But can the Millennials afford it?

-

We have decided that we are never moving from here. When a new 2,000 sqft standard construction cost house located on a postage stamp size lot, costs $400k, I cringe.

@mark said in But can the Millennials afford it?:

We have decided that we are never moving from here. When a new 2,000 sqft standard construction cost house located on a postage stamp size lot, costs $400k, I cringe.

I could sell my house for about three times what we paid for it today. But I'd just have to buy something else, so where is the profit if I am not moving somewhere less expensive?

-

@mark said in But can the Millennials afford it?:

We have decided that we are never moving from here. When a new 2,000 sqft standard construction cost house located on a postage stamp size lot, costs $400k, I cringe.

I could sell my house for about three times what we paid for it today. But I'd just have to buy something else, so where is the profit if I am not moving somewhere less expensive?

@mik said in But can the Millennials afford it?:

@mark said in But can the Millennials afford it?:

We have decided that we are never moving from here. When a new 2,000 sqft standard construction cost house located on a postage stamp size lot, costs $400k, I cringe.

I could sell my house for about three times what we paid for it today. But I'd just have to buy something else, so where is the profit if I am not moving somewhere less expensive?

That last part is going to become very interesting, because that's going to become more and more possible as remote work becomes more commonplace.

-

@doctor-phibes said in But can the Millennials afford it?:

The 2.5 rule is pretty much impossible to follow in most of Massachusetts, at least when you're starting out. I followed it for our first two houses (UK and Canada), but not the third one, which is actually the smallest of the three.

Bloody New England.

Median income in Massachusetts is $80K. So $200K homes.

https://www.zillow.com/homedetails/79-Hope-St-Greenfield-MA-01301/56135299_zpid/

I found about 15 similar around the state. If you bump it up to 3 - 3.5% the options open up quite a bit more.

@lufins-dad said in But can the Millennials afford it?:

@doctor-phibes said in But can the Millennials afford it?:

Bloody New England.

https://www.zillow.com/homedetails/79-Hope-St-Greenfield-MA-01301/56135299_zpid/

Hey, my wife is from Greenfield. We were married in Northfield, just down the road.

It is almost in Vermont and almost in New Hampshire. You wouldn't want to commute to Boston, maybe Springfield.

The nearest airport is at Turner's Falls, you can see a picture of my airplane there in 2013 when I flew in to visit, small world.

Improv flew that plane.

