Trumpenomics

-

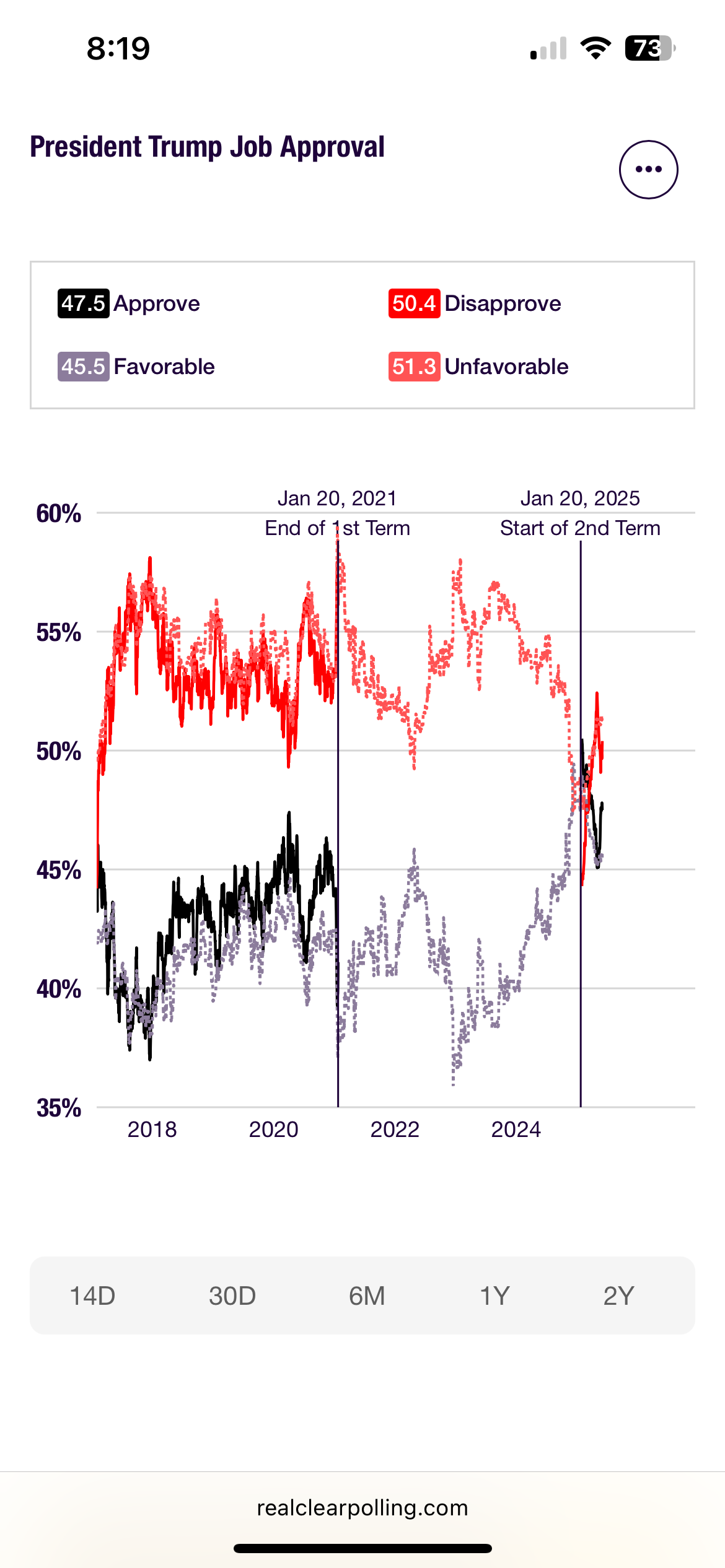

And yet his popularity is still higher than at any point his first term.

-

Current popularity is 43% (by Gallop poll)

-

Current popularity is 43% (by Gallop poll)

@taiwan_girl said in Trumpenomics:

Current popularity is 43% (by Gallop poll)

Here’s the aggregate….

-

The OECD lowers its global GDP growth projections for 2025 & 2026 due to Trump's tariffs:

https://www.oecd.org/en/publications/oecd-economic-outlook-volume-2025-issue-1_83363382-en.html

Key figures 3.1% ⏷ 2.9% Revision to projected global GDP growth for 2025 3.0% ⏷ 2.9% Revision to projected global GDP growth for 2026 -

U.S. manufacturing activity slumped in March to the lowest level in nearly three years as new orders plunged, and analysts said activity could decline further due to tighter credit conditions.

The Institute for Supply Management (ISM) survey on Monday showed all subcomponents of its manufacturing PMI below the 50 threshold for the first time since 2009. Some economists said this suggested a recession was around the corner, while others said much would depend on the services sector, whose PMI remains consistent with a growing economy.

-

China’s government is projecting confidence that it can outlast the U.S. in a protracted trade war in large part because of the potential damage inflicted by its restrictions on rare earth metals, said Eswar Prasad, a Cornell University economist who has spoken this week with Chinese finance officials.

