Bidenomics At Work

-

LOL, listening to a local news & traffic station (WTOP) not 5 minutes ago, and their financial guy came on and said “Enjoy it while it lasts! A surprising GDP of 4.9% was fueled primarily by Government and Consumer spending… Expect next quarter to be down around 1% and many analysts are predicting a coming recession…”

WTOP is not a right leaning news station and it s not in the doom business…

-

LOL, listening to a local news & traffic station (WTOP) not 5 minutes ago, and their financial guy came on and said “Enjoy it while it lasts! A surprising GDP of 4.9% was fueled primarily by Government and Consumer spending… Expect next quarter to be down around 1% and many analysts are predicting a coming recession…”

WTOP is not a right leaning news station and it s not in the doom business…

@LuFins-Dad said in Bidenomics At Work:

LOL, listening to a local news & traffic station (WTOP) not 5 minutes ago, and their financial guy came on and said “Enjoy it while it lasts! A surprising GDP of 4.9% was fueled primarily by Government and Consumer spending… Expect next quarter to be down around 1% and many analysts are predicting a coming recession…”

WTOP is not a right leaning news station and it s not in the doom business…

My son gets to talk with people at the larger telecom companies and he still has friends at the fruit company. Some of those businesses think we have already entered a recession and the numbers just haven't caught up, yet.

That would jibe with the above WTOP statement.

-

Behind a paywall, but I see it on Apple News:

On paper, 2023 looks like an incredible year so far for the US economy.

The unemployment rate is at 3.8%. The US economy added a robust 336,000 jobs in September. The S&P 500 is up 7.6% year-to-date. And GDP grew a staggering 4.9% year-over-year in Q3. All of that happened in spite of the Federal Reserve's aggressive rate-hike campaign.But Societe Generale Chief Global Strategist Albert Edwards, who called the dot-com bubble over two decades ago, urged investors to look beneath the headline numbers. Doing so reveals a more chilling reality of where the US economy really stands at the moment.

"I'm very much a macro-man, but I recognize that the macro data is disguising the depth of pain the Fed has inflicted on the economy, which will soon be obvious to all," Edwards said in an October 26 note.