-

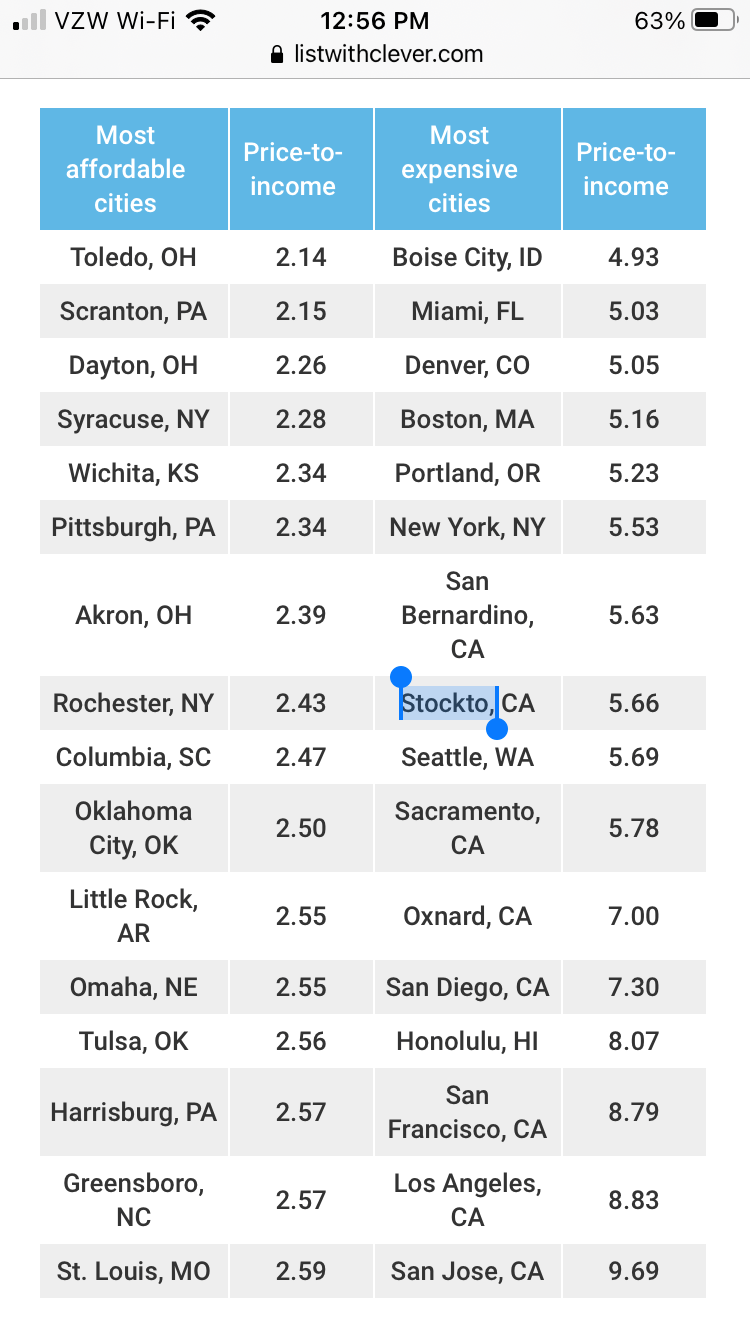

There was an old rule. It was a rule Karla and I followed when we bought our current house and it works in most areas of the country (or it did pre-Covid, now? Who knows...)

The rule was 2.5. Your house should cost about 2.5 times your annual income. And in most of the country that still worked a few years ago.

@lufins-dad said in But can the Millennials afford it?:

The rule was 2.5. Your house should cost about 2.5 times your annual income.

Good that you have a clear, quantitive measure for what is reasonable/affordable to you.

Lots of folks use cash flow type thinking (e.g., month payment being less than X% of monthly income) to decide on affordability. So it's refreshing to see that you use total cost to decide affordability. Nice!

-

@mik said in But can the Millennials afford it?:

@mark said in But can the Millennials afford it?:

We have decided that we are never moving from here. When a new 2,000 sqft standard construction cost house located on a postage stamp size lot, costs $400k, I cringe.

I could sell my house for about three times what we paid for it today. But I'd just have to buy something else, so where is the profit if I am not moving somewhere less expensive?

That last part is going to become very interesting, because that's going to become more and more possible as remote work becomes more commonplace.

@aqua-letifer said in But can the Millennials afford it?:

@mik said in But can the Millennials afford it?:

@mark said in But can the Millennials afford it?:

We have decided that we are never moving from here. When a new 2,000 sqft standard construction cost house located on a postage stamp size lot, costs $400k, I cringe.

I could sell my house for about three times what we paid for it today. But I'd just have to buy something else, so where is the profit if I am not moving somewhere less expensive?

That last part is going to become very interesting, because that's going to become more and more possible as remote work becomes more commonplace.

I think that is already a part of this migration...

-

And Aqua, I’m still going to disagree with you about what the Occupy movement was about. All we heard was a whole bunch of rhetoric about 1% vs the 99%, student debt forgiveness, and open borders. There was something about getting rid of credit reporting agencies, too. I suppose the housing prices may have been hidden in there somewhere in the general mantra of income inequality, but there was so much bullshit in there that any reasonable point they may have made is discredited because it came from them.

-

@jolly said in But can the Millennials afford it?:

@klaus said in But can the Millennials afford it?:

@jolly said in But can the Millennials afford it?:

How can a couple like this ever own a home? Or any of many similar couples like cop/pharm tech, construction worker/waitress, teacher/teacher...guys that are making anywhere from $75k-$90k/yr.

You mean household income of 75-90K$, right? If each of them makes that amount of $, that's would be way above average, no?

Household income. A young postman and a teacher or teacher/teacher down here would make around $80k-ish, together.

How much of that would need to be deducted for taxes? How much of that would they typically need to pay for health and pension insurance?

@klaus said in But can the Millennials afford it?:

@jolly said in But can the Millennials afford it?:

@klaus said in But can the Millennials afford it?:

@jolly said in But can the Millennials afford it?:

How can a couple like this ever own a home? Or any of many similar couples like cop/pharm tech, construction worker/waitress, teacher/teacher...guys that are making anywhere from $75k-$90k/yr.

You mean household income of 75-90K$, right? If each of them makes that amount of $, that's would be way above average, no?

Household income. A young postman and a teacher or teacher/teacher down here would make around $80k-ish, together.

How much of that would need to be deducted for taxes? How much of that would they typically need to pay for health and pension insurance?

Federal taxes would be minimal with two kids, but they certainly would be subject to sales taxes, state income taxes and property taxes, just to name a few off the top of my head.

Insurance could be through Tri-care or through the teacher's insurance. I'm guessing $500-ish/month for the family, because of the government jobs.

-

@jolly said in But can the Millennials afford it?:

@aqua-letifer said in But can the Millennials afford it?:

@lufins-dad said in But can the Millennials afford it?:

@aqua-letifer said in But can the Millennials afford it?:

I don't understand. Aren't we supposed to make fun of Millennials for whining about housing prices, because that's something they whined about during the Occupy Wall Street B.S.? We're not expected to take anything that came out of that seriously, are we? We're supposed to just say it's their fault and bring up participation trophies, right?

