The Bitcoin/Crypto Thread

-

Bad day for Crypto, lol. I may need to switch my purchasing from Monday to Tuesday…

-

I've opened an additional ccount at an US exchange, Kraken.

I wonder how safe the deposit there is. Over here, there's a kind of insurance that protects me from insolvency risk of the exchange or bank.

Any particular keywords I need to look out for in their terms of service to gauge how safe my money is?

-

I've opened an additional ccount at an US exchange, Kraken.

I wonder how safe the deposit there is. Over here, there's a kind of insurance that protects me from insolvency risk of the exchange or bank.

Any particular keywords I need to look out for in their terms of service to gauge how safe my money is?

-

@doctor-phibes said in The Bitcoin/Crypto Thread:

@klaus said in The Bitcoin/Crypto Thread:

Kraken

Oh no.

It's no good?

-

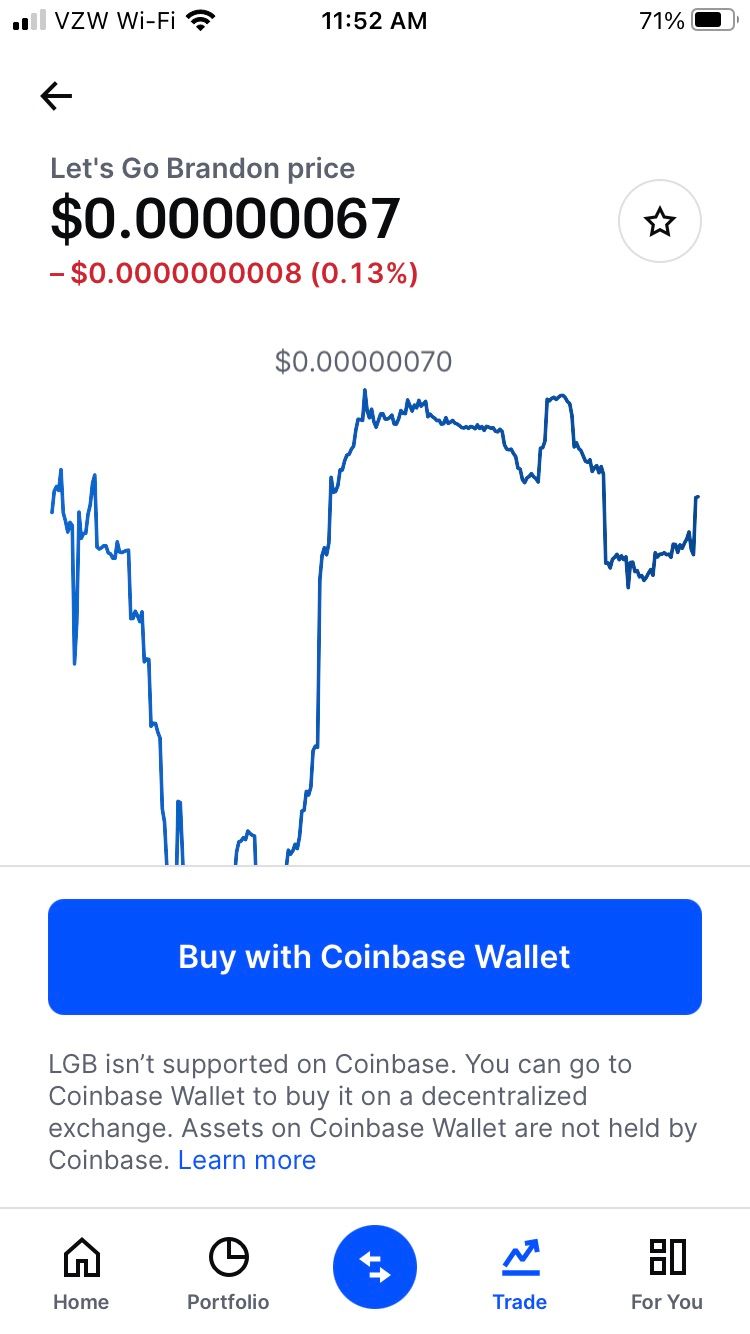

Might I interest @Jolly @Improviso and @Larry in the Let’s Go Brandon currency?

