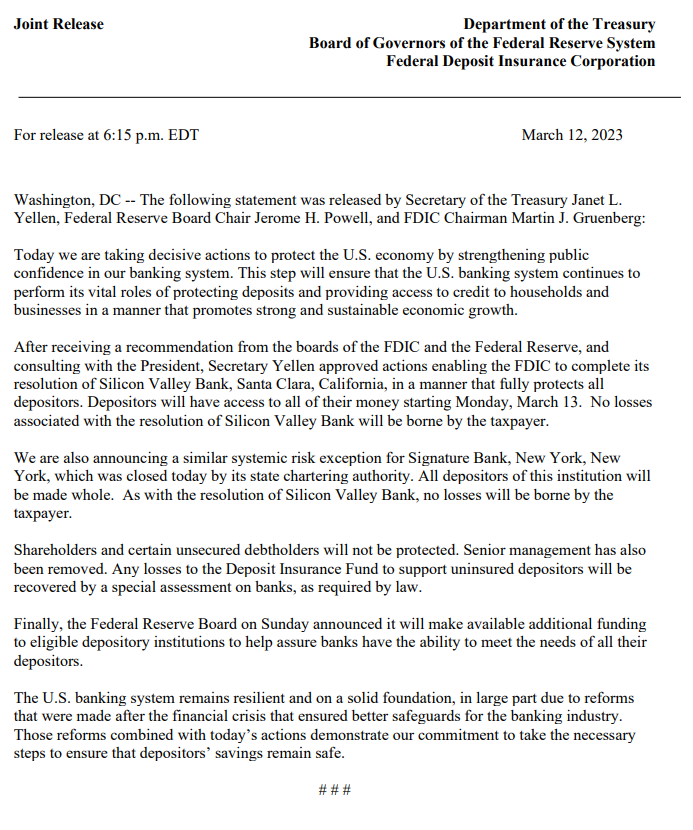

no losses will be borne by the taxpayers…

Well, today’s taxpayers… Your kids, otoh…

-

@Jolly said in Silicon Valley Bank / SVB Financial Group:

Go woke, go broke?

So astoundingly stupid to blame SVB's failure on wokeness.

https://www.theatlantic.com/ideas/archive/2023/03/republicans-svb-collapse-wokeness-esg-dei/673378/

-

@Jolly said in Silicon Valley Bank / SVB Financial Group:

Go woke, go broke?

So astoundingly stupid to blame SVB's failure on wokeness.

https://www.theatlantic.com/ideas/archive/2023/03/republicans-svb-collapse-wokeness-esg-dei/673378/

@Axtremus said in Silicon Valley Bank / SVB Financial Group:

@Jolly said in Silicon Valley Bank / SVB Financial Group:

Go woke, go broke?

So astoundingly stupid to blame SVB's failure on wokeness.

https://www.theatlantic.com/ideas/archive/2023/03/republicans-svb-collapse-wokeness-esg-dei/673378/

Ya think so? Do tell, banker boy...

-

@Jolly said in Silicon Valley Bank / SVB Financial Group:

Go woke, go broke?

So astoundingly stupid to blame SVB's failure on wokeness.

https://www.theatlantic.com/ideas/archive/2023/03/republicans-svb-collapse-wokeness-esg-dei/673378/

@Axtremus said in Silicon Valley Bank / SVB Financial Group:

@Jolly said in Silicon Valley Bank / SVB Financial Group:

Go woke, go broke?

So astoundingly stupid to blame SVB's failure on wokeness.

https://www.theatlantic.com/ideas/archive/2023/03/republicans-svb-collapse-wokeness-esg-dei/673378/

Trump Jr., for example, focused on a screenshot of an executive at SVB who touted her work on LGBTQ issues.

The problem is that the executive that TJ focused on was the head Risk Officer for SVB’s European Division and was really the only Risk Assessment Officer over the past year until SVB hired Kim Olson in January. So can the argument be made that Xe/Xer should have seen the potential problems earlier? Absolutely. Can the argument also be made that the officer was more interested in social causes than the actual job? Sure…

