Quite Sad - Seniors with no Savings

-

"This is What Life Without Retirement Savings Looks Like"

https://www.theatlantic.com/business/archive/2018/02/pensions-safety-net-california/553970/

Quite sad, as I think there is no family support either.

Roberta Gordon never thought she’d still be alive at age 76. She definitely didn’t think she’d still be working. But every Saturday, she goes down to the local grocery store and hands out samples, earning $50 a day, because she needs the money.

“I’m a working woman again,” she told me, in the common room of the senior apartment complex where she now lives, here in California’s Inland Empire. Gordon has worked dozens of odd jobs throughout her life—as a house cleaner, a home health aide, a telemarketer, a librarian, a fundraiser—but at many times in her life, she didn’t have a steady job that paid into Social Security. She didn’t receive a pension. And she definitely wasn’t making enough to put aside money for retirement.

So now, at 76, she earns $915 a month through Social Security and through Supplemental Security Income, or SSI, a program for low-income seniors. Her rent, which she has had to cover solo since her roommate died in August, is $1,040 a month. She’s been taking on credit-card debt to cover the gap, and to pay for utilities, food, and other essentials. She often goes to a church food bank for supplies.

-

First and foremost, that’s sad. If nothing else, that’s my position.

But secondly, in this country (and others) there is a bit of an unofficially social contract. If you work hard and/or get lucky and/or plan wisely, you’ll set yourself up for a comfortable life. Conversely if you get unlucky and/or don’t work hard and/or don’t plan wisely, you’re setting yourself up for misery. It’s part of the self-reliance and freedom the country allows.

Thirdly, while not helpful, let’s keep in mind getting $1,000 a month in this country and the housing/food/health options compared to the majority of the world that is far worse off.

-

-

Yes, old or not, quite often being poor is sad.

-

Housing cost is high for a single person. I wish more people can be more open to having "roommates" or "housemates" to lower housing cost.

-

"Old" people are not all the same. This story managed to increase my respect for another 76 year old person I happen to know. He still works construction, not "supervisor" or "manager," but one who does the actual work -- drywall, ceiling, floor, plumbing, painting, carpentry, whatever. Before he told me his age, just from outward appearance I thought he's ~15 years younger than his real age. I get the impression that this "old" contractor is still doing pretty good business and living a fairly comfortable life.

-

-

Did anybody ever watch the "documentary" Nomadland? I think it is not a real movie, but actually fiction, is very good and related to the story of older person who is living on the edge.

Fern (Frances McDormand) is grieving a life that’s been ripped away from her. It seems like she was relatively happy in Empire, Nevada, one of those many American small towns built around industry. When the gypsum plant there closed, the town of Empire quite literally closed with it. In six months, its entire zip code was eliminated. In this nightmare state, Fern’s husband died, leaving her completely alone and, well, she likes the word “houseless” more than “homeless.” Hitting the road in search of work as a seasonal employee at an Amazon center, Fern starts living in her van, eventually getting involved with a group of modern nomads, people who sometimes form makeshift communities, but she inevitably ends up alone again, traversing the American landscape. Fern is the unforgettable center of Chloé Zhao’s masterful “Nomadland,” a movie that finds poetry in the story of a seemingly average woman. It is a gorgeous film that’s alternately dreamlike in the way it captures the beauty of this country and grounded in its story about the kind of person we don’t usually see in movies.

-

Back to the initial post...I used to go through the finances of people that got by on jobs that today are paying $16/hr. If those guys work a second job or marry somebody that makes about the same amount of money, you can get by. Not great, but get by. Problem is, those guys are always just a fairly minor event from being in bad financial trouble. There's just no cushion there.

Awfully hard to save much of anything when you're just getting by...

-

Those of us who are doing ok forget how lucky we are. I've seen people in jobs like mine make terrible decisions due to other stuff that was going on in their lives, and Mrs. Phibes has one friend who was recently one paycheck away from being homeless, and had really been through a pretty desperate time through no real fault of their own.

-

Finances really get bogged down to mostly a few life events. Don't want to be poor? Some things you can do (and not do)...

- Graduate from high school.

- Learn a trade or obtain an AD or bachelor's degree in a major that will allow you to make more money than your average untrained peers.

- Don't have children out of wedlock.

- Live below your means, if at all possible. Develop a habit of saving.

- Consider any job or vocational choice with an evaluation of both salary and benefits.

- Marry well and stay married. (Maybe the toughest one on the list).

- Most debt is bad. Borrow no more than what you must and borrow only for things

which will increase your net worth. - At some point, after you have several months salary saved, start to invest and make investing a habit. Know what your money is invested in and structure your investnents based on where you are in life.

- Lastly, try to keep sentiment separated from financial business. Sometimes, you need to sell the old family home. Sometimes, you need to tell the kids you cannot financially help them. Sometimes, you have to downsize. Lots of lifetime decisions fall under this one.

-

Finances really get bogged down to mostly a few life events. Don't want to be poor? Some things you can do (and not do)...

- Graduate from high school.

- Learn a trade or obtain an AD or bachelor's degree in a major that will allow you to make more money than your average untrained peers.

