Here comes the middle-class tax hike

-

https://www.wsj.com/articles/nyt-biden-plans-middle-class-tax-hike-11622149787?mod=djemBestOfTheWeb

=-=-=-=-=-=

NYT: Biden Plans Middle-Class Tax Hike

Just before Memorial Day, President expected to propose World War II levels of spending.

James FreemanMay 27, 2021 5:09 pm ET

Now it can be told? President Joe Biden has been saying over and over since he was merely a candidate for the nation’s highest office that his tax increases would only target corporations and rich people. The line was always disingenuous because even his old boss President Barack Obama acknowledged that workers suffer when corporate income tax rates rise. But now the New York Times is reporting that President Biden plans to support a direct tax increase on Americans who are not at all wealthy.

Jim Tankersley reports in the Times that the paper has obtained Biden budget documents and that “the documents forecast that Mr. Biden and Congress will allow tax cuts for low- and middle-income Americans, signed into law by President Donald J. Trump in 2017, to expire as scheduled in 2025.”

Granted this is the Times, so readers should be skeptical. But Mr. Tankersley’s account does offer a plausible explanation for why the White House budget team and the Biden Treasury would be looking to shake revenue out of every available American taxpayer:

President Biden will propose a $6 trillion budget on Friday that would take the United States to its highest sustained levels of federal spending since World War II as he looks to fund a sweeping economic agenda that includes large new investments in education, transportation and fighting climate change.

Documents obtained by The New York Times show that the budget request, the first of Mr. Biden’s presidency, calls for total spending to rise to $8.2 trillion by 2031, with deficits running above $1.3 trillion throughout the next decade. The growth is driven by Mr. Biden’s two-part agenda to upgrade the nation’s infrastructure and substantially expand the social safety net, contained in his American Jobs Plan and American Families Plan, along with other planned increases in discretionary spending.

Federal spending in the World War II era allowed the United States to save Western civilization by defeating Nazi Germany and Imperial Japan. The Biden spending plan will subsidize daycare and electric cars, among other political desires. Unclear is what the U.S. will do in the tragic event it has to fund victory in a world war again.

But it does seem clear that taxpayers are being drafted to support a much larger government—almost akin to a permanent Covid emergency. Adds Mr. Tankersley:

In each year of Mr. Biden’s budget, the government would spend more as a share of the economy than all but two years since World War II: 2020 and 2021, which were marked by trillions of dollars in federal spending to help people and businesses endure the pandemic-induced recession. By 2028, when Mr. Biden could be finishing a second term in office, the government would be collecting more tax revenue as a share of the economy than almost any point in the last century; the only other comparable period was the end of President Bill Clinton’s second term, when the economy was roaring and the budget was in surplus.

Don’t count on another roaring economy or a federal budget surplus if the Biden agenda is enacted. In the first year of his second term, President Clinton collaborated with House Speaker Newt Gingrich (R., Ga.) on a capital gains tax cut, slashing the rate to 20% from 28% and encouraging investment and the economic acceleration that followed. Team Biden now seeks to raise such taxes on the wealthy—and then, according to the Times, raise taxes on just about everybody else at the start of the next presidential term.

Taxpayers at all income levels, whether they own stocks or not, could be in danger of a Biden tax hike. A 2020 Tax Foundation report showed that the 2017 Trump tax reforms reduced effective tax rates for filers up and down the income scale.

Depending on how far President Biden wants to go in erasing the Trump reforms, taxpayers might have to sacrifice not just money but simplicity as well. Another report by the Tax Foundation showed that in the first year after Mr. Trump’s Tax Cuts and Jobs Act, there was a dramatic increase in the number of filers choosing a less complicated tax return:

One of the most significant changes introduced by the TCJA was the expansion of the standard deduction. The standard deduction in 2018 increased from $6,500 to $12,000 for single filers, and from $13,000 to $24,000 for those married filing jointly. As shown below, the percent of taxpayers who itemized went down at all income levels. Overall, the percentage of the population that itemizes decreased from 30 percent to 10 percent.

The emerging picture of the Biden economic agenda is a larger tax bite and more tax complexity for Americans generally, plus more IRS audits for those at higher incomes. The administration hopes to collect an additional $700 billion over 10 years through more aggressive IRS enforcement. James Lucier of Capital Alpha Partners writes today:

For purposes of comparison, this $700 billion number is about what Biden could expect to raise by increasing the corporate tax rate by seven points. It is far higher than prior estimates of uncollected tax revenue, and it is hard to see how one can reach such an estimate without questioning the ethics and professional integrity of every accounting and law firm in the United States.

