Trumpenomics

-

If it was possible to have factories up and running within a month or two, this still wouldn’t have merit.

@LuFins-Dad said in Trumpenomics:

If it was possible to have factories up and running within a month or two, this still wouldn’t have merit.

I have hope that automation will be allowed to continue apace, and having automated factories in America would actually be a good thing. Musk is a pioneer of factory automation, so it's not far-fetched that this is in the mind of the administration.

The other hope would be that the tariffs are a negotiating tool which will motivate more advantageous trade agreements for America.

-

@LuFins-Dad said in Trumpenomics:

If it was possible to have factories up and running within a month or two, this still wouldn’t have merit.

I have hope that automation will be allowed to continue apace, and having automated factories in America would actually be a good thing. Musk is a pioneer of factory automation, so it's not far-fetched that this is in the mind of the administration.

The other hope would be that the tariffs are a negotiating tool which will motivate more advantageous trade agreements for America.

The other hope would be that the tariffs are a negotiating tool which will motivate more advantageous trade agreements for America.

Take dairy. Hypothetically Canada caves and gets rid of its supply management that assigns the US a tariff free quota for dairy products. We too revert back to a government subsidy system as in the US and EU, to keep our domestic dairy industry viable - you know, the Support Your Local Farmer ethos. The problem though is that consumers here are so pissed off at the US that they refuse to buy US produced dairy products. Canadian distributors and suppliers stop importing because the demand is not there. Consumers would rather pay a premium for Canadian or EU made products because they are not of US origin.

Once again I come back to the statement, you cannot fool the market.

-

@Jolly said in Trumpenomics:

- I think real estate is still in a bubble.

- I also think a lot of P/E ratios are hideous.