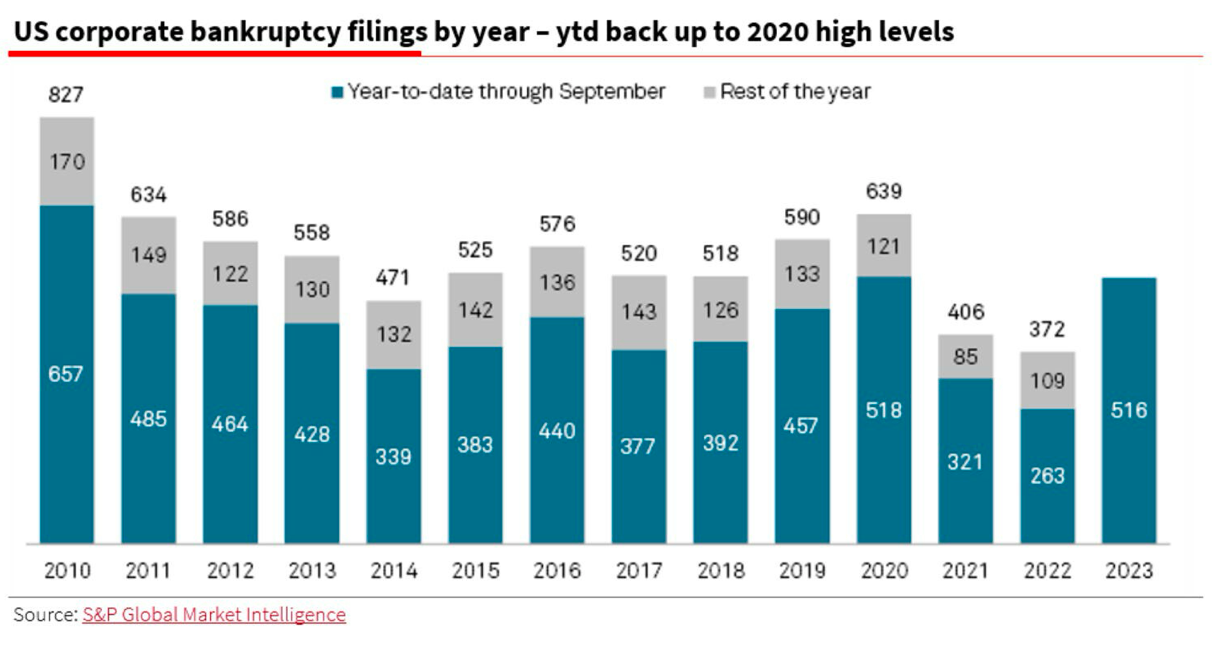

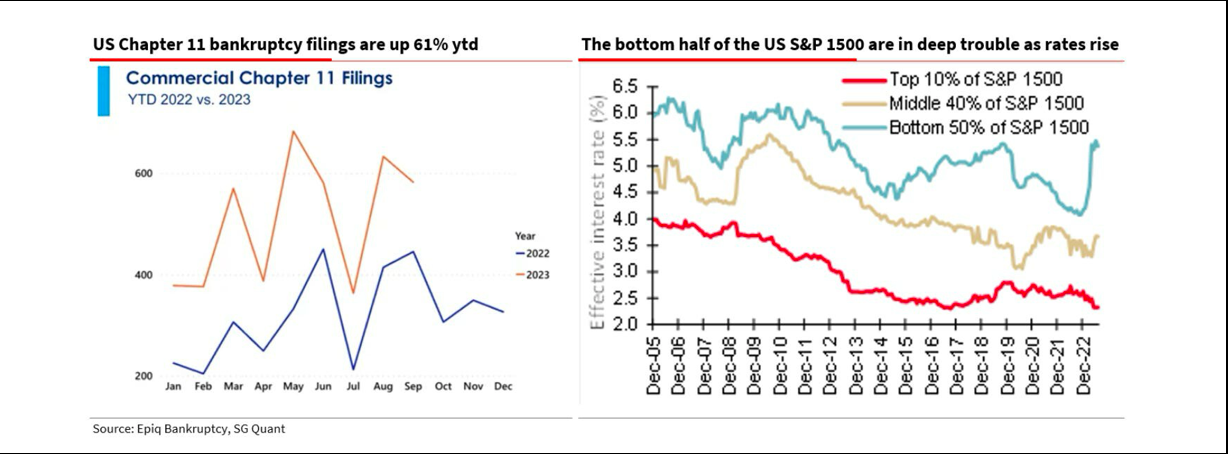

Start with bankruptcy data, Edwards said. Year-to-date, bankruptcy filings are higher than during any year since 2010.

They're also up 61% this year alone. And it's worse for smaller firms, which have smaller cash reserves and are more sensitive to higher interest rates.

"Bankruptcy experts think many companies are on the brink. Post-GFC QE and direct Covid pandemic relief certainly kept many zombie companies on extended life support," Edwards said. "But now the sharp rise in rates is causing a surge in bankruptcies beyond one's worst Freddie Kruger nightmares."