-

@doctor-phibes said in The Bitcoin/Crypto Thread:

@klaus said in The Bitcoin/Crypto Thread:

Kraken

Oh no.

It's no good?

@klaus said in The Bitcoin/Crypto Thread:

@doctor-phibes said in The Bitcoin/Crypto Thread:

@klaus said in The Bitcoin/Crypto Thread:

Kraken

Oh no.

It's no good?

Dude, you've released the Kraken!

-

@lufins-dad said in The Bitcoin/Crypto Thread:

Might I interest @Jolly @Improviso and @Larry in the Let’s Go Brandon currency?

What kind of Ponzi scheme is this?

-

I think I'll also diversify and buy a little Solana and Cardano, and maybe some Polkadot. Each of them has something that none of the others have.

@klaus said in The Bitcoin/Crypto Thread:

I think I'll also diversify and buy a little Solana and Cardano, and maybe some Polkadot. Each of them has something that none of the others have.

What the hell did you do?! Solana is bouncing along all nice and average, Klaus buys some and POW! Straight down the crapper….

-

-

@ivorythumper said in The Bitcoin/Crypto Thread:

If Bitcoin continues to exist for the next few hundred years, we will see the reverse problem: A house costing 0.00000000001 Bitcoin or something. The amount of Bitcoin will soon start to shrink every year. Bitcoin that is lost can never return.

-

Anyone use tether when banking between coins?

Could be a bigger Ponzi scheme than madoff:

-

@ivorythumper said in The Bitcoin/Crypto Thread:

If Bitcoin continues to exist for the next few hundred years, we will see the reverse problem: A house costing 0.00000000001 Bitcoin or something. The amount of Bitcoin will soon start to shrink every year. Bitcoin that is lost can never return.

@klaus said in The Bitcoin/Crypto Thread:

@ivorythumper said in The Bitcoin/Crypto Thread:

If Bitcoin continues to exist for the next few hundred years, we will see the reverse problem: A house costing 0.00000000001 Bitcoin or something. The amount of Bitcoin will soon start to shrink every year. Bitcoin that is lost can never return.

Bitcoin (tm) is just one brand. There can be a whole lot of competitive ways to buy and sell with other alt coins, right? So if Shiba Inu is capitalized for 1,000,000,000,000,000 coins, and there are a couple of other dozen competitors, how does ever get to a useful money supply to peg to any hard currency?

-

@klaus said in The Bitcoin/Crypto Thread:

@ivorythumper said in The Bitcoin/Crypto Thread:

If Bitcoin continues to exist for the next few hundred years, we will see the reverse problem: A house costing 0.00000000001 Bitcoin or something. The amount of Bitcoin will soon start to shrink every year. Bitcoin that is lost can never return.

Bitcoin (tm) is just one brand. There can be a whole lot of competitive ways to buy and sell with other alt coins, right? So if Shiba Inu is capitalized for 1,000,000,000,000,000 coins, and there are a couple of other dozen competitors, how does ever get to a useful money supply to peg to any hard currency?

@ivorythumper said in The Bitcoin/Crypto Thread:

@klaus said in The Bitcoin/Crypto Thread:

@ivorythumper said in The Bitcoin/Crypto Thread:

If Bitcoin continues to exist for the next few hundred years, we will see the reverse problem: A house costing 0.00000000001 Bitcoin or something. The amount of Bitcoin will soon start to shrink every year. Bitcoin that is lost can never return.

Bitcoin (tm) is just one brand. There can be a whole lot of competitive ways to buy and sell with other alt coins, right? So if Shiba Inu is capitalized for 1,000,000,000,000,000 coins, and there are a couple of other dozen competitors, how does ever get to a useful money supply to peg to any hard currency?

