The Bitcoin/Crypto Thread

-

https://arstechnica.com/tech-policy/2024/12/teen-creates-memecoin-dumps-it-and-earns-50000/

Teen creates memecoin, dumps it, earns $50,000

This being a zero-sum game, the teen "earns" $50,000 means other people "lose" $50,000 elsewhere.

After all these years, it seems cryptocurrencies still have only one application: speculation.

@Axtremus said in The Bitcoin/Crypto Thread:

https://arstechnica.com/tech-policy/2024/12/teen-creates-memecoin-dumps-it-and-earns-50000/

Teen creates memecoin, dumps it, earns $50,000

This being a zero-sum game, the teen "earns" $50,000 means other people "lose" $50,000 elsewhere.

After all these years, it seems cryptocurrencies still have only one application: speculation.

You forgot money laundering.

-

It is speculating, but it’s not blind speculation. Emerging blockchain technologies do look to have very promising applications in secure data transfer. Healthcare systems are looking at using it for faster and more secure methods of transferring patient data, banks and credit card processors are investing into it for better and more secure financial transactions. There are applications that could make blockchains one of the most critical technologies developed in first half of the century, which could have significant financial implications. Tossing a few bucks into the pot doesn’t necessarily hurt. Especially with a pro-crypto admin coming in.

-

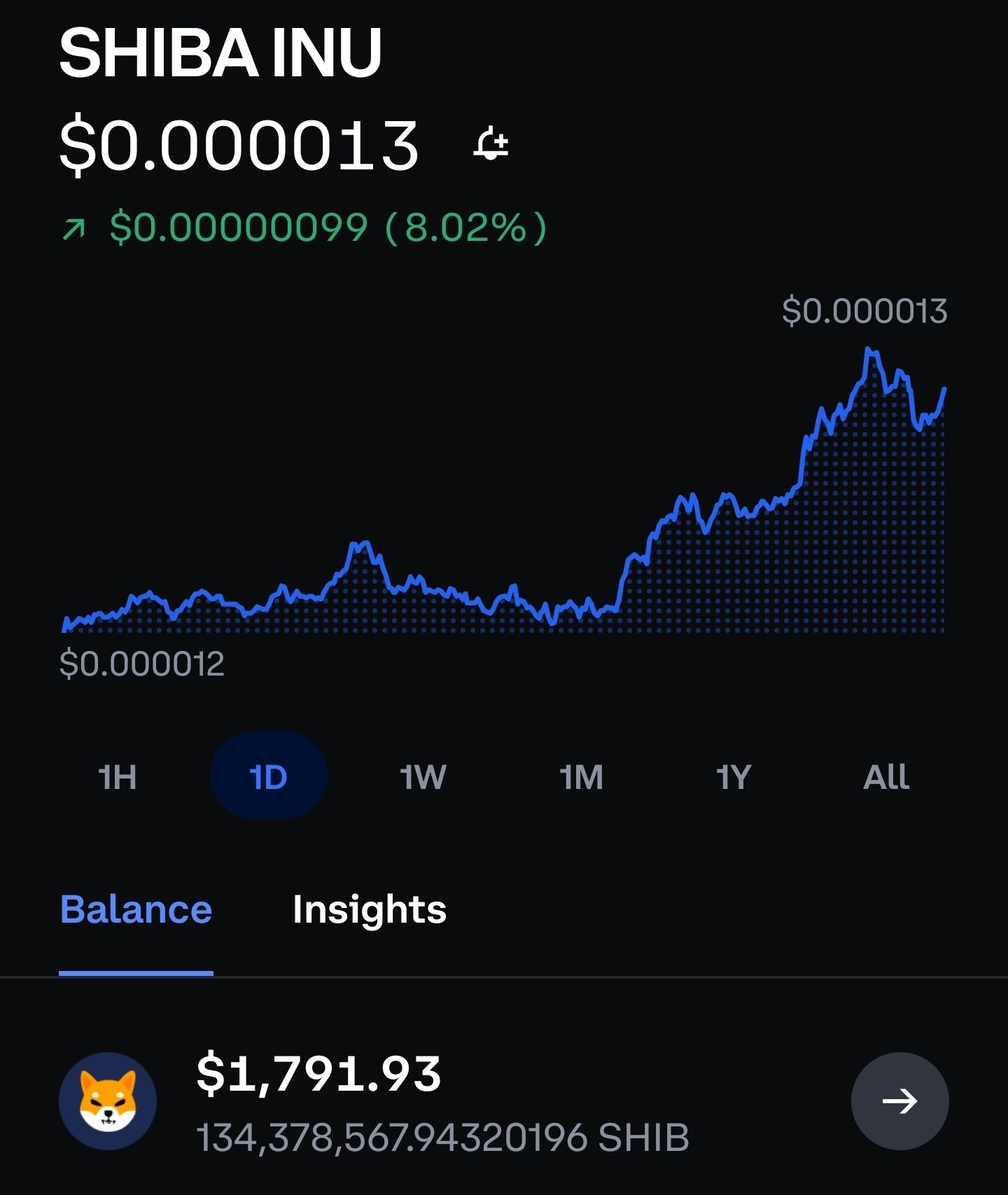

My "investment" or "wager" in Shiba Inu is currently almost twice what I have invested. I am waiting this cycle out, to see if it gets close to ATH. If it does I will cash out with 2 - 3 x the "lunch money investment" I made and still have 40 million of them

for which I will have spent zero "real coins"I have already cashed in 50% of my original wager in fiat dollars issued by the Federal Reserve Bank.