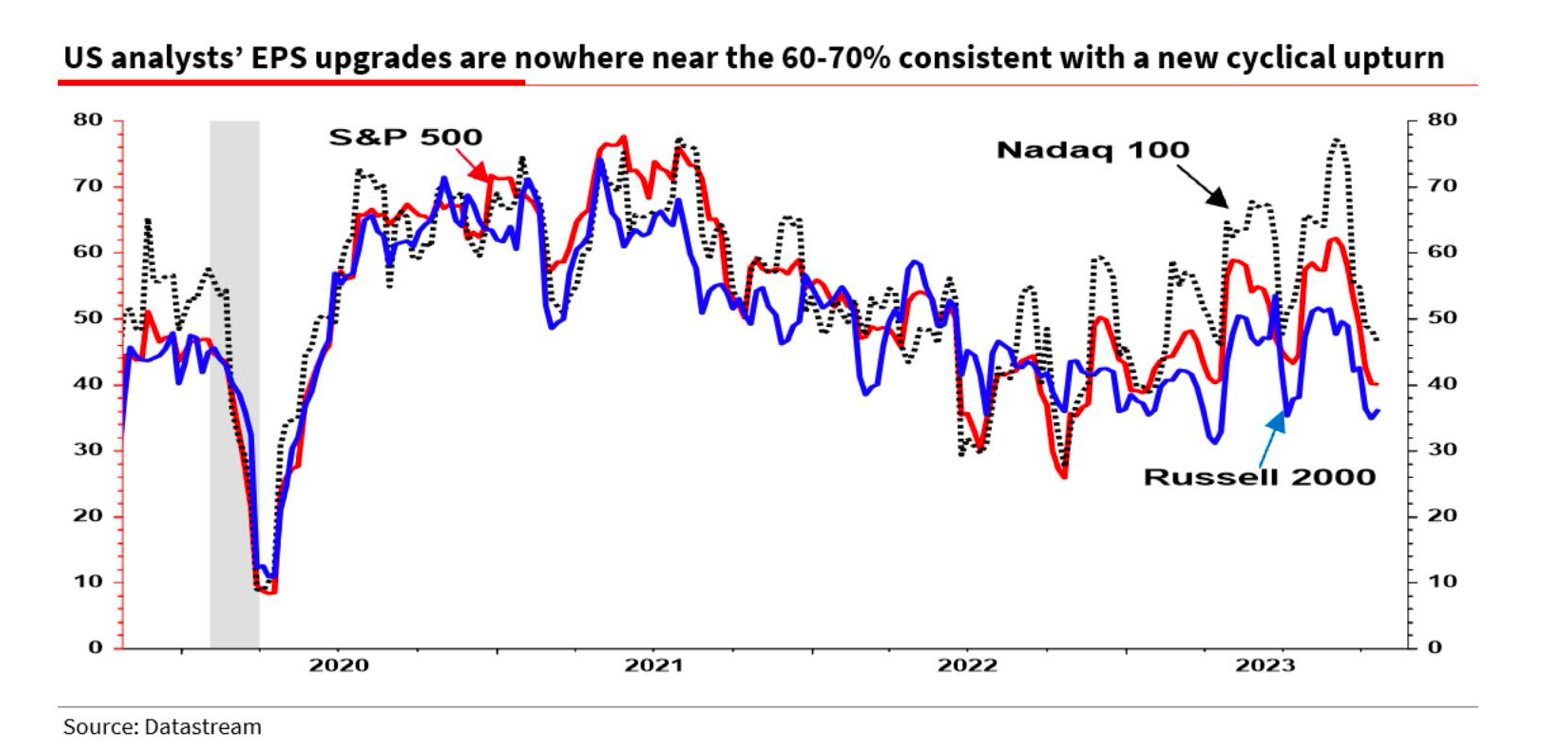

And then there's weak analyst optimism. Only about 40% of analyst ratings changes for S&P 500 companies are upgrades. Edwards says in new economic cycles that number is typically 60-70%.

