Home insurance spike

-

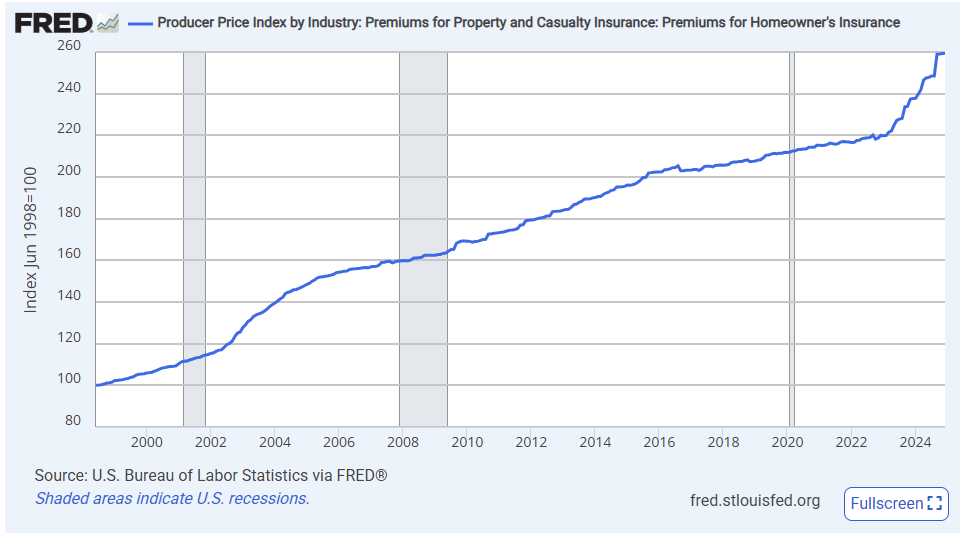

Is this a local thing or did everybody's home insurance spike? I wonder if it's related to claims from last year's hurricane. My home insurance premiums went up 65% this year as compared to last year. 4000 a year now. I am going to shop around.

@Horace said in Home insurance spike:

Is this a local thing or did everybody's home insurance spike? I wonder if it's related to claims from last year's hurricane. My home insurance premiums went up 65% this year as compared to last year. 4000 a year now. I am going to shop around.

Ours did. Drastically. We are shopping for new insurance, now.

-

Property insurance is going up all over North America the last few years. Ours has increased by $800 over the last two years. The industry has to recoup its losses owing to the frequency of extreme weather events and wildfires causing not just property damage but total destruction and loss.

-

Property insurance is going up all over North America the last few years. Ours has increased by $800 over the last two years. The industry has to recoup its losses owing to the frequency of extreme weather events and wildfires causing not just property damage but total destruction and loss.

@Renauda said in Home insurance spike:

Property insurance is going up all over North America the last few years. Ours has increased by $800 over the last two years. The industry has to recoup its losses owing to the frequency extreme weather events and wildfires causing not just property damage but total destruction and loss.

Yeah might have to find a local place that isn't trying to use my money to pay for Florida and California disasters. I moved to Minnesota for the skiing December-March, weather May-October, and the lack of natural disasters!

-

@Renauda said in Home insurance spike:

Property insurance is going up all over North America the last few years. Ours has increased by $800 over the last two years. The industry has to recoup its losses owing to the frequency extreme weather events and wildfires causing not just property damage but total destruction and loss.

Yeah might have to find a local place that isn't trying to use my money to pay for Florida and California disasters. I moved to Minnesota for the skiing December-March, weather May-October, and the lack of natural disasters!

I wish you luck in finding an Insurer whose underwriters share your views rather than the collective risk. We get a comparatively good deal through a group home and vehicle plan my wife’s professional college offers for its membership and because I am over 65. Even then it is not by any means cheap.

-

-

Ha... I reached out to the local State Farm rep (he actually used to live in a house 4 down from where I live now). I'm sure his hands will be tied by his rates, but I'm giving him a shot at bundling our home, auto, and a special jewelry policy.

-

@89th said in Home insurance spike:

... and a special jewelry policy.

Yours, hers, or Aqua's sister's?

@Axtremus said in Home insurance spike:

@89th said in Home insurance spike:

... and a special jewelry policy.

Yours, hers, or Aqua's sister's?

I don’t think Aqua’s Sister’s Pearl Necklace can be covered.