Their are hundreds or even thousands of Credit Card/Charge Card systems. Most of the major ones are built off the Visa, MasterCard, Discover, and American Express platforms, but there are also innumerable retailers with their own unique platforms. Kohl’s, Macy’s, Target, and on, and on, and on…

Ethereum and possibly Solana stand primed to be your Visa and MC platforms… Then you have other currencies built off of these platforms such as Cardano… These fill the slot that the individual banks fill such as Chase or Citibank. Many of these little alt coins are built for specific and limited use in different gaming or specialty platforms. These are comparable to your small retail cards for specific stores.

There are several competing currencies and marketplaces to handle transactions and tying it to hard currencies.

-

@ivorythumper said in The Bitcoin/Crypto Thread:

@klaus said in The Bitcoin/Crypto Thread:

@ivorythumper said in The Bitcoin/Crypto Thread:

If Bitcoin continues to exist for the next few hundred years, we will see the reverse problem: A house costing 0.00000000001 Bitcoin or something. The amount of Bitcoin will soon start to shrink every year. Bitcoin that is lost can never return.

Bitcoin (tm) is just one brand. There can be a whole lot of competitive ways to buy and sell with other alt coins, right? So if Shiba Inu is capitalized for 1,000,000,000,000,000 coins, and there are a couple of other dozen competitors, how does ever get to a useful money supply to peg to any hard currency?

Their are hundreds or even thousands of Credit Card/Charge Card systems. Most of the major ones are built off the Visa, MasterCard, Discover, and American Express platforms, but there are also innumerable retailers with their own unique platforms. Kohl’s, Macy’s, Target, and on, and on, and on…

Ethereum and possibly Solana stand primed to be your Visa and MC platforms… Then you have other currencies built off of these platforms such as Cardano… These fill the slot that the individual banks fill such as Chase or Citibank. Many of these little alt coins are built for specific and limited use in different gaming or specialty platforms. These are comparable to your small retail cards for specific stores.

There are several competing currencies and marketplaces to handle transactions and tying it to hard currencies.

@lufins-dad said in The Bitcoin/Crypto Thread:

@ivorythumper said in The Bitcoin/Crypto Thread:

@klaus said in The Bitcoin/Crypto Thread:

@ivorythumper said in The Bitcoin/Crypto Thread:

If Bitcoin continues to exist for the next few hundred years, we will see the reverse problem: A house costing 0.00000000001 Bitcoin or something. The amount of Bitcoin will soon start to shrink every year. Bitcoin that is lost can never return.

Bitcoin (tm) is just one brand. There can be a whole lot of competitive ways to buy and sell with other alt coins, right? So if Shiba Inu is capitalized for 1,000,000,000,000,000 coins, and there are a couple of other dozen competitors, how does ever get to a useful money supply to peg to any hard currency?

Their are hundreds or even thousands of Credit Card/Charge Card systems. Most of the major ones are built off the Visa, MasterCard, Discover, and American Express platforms, but there are also innumerable retailers with their own unique platforms. Kohl’s, Macy’s, Target, and on, and on, and on…

Ethereum and possibly Solana stand primed to be your Visa and MC platforms… Then you have other currencies built off of these platforms such as Cardano… These fill the slot that the individual banks fill such as Chase or Citibank. Many of these little alt coins are built for specific and limited use in different gaming or specialty platforms. These are comparable to your small retail cards for specific stores.

There are several competing currencies and marketplaces to handle transactions and tying it to hard currencies.

I still don’t know what the pain points in the current MC/Visa platform are for consumers that crypto would solve.

How would my life be different if Amazon and all other retailers accepted Future Coin?

-

@lufins-dad said in The Bitcoin/Crypto Thread:

@ivorythumper said in The Bitcoin/Crypto Thread:

@klaus said in The Bitcoin/Crypto Thread:

@ivorythumper said in The Bitcoin/Crypto Thread:

If Bitcoin continues to exist for the next few hundred years, we will see the reverse problem: A house costing 0.00000000001 Bitcoin or something. The amount of Bitcoin will soon start to shrink every year. Bitcoin that is lost can never return.

Bitcoin (tm) is just one brand. There can be a whole lot of competitive ways to buy and sell with other alt coins, right? So if Shiba Inu is capitalized for 1,000,000,000,000,000 coins, and there are a couple of other dozen competitors, how does ever get to a useful money supply to peg to any hard currency?