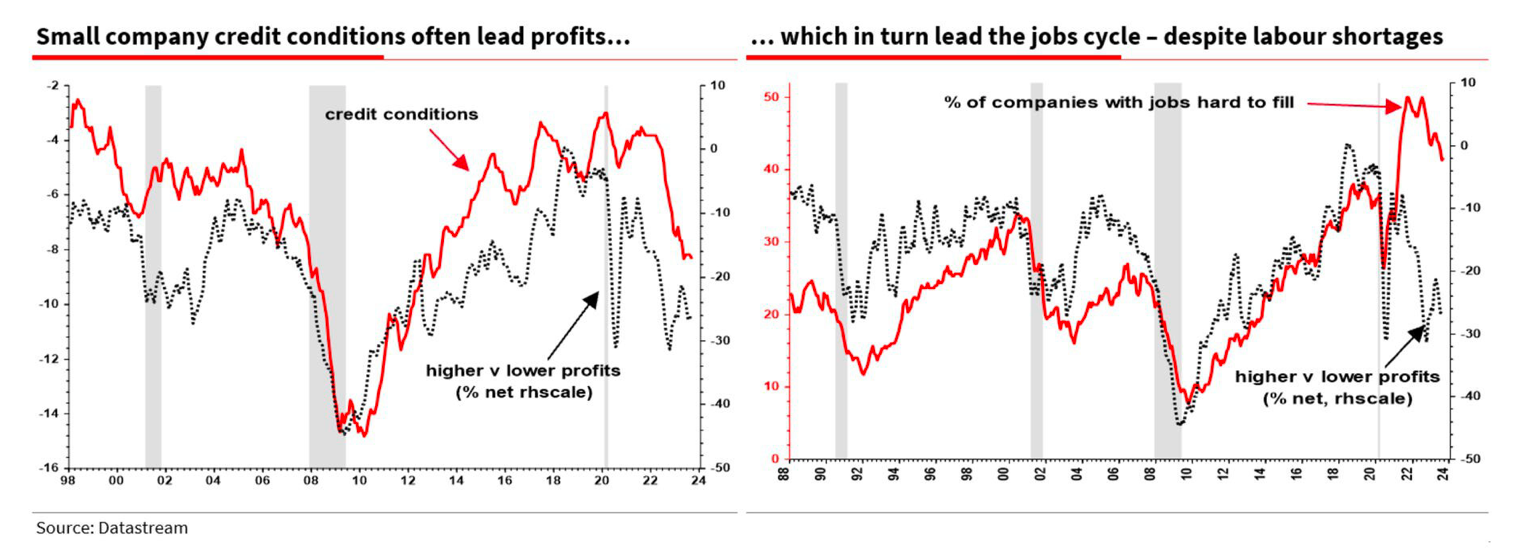

Credit conditions for small businesses are also in dangerous territory. Credit conditions refer to how easy it is for a business to get a loan. The National Federation for Independent Businesses' index on small business credit conditions is right at levels seen at the start of prior recessions, Edwards pointed out.

This typically means lower profits and softening in the labor market, he said.

"The notion that we are at the start of a new economic cycle seems preposterous to me," Edwards said.

Is a recession really coming?

It's getting harder to say a recession will arrive in the near future as the economic data continues to come in strong.

Yet classic leading recession indicators continue to suggest that weakness still lies ahead.

The Institute for Supply Management's Purchasing Manager's Index, which takes the pulse on manufacturing activity in the US, is in contraction territory. The Conference Board's Leading Economic Index — which bundles indicators like consumer sentiment, manufacturing activity, stock and bond market performance, housing market activity, and lending activity — has been in recession territory for months now. And the Treasury yield curve remains inverted, with 3-month yields higher than those on the 10-year. The latter two indicators have a perfect track record over the last several decades of preceding recessions.

But the current economic cycle is in many ways unprecedented, given the massive amounts of stimulus pumped into the global economy over the last few years and the vast labor shortages the US economy has now with over nine million open jobs. These could mean the US could stave off a recession despite the warning signs.

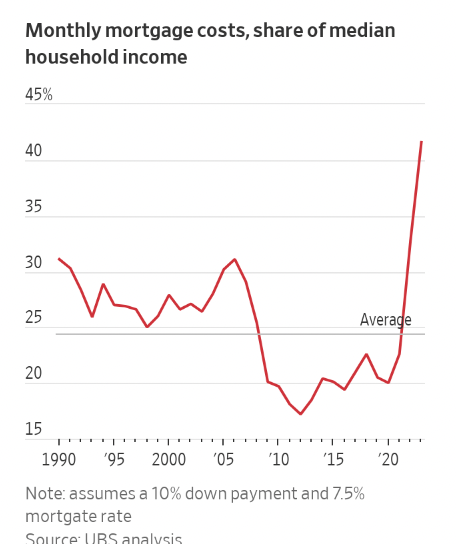

However, the longer the Fed keeps rates elevated, the higher the risk of a recession becomes. While inflation has come down significantly, it's shown a small resurgence in the last few months, perhaps necessitating a continually hawkish Fed.

-

Dumb question...When we talk about GDP, are those in today's dollars? Or are those figures in terms of steady dollars?

Second dumb question...Does anybody know how how many people are working more than one job, trying to hang onto their home, their car and to keep the lights turned on?

-

Dumb question...When we talk about GDP, are those in today's dollars? Or are those figures in terms of steady dollars?

Second dumb question...Does anybody know how how many people are working more than one job, trying to hang onto their home, their car and to keep the lights turned on?

-

@Jolly said in Bidenomics At Work:

..Does anybody know how how many people are working more than one job

DIdn't we talk about that in a post commenting on the unemployment numbers? IIRC, the percentage is quite high - perhaps at a record.

@George-K said in Bidenomics At Work:

@Jolly said in Bidenomics At Work:

..Does anybody know how how many people are working more than one job

DIdn't we talk about that in a post commenting on the unemployment numbers? IIRC, the percentage is quite high - perhaps at a record.

@taiwan_girl gave the answer two weeks ago: https://nodebb.the-new-coffee-room.club/post/243385

-

A Axtremus referenced this topic on

A Axtremus referenced this topic on

-

@Jolly try https://www.marketwatch.com/story/more-people-are-working-multiple-jobs-as-americans-battle-high-prices-and-layoff-jitters-4da47ab3

Multiple jobholders reached 8,137,000 in March, or 5.1% of the total employed population ...

Historical comparison:

But the March level was still lower than the pre-pandemic level of 8,181,000 million in February 2020 at 5.2% of the total employed population.

-

On "working more than one job", generally I expect that to increase over time as it has become easier for people to take up "side gigs." Anyone can sign up to drive drive ride-shares (Uber, Lyft), deliver food/grocery (GrubHub, Postmates, DoorDash), take on various tasks (Fiverr, TaskRabbit, FlexJobs). The trend started before Biden and will continue with or without Biden, domestically and internationally.

-

Maybe you need to show your numbers to more people...

-

@Jolly said in Bidenomics At Work:

Yep, explains one of the lowest approval ratings in modern times..

Show you blockbuster jobs report, you not happy.

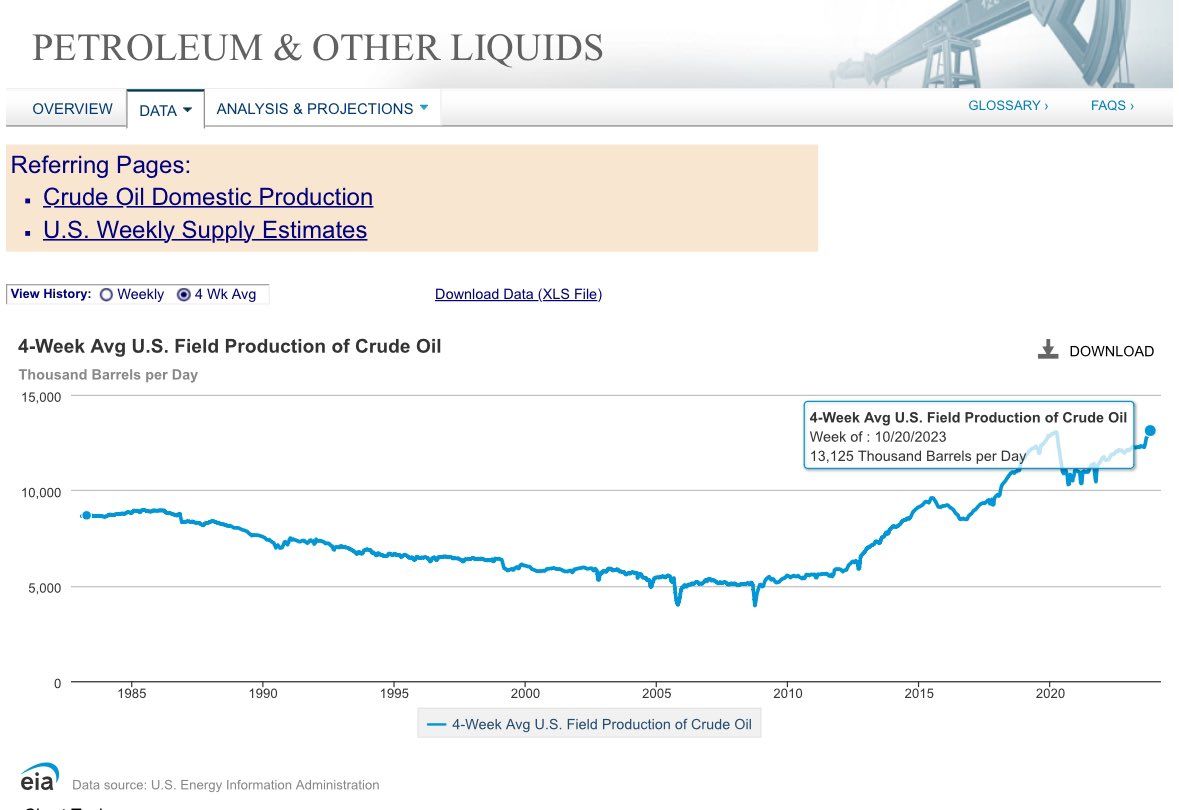

Show you great oil production report, you not happy.Biden Derangement Syndrome.

@Axtremus said in Bidenomics At Work:

@Jolly said in Bidenomics At Work:

Yep, explains one of the lowest approval ratings in modern times..

Show you blockbuster jobs report, you not happy.

Show you great oil production report, you not happy.Biden Derangement Syndrome.

When they are from your "side", good things are because of them and bad things are in spite of them.

When they are from the other "side", good things are in spite of them, and bad things are because of them.

President Trump could have personally come up with a cure for all cancers, and the Democrats would still have found something with that to blame on him (why didn't he do this earlier? Too expensive! Great, cured cancer, but doesn't he care about high blood pressure?)

-

Maybe you need to show your numbers to more people...