The IRS doesn't fuck around

-

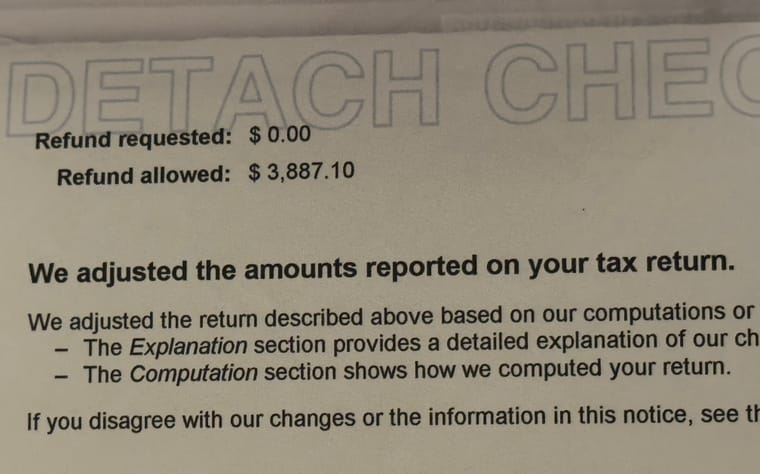

So for some inexplicable reason I underpaid my April 2024 estimated tax by 5k. Really I don't know why, my checks are always the same amount year after year. Probably a typo or brain fart, whatever you want to call it.

I filed in October of 2025 and (without checking) put in what I thought were my estimated taxes paid, not realizing about the 5k underpayment.

This week I got a notice in the mail - I owe them the 5k (fair enough) and interest of $798.86. But get this - a PENALTY of $4,412.49.

So my 5k underpayment results in me writing a check of $9,768.35.

FML.

-

When/how does someone need to do quarterly taxes? I always file and pay (or get paid) in April. This year I'm going to owe a lot for various company and investment reasons, wonder if that'll make me required to do quarterlies next year? I literally have no idea, I should ask TARS.

-

When/how does someone need to do quarterly taxes? I always file and pay (or get paid) in April. This year I'm going to owe a lot for various company and investment reasons, wonder if that'll make me required to do quarterlies next year? I literally have no idea, I should ask TARS.

@89th said in The IRS doesn't fuck around:

When/how does someone need to do quarterly taxes? I always file and pay (or get paid) in April. This year I'm going to owe a lot for various company and investment reasons, wonder if that'll make me required to do quarterlies next year? I literally have no idea, I should ask TARS.

Generally you have to keep you taxes paid throughout the year within a certain percentage of what you will end up owing (80 I think) or above what you actually owed the year before. For standard wage earners withholding covers that. If you have sufficient business income or investment income or other income for which no money is withheld that’s when it becomes necessary.

AI can give you the details.

-

I think there’s something else going on. I’m still investigating. I’ve paid small penalties before never something that grabbed your attention.

@jon-nyc said in The IRS doesn't fuck around:

I think there’s something else going on. I’m still investigating. I’ve paid small penalties before never something that grabbed your attention.

They've seen your posts on TNCR.

Seriously though--good luck with that. It's unconscionable unfair. But, that's why the IRS has the reputation it has.

-

Drinks are on Jon!!!!