I mostly remember Occupy being primarily about dudes being upset because they were $150K in debt for erring a Masters Degree in Puppetry and Marionettes and were only able to get jobs as Elementary School Teachers making $45K a year living in NYC with a rent of $2500.

That and drum circles.

You don't remember that because you believed what you wanted without actually listening to any of them. I found most of their shit completely ridiculous, but I spent a lot of time listening anyway. That's why I'm able to tell you that a shitload of Occupy folks complained about housing prices being not only out of their reach, but perhaps forever so. Those complaints went on for months. You don't remember because Not My Side = they're everything I think they are and I have their number.

Well, they were good at building tent cities, so maybe they can try their hand at other forms of construction.

If you want sympathy for Occupy, look in the dictionary between shit and syphillis and you'll find the word.

The point, which you missed, is that they brought this very problem up years ago, but you didn't seem to take it seriously because of the source of the complaint. But looking at it from an angle conservatives can sympathize with, all of a sudden it's, well, shit, look what happened.

As for sympathy for Occupy, I just said, in a couple posts above this one, that I think they're ridiculous. What I said then, and what I'm trying to reiterate here, is that at the time, they were indeed complaining about real problems. That's separate from having legitimate gripes, which largely they didn't have.

@aqua-letifer said in But can the Millennials afford it?:

@jolly said in But can the Millennials afford it?:

@aqua-letifer said in But can the Millennials afford it?:

@lufins-dad said in But can the Millennials afford it?:

@aqua-letifer said in But can the Millennials afford it?:

I don't understand. Aren't we supposed to make fun of Millennials for whining about housing prices, because that's something they whined about during the Occupy Wall Street B.S.? We're not expected to take anything that came out of that seriously, are we? We're supposed to just say it's their fault and bring up participation trophies, right?

I mostly remember Occupy being primarily about dudes being upset because they were $150K in debt for erring a Masters Degree in Puppetry and Marionettes and were only able to get jobs as Elementary School Teachers making $45K a year living in NYC with a rent of $2500.

That and drum circles.

You don't remember that because you believed what you wanted without actually listening to any of them. I found most of their shit completely ridiculous, but I spent a lot of time listening anyway. That's why I'm able to tell you that a shitload of Occupy folks complained about housing prices being not only out of their reach, but perhaps forever so. Those complaints went on for months. You don't remember because Not My Side = they're everything I think they are and I have their number.

Well, they were good at building tent cities, so maybe they can try their hand at other forms of construction.

If you want sympathy for Occupy, look in the dictionary between shit and syphillis and you'll find the word.

The point, which you missed, is that they brought this very problem up years ago, but you didn't seem to take it seriously because of the source of the complaint. But looking at it from an angle conservatives can sympathize with, all of a sudden it's, well, shit, look what happened.

As for sympathy for Occupy, I just said, in a couple posts above this one, that I think they're ridiculous. What I said then, and what I'm trying to reiterate here, is that at the time, they were indeed complaining about real problems. That's separate from having legitimate gripes, which largely they didn't have.

Every swinging dick in the world has some legitimate beef, if you listen long enough.

The problem is that Occupy certainly drowned out that message, if they ever promoted it.

-

@mik said in But can the Millennials afford it?:

@mark said in But can the Millennials afford it?:

We have decided that we are never moving from here. When a new 2,000 sqft standard construction cost house located on a postage stamp size lot, costs $400k, I cringe.

I could sell my house for about three times what we paid for it today. But I'd just have to buy something else, so where is the profit if I am not moving somewhere less expensive?

That last part is going to become very interesting, because that's going to become more and more possible as remote work becomes more commonplace.

@aqua-letifer said in But can the Millennials afford it?:

@mik said in But can the Millennials afford it?:

@mark said in But can the Millennials afford it?:

We have decided that we are never moving from here. When a new 2,000 sqft standard construction cost house located on a postage stamp size lot, costs $400k, I cringe.

I could sell my house for about three times what we paid for it today. But I'd just have to buy something else, so where is the profit if I am not moving somewhere less expensive?

That last part is going to become very interesting, because that's going to become more and more possible as remote work becomes more commonplace.

Maybe.

In Louisiana, the state had gone to mostly remote work for the AFDC case workers. It was a bust...I talked with the supervisor for Region 8 and they were drawing their workers back in, due to productivity plummeting. COVID temporarily put an end to that, but I suspect it will start again, as things come back to "normal".

I suspect there are other jobs out there where the same thing happened.

