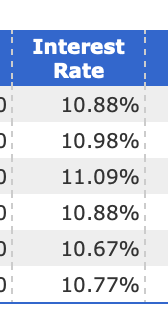

Interest rates on my I-bonds

-

Did you buy some (let's say $30k) each year for like 6 years? (The number of rows in your screenshot)

Do you just hold onto them since they vary in rate? I guess it's a fixed income investment (yes I'm a noob) since from like 2008 to 2019 the rate was probably less than 0.5%

-

Did you buy some (let's say $30k) each year for like 6 years? (The number of rows in your screenshot)

Do you just hold onto them since they vary in rate? I guess it's a fixed income investment (yes I'm a noob) since from like 2008 to 2019 the rate was probably less than 0.5%

-

@89th x2. Rachel’s account and mine

At the time I didn’t have much space in my retirement account for fixed income and didn’t want to buy it in taxable. So this was my method of buying fixed income for many years.