Their are hundreds or even thousands of Credit Card/Charge Card systems. Most of the major ones are built off the Visa, MasterCard, Discover, and American Express platforms, but there are also innumerable retailers with their own unique platforms. Kohl’s, Macy’s, Target, and on, and on, and on…

Ethereum and possibly Solana stand primed to be your Visa and MC platforms… Then you have other currencies built off of these platforms such as Cardano… These fill the slot that the individual banks fill such as Chase or Citibank. Many of these little alt coins are built for specific and limited use in different gaming or specialty platforms. These are comparable to your small retail cards for specific stores.

There are several competing currencies and marketplaces to handle transactions and tying it to hard currencies.

I still don’t know what the pain points in the current MC/Visa platform are for consumers that crypto would solve.

How would my life be different if Amazon and all other retailers accepted Future Coin?

@xenon said in The Bitcoin/Crypto Thread:

@lufins-dad said in The Bitcoin/Crypto Thread:

@ivorythumper said in The Bitcoin/Crypto Thread:

@klaus said in The Bitcoin/Crypto Thread:

@ivorythumper said in The Bitcoin/Crypto Thread:

If Bitcoin continues to exist for the next few hundred years, we will see the reverse problem: A house costing 0.00000000001 Bitcoin or something. The amount of Bitcoin will soon start to shrink every year. Bitcoin that is lost can never return.

Bitcoin (tm) is just one brand. There can be a whole lot of competitive ways to buy and sell with other alt coins, right? So if Shiba Inu is capitalized for 1,000,000,000,000,000 coins, and there are a couple of other dozen competitors, how does ever get to a useful money supply to peg to any hard currency?

Their are hundreds or even thousands of Credit Card/Charge Card systems. Most of the major ones are built off the Visa, MasterCard, Discover, and American Express platforms, but there are also innumerable retailers with their own unique platforms. Kohl’s, Macy’s, Target, and on, and on, and on…

Ethereum and possibly Solana stand primed to be your Visa and MC platforms… Then you have other currencies built off of these platforms such as Cardano… These fill the slot that the individual banks fill such as Chase or Citibank. Many of these little alt coins are built for specific and limited use in different gaming or specialty platforms. These are comparable to your small retail cards for specific stores.

There are several competing currencies and marketplaces to handle transactions and tying it to hard currencies.

I still don’t know what the pain points in the current MC/Visa platform are for consumers that crypto would solve.

How would my life be different if Amazon and all other retailers accepted Future Coin?

Well, instead of paying 16% interest you could be making 16% interest for one...

-

@xenon said in The Bitcoin/Crypto Thread:

@lufins-dad said in The Bitcoin/Crypto Thread:

@ivorythumper said in The Bitcoin/Crypto Thread:

@klaus said in The Bitcoin/Crypto Thread:

@ivorythumper said in The Bitcoin/Crypto Thread:

If Bitcoin continues to exist for the next few hundred years, we will see the reverse problem: A house costing 0.00000000001 Bitcoin or something. The amount of Bitcoin will soon start to shrink every year. Bitcoin that is lost can never return.

Bitcoin (tm) is just one brand. There can be a whole lot of competitive ways to buy and sell with other alt coins, right? So if Shiba Inu is capitalized for 1,000,000,000,000,000 coins, and there are a couple of other dozen competitors, how does ever get to a useful money supply to peg to any hard currency?

Their are hundreds or even thousands of Credit Card/Charge Card systems. Most of the major ones are built off the Visa, MasterCard, Discover, and American Express platforms, but there are also innumerable retailers with their own unique platforms. Kohl’s, Macy’s, Target, and on, and on, and on…

Ethereum and possibly Solana stand primed to be your Visa and MC platforms… Then you have other currencies built off of these platforms such as Cardano… These fill the slot that the individual banks fill such as Chase or Citibank. Many of these little alt coins are built for specific and limited use in different gaming or specialty platforms. These are comparable to your small retail cards for specific stores.

There are several competing currencies and marketplaces to handle transactions and tying it to hard currencies.