However, it does support the administration’s narrative that the wealthy are not paying their share, and that they could or should be paying more.

Would Americans rather have a narrative designed to fuel resentment, or an economic policy designed to fuel prosperity?

-

But we can all take comfort in the fact that policy has no effect on the economy or any individual's stake in that economy. Never has, never will. None of this matters because none of this matters. Just look at history, look at the economies during Democrat and Republican administrations. Policy is a non-factor, full stop. QED.

Given that, I'm not sure why we don't just raise the tax rate to 90%. It won't have any meaningful effect on anybody or anything, but the government would have way more money to spend on stuff. I see no drawbacks there.

-

But we can all take comfort in the fact that policy has no effect on the economy or any individual's stake in that economy. Never has, never will. None of this matters because none of this matters. Just look at history, look at the economies during Democrat and Republican administrations. Policy is a non-factor, full stop. QED.

Given that, I'm not sure why we don't just raise the tax rate to 90%. It won't have any meaningful effect on anybody or anything, but the government would have way more money to spend on stuff. I see no drawbacks there.

@horace said in Here comes the middle-class tax hike:

But we can all take comfort in the fact that policy has no effect on the economy or any individual's stake in that economy. Never has, never will. None of this matters because none of this matters. Just look at history, look at the economies during Democrat and Republican administrations. Policy is a non-factor, full stop. QED.

Given that, I'm not sure why we don't just raise the tax rate to 90%. It won't have any meaningful effect on anybody or anything, but the government would have way more money to spend on stuff. I see no drawbacks there.

Sic 'em, Phideaux!

Sounds like perfect new logic to me...Life in the times of Carter II, the FDR-wannabe edition...

-

But we can all take comfort in the fact that policy has no effect on the economy or any individual's stake in that economy. Never has, never will. None of this matters because none of this matters. Just look at history, look at the economies during Democrat and Republican administrations. Policy is a non-factor, full stop. QED.

Given that, I'm not sure why we don't just raise the tax rate to 90%. It won't have any meaningful effect on anybody or anything, but the government would have way more money to spend on stuff. I see no drawbacks there.

@horace said in Here comes the middle-class tax hike:

... I'm not sure why we don't just raise the tax rate to 90%.

We did:

“In 1944, the top rate peaked at 94 percent on taxable income over $200,000 ... Over the next three decades, the top federal income tax rate remained high, never dipping below 70 percent.“The country did great and sent quite a few Americans to the moon in that period.

-

@horace said in Here comes the middle-class tax hike:

... I'm not sure why we don't just raise the tax rate to 90%.

We did:

“In 1944, the top rate peaked at 94 percent on taxable income over $200,000 ... Over the next three decades, the top federal income tax rate remained high, never dipping below 70 percent.“The country did great and sent quite a few Americans to the moon in that period.

-

@jolly said in Here comes the middle-class tax hike:

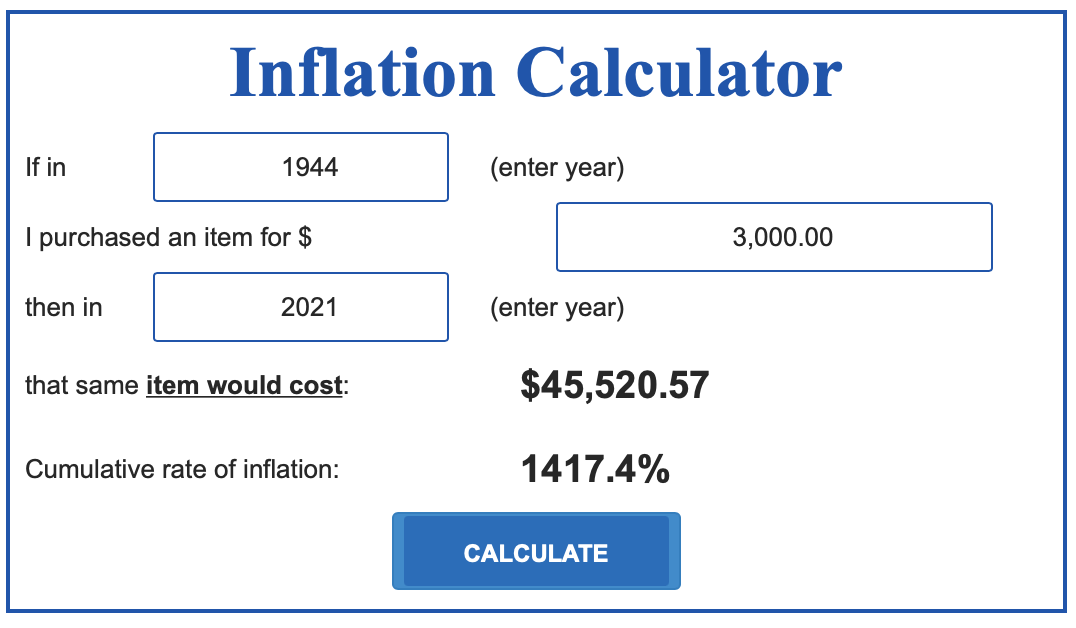

Fact check: The median family income in 1944 was less than $3000.

Today's median family income is $79,900.

https://www.huduser.gov/portal/datasets/il/il21/Medians2021.pdf

-

I keep hearing about the destruction of the middle class even as I see the middle class living a far better life than when I was a kid.

@mik said in Here comes the middle-class tax hike:

I keep hearing about the destruction of the middle class even as I see the middle class living a far better life than when I was a kid.

I think through a middle class person's financial outlook for retirement, if they work a job with no pension, raise a family, and save reasonably. Good luck with that unless the stock market is high performing.

And what's the statistic again, more than 50% of Americans have essentially no savings?

-

I keep hearing about the destruction of the middle class even as I see the middle class living a far better life than when I was a kid.

@mik said in Here comes the middle-class tax hike:

I keep hearing about the destruction of the middle class even as I see the middle class living a far better life than when I was a kid.

I am so much better off than my parents were, it's ridiculous. And they did fine.

-

@mik said in Here comes the middle-class tax hike:

I keep hearing about the destruction of the middle class even as I see the middle class living a far better life than when I was a kid.

I am so much better off than my parents were, it's ridiculous. And they did fine.

@doctor-phibes said in Here comes the middle-class tax hike:

@mik said in Here comes the middle-class tax hike:

I keep hearing about the destruction of the middle class even as I see the middle class living a far better life than when I was a kid.

I am so much better off than my parents were, it's ridiculous.

What does that mean? Presumably you're not talking about having iPhones while they did not.

I thought it was widely agreed on that the days of a one-income family being comfortable owning a home, raising a family, and retiring at 60, are gone. That was our parents' generation.

-

@doctor-phibes said in Here comes the middle-class tax hike:

@mik said in Here comes the middle-class tax hike:

I keep hearing about the destruction of the middle class even as I see the middle class living a far better life than when I was a kid.

I am so much better off than my parents were, it's ridiculous.

What does that mean? Presumably you're not talking about having iPhones while they did not.

I thought it was widely agreed on that the days of a one-income family being comfortable owning a home, raising a family, and retiring at 60, are gone. That was our parents' generation.

@horace said in Here comes the middle-class tax hike:

@doctor-phibes said in Here comes the middle-class tax hike:

@mik said in Here comes the middle-class tax hike:

I keep hearing about the destruction of the middle class even as I see the middle class living a far better life than when I was a kid.

I am so much better off than my parents were, it's ridiculous.

What does that mean? Presumably you're not talking about having iPhones while they did not.

I thought it was widely agreed on that the days of a one-income family being comfortable owning a home, raising a family, and retiring at 60, are gone. That was our parents' generation.

It wasn't agreed by me. We live in a very small house by American standards, but my wife doesn't work. I can probably retire at 62 if I want to. Admittedly, we live pretty conservatively, compared to a lot of people I know.

Not American conservatively, obviously. Those guys have gold toilets and spray-tans.

-

@mik said in Here comes the middle-class tax hike:

I keep hearing about the destruction of the middle class even as I see the middle class living a far better life than when I was a kid.

I think through a middle class person's financial outlook for retirement, if they work a job with no pension, raise a family, and save reasonably. Good luck with that unless the stock market is high performing.

And what's the statistic again, more than 50% of Americans have essentially no savings?