“That is the choke point,” Prasad said. “Beijing does not feel like it is going to back down and that the U.S. is in no position to dictate terms. A big, big part of that is rare earths, where they feel they have the capacity to do significant harm to American manufacturers.”@jon-nyc said in Trumpenomics:

China’s government is projecting confidence that it can outlast the U.S. in a protracted trade war in large part because of the potential damage inflicted by its restrictions on rare earth metals, said Eswar Prasad, a Cornell University economist who has spoken this week with Chinese finance officials.

“That is the choke point,” Prasad said. “Beijing does not feel like it is going to back down and that the U.S. is in no position to dictate terms. A big, big part of that is rare earths, where they feel they have the capacity to do significant harm to American manufacturers.”Seems like it is happening unfortunately

A group representing auto suppliers in the United States called on Wednesday for immediate action to address China's restricted exports of rare earths, minerals and magnets, warning the issue could quickly disrupt auto parts production.

and

-

Gilead announced an $11B investment into new US manufacturing. Kraft is investing an additional $3 billion into new American manufacturing facilities. Carrier is investing $1 billion into a new factory, creating 4K jobs. The Dow is up roughly 3800 over last year. Not great, but not a disaster, either. It’s not all doom and gloom…

-

Too lazy to check, but:

- How do those investments compare to normal corporate manufacturing expenditures?

- How often are these announced investments actually realized?

- The DOW is up 8% since this time last year, but down 4% since Trump took over (was down 15% but has bounced back after a few TACO Tuesdays)

-

You fail to catch the point.

-

@Horace said in Trumpenomics:

Mission accomplished. We can stop the tariffs now.

And that's just Tesla's.

-

Actually, I think it’s okay to buy Teslas again…

-

Trade deficit cut in half. What’s cut in half you might ask? The spike in trade deficit that was the result of companies racing to import before liberation day. Another headline could’ve said, trade deficit returns to what the average was during the Biden administration.

-

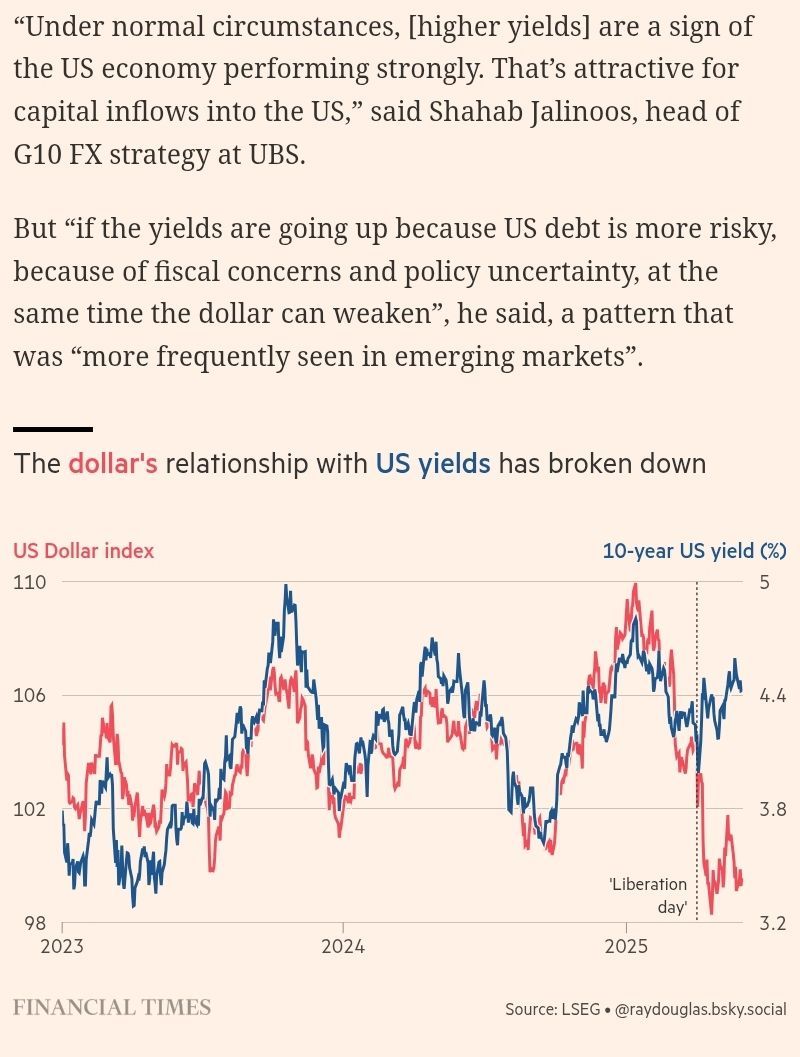

.1% CPI increase as opposed to the predicted .3%. Stock Futures jump, and Bond Rate drops…