-

@aqua-letifer said in But can the Millennials afford it?:

@mik said in But can the Millennials afford it?:

@mark said in But can the Millennials afford it?:

We have decided that we are never moving from here. When a new 2,000 sqft standard construction cost house located on a postage stamp size lot, costs $400k, I cringe.

I could sell my house for about three times what we paid for it today. But I'd just have to buy something else, so where is the profit if I am not moving somewhere less expensive?

That last part is going to become very interesting, because that's going to become more and more possible as remote work becomes more commonplace.

Maybe.

In Louisiana, the state had gone to mostly remote work for the AFDC case workers. It was a bust...I talked with the supervisor for Region 8 and they were drawing their workers back in, due to productivity plummeting. COVID temporarily put an end to that, but I suspect it will start again, as things come back to "normal".

I suspect there are other jobs out there where the same thing happened.

@jolly said in But can the Millennials afford it?:

@aqua-letifer said in But can the Millennials afford it?:

@mik said in But can the Millennials afford it?:

@mark said in But can the Millennials afford it?:

We have decided that we are never moving from here. When a new 2,000 sqft standard construction cost house located on a postage stamp size lot, costs $400k, I cringe.

I could sell my house for about three times what we paid for it today. But I'd just have to buy something else, so where is the profit if I am not moving somewhere less expensive?

That last part is going to become very interesting, because that's going to become more and more possible as remote work becomes more commonplace.

Maybe.

In Louisiana, the state had gone to mostly remote work for the AFDC case workers. It was a bust...I talked with the supervisor for Region 8 and they were drawing their workers back in, due to productivity plummeting. COVID temporarily put an end to that, but I suspect it will start again, as things come back to "normal".

I suspect there are other jobs out there where the same thing happened.

My job is entirely remote and will be forever. It started this year. My wife's temporarily remote until June, when they'll make it official and permanent for not only her but her entire department. And how many businesses do you know of that were able to start specifically because of COVID-created remote opportunities? I know three.

It's the digital age. If you can do a job remotely, then by definition your employers also have all the accountability tools they'll ever need. If productivity dropped, then either the managers were too dumb to know that, or they made terrible hires. Either way it's a completely avoidable problem.

-

My company resisted work from home for years due to productivity problems. COVID upended that and they found that maybe 95% of their work force did just fine from home. Prior to COVID it was the people wanting to work from home (with sketchy home lives and issues pulling them there) that skewed the numbers.

Going forward they are going to tilt toward work from home and performance manage the people that can't hack it.

-

@jolly said in But can the Millennials afford it?:

@axtremus said in But can the Millennials afford it?:

Why fixating on single family houses? Why not apartments/condos or multi family houses?

As a matter of public policy, fix zoning and incentives to promote low cost housing, multi family ones too; with means- and asset-testing to ensure that only those with modest income/asset get to buy them as their main residences (screen out “investors” looking to collect rental properties).

As matter of individual choices, take advantage of federal government programs like the FHA loans.

Maybe in your neck of the woods it's different, but few people I know point to a condo with pride of ownership.

People need to change their expectations. When we moved from Canada we were basically forced to buy a house that was half the square-footage for double the price.

Not being able to own the house you'd really like isn't the same as not being able to own a home.

@doctor-phibes said in But can the Millennials afford it?:

@jolly said in But can the Millennials afford it?:

@axtremus said in But can the Millennials afford it?:

Why fixating on single family houses? Why not apartments/condos or multi family houses?

As a matter of public policy, fix zoning and incentives to promote low cost housing, multi family ones too; with means- and asset-testing to ensure that only those with modest income/asset get to buy them as their main residences (screen out “investors” looking to collect rental properties).

As matter of individual choices, take advantage of federal government programs like the FHA loans.

Maybe in your neck of the woods it's different, but few people I know point to a condo with pride of ownership.

People need to change their expectations. When we moved from Canada we were basically forced to buy a house that was half the square-footage for double the price.

Not being able to own the house you'd really like isn't the same as not being able to own a home.

Well said.

Not saying it’s fair or nice, but it does seem there’s an expectation of how perfect your first purchased home will be. Can we blame HGTV?

-

Three years ago my 28-year-old single, divorced daughter got a no-down USDA loan (best kept secret) just outside the Portland Metro urban growth boundary and bought half of a duplex in an HOA neighborhood. Cost her $157,900 but was probably about a $180,00-190,000 value all because there were no interior pics because it had renters in it, you couldn't tour it until you made a rescindable offer, and it had sat on the market about a month.

Two years later and some improvements like all new flooring and landscaping she sold it for about $50k in profit and bought a condo in one of the most upscale communities just outside of Portland proper.

A little luck and some smart thinking. Her commute was about 30 minutes on a typical day, and sometimes a horrific 2 hours if there was an accident.

It can be done.