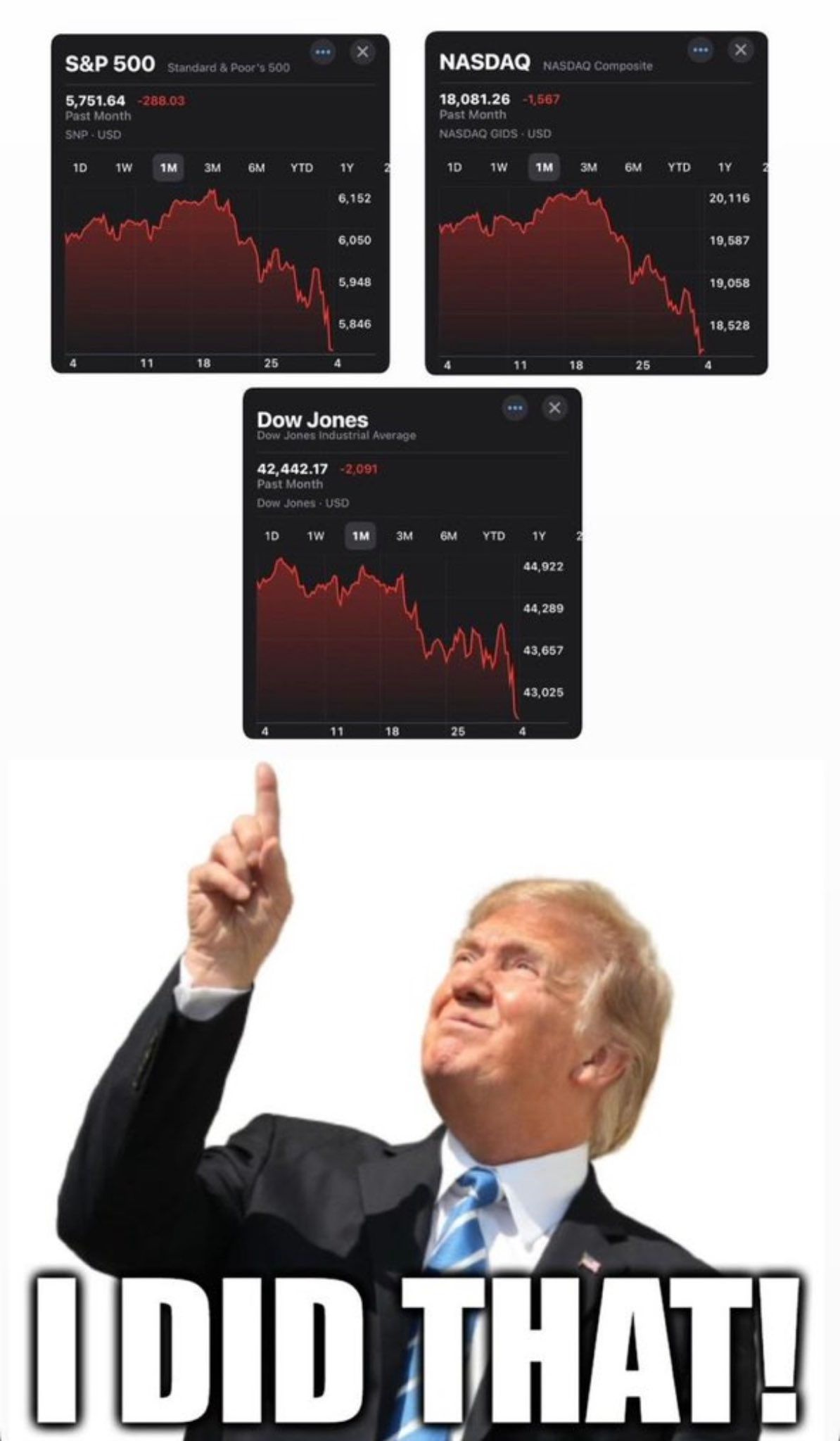

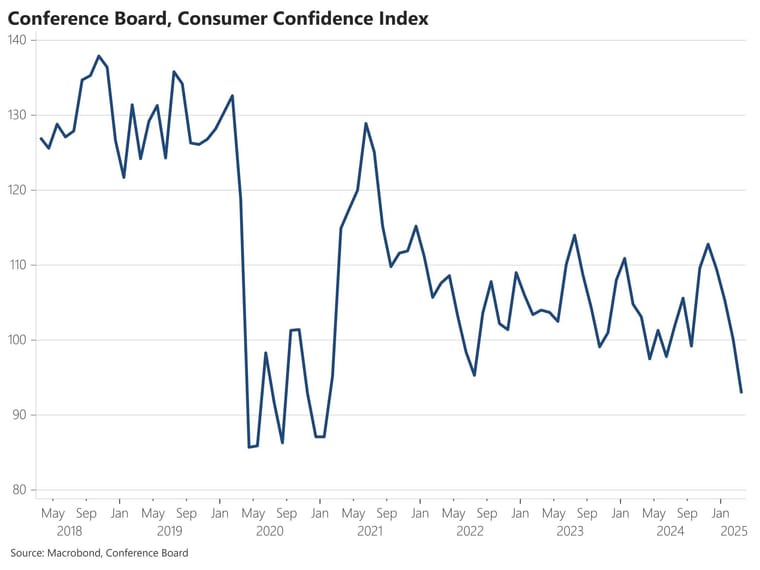

High asset prices and high PE ratios are products of market and consumer optimism.

I think the Trump policies are doing a great number on that optimism.

-

I don’t see the sociological signs of a housing bubble but I agree with you on P/Es.

Housing is expensive, largely because we subsidize homeborrowership while restricting the fuck out of new supply.

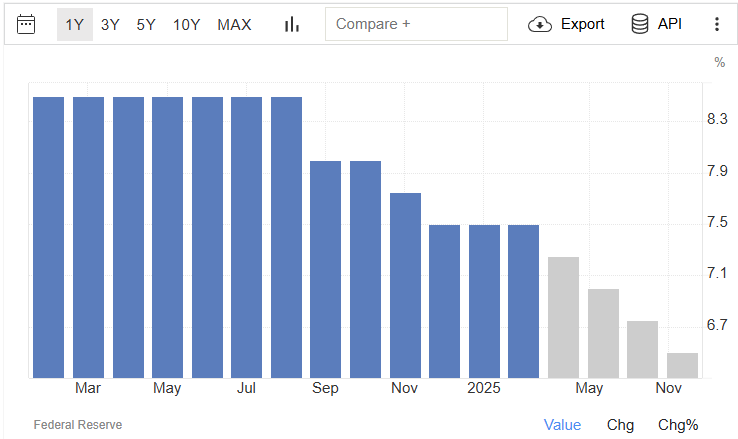

It could come down as interest rates go back up, which seems inevitable.

-

If this is a good forecast housing might get a little cheaper.

https://tradingeconomics.com/united-states/bank-lending-rate

United States Average Monthly Prime Lending Rate

-

Recession, "detox," "worth the pain," "not that bad" ...

Howard Lutnick, the commerce secretary, has said Mr. Trump’s policies are “worth it” even if they cause a recession. Scott Bessent, the Treasury secretary, has said the economy may need a “detox period” after becoming dependent on government spending. And Mr. Trump has said there will be a “period of transition” as his policies take effect.

“It’s the kind of language that you use when your policy isn’t going great and you can see that it’s actively harming people,” ...

-

They'll change their tune pretty quickly if there is a recession and Trump's popularity goes down the toilet.

A bunch of millionaires and billionaires telling regular folk that they need to suffer for the common good is really going to go down well.

-

@89th said in Trumpenomics:

"Tariffs are a tax hike on foreign countries. Tariffs are a tax cut for the American people." Either I totally am wrong (possible) or I think the white house truly has NO idea what a tariff is and who pays it. WTFFFFFFFF

Of course she snips at the AP at the end of it.

a good summary.

For those who do not follow economics, here's basically what happened:

Leavitt: 2+2=Purple.

AP Reporter: I have a calculator and 2+2=4.

Leavitt: How DARE you insult my math skills!

Conservative Media: White House DESTROYS disrespectful and un-American AP reporter.@jon-nyc said in Trumpenomics:

@89th said in Trumpenomics:

"Tariffs are a tax hike on foreign countries. Tariffs are a tax cut for the American people." Either I totally am wrong (possible) or I think the white house truly has NO idea what a tariff is and who pays it. WTFFFFFFFF

Of course she snips at the AP at the end of it.

a good summary.

For those who do not follow economics, here's basically what happened:

Leavitt: 2+2=Purple.

AP Reporter: I have a calculator and 2+2=4.

Leavitt: How DARE you insult my math skills!

Conservative Media: White House DESTROYS disrespectful and un-American AP reporter.During an interview show over the weekend

White House Press Secretary Karoline Leavitt accused Associated Press reporter Josh Boak of "failing" to see President Trump's "long-term economic strategy" in a Sunday interview, days after he sparred with her over tariffs during a press briefing.

"He [Boak] clearly fails to see President Trump's long-term economic strategy, which is to bring in so much revenue, so much wealth into our country through tariffs, that we can give larger tax cuts to the American people to put more money back into their pockets," Leavitt told Maria Bartiromo on "Sunday Morning Futures."

-

They think we're idiots.