I still don’t know what the pain points in the current MC/Visa platform are for consumers that crypto would solve.

How would my life be different if Amazon and all other retailers accepted Future Coin?

Well, instead of paying 16% interest you could be making 16% interest for one...

@lufins-dad said in The Bitcoin/Crypto Thread:

@xenon said in The Bitcoin/Crypto Thread:

@lufins-dad said in The Bitcoin/Crypto Thread:

@ivorythumper said in The Bitcoin/Crypto Thread:

@klaus said in The Bitcoin/Crypto Thread:

@ivorythumper said in The Bitcoin/Crypto Thread:

If Bitcoin continues to exist for the next few hundred years, we will see the reverse problem: A house costing 0.00000000001 Bitcoin or something. The amount of Bitcoin will soon start to shrink every year. Bitcoin that is lost can never return.

Bitcoin (tm) is just one brand. There can be a whole lot of competitive ways to buy and sell with other alt coins, right? So if Shiba Inu is capitalized for 1,000,000,000,000,000 coins, and there are a couple of other dozen competitors, how does ever get to a useful money supply to peg to any hard currency?

Their are hundreds or even thousands of Credit Card/Charge Card systems. Most of the major ones are built off the Visa, MasterCard, Discover, and American Express platforms, but there are also innumerable retailers with their own unique platforms. Kohl’s, Macy’s, Target, and on, and on, and on…

Ethereum and possibly Solana stand primed to be your Visa and MC platforms… Then you have other currencies built off of these platforms such as Cardano… These fill the slot that the individual banks fill such as Chase or Citibank. Many of these little alt coins are built for specific and limited use in different gaming or specialty platforms. These are comparable to your small retail cards for specific stores.

There are several competing currencies and marketplaces to handle transactions and tying it to hard currencies.

I still don’t know what the pain points in the current MC/Visa platform are for consumers that crypto would solve.

How would my life be different if Amazon and all other retailers accepted Future Coin?

Well, instead of paying 16% interest you could be making 16% interest for one...

I never pay any interest on cards but still use them for all my transactions. I use the cards for convenience and online transactions.

I also don’t think pure coins would offer a credit platform - or if they did the incentives and prices wouldn’t be so different from current credit prices.

But credit is a different mechanism from currency.

-

The only advantage I hear for crypto is that it’s the payment tech of the future.

But, modern credit card payments are all based on modern SW tech.

Yeah - they don’t use a decentralized ledger, but has trustworthiness of the Visa / MC / Chase bank ledger been a problem for anyone here?

There are also human-based mechanisms like disputes and chargebacks built into their process that provide utility.

I just don’t know what the problem is that cryptocurrency is trying to solve.

What’s the vision for any easy future? Cross-border transactions?

-

@lufins-dad said in The Bitcoin/Crypto Thread:

@xenon said in The Bitcoin/Crypto Thread:

@lufins-dad said in The Bitcoin/Crypto Thread:

@ivorythumper said in The Bitcoin/Crypto Thread:

@klaus said in The Bitcoin/Crypto Thread:

@ivorythumper said in The Bitcoin/Crypto Thread:

If Bitcoin continues to exist for the next few hundred years, we will see the reverse problem: A house costing 0.00000000001 Bitcoin or something. The amount of Bitcoin will soon start to shrink every year. Bitcoin that is lost can never return.

Bitcoin (tm) is just one brand. There can be a whole lot of competitive ways to buy and sell with other alt coins, right? So if Shiba Inu is capitalized for 1,000,000,000,000,000 coins, and there are a couple of other dozen competitors, how does ever get to a useful money supply to peg to any hard currency?

Their are hundreds or even thousands of Credit Card/Charge Card systems. Most of the major ones are built off the Visa, MasterCard, Discover, and American Express platforms, but there are also innumerable retailers with their own unique platforms. Kohl’s, Macy’s, Target, and on, and on, and on…

Ethereum and possibly Solana stand primed to be your Visa and MC platforms… Then you have other currencies built off of these platforms such as Cardano… These fill the slot that the individual banks fill such as Chase or Citibank. Many of these little alt coins are built for specific and limited use in different gaming or specialty platforms. These are comparable to your small retail cards for specific stores.

