Subsidizing Homeborrowership

-

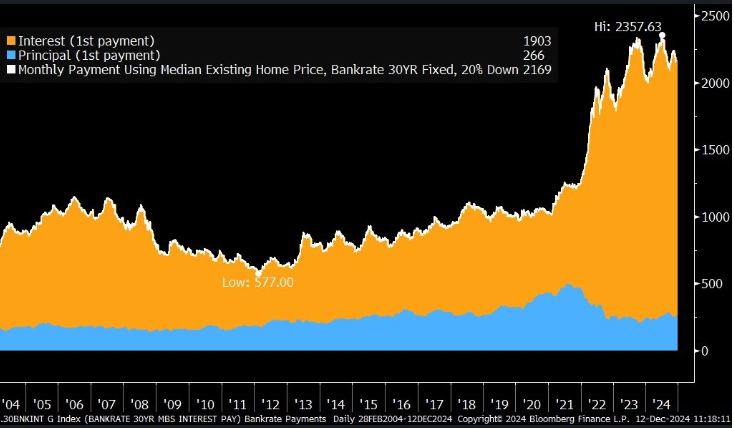

@jon-nyc any ideas of the sourcing of that graph? I’m seeing it pop up on Facebook, and while I see they cite Bloomberg and several realtor groups, there’s no actual citation or methodology for the graph listed. I’m strongly thinking it’s BS or poorly correlated data at the best.

-

The amount of principal being equal or lower than it was from 17-21 seems wrong, though, too. It would project that the median home value is lower than it was in 2021, and that’s certainly not the case.

-

I’m not trying to say that the interest rates haven’t drastically altered the equation. They obviously have… But as home prices have gone up, so too would the amount of principal paid per payment.

-

The other thing that strikes me is the recency bias. The interest rates over the past 25 years have been historically low. Even today. The total difference in principal vs interest as a percentage of the payment today isn’t that much more than it was in 2001. In fact, the mortgage interest rate today is actually lower than it was in 2001… The affordability crisis is not being caused by mortgage interest, it’s being caused by the Median home value skyrocketing increasing over 150% over 20 years while wages have only been a little better than stagnant.

-

The amount of principal being equal or lower than it was from 17-21 seems wrong, though, too. It would project that the median home value is lower than it was in 2021, and that’s certainly not the case.

@LuFins-Dad said in Subsidizing Homeborrowership:

The amount of principal being equal or lower than it was from 17-21 seems wrong, though, too. It would project that the median home value is lower than it was in 2021, and that’s certainly not the case.

I thought about that. It probably means that on average people were taking on longer term mortgages as rates rose - fewer 15yr and more 30 yr. That means less principal in the early payment.