@horace said in Here comes the middle-class tax hike:

@mik said in Here comes the middle-class tax hike:

I keep hearing about the destruction of the middle class even as I see the middle class living a far better life than when I was a kid.

I think through a middle class person's financial outlook for retirement, if they work a job with no pension, raise a family, and save reasonably. Good luck with that unless the stock market is high performing.

And what's the statistic again, more than 50% of Americans have essentially no savings?

Is that a result of low income or of poor budgeting and spending habits? Possibly a combination of both, a drawback of the consumer economy.

Our retirement savings are mostly in the same investments they were in when they were called pensions. They are just not managed nor guaranteed by the corporations. But they were always in securities of one sort or another.

In the so called Golden Age of the American worker my uncle worked in a machine shop with no pension all his life. That can still happen today. But it doesn't have to.

-

@doctor-phibes said in Here comes the middle-class tax hike:

I can probably retire at 62 if I want to.

Does that depend on being able to go back to Canada for healthcare?

-

@doctor-phibes said in Here comes the middle-class tax hike:

@mik said in Here comes the middle-class tax hike:

I keep hearing about the destruction of the middle class even as I see the middle class living a far better life than when I was a kid.

I am so much better off than my parents were, it's ridiculous.

What does that mean? Presumably you're not talking about having iPhones while they did not.

I thought it was widely agreed on that the days of a one-income family being comfortable owning a home, raising a family, and retiring at 60, are gone. That was our parents' generation.

@horace said in Here comes the middle-class tax hike:

@doctor-phibes said in Here comes the middle-class tax hike:

@mik said in Here comes the middle-class tax hike:

I keep hearing about the destruction of the middle class even as I see the middle class living a far better life than when I was a kid.

I am so much better off than my parents were, it's ridiculous.

What does that mean? Presumably you're not talking about having iPhones while they did not.

I thought it was widely agreed on that the days of a one-income family being comfortable owning a home, raising a family, and retiring at 60, are gone. That was our parents' generation.

I never knew many people who retired at 60.

-

@horace said in Here comes the middle-class tax hike:

@doctor-phibes said in Here comes the middle-class tax hike:

@mik said in Here comes the middle-class tax hike:

I keep hearing about the destruction of the middle class even as I see the middle class living a far better life than when I was a kid.

I am so much better off than my parents were, it's ridiculous.

What does that mean? Presumably you're not talking about having iPhones while they did not.

I thought it was widely agreed on that the days of a one-income family being comfortable owning a home, raising a family, and retiring at 60, are gone. That was our parents' generation.

It wasn't agreed by me. We live in a very small house by American standards, but my wife doesn't work. I can probably retire at 62 if I want to. Admittedly, we live pretty conservatively, compared to a lot of people I know.

Not American conservatively, obviously. Those guys have gold toilets and spray-tans.

@doctor-phibes said in Here comes the middle-class tax hike:

@horace said in Here comes the middle-class tax hike:

@doctor-phibes said in Here comes the middle-class tax hike:

@mik said in Here comes the middle-class tax hike:

I keep hearing about the destruction of the middle class even as I see the middle class living a far better life than when I was a kid.

I am so much better off than my parents were, it's ridiculous.

What does that mean? Presumably you're not talking about having iPhones while they did not.

I thought it was widely agreed on that the days of a one-income family being comfortable owning a home, raising a family, and retiring at 60, are gone. That was our parents' generation.

It wasn't agreed by me. We live in a very small house by American standards, but my wife doesn't work. I can probably retire at 62 if I want to.

Do you have a pension? I exclude people with pensions from consideration about retirement concerns, or really any big financial concerns. But the fact that the vast majority of private sector workers don't have a pension allows me to do that while still speaking in generalities.

I am a secondary beneficiary of pensions, in that my dad had one, which has now transferred to my mom. They raised a middle class family, and retired at 60. But to the extent they ever built any wealth, that all happened in retirement, with the pension as income, funneled into the stock market.

-

Yes, I've got a pension, plus a 401K. I know, I'm very lucky regarding the pension, although I chose my employer based on my own cautious outlook to money.

Anybody who can't afford to put money into a 401K isn't really middle-class as I understand the term, and if they can afford to but aren't doing so, then they've really only got themselves to blame.

-

Today's pensions are not what they used to be either. We had three between us, two of which we cashed in for self-managed investments. We could have gone for the annuity, but that is an illusion too. If the market were to go that bust you're not getting your money anyway.