There are several competing currencies and marketplaces to handle transactions and tying it to hard currencies.

I still don’t know what the pain points in the current MC/Visa platform are for consumers that crypto would solve.

How would my life be different if Amazon and all other retailers accepted Future Coin?

Well, instead of paying 16% interest you could be making 16% interest for one...

I never pay any interest on cards but still use them for all my transactions. I use the cards for convenience and online transactions.

I also don’t think pure coins would offer a credit platform - or if they did the incentives and prices wouldn’t be so different from current credit prices.

But credit is a different mechanism from currency.

@xenon said in The Bitcoin/Crypto Thread:

@lufins-dad said in The Bitcoin/Crypto Thread:

@xenon said in The Bitcoin/Crypto Thread:

@lufins-dad said in The Bitcoin/Crypto Thread:

@ivorythumper said in The Bitcoin/Crypto Thread:

@klaus said in The Bitcoin/Crypto Thread:

@ivorythumper said in The Bitcoin/Crypto Thread:

If Bitcoin continues to exist for the next few hundred years, we will see the reverse problem: A house costing 0.00000000001 Bitcoin or something. The amount of Bitcoin will soon start to shrink every year. Bitcoin that is lost can never return.

Bitcoin (tm) is just one brand. There can be a whole lot of competitive ways to buy and sell with other alt coins, right? So if Shiba Inu is capitalized for 1,000,000,000,000,000 coins, and there are a couple of other dozen competitors, how does ever get to a useful money supply to peg to any hard currency?

Their are hundreds or even thousands of Credit Card/Charge Card systems. Most of the major ones are built off the Visa, MasterCard, Discover, and American Express platforms, but there are also innumerable retailers with their own unique platforms. Kohl’s, Macy’s, Target, and on, and on, and on…

Ethereum and possibly Solana stand primed to be your Visa and MC platforms… Then you have other currencies built off of these platforms such as Cardano… These fill the slot that the individual banks fill such as Chase or Citibank. Many of these little alt coins are built for specific and limited use in different gaming or specialty platforms. These are comparable to your small retail cards for specific stores.

There are several competing currencies and marketplaces to handle transactions and tying it to hard currencies.

I still don’t know what the pain points in the current MC/Visa platform are for consumers that crypto would solve.

How would my life be different if Amazon and all other retailers accepted Future Coin?

Well, instead of paying 16% interest you could be making 16% interest for one...

I never pay any interest on cards but still use them for all my transactions. I use the cards for convenience and online transactions.

I also don’t think pure coins would offer a credit platform - or if they did the incentives and prices wouldn’t be so different from current credit prices.

But credit is a different mechanism from currency.

I'm not saying that Crypto will offer "credit" (though there is some research in that arena).

My comparison is using Crypto for a "cash" payment vs using a credit card. While you may get your card paid off every month, a lot of people don't. They intend to, but they miss it. If this didn't happen, the credit cards wouldn't be in business. Even for you, however, Crypto would still be a more secure payment option. A lot lower risk of fraud and personal identity theft. It will also be easier and cheaper for you to send and receive funds personally. Yes, Venmo works pretty well, but there is still a lot of personal security risk there.

Overseas payments are far easier, cheaper, and more secure. I recently received an EFT for a piano purchase where the customer sent the money from their German Bank. It took 7 days and 2 additional banks to take care of the proper handshakes and receive the money.

-

The only advantage I hear for crypto is that it’s the payment tech of the future.

But, modern credit card payments are all based on modern SW tech.

Yeah - they don’t use a decentralized ledger, but has trustworthiness of the Visa / MC / Chase bank ledger been a problem for anyone here?

There are also human-based mechanisms like disputes and chargebacks built into their process that provide utility.

I just don’t know what the problem is that cryptocurrency is trying to solve.

What’s the vision for any easy future? Cross-border transactions?

@xenon said in The Bitcoin/Crypto Thread:

I just don’t know what the problem is that cryptocurrency is trying to solve.

It seems to mainly be trying to solve the problem of people who don't like working for a living never having any money.