- Don't have children out of wedlock.

- Live below your means, if at all possible. Develop a habit of saving.

- Consider any job or vocational choice with an evaluation of both salary and benefits.

- Marry well and stay married. (Maybe the toughest one on the list).

- Most debt is bad. Borrow no more than what you must and borrow only for things

which will increase your net worth. - At some point, after you have several months salary saved, start to invest and make investing a habit. Know what your money is invested in and structure your investnents based on where you are in life.

- Lastly, try to keep sentiment separated from financial business. Sometimes, you need to sell the old family home. Sometimes, you need to tell the kids you cannot financially help them. Sometimes, you have to downsize. Lots of lifetime decisions fall under this one.

@Jolly said in Quite Sad - Seniors with no Savings:

Finances really get bogged down to mostly a few life events. Don't want to be poor? Some things you can do (and not do)...

- Graduate from high school.

- Learn a trade or obtain an AD or bachelor's degree in a major that will allow you to make more money than your average untrained peers.

- Don't have children out of wedlock.

- Live below your means, if at all possible. Develop a habit of saving.

- Consider any job or vocational choice with an evaluation of both salary and benefits.

- Marry well and stay married. (Maybe the toughest one on the list).

- Most debt is bad. Borrow no more than what you must and borrow only for things

which will increase your net worth. - At some point, after you have several months salary saved, start to invest and make investing a habit. Know what your money is invested in and structure your investnents based on where you are in life.

- Lastly, try to keep sentiment separated from financial business. Sometimes, you need to sell the old family home. Sometimes, you need to tell the kids you cannot financially help them. Sometimes, you have to downsize. Lots of lifetime decisions fall under this one.

I'm not going to disagree, but I suspect the one life-event that trumps all of those is being born into a stable, financially secure and loving family environment.

-

Finances really get bogged down to mostly a few life events. Don't want to be poor? Some things you can do (and not do)...

- Graduate from high school.

- Learn a trade or obtain an AD or bachelor's degree in a major that will allow you to make more money than your average untrained peers.

- Don't have children out of wedlock.

- Live below your means, if at all possible. Develop a habit of saving.

- Consider any job or vocational choice with an evaluation of both salary and benefits.

- Marry well and stay married. (Maybe the toughest one on the list).

- Most debt is bad. Borrow no more than what you must and borrow only for things

which will increase your net worth. - At some point, after you have several months salary saved, start to invest and make investing a habit. Know what your money is invested in and structure your investnents based on where you are in life.

- Lastly, try to keep sentiment separated from financial business. Sometimes, you need to sell the old family home. Sometimes, you need to tell the kids you cannot financially help them. Sometimes, you have to downsize. Lots of lifetime decisions fall under this one.

@Jolly Good points.

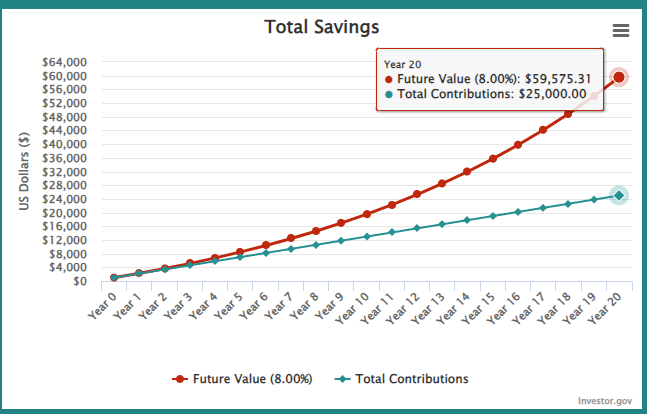

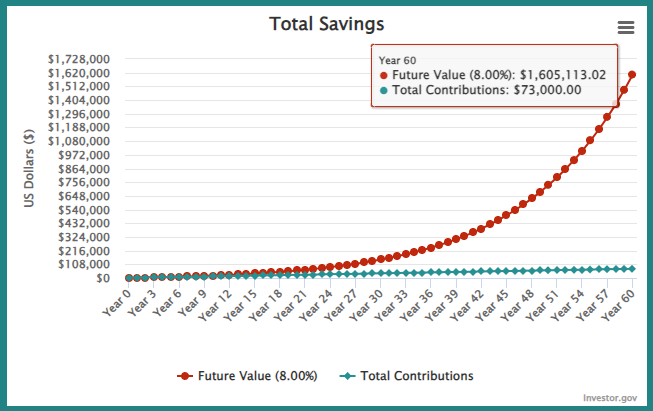

One thing that I remember I learned early on is to live as if you were only making 80% of what you actually do. Have a salary of USD$1000/month. Pretend it is only $800 and save the rest.

Soon, your money will start making money for you. Once that starts happening, you dont have to get outrageous returns to be okay.

5% return of $100000 = $5000

10% return of $100 = $10 -

@Jolly Good points.

One thing that I remember I learned early on is to live as if you were only making 80% of what you actually do. Have a salary of USD$1000/month. Pretend it is only $800 and save the rest.

Soon, your money will start making money for you. Once that starts happening, you dont have to get outrageous returns to be okay.

