Silicon Valley Bank / SVB Financial Group

-

Home Depot co-founder torches ‘woke’ Silicon Valley Bank collapse, warns recession may be here already

Banks are more concerned with 'global warming' than shareholder returns, Bernie Marcus argued

That line will be repeated.

-

Can Jon, or somebody who knows about this explain to me using words of one syllable or less why a bank would have uninsured deposits? Is it just that they will only insure up to a certain amount?

-

I believe they grew so quickly from 2019-2021 that they couldn’t even lend out money fast enough. (Reminder, banks loan/invest their money to make a profit. Whether they are using clients money, I presume?… but prefer ignorance to be honest.) Anyway, since they couldn’t loan it fast enough they invested in a shit ton of government treasury bonds. Normally that would be fine and they’d make a profit after 10 years on the bonds, but once lots of companies started withdrawing funds, they had to sell a ton of their bonds early and take lots of losses, then once that word was out, everyone tried to withdraw last Thursday/Friday only to find out…oops!

Something like that.

-

Can Jon, or somebody who knows about this explain to me using words of one syllable or less why a bank would have uninsured deposits? Is it just that they will only insure up to a certain amount?

@Doctor-Phibes said in Silicon Valley Bank / SVB Financial Group:

... explain to me using words of one syllable or less why a bank would have uninsured deposits?

https://www.fdic.gov/regulations/laws/rules/1000-1200.html

The law, the Federal Deposit Insurance Act, currently defines the term "standard maximum deposit insurance amount" to mean $250,000 per depositor.

Most banks just go with that maximum when it comes to insuring depositors' money. So in most situations if you have more than $250,000 in a bank and that bank goes under, your first $250,000 is insured but any amount over $250,000 is not. If you spread your money across multiple banks such that no one bank has more than $250,000 of your deposits, that most likely all your deposits are insured.

-

The other problem with SVB, from what I understand, is that the minimum "cash on hand" amount had been lowered because ... COVID.

IOW, banks used to be required to have a certain amount of liquid funds available should depositors request withdrawals. SVB played it close to the (newly adjusted lower) line. The bank also invested in long-term bonds, expecting great returns. When this became known, depositors said, "Gimme mah moneeee!"

https://finance.yahoo.com/news/svb-spectacularly-fails-unthinkable-heresy-222710493.html

In a meeting late last week, Moody’s Investors Service had bad news for SVB: the bank’s unrealized losses meant it was at serious risk of a credit downgrade, potentially of more than one level, according to a person familiar with the matter.

That put SVB in a tough spot. To shore up its balance sheet, it would need to offload a large portion of its bond investments at a loss to increase its liquidity — potentially spooking depositors. But standing pat and getting hit with a multi-notch downgrade could trigger a similar exodus.

SVB, along with its adviser, Goldman Sachs Group Inc., ultimately decided to sell the portfolio and announce a $2.25 billion equity deal, said the person, who requested anonymity to discuss internal deliberations. It was downgraded by Moody’s on Wednesday anyway.

At the time, large mutual funds and hedge funds indicated interest in taking sizable positions in the shares, the person said.

That is, until they realized how quickly the bank was hemorrhaging deposits, which only got worse on Thursday after a number of prominent venture capital firms, including Peter Thiel’s Founders Fund, were advising portfolio companies to pull money as a precaution.

Around that same time, on Thursday afternoon, SVB was reaching out to its biggest clients, stressing that it was well-capitalized, had a high-quality balance sheet and “ample liquidity and flexibility,” according to a memo viewed by Bloomberg. Becker had a conference call in which he urged people to “stay calm.”

But they were already too late.

SVB “should have paid attention to the basics of banking: that similar depositors will walk in similar ways all at the same time,” said Daniel Cohen, former chairman of The Bancorp. “Bankers always overestimate the loyalty of their customers.”

-

Again, banking law reform. I don't think we have to go back to the 1930's, but things have to tighten up.

@Jolly said in Silicon Valley Bank / SVB Financial Group:

Again, banking law reform. I don't think we have to go back to the 1930's, but things have to tighten up.

You'd really think we'd have learned our lesson from 2008.

And when I say 'we', I mean the government.