-

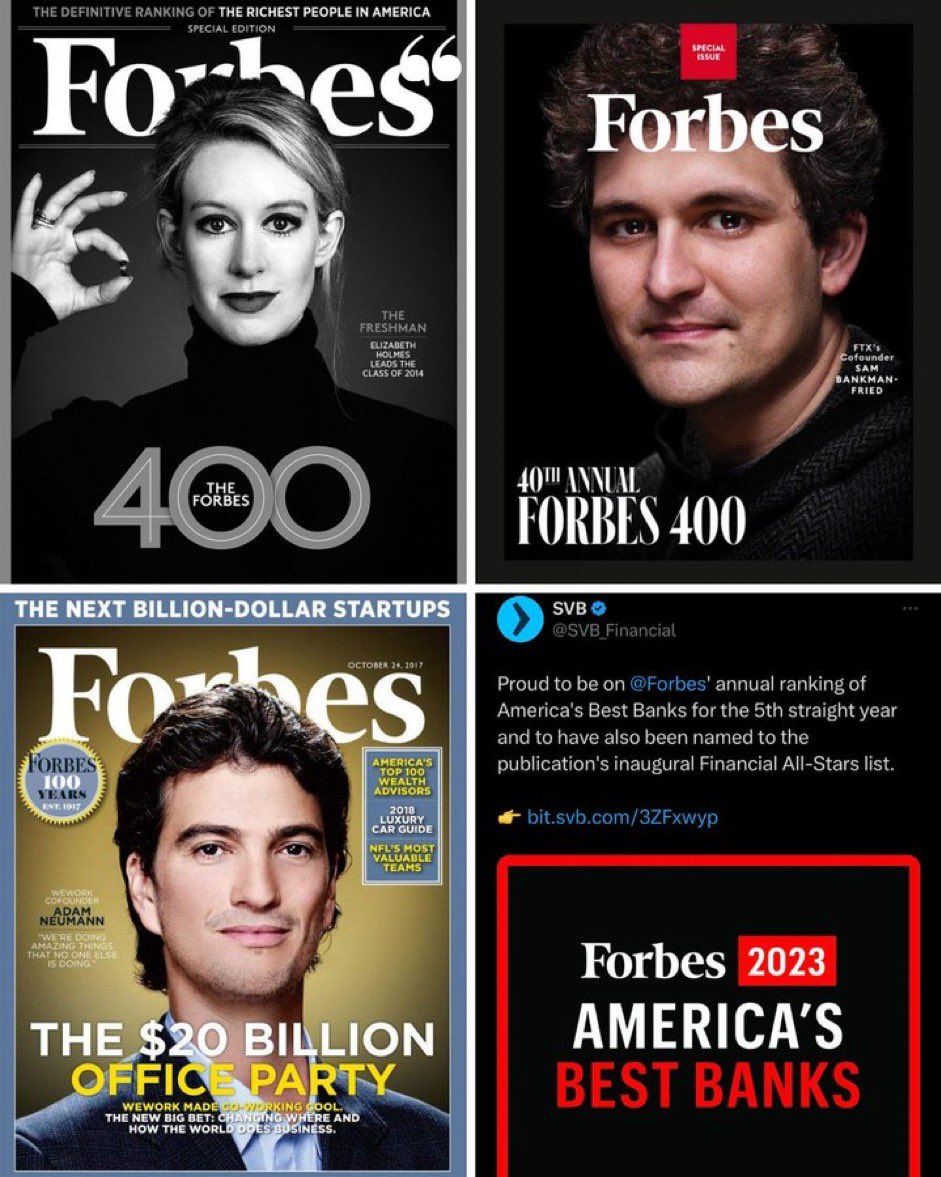

It really makes you think. If the best of us, our bankers, can fail at their jobs, it can happen to any of us. There but for grace of God.

@Horace said in Silicon Valley Bank / SVB Financial Group:

It really makes you think. If the best of us, our bankers, can fail at their jobs, it can happen to any of us. There but for grace of God.

Bean counters, technocrats and MBAs are not the best of us or of any known civilisation, past or present.

-

The author argues that “2018’s Regulatory Rollback Made the SVB Catastrophe More Likely” and “S.2155 Allowed Regulators to Miss SVB’s Warning Signs.” Prior to the 2018 regulatory rollback, Dodd-Frank required sharp regulatory monitoring ad “stress testing” of liquidities for banks with assets over $50 Billion — this would have included SVB. But the 2018 regulatory rollback raised that threshold to $250 Billion, that higher threshold allowed SVB (and many other regional banks) to operate under weakened regulatory oversight and a bunch of less stringent rules (examples cited in the article). The argument goes that SVB might not have gotten to where it was had all the original Dodd-Frank rules were left in place.