NY congressmen call for tax breaks for the rich

-

-

Democrats hold a 6 seat majority. If three members of the Dems vote "no" and the GOP sticks together, any bill is dead (ties in the House are considered not approved).

If Nadler and the other members of the NY delegation are true to their word, the "infrastructure" bill is dead.

-

@george-k said in NY congressmen call for tax breaks for the rich:

He's right. No one should be taxed twice on the same income.

The Republicans used to subscribe to that principle, then they abandoned it to pass the 2017 tax reform with Trump.

-

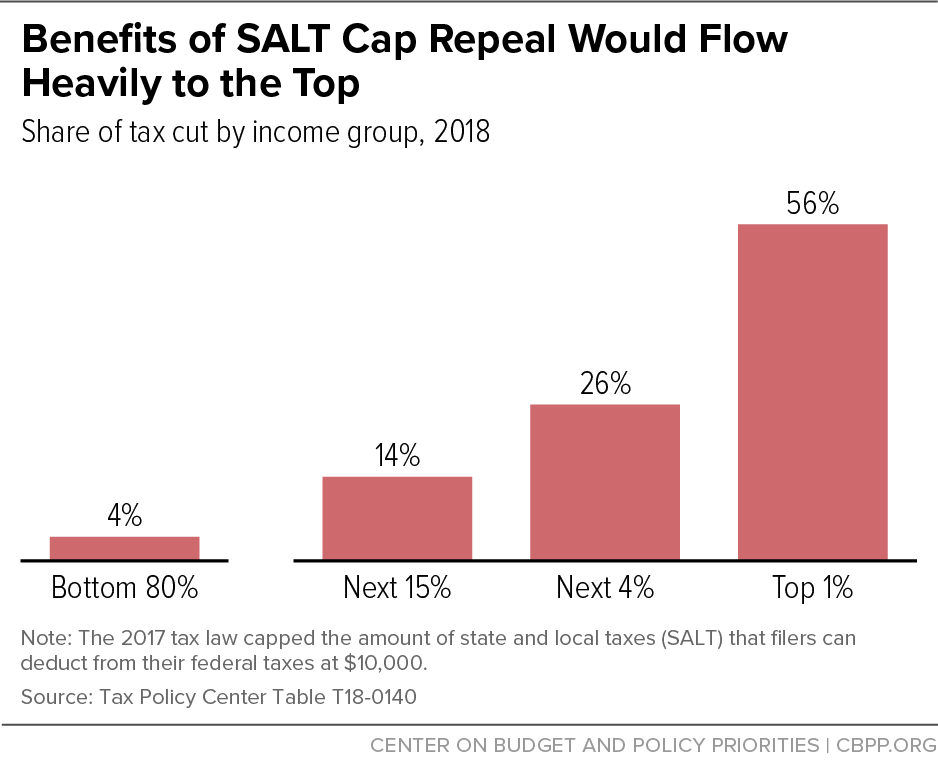

*Repealing the cap would be regressive and costly. The top 1 percent of households would receive 56 percent of the benefit of repeal, and the top 5 percent of households would receive over 80 percent of the benefit, while the bottom 80 percent of households would receive just 4 percent, according to the Tax Policy Center (TPC).[3] The cost of just the SALT provisions over ten years would be roughly $185 billion, according to Joint Committee on Taxation (JCT) estimates.[4] If repeal were later extended through 2025 (the last year the cap is in effect under current law), we estimate that the total cost would grow to nearly $600 billion.[5]

*Few middle-income households would benefit. The vast majority of households in the bottom 80 percent are unaffected by the SALT cap and thus would not benefit from its repeal. Fewer than 3 percent of households in the middle income quintile (those between roughly $51,000 and $88,000 in 2018), and fewer than 10 percent of households in the fourth quintile (those between roughly $88,000 and $157,000 in 2018), would receive any tax cut from repeal, according to TPC.[6]

*Higher-income households affected by the cap would still receive a large net tax cut from the 2017 tax law overall. Given the controversy around the SALT cap and the attention it has received, policymakers and many filers affected by the cap may mistakenly assume that affected filers fared poorly under the 2017 law. Both nationally and in affluent states, however, households in the 95th to 99th percentiles of the income spectrum — many of whom live in affluent suburbs and may feel targeted by the SALT cap — received the largest net tax cuts from the tax law, measured as a share of pre-tax income.[7]