-

@Jolly said in Silicon Valley Bank / SVB Financial Group:

Again, banking law reform. I don't think we have to go back to the 1930's, but things have to tighten up.

You'd really think we'd have learned our lesson from 2008.

And when I say 'we', I mean the government.

@Doctor-Phibes said in Silicon Valley Bank / SVB Financial Group:

@Jolly said in Silicon Valley Bank / SVB Financial Group:

Again, banking law reform. I don't think we have to go back to the 1930's, but things have to tighten up.

You'd really think we'd have learned our lesson from 2008.

And when I say 'we', I mean the government.

Money talks. I don't know what a pet senator or congressman costs nowadays, but banks do have money...

-

I know a lot of people are pointing to the 2018 rollback of Dodd Frank, but I don’t see where that would have made a difference in this particular case?

-

-

Silicon Valley Bank paid out bonuses hours before seizure

Silicon Valley Bank on Friday paid out annual bonuses to eligible U.S. employees, just hours before the bank was seized by the U.S. government, Axios has learned from multiple sources.

What to know: The bonuses were for work done during 2022, and were previously scheduled to be disbursed on March 10. That date ultimately coincided with the bank's takeover by the Federal Deposit Insurance Corporation.

- Bonuses for employees in some other countries were scheduled for later in the month, so those haven't yet been paid.

State of play: An unknown number of SVB employees were emailed by the FDIC on Friday evening, offering them employment with the remnant organization for the next 45 days.

- The employees would be compensated 1.5x times their normal salaries, while hourly workers would receive 2x their normal wages for overtime.

- An FDIC spokesperson tells Axios: "Without commenting on salaries, it’s our standard practice to ask retain [sic] bank employees to assist with an orderly transition as part of our resolution process."

-

I know a lot of people are pointing to the 2018 rollback of Dodd Frank, but I don’t see where that would have made a difference in this particular case?

@LuFins-Dad said in Silicon Valley Bank / SVB Financial Group:

I know a lot of people are pointing to the 2018 rollback of Dodd Frank, but I don’t see where that would have made a difference in this particular case?

Doesn’t make much sense. This bank took an unusual amount of interest rate risk, depositors got nervous and started a run.

-

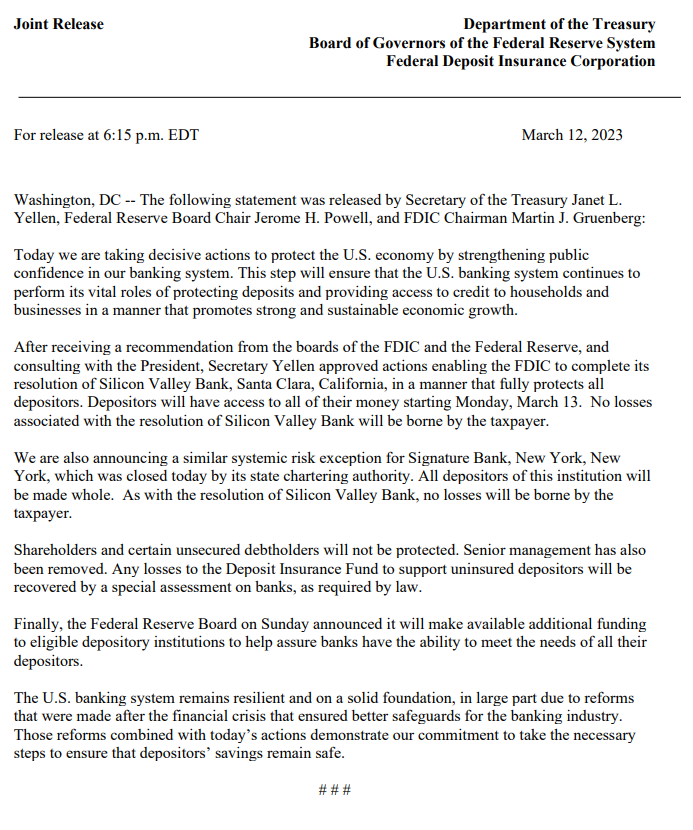

no losses will be borne by the taxpayers…

Well, today’s taxpayers… Your kids, otoh…