-

It is speculating, but it’s not blind speculation. Emerging blockchain technologies do look to have very promising applications in secure data transfer. Healthcare systems are looking at using it for faster and more secure methods of transferring patient data, banks and credit card processors are investing into it for better and more secure financial transactions. There are applications that could make blockchains one of the most critical technologies developed in first half of the century, which could have significant financial implications. Tossing a few bucks into the pot doesn’t necessarily hurt. Especially with a pro-crypto admin coming in.

@LuFins-Dad said in The Bitcoin/Crypto Thread:

It is speculating, but it’s not blind speculation. Emerging blockchain technologies do look to have very promising applications in secure data transfer. Healthcare systems are looking at using it for faster and more secure methods of transferring patient data, banks and credit card processors are investing into it for better and more secure financial transactions. There are applications that could make blockchains one of the most critical technologies developed in first half of the century, which could have significant financial implications. Tossing a few bucks into the pot doesn’t necessarily hurt. Especially with a pro-crypto admin coming in.

I don’t see the connection between the general value of an algorithm and the value of an application of that algorithm into a gambling game. The gambling game might still be useless.

-

What ultimately gives fiat currencies value is that governments require you to use them to pay taxes. No such equivalent for crypto.

@jon-nyc said in The Bitcoin/Crypto Thread:

What ultimately gives fiat currencies value is that governments require you to use them to pay taxes. No such equivalent for crypto.

Slightly imprecise framing IMO. I would say that fiat currencies have value because they are defined as valuable by entities with authority to impose violence on you, if you do not provide them that value upon request.

-

https://fortune.com/crypto/2025/01/30/errol-musk-memecoin-elon-tesla-donald-trump-crypto/

Elon Musk’s father Errol looks to monetize his famous name with ‘Musk It’ memecoin: ‘I’m the head of the family’

-

A close look into a cryptocurrency Ponzi scheme that took a town in Argentina, one of hundreds such schemes around the world.

-

https://www.pcworld.com/article/2767705/bitcoin-mining-is-no-longer-profitable.html

... the basic equation is that it now costs more in electricity to “mine” a single Bitcoin than that Bitcoin is currently worth—by a significant margin. Due to the nature of the Bitcoin protocol, which started the better part of two decades ago, it was inevitable that we’d reach this point eventually. The pool of minable Bitcoins shrinks as more are mined, and as that happens, the cryptographic work needed to “find” new ones becomes increasingly harder.

Coinshares, via reporting from Overlclockers.ru and PCGamer, reports that we’re now past that point—well past it, in fact. The math says that mining a new Bitcoin in 2025 costs approximately $137,000 USD in electricity, even if you have the (very expensive) computer power to do it, while that Bitcoin is worth about $95,000 on the open market. Even at its all-time high of over $100,000 earlier this year, and assuming ideal conditions with access to cheap power and hardware, it’s a losing game.

-

That doesn't make sense to me. The difficulty of mining a Bitcoin is adjusted every two weeks to get a block time around every 10 mins. That should make that situation very unlikely and self-correct quickly. Also, I believe the miners get something extra from the transaction costs.

-

Yes, from what I understand, the transaction costs are going to become more and more important until they become the single source of income for miners (namely when the maximum number of bitcoins has been reached).

In any case, I believe the protocol is self-adjusting in the sense that the situation above - mining more expensive than reward - self-corrects quickly.

-

Bitcoin has plummeted sharply amid fears U.S involvement in the Israel-Iran conflict could escalate into a wider regional war (adding to volatility expected from an imminent Federal Reserve earthquake).

The bitcoin price, after shrugging off the initial exchange of fire between Israel and Iran, has crashed under $100,000 per bitcoin despite U.S. president Donald Trump confirming a "massive" game-changer this week. Ethereum, XRP and other major cryptocurrencies have also plummeted, wiping $250 billion from the combined market in just 24 hours.

My question - who cares? Unless you have a high amount invested in bitcoin, does it really matter? If it drops to lets say, USD $10000, will it have any effect on the world economy? For me, I dont think so.

-

Bitcoin above $114,000 today. I haven't checked my coinbase balance in a while (it'll be something I check in the 2030s and then maybe cash out) but checked today.... nothing crazy but since 2021 I'm up like 230%. Not too bad. I'm still waiting for SHIBU to go to the moon so I can retire early with @mark