5% return of $100000 = $5000

10% return of $100 = $10@taiwan_girl said in Quite Sad - Seniors with no Savings:

@Jolly Good points.

One thing that I remember I learned early on is to live as if you were only making 80% of what you actually do. Have a salary of USD$1000/month. Pretend it is only $800 and save the rest.

Soon, your money will start making money for you. Once that starts happening, you dont have to get outrageous returns to be okay.

5% return of $100000 = $5000

10% return of $100 = $10I only really got serious about putting money away once I turned 40. I kind of wish I'd done it sooner, but 40 wasn't too late. I despair when I see how some people of that age act.

-

@Jolly said in Quite Sad - Seniors with no Savings:

Finances really get bogged down to mostly a few life events. Don't want to be poor? Some things you can do (and not do)...

- Graduate from high school.

- Learn a trade or obtain an AD or bachelor's degree in a major that will allow you to make more money than your average untrained peers.

- Don't have children out of wedlock.

- Live below your means, if at all possible. Develop a habit of saving.

- Consider any job or vocational choice with an evaluation of both salary and benefits.

- Marry well and stay married. (Maybe the toughest one on the list).

- Most debt is bad. Borrow no more than what you must and borrow only for things

which will increase your net worth. - At some point, after you have several months salary saved, start to invest and make investing a habit. Know what your money is invested in and structure your investnents based on where you are in life.

- Lastly, try to keep sentiment separated from financial business. Sometimes, you need to sell the old family home. Sometimes, you need to tell the kids you cannot financially help them. Sometimes, you have to downsize. Lots of lifetime decisions fall under this one.

I'm not going to disagree, but I suspect the one life-event that trumps all of those is being born into a stable, financially secure and loving family environment.

@Doctor-Phibes said in Quite Sad - Seniors with no Savings:

@Jolly said in Quite Sad - Seniors with no Savings:

Finances really get bogged down to mostly a few life events. Don't want to be poor? Some things you can do (and not do)...

- Graduate from high school.

- Learn a trade or obtain an AD or bachelor's degree in a major that will allow you to make more money than your average untrained peers.

- Don't have children out of wedlock.

- Live below your means, if at all possible. Develop a habit of saving.

- Consider any job or vocational choice with an evaluation of both salary and benefits.

- Marry well and stay married. (Maybe the toughest one on the list).

- Most debt is bad. Borrow no more than what you must and borrow only for things

which will increase your net worth. - At some point, after you have several months salary saved, start to invest and make investing a habit. Know what your money is invested in and structure your investnents based on where you are in life.

- Lastly, try to keep sentiment separated from financial business. Sometimes, you need to sell the old family home. Sometimes, you need to tell the kids you cannot financially help them. Sometimes, you have to downsize. Lots of lifetime decisions fall under this one.

I'm not going to disagree, but I suspect the one life-event that trumps all of those is being born into a stable, financially secure and loving family environment.

Great list @Jolly and very fair point, @Doctor-Phibes . Plus look at you, now you're a doctor!

-

@taiwan_girl said in Quite Sad - Seniors with no Savings:

@Jolly Good points.

One thing that I remember I learned early on is to live as if you were only making 80% of what you actually do. Have a salary of USD$1000/month. Pretend it is only $800 and save the rest.

Soon, your money will start making money for you. Once that starts happening, you dont have to get outrageous returns to be okay.

5% return of $100000 = $5000

10% return of $100 = $10I only really got serious about putting money away once I turned 40. I kind of wish I'd done it sooner, but 40 wasn't too late. I despair when I see how some people of that age act.

@Doctor-Phibes said in Quite Sad - Seniors with no Savings:

@taiwan_girl said in Quite Sad - Seniors with no Savings:

@Jolly Good points.

One thing that I remember I learned early on is to live as if you were only making 80% of what you actually do. Have a salary of USD$1000/month. Pretend it is only $800 and save the rest.

Soon, your money will start making money for you. Once that starts happening, you dont have to get outrageous returns to be okay.

5% return of $100000 = $5000

10% return of $100 = $10I only really got serious about putting money away once I turned 40. I kind of wish I'd done it sooner, but 40 wasn't too late. I despair when I see how some people of that age act.

I have two brothers who haven't saved a dime, let alone invest. And another brother who is like me, who has saved and invested what we can. Will be interesting to see how things play out in 30-40 years (I'm in my early 40s now, which is crazy since I met you when I was 25 in Boston that one time).

Anyway, I have recently started a modest investment account (UTMA) for each of my 3 kids. When they turn 21, the account becomes theirs. Sure that is a risk if they are a junky at 21, but otherwise the WHOLE point is to show them what small/regular investments can do with compound interest over 20+ or so years. Hopefully they either use the accounts to help with a down payment on a house or, better yet, continue to save/invest in it and when they turn 60 or so, it'll be worth a lot.

-

The super low interest rates from the late 1990s to 2022 really doesn't help to encourage saving. The compound interest graph assuming a 0.02% interest rate really isn't all the interesting. Many banks are still holding interest rates for regular savings accounts at yet level today, and offer inflation-beating interest rates only for CDs. :man-shrugging: