Bidenomics At Work

-

GOLDMAN SACHS: "The CHIPS Act and Inflation Reduction Act are boosting US manufacturing construction substantially. New incentives have boosted spending on manufacturing-related construction and should boost manufacturing equipment investment and employment soon too."

-

@Jolly said in Bidenomics At Work:

Now, give me the debt figures since

the IRAReagan ...@Axtremus said in Bidenomics At Work:

@Jolly said in Bidenomics At Work:

Now, give me the debt figures since

the IRAReagan ...The goalposts are at the back of the end zone, not across the street from the parking lot.

-

@Jolly said in Bidenomics At Work:

Well, that's a used Corolla and a studio apartment on the East Coast...

In rural Delaware maybe.

-

I dunno...inventory at all price points is crazy low, but someone in that income range should be able to get a decent little house in the $250-275k range.... at least in much of Connecticut. (of course, pre-covid these were $150-180K houses)

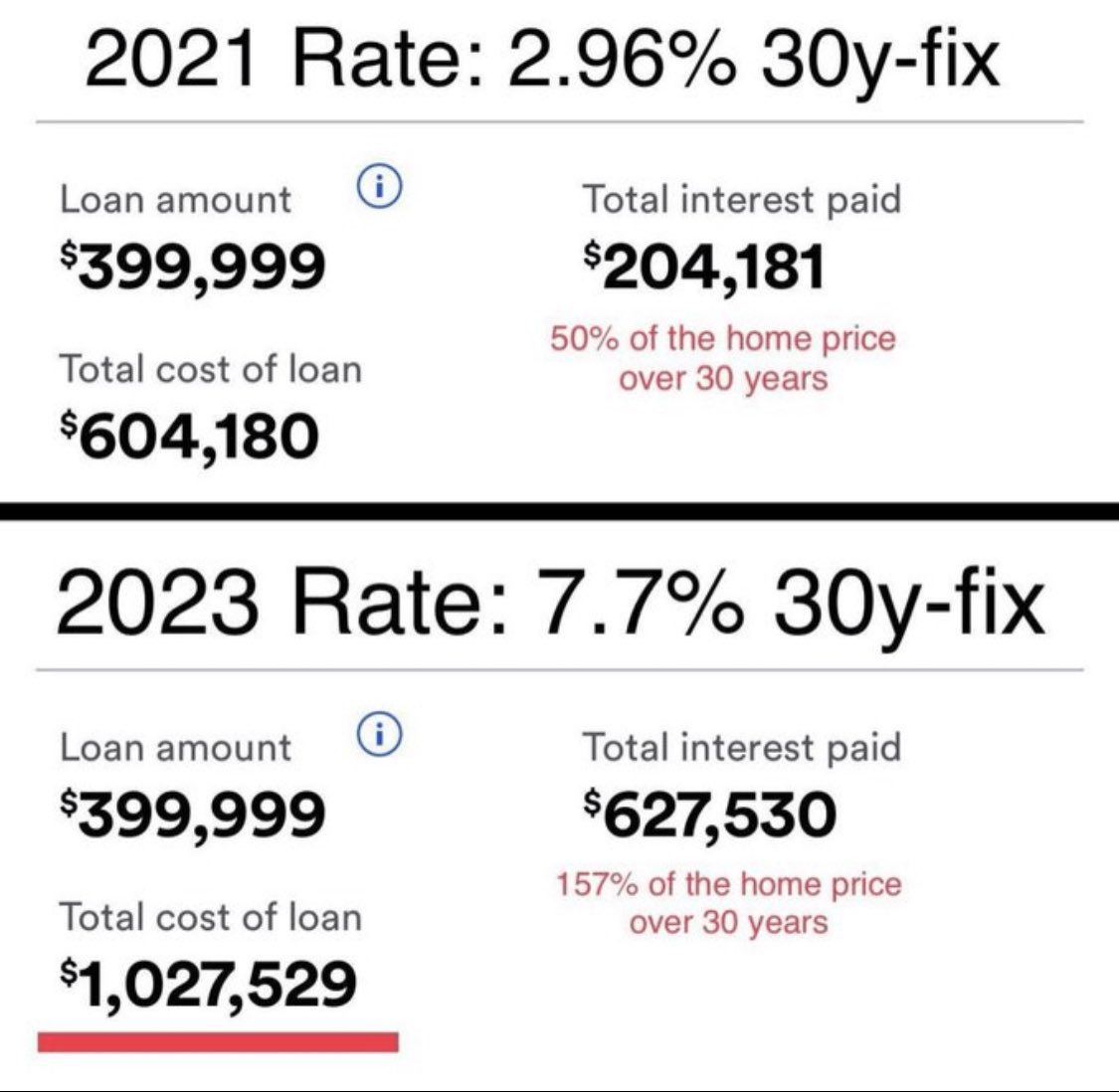

@Rich said in Bidenomics At Work:

a decent little house in the $250-275k range

Three years ago, a conventional (30 year) 80% mortgage on that house would have cost you about $1137 a month.

Today, the same loan is $1746. More than $7,000 a year more.

-

We’re setting oil production records under Biden.

U.S. oil production is forecast to average an all-time high of 12.8 million barrels a day this year and keep growing to 13.1 million in 2024, the federal Energy Information Administration said in its latest forecast. That’s up from the most recent trough of 5 million barrels a day in 2008, and probably enough to help the U.S. to keep its title as the No. 1 global crude oil producer.

But what about federal lands?

In fact, though, oil production from federal lands and waters has risen on Biden’s watch, reaching past 3 million barrels per day last year. The high mark during President Donald Trump’s term was 2.75 million barrels a day.

-

We’re setting oil production records under Biden.

U.S. oil production is forecast to average an all-time high of 12.8 million barrels a day this year and keep growing to 13.1 million in 2024, the federal Energy Information Administration said in its latest forecast. That’s up from the most recent trough of 5 million barrels a day in 2008, and probably enough to help the U.S. to keep its title as the No. 1 global crude oil producer.

But what about federal lands?

In fact, though, oil production from federal lands and waters has risen on Biden’s watch, reaching past 3 million barrels per day last year. The high mark during President Donald Trump’s term was 2.75 million barrels a day.

@jon-nyc said in Bidenomics At Work:

We’re setting oil production records under Biden.

U.S. oil production is forecast to average an all-time high of 12.8 million barrels a day this year and keep growing to 13.1 million in 2024, the federal Energy Information Administration said in its latest forecast. That’s up from the most recent trough of 5 million barrels a day in 2008, and probably enough to help the U.S. to keep its title as the No. 1 global crude oil producer.

But what about federal lands?

In fact, though, oil production from federal lands and waters has risen on Biden’s watch, reaching past 3 million barrels per day last year. The high mark during President Donald Trump’s term was 2.75 million barrels a day.

At that rate, how long will it take to replenish the SPR?

-

What would be reasons to take oil out of the strategic reserve? Not exactly sure why people were upset when oil was taken out a couple of years ago.

Appears that the US govt made money on it. (Of course I am sure they had no idea of exactly where oil prices would go, so kind of risky if they were just doing it for money)

"On March 31, 2022, President Joe Biden announced that his administration would release 1 million barrels of oil per day from the reserve for the next 180 days, selling it at an average price of $96 per barrel. After oil prices declined during the second half of the year, in December the administration announced it would begin replenishing the SPR in early 2023, expecting to purchase oil at a lower price than it was sold, a process that would take months or years to complete."

-

https://www.washingtonpost.com/business/2023/10/06/september-jobs-report-unemployment/

Economy adds 336,000 jobs in September, in a stunning gain

The unemployment rate held at 3.8%

.

The average hourly wage rose in September by 4.2 percent over the previous 12 months to $33.88 an hour, a sharper annual increase than inflation, which climbed to 3.7 percent in August. -

Most troubling was the decline in the index measuring future expectations, which tumbled to 73.7 in September from 83.3 in August. Readings below 80 for future expectations historically signal a recession within a year.

-

-

https://www.washingtonpost.com/business/2023/10/06/september-jobs-report-unemployment/

Economy adds 336,000 jobs in September, in a stunning gain

The unemployment rate held at 3.8%

.

The average hourly wage rose in September by 4.2 percent over the previous 12 months to $33.88 an hour, a sharper annual increase than inflation, which climbed to 3.7 percent in August.You can see pitchers in the whole thread:

https://threadreaderapp.com/thread/1710301675234234566.html

Latest Jobs Report looks good w/ headline numbers blowing away expectations, but the devil is in the details - here's a plain-English thread on why this is a very troubling report🧵...

First the headlines:

Sep nonfarm payrolls jump 336k; Unemployment rate flat at 3.8%; Labor force participation rate remains depressed at 62.8%; Those not in the labor force rose to roughly 5 million more than pre-pandemic - this is artificially pushing down unemployment rate:There are various ways to account for the people missing from the labor force (4.5-5.4 million) and doing so yields an unemployment rate between 6.3 and 6.8%

Where were the jobs added in Sep? 22% came from government - an unsustainable increase; remember that private sector workers have to support those public sector jobs:

What kinds of jobs were added? Entirely part-time (+151k); in fact, we LOST full-time jobs (-22k); last 3 months have seen part-time jump 1.2 million while full-time fell 700k (most since lockdowns); double counting of multiple jobholders (123k) was 37% of job gains...

Who has the jobs? Let's break it down a few ways; first, foreign-born workers are already back to pre-pandemic trend while native-born workers have never recovered; since Mar '22, jobs disproportionately went to the foreign born, which brings up another important point...

Something broke in the labor market in Mar '22; the household and establishment surveys began to diverge and full-time job gains slowed dramatically; this continues today as nonfarm payrolls (establishment) jumped 336k in Sep, employment level (household) only rose 86k:

But back to who has the jobs, it's college grads, in spades: unemployment rate 2.1%, employment level 63 million (inline w/ pre-pandemic trend), emp-to-pop ratio 71.9%, and their earnings are outpacing inflation - why would you give this group a student loan bailout?

Lastly, the loss of full-time jobs and their replacement w/ part-time work is helping slow wage growth, which is then negative after adjusting for inflation - real weekly earnings fell dramatically until Jun '22 and have moved sideways since:

TLDR: people supplementing incomes w/ part-time jobs are goosing the headline numbers while underlying economic fundamentals remain weak; people absent from workforce pushing down unemployment rate; earnings not keeping up with inflation